Ava Tax: General Invoicing

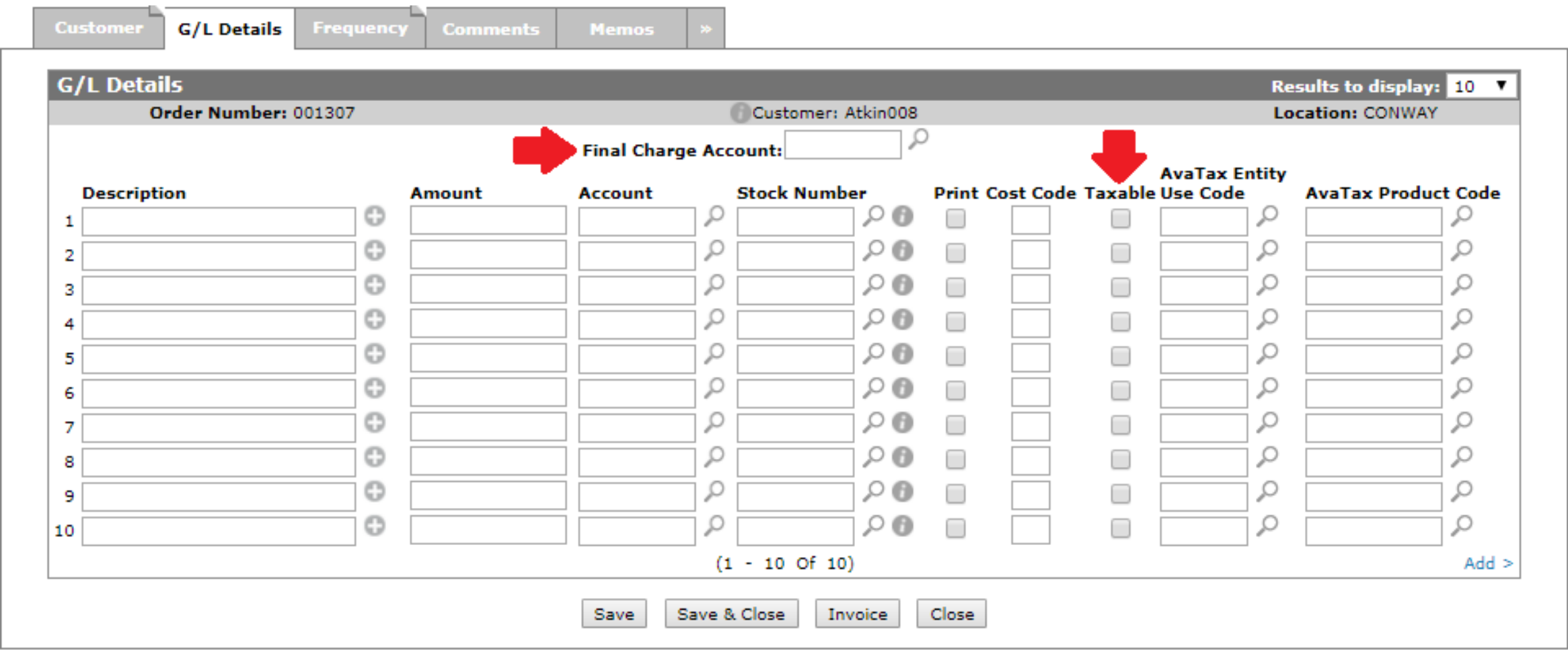

To simplify the process of creating a taxable invoice in General Invoicing, the G/L Details screen has been modified to include a Final Charge Account field and a Taxable checkbox column as shown below.

