The purpose of WIP (work in process) is to track outstanding work order amounts in the general ledger to properly account for work being done. When a part is ‘sold’ to a work order it is not ready to be invoiced to the customer until it is installed and the work is completed, but it is also not available for sale to another customer. WIP is the process that stores these parts and labor entries in suspension.

Topics in this section include:

Examples For How Taxes are Calculated

WIP in More Detail

The initial entry to the WIP account is done during the parts billing run (both labor and parts are posted during the parts billing run). Whenever the work order is closed the entry will be taken out of WIP and the value left in the WIP account is zero. The amount that comes out of WIP is always the same as what goes into WIP. You should never need to make any journal entries to your WIP account if everything is being processed normally.

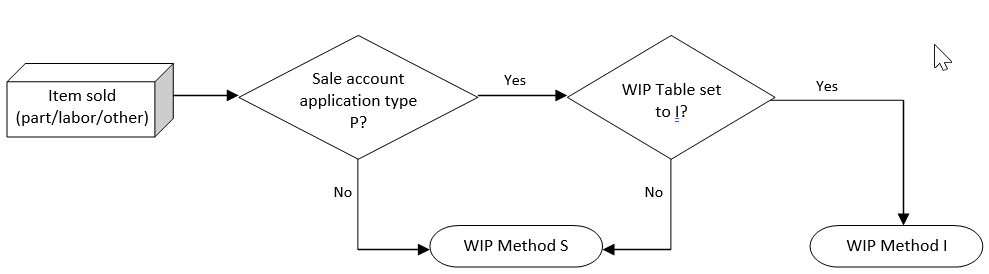

There are two different kinds of WIP in the system, S (sale) and I (inventory). They are also referred to as Traditional WIP (method S) and Alternative WIP (method I). The sale account configuration and WIP table determine what base method is used (if a WIP table is NOT set up, type ‘S’ is the default). When the WIP table is set to an ‘I’, items will be handled with method I for parts and/or labor posted as long as there is costing set up on the entry. Items will be handled with method S either when the WIP table setting is set to an S, the WIP table doesn’t exist, or when a transaction is posted to an account that does not have an application type P. Note there is no labor costing done when the WIP type on the system is an ‘S’, labor costing can only be done if the WIP method is set to an ‘I’. Since WIP method I is posted using average cost, if no cost is available the entry will be done using WIP method S regardless of the WIP table setting. This scenario is most commonly found with GL parts and miscellaneous charges. For type S the revenue is realized when posted but the taxes and discounts are only realized when the work order is closed. It represents the amount of unbilled receivables since it’s based on the sale amount. For type I no revenue is realized until the work order is closed. It avoids the un-matching of revenue and expenses if work orders are closed to an expense account.

How the Billing Run Determines WIP Method

Configuration

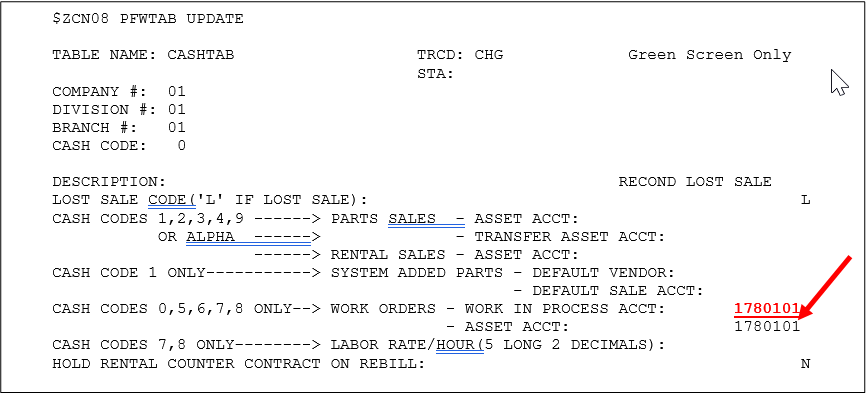

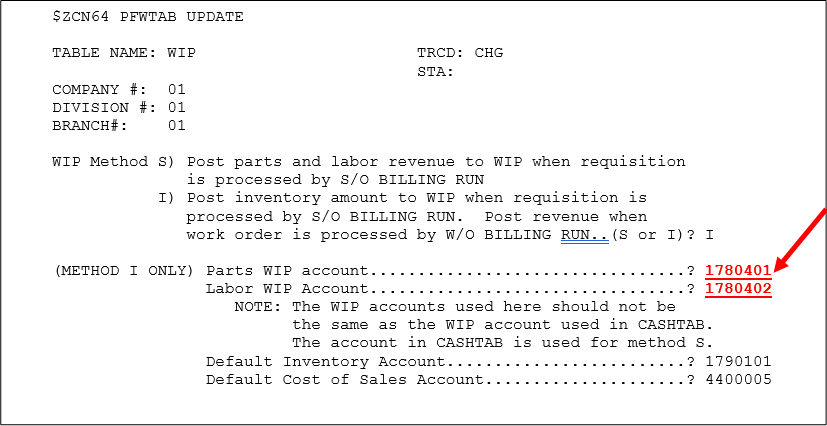

The WIP accounts are configured in two places.

