AvaTax: Customer Exemption Certificates

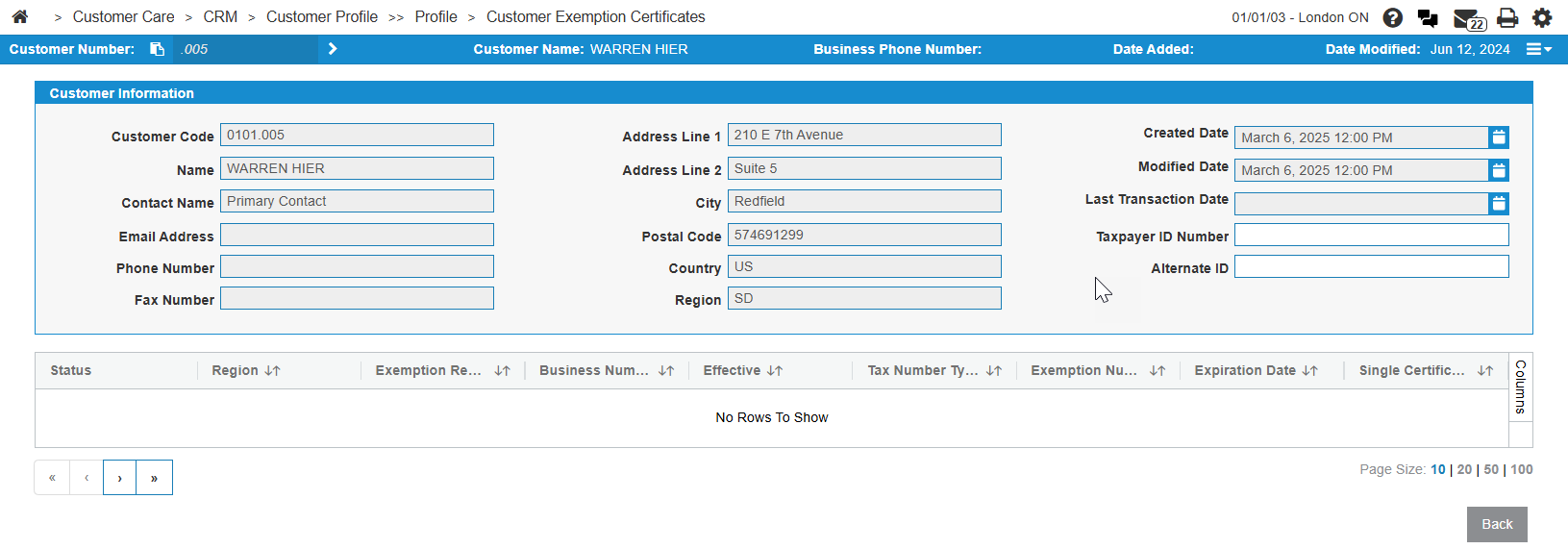

You can use the Customer Exemption Certificates screen to manage a customer’s tax exemption certificates that are registered with Avalara. This screen displays a list of certificates already in the Avalara system and provides a means for you to request other certificates from the customer.

Invoice taxes are captured at the time of invoice creation. However, the billing run serves as a final commit for both invoices and taxes, triggering another call to Avalara to validate the tax rate. If an exemption certificate is added to the customer record during this interval—with a current or retroactive effective date—it can result in a discrepancy because tax appears on the invoice initially but is removed when processed by the billing run.

Tip: Recommended best practice is to load exemption certificates with an effective date after the next billing run to avoid inconsistencies.

