AvaTax: Exemptions

In IntelliDealer, you can assign the Entity Use Code to the customer identifying them as Agricultural, Federal, Native American, etc. If you do this, the AvaTax engine uses this coding to outright determine taxability and does not check for a valid certificate in the Avalara Exemption Certificate Management (ECM) product.

Exemption Certificate Management (ECM) System

Avalara allows for exemptions to be loaded and managed directly through their online system. IntelliDealer provides integrated certificate management within a customer's profile. See Avalara: Certificate Dashboard for details.

Invoice taxes are captured at the time of invoice creation. However, the billing run serves as a final commit for both invoices and taxes, triggering another call to Avalara to validate the tax rate. If an exemption certificate is added to the customer record during this interval—with a current or retroactive effective date—it can result in a discrepancy because tax appears on the invoice initially but is removed when processed by the billing run.

Tip: Recommended best practice is to load exemption certificates with an effective date after the next billing run to avoid inconsistencies.

For more information on ECM, please contact your Avalara representative or visit: www.avalara.com

Adjusting Taxes for an Exemption

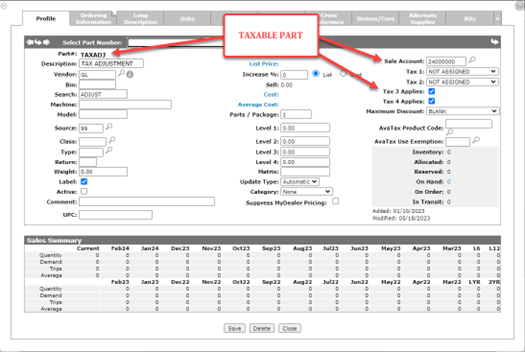

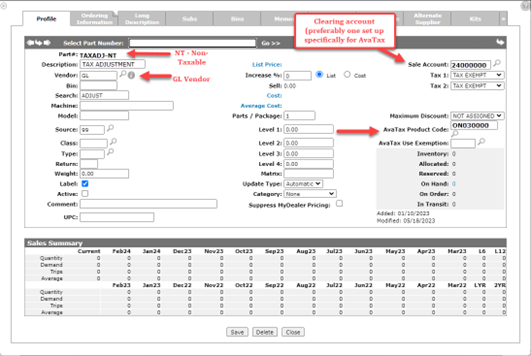

If a customer presents an exemption certificate after they have already been taxed, and your system is using AvaTax, then you can use special part numbers to make tax adjustments. IntelliDealer uses these part numbers to identify the associated General Ledger account. VitalEdge recommends that you create these special part numbers to use for tax adjustments:

-

TAXADJ—a taxable part posting to a clearing account.

-

TAXADJ-NT—a non-taxable part posting to the same clearing account (set up with product code ON030000)

See Special Part Numbers.

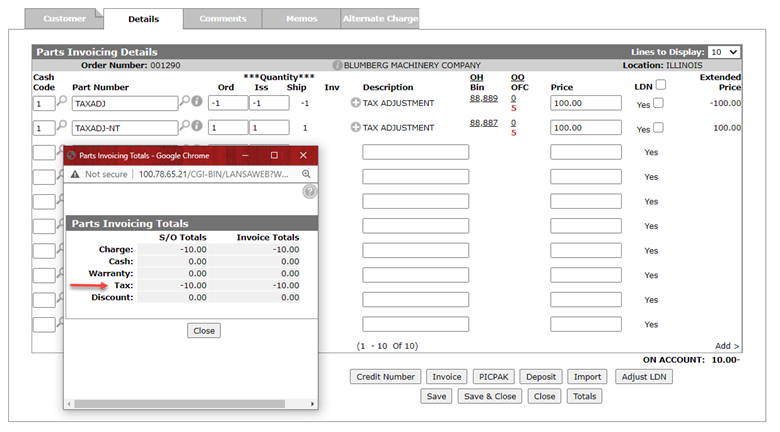

For example, say a customer had been taxed $10 on a $100 purchase and later presented a tax exemption certificate. To refund the tax to the customer, create a parts ticket using these two special parts:

On line 1, part number TAXADJ is set to credit $100 so that tax is calculated on the original amount sold.

On line 2, part number TAXADJ-NT is sold at $100 to net the revenue to zero.

The result is a tax credit equivalent to the original sale.

The net effect on the General Ledger is:

-

DR AvaTax payable $10

-

CR Accounts receivable $10

You can now invoice the customer to complete the transaction.