How to Reverse a Check in IntelliDealer

Occasionally, you may be required to cancel a check that has already been issued by the system or cancel a hand-written check previously entered into the system as a manual check. To do this, you must create an adjustment voucher to reverse the amount charged to the expense accounts involved and to debit the bank account for the amount of the cancelled check.

Method 1: Using the Check Reversal feature in IntelliDealer

IntelliDealer has a Check Reversal feature which will automatically generate an adjustment voucher to reverse a check. The check reversal feature will create an Adjustment Voucher to reverse the effect of the original voucher(s). This voucher will reverse the original distribution of all vouchers paid on the check and post a Debit to the bank account. Optionally, when using the check reversal, the choice will be given to re-issue the voucher(s). Use this option when the voucher(s) need to be re-created in Accounts Payable. The new voucher(s) will be identical to the original voucher(s) with exception of the due date which must be re-entered. Additionally, the check will be automatically marked as Cancelled in the Check Reconciliation or Bank Reconciliation system.

Steps to Using the Check Reversal feature in IntelliDealer:

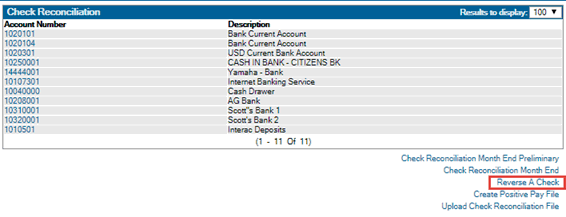

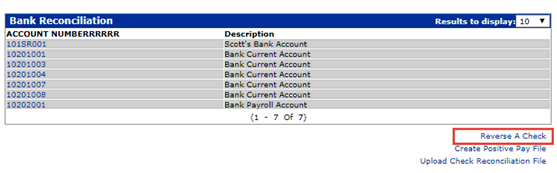

1. Navigate to Financial Management - Accounts Payable - Check Reconciliation

or Financial Management - General Ledger - Bank Reconciliation depending of which reconciliation system is being used and click Reverse A Check

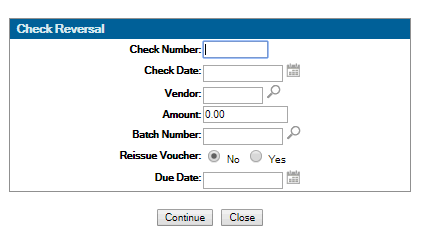

2. Enter the following information then click Continue:

- Enter the Check Number being reversed. All leading zeroes must be keyed.

- Enter the Vendor that the check was issued to.

- Enter the Amount of the check being reversed.

- Enter the Batch Number that the reversal (and optionally the reissued voucher) is to be added to.

- Select Reissue Voucher if you wish to have the voucher re-created in Accounts Payable. The new voucher will debit the original expense account and credit A/P. This voucher can be edited by the user and is updated during the next batch update containing this voucher. If yes is selected, key the Due Date for the reissued voucher.

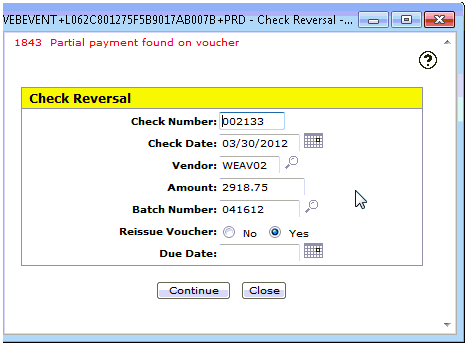

1843 Partial payment found on a voucher or 1844 Cannot reverse voucher with invoiced unit, example:

The system will not allow you to reverse a check for a voucher that has a partial payment or an invoiced unit. To reverse you will have to use Method 2.

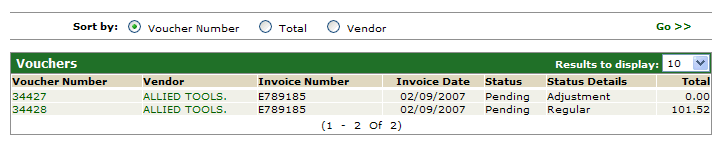

Here is a screen shot of the resulting two vouchers that were created in this example. The first voucher is the Adjustment Voucher to reverse the original. The second voucher is to re-issue the original:

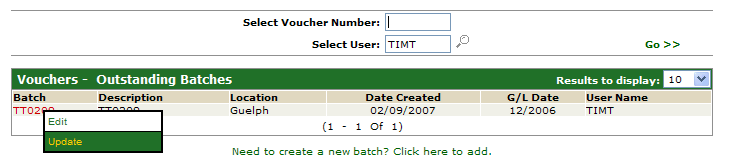

3. Update the batch from Financial Management - Vouchers:

Note: These vouchers can be viewed/edited if necessary before updating the batch.

Here is what happens when an A/P check is reversed or cancelled

Reverse Check

Two vouchers are created when this option is taken. The first one reverses out the original voucher while the second one sets it back up in accounts payable.

Voucher 1: Cr Original expense account

Dr Bank

Voucher 2: Dr Original expense account

Cr A/P to set voucher back up

These vouchers can be edited by the user and is updated during the next batch update containing these vouchers

Cancel Check

One voucher is created. It reverses out the original voucher. The voucher is not set up again as with the Reverse Check process above

Voucher 1: Cr Original expense account

Dr Bank

This voucher can be edited by the user and is updated during the next batch update containing this voucher.

There may be certain situations where the system will not allow you to use the check reversal feature described above. Examples are when the original voucher contained payment schedules, or when this voucher was a "converted" voucher from a previous business system. This does not mean that this check cannot be reversed. In these cases, you must manually create the reversal voucher as well as any vouchers that need to be re-issued.

Steps to Manually Reverse:

1. From Financial Management – Vouchers create a new A/P batch. Then enter the voucher as originally keyed except:

- Enter today's date in the Due Date field

- Enter the same invoice number as was entered on the original voucher.

Note: A different invoice number may be required depending on the retention months specified in table DIVTAB (the invoice number was used on a previous voucher). See the PFW System Configuration User’s Manual for more details.

- If the original voucher was keyed as a debit, all amount fields are keyed as credits. If the original voucher was keyed as a credit, amount fields are keyed as debits.

- The Voucher Type field must be set to Adjustment.

- The Check# field: Cannot be a check number already used. Besides that you may put whatever you like into this field.

2. If the Check Being Cancelled is Made Up Of Several Vouchers:

- Each voucher should be reversed out as described above. If desired, all original vouchers can be reversed on one adjustment voucher.

- As in the above procedure if the original voucher was keyed as a debit, all amount fields are keyed as credits. If the original voucher was keyed as a credit, amount fields are keyed as debits.

Note: If any of the vouchers were originally credit vouchers, then you will need to reverse all vouchers on a single adjustment voucher. This is because the system will not allow a debit voucher to be created as an adjustment voucher.

3. Re-issuing the Voucher(s)

If you choose to pay the voucher(s) comprising the check just cancelled at a future date, re-enter regular voucher(s) with the proper due date and the system will issue a check when the vouchers come due.

4. Updating the Check Reconciliation System

It's also important to remember to mark the check as cancelled if using the Check Reconciliation system. This is accessed from Financial Management – Check Reconciliation. This will remove the check number from the outstanding check list.

What if the original voucher was a posting to an equipment inventory account, and that stock# has since been invoiced?

In this scenario, it is best to use a clearing account instead of the equipment inventory account. This is only advised if the voucher is being immediately re-issued. You would use the clearing account for the vouchers created in step 3 and step 4 and the net result would be a wash to the clearing account.