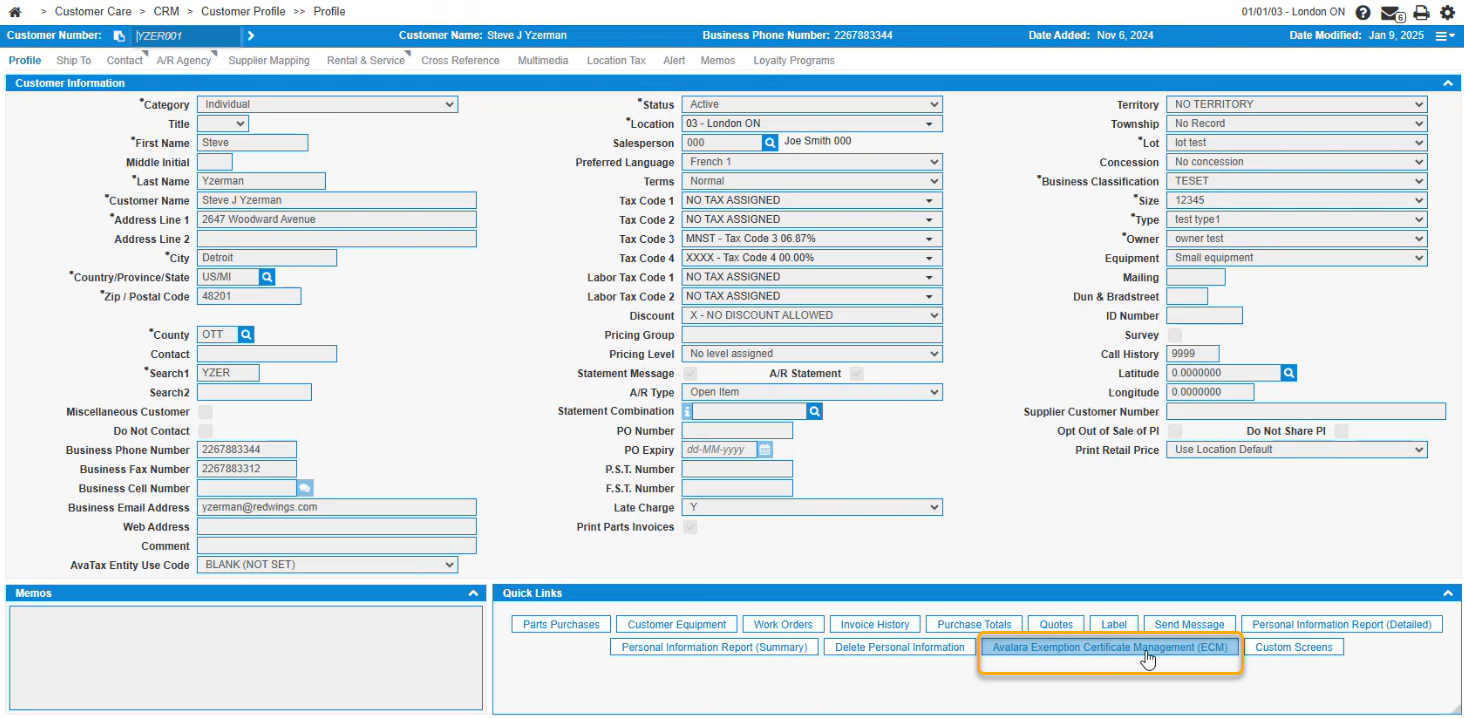

To access the Customer Exemption Certificates, open a Customer Profile, and under the Quick Links section, click the Avalara Exemption Certificate Management (ECM) button. OR click the Avalara ECM link where available (for example on the Work Order Quoting screen).

The Customer Information section displays the information IntelliDealer sent to Avalara from the Customer Profile. Additionally, you can add information for these fields:

| Field | Description |

|---|---|

| Taxpayer ID Number | A government-issued number that identifies the taxpayer. |

| Alternate ID Number | An alternate ID number. |

The fields on the Customer Exemption Certificates screen are:

| Field | Description |

|---|---|

| Status | The status of the exemption certificate. |

| Region | The region the certificate is applicable to. |

| Exemption Reason | The reason for the tax exemption. |

| Business Number Type | The type of business number. |

| Effective | The date the tax exemption certificate became effective. |

| Tax Number Type | The type of tax number. |

| Exemption Number | The exemption number of the certificate. |

| Expiration Date | The date the tax exemption certificate expires. |

| Single Certificate | If this checkbox is selected, it indicates that this tax exemption certificate applies to a specific invoice. |

| Verified | If this checkbox is selected, it indicates that the tax exemption certificate has been verified within the Avalara system by the dealer. |

| Document Exists | If this checkbox is selected, it indicates that the tax exemption certificate document is present in the Avalara system. IntelliDealer does not store documents, but you can download them if required (see AvaTax: Certificate Information). |

| Created Date | The date the record of this tax exemption certificate was created. |

| Modified Date | The last date this tax exemption certificate record was modified on. |

| Exempt Percentage | The percentage of exemption. Applicable for certificates that exempt only a portion of the total tax. See the Avalara system for details. |

The buttons on the Customer Exemption Certificates screen are:

| Button | Description |

|---|---|

| Update/Add Customer | Sends the customer's data to Avalara. Use this button to send new customer data to Avalara, or to update a customer's data if edits have been made to their profile within IntelliDealer. |

| Request Certificate | Opens the Request Certificate screen. Avalara sends a form letter to the customer, based on the inputs, to request a tax exemption certificate. |

| Back | Returns to the Customer Profile. |

Feature: 6238

Revision: 2025.10