1) The CASHTAB table for cash codes 0, 5, 6 7, and 8 contain the type S accounts for all dealers. Dealers using method S generally set up different GL accounts for some or all of these cash codes so they can track the amounts separately (ie. Customer WIP versus Warranty WIP versus Internal WIP).

2) The WIP table controls the accounts when using method I. The default inventory and default cost of sales accounts will be used for any entries where the system cannot find a wip account. These should be filled in as a precaution but they are really no longer used since a snapshot of the accounts are stored with each transaction processed by the billing run.

Changing WIP Settings

As of release 7.0 you can change your WIP method and/or accounts anytime. Every transaction saves the WIP method and account so when a work order is closed the entries will always come out of WIP exactly the same way they went in. Prior to 7.0 changing WIP settings could be more difficult depending on what method you were going from/to or what accounts you were changing.

Balancing WIP

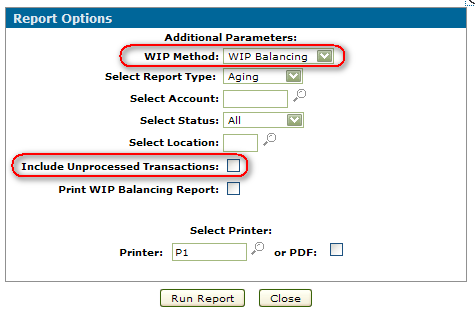

The method used to balance work in process to the general ledger depends upon the WIP method being used. This is determined in the WIP table. The IntelliDealer reports can be run from Product Support/Service/Analysis Reports. From the Work in Process tab you should see an option to ‘Create a Work in Process Report’. The green screen reports can be run from the service menu under option #15 for Selective Reports.

In IntelliDealer you can just run the report using the ‘WIP Balancing’ method and the system will generate the correct report based on the transactions types. If you want to balance the report back to the GL make sure you leave the option to ‘Include Unprocessed Transactions’ unchecked. There is also an option at the bottom to ‘Print WIP balancing report’ which will generate a summary report by account which you may want to generate.

Examples For How Taxes are Calculated

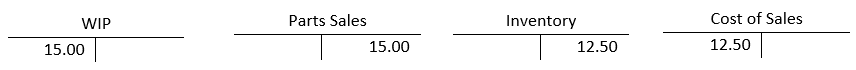

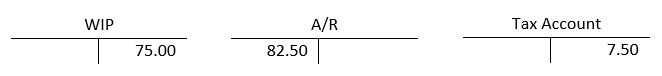

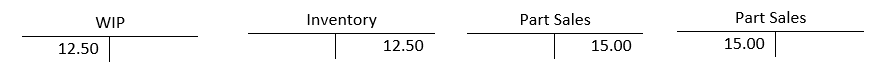

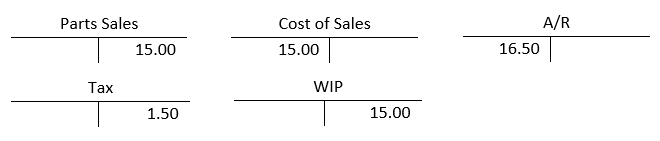

WIP method S – Example Part with Tax at 10% (with Costing)

Part A10000 is sold to work order. The part has a sell price of $15.00 and an average cost of $12.50. Because the entry is type S the amount going into WIP is the sale amount, NOT the inventory amount. Since the sale is being processed as the entry goes into WIP, the part is also costed at this time. The WIP account used comes from the CASHTAB table based on the cash code on the transaction. Since there is a distinct difference in the entries based on the type of tax charged, there are two scenarios below when the work order is closed based on the type of tax being used.

-

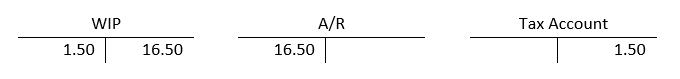

Tax 1/2

When the work order is closed the entry comes out of WIP and hits the charge account. In this example we’re using a/r but it could be cash, credit card, a warranty account, an expense account, etc. Notice the amount coming out of WIP is the total price of the part including taxes, but there is a second entry for the tax amount going back into WIP so the net to WIP is 0.

-

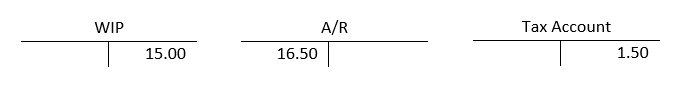

Tax 3/4

When the work order is closed the entry comes out of WIP and hits the charge account. In this example we’re using a/r but it could be cash, credit card, a warranty account, an expense account, etc.

