AvaTax: Customers

Overview

If you are using Entity Use Codes in IntelliDealer, you may either use Group File Maintenance or the Location Tax Utility to set the AvaTax Entity Use Code on customers. The entity use code identifies any special designation for a customer (eg. Agriculture, Government, etc.). The best way to set this value is based on the exempt codes you previously used in the legacy tax code system.

Not all customers require an AvaTax Entity Use Code – only those with a special designation. You can set this code by hand or use one of the two mass change utilities. If you are using Avalara’s Exemption Certificate Management (ECM) System you do not need to set the Entity Use Code on any customers.

IntelliDealer only imports use exemptions from Avatax that have the rule type Exempt Entity Rulein the AvaTax configuration. If you have a type of use or exemption that does not appear on the AvaTax Entity Use Codes list, consult your Avalara representative about potentially creating a custom code.

Note: When setting up custom codes, you are responsible for managing and maintaining the codes and their custom rules.

Group File Maintenance (Mass Update)

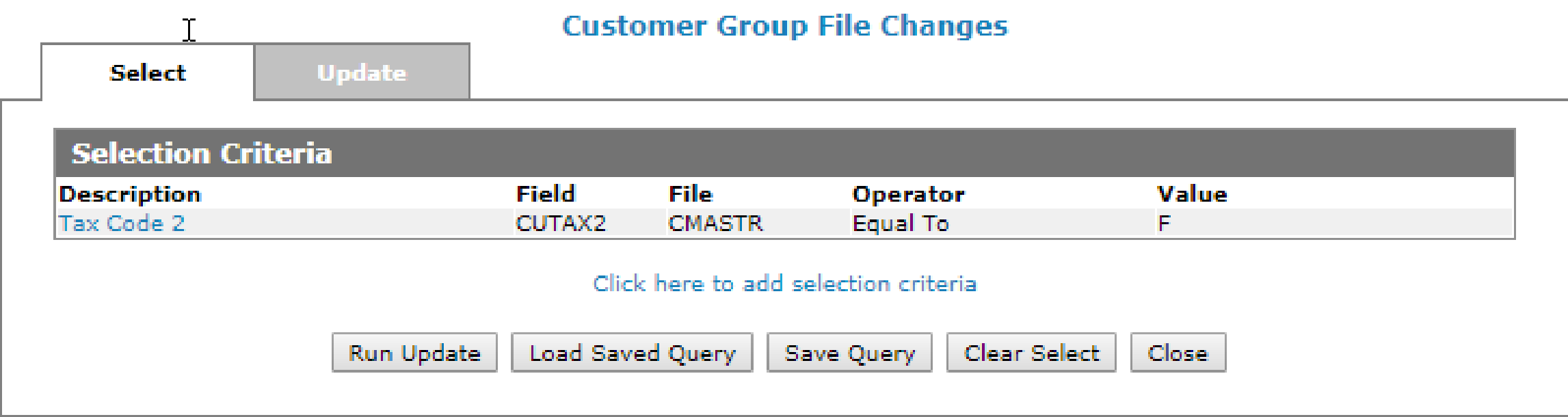