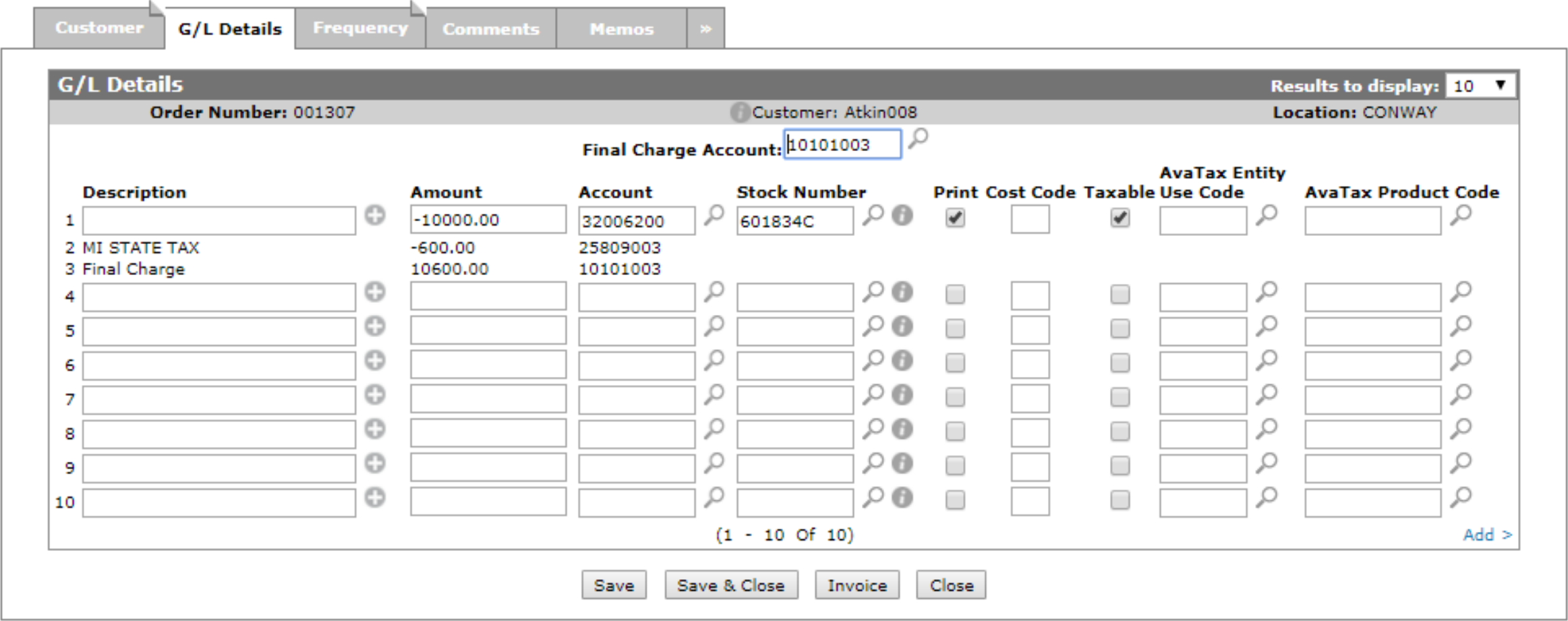

Using these fields, the system automatically calculates the appropriate taxes based on the information received from AvaTax.

The total of the lines with the Taxable box unchecked needs to balance to zero (like any general invoice) and each line with the Taxable box checked has the appropriate tax applied by Avalara and an opposite entry to the total of those taxable lines after tax posts against the Final Charge Account. If the Final Charge Account is used in the distribution the A/R Agency tab is not available for authorization, regardless of the final charge account being linked to an agency code that would normally require authorization.

Warning: If you do not follow the steps outlined below when selling products through General Invoicing and posting directly to tax liability GL accounts, these transactions do NOT appear on the IntelliDealer tax reports nor do they appear on the Avatax reports. It is your responsibility to audit these tax liability GL accounts for the purposes of filing your monthly tax sales and use tax reports and remitting the appropriate funds to respective jurisdictions.

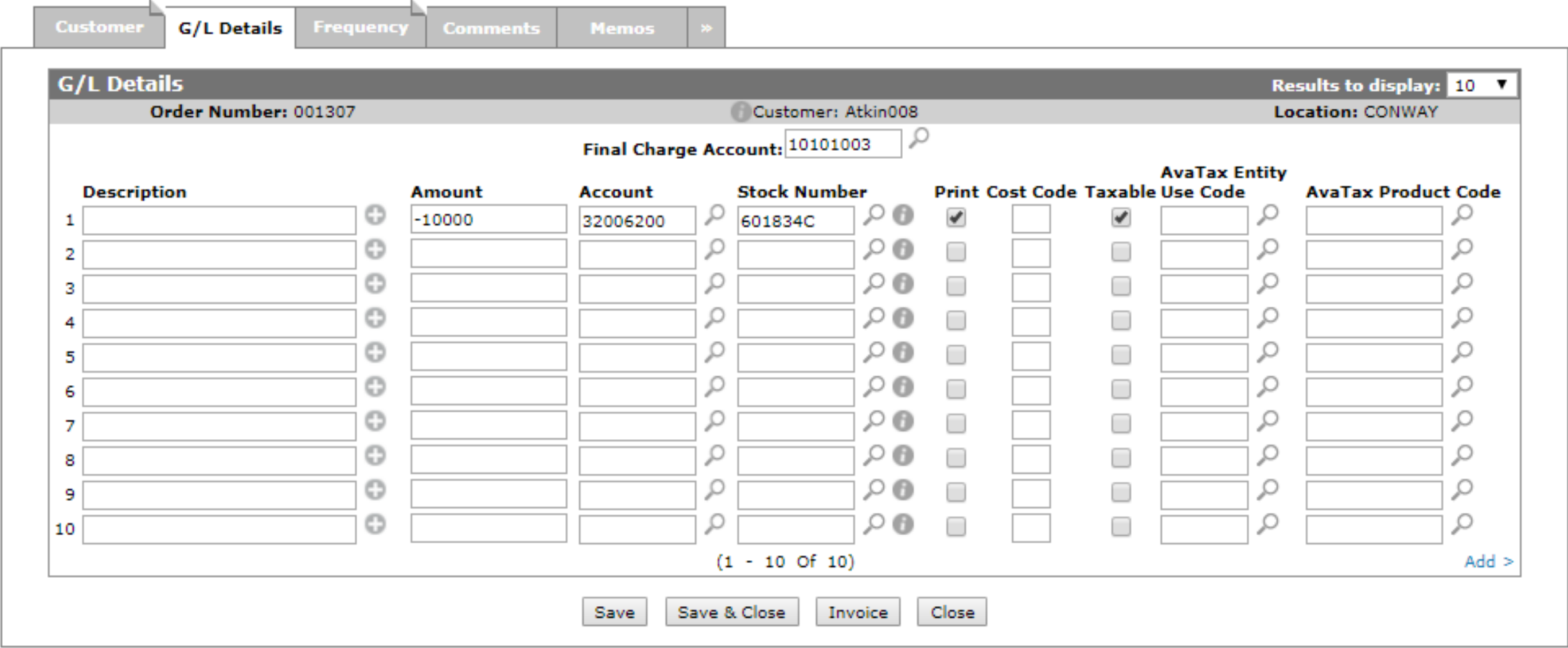

Load all the usual accounting entries except the tax and final charge lines. Place the final charge account at the top of the screen in conjunction with the Taxable indicator beside the lines that should be taxed.

When SAVE (or SAVE & CLOSE) is clicked, the system automatically calculates the appropriate taxes and final charge amount lines and adds them to the invoice as shown below.

If the (Final) Invoice button is clicked, the invoice is locked and posts the tax according to what was retrieved. However, if the General Invoice produces more than one invoice, the General Invoicing Billing Run updates the taxes on the invoice prior to posting the invoice.

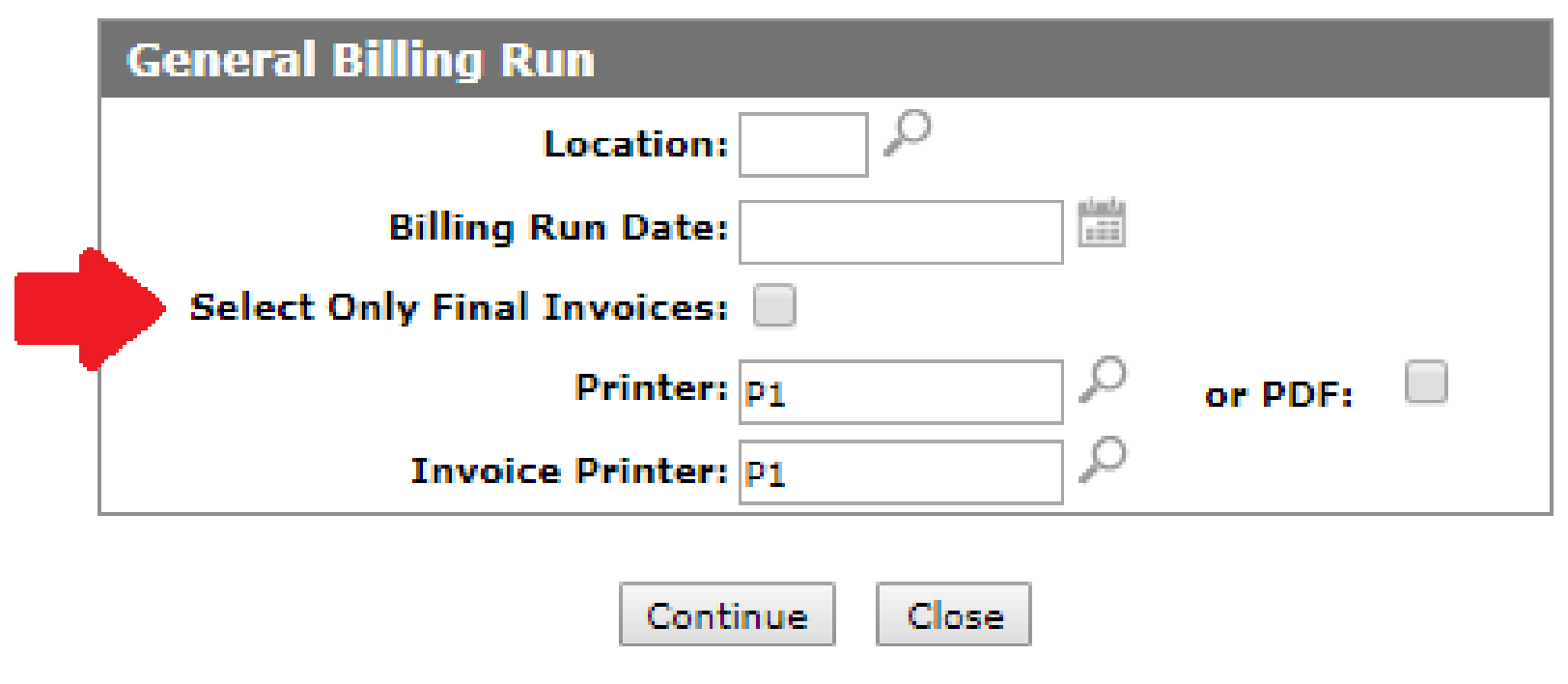

With this change, the General Invoicing Billing Run has been modified and no longer allows the processing of Final Invoices and Non-Final Invoices at the same time. The system issues an error message if you try to process both and AvaTax has been licensed.

You are required to first process the Final Invoices before processing the Non-Final Invoices.