Note: If the item had no costing done on it, all entries would be the same except there would be no inventory/cost of sales entries when the part was originally sold to the work order.

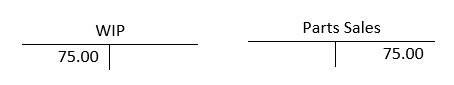

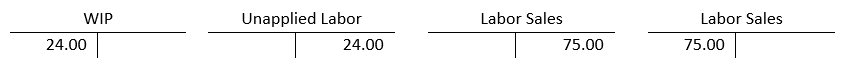

WIP method S – Example of Labor with Tax at 10%

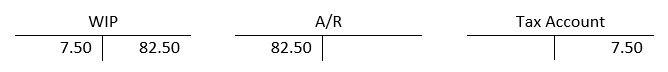

An hour of labor is sold to a work order at a rate of $75.00. Because the entry is type S the amount going into WIP is the sale amount, NOT the inventory amount. There is never any labor costing done using WIP method S. The WIP account used comes from the CASHTAB table based on the cash code on the transaction. Since there is a distinct difference in the entries based on the type of tax charged, there are two scenarios below when the work order is closed based on the type of tax being used.

-

Tax 1/2

When the work order is closed the entry comes out of WIP and hits the charge account. In this example we’re using a/r but it could be cash, credit card, a warranty account, an expense account, etc. Notice the amount coming out of WIP is the total price of the part including taxes, but there is a second entry for the tax amount going back into WIP so the net to WIP is 0.

-

Tax 3/4

When the work order is closed the entry comes out of WIP and hits the charge account. In this example we’re using a/r but it could be cash, credit card, a warranty account, an expense account, etc.

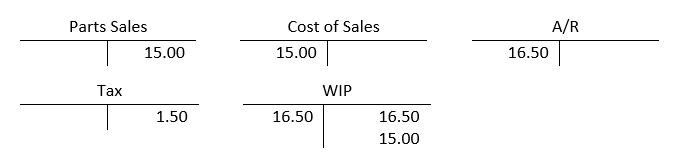

WIP method I – Example Part with Tax at 10%

Part A10000 is sold to work order. The part has a sell price of $15.00 and an average cost of $12.50. Because the entry is type I the amount going into WIP is the inventory amount, NOT the sale amount. The WIP account used comes from the WIP table. Since there is a distinct difference in the entries based on the type of tax charged, there are two scenarios below when the work order is closed based on the type of tax being used.

-

Tax 1/2

When the work order is closed the entry comes out of WIP and hits the charge account. In this example we’re using a/r but it could be cash, credit card, a warranty account, an expense account, etc. Notice there are 3 entries made to WIP here – a debit and credit for the sales plus the tax amount (which nets to zero) plus a credit to the inventory amount that originally went into WIP to zero out the balance:

-

Tax 3/4

When the work order is closed the entry comes out of WIP and hits the charge account. In this example we’re using a/r but it could be cash, credit card, a warranty account, an expense account, etc.

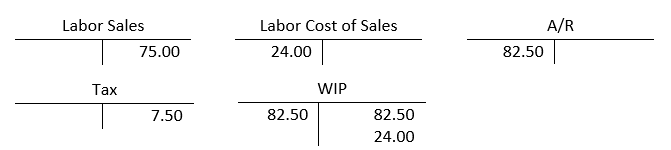

WIP method I – Example Labor

Labor is charged to the work order at a rate of $75.00 for one hour. The cost of this labor is $24.00. Because the entry is going into WIP using method I, the amount going into WIP is the inventory amount, not the sale amount. Notice that there is a debit and credit to the sale account here (the net is zero). This happens on all WIP ‘I’ entries when the entry is first put into WIP.

-

Tax 1/2

When the work order is closed the entry comes out of WIP and hits the charge account. In this example we’re using a/r but it could be cash, credit card, a warranty account, an expense account, etc. Notice there are 3 entries made to WIP here – a debit and credit for the sales plus the tax amount (which nets to zero) plus a credit to the inventory amount that originally went into WIP to zero out the balance:

-

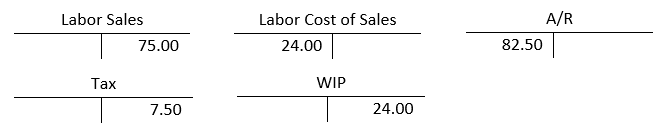

Tax 3/4

When the work order is closed the entry comes out of WIP and hits the charge account. In this example we’re using a/r but it could be cash, credit card, a warranty account, an expense account, etc.

Revision: 2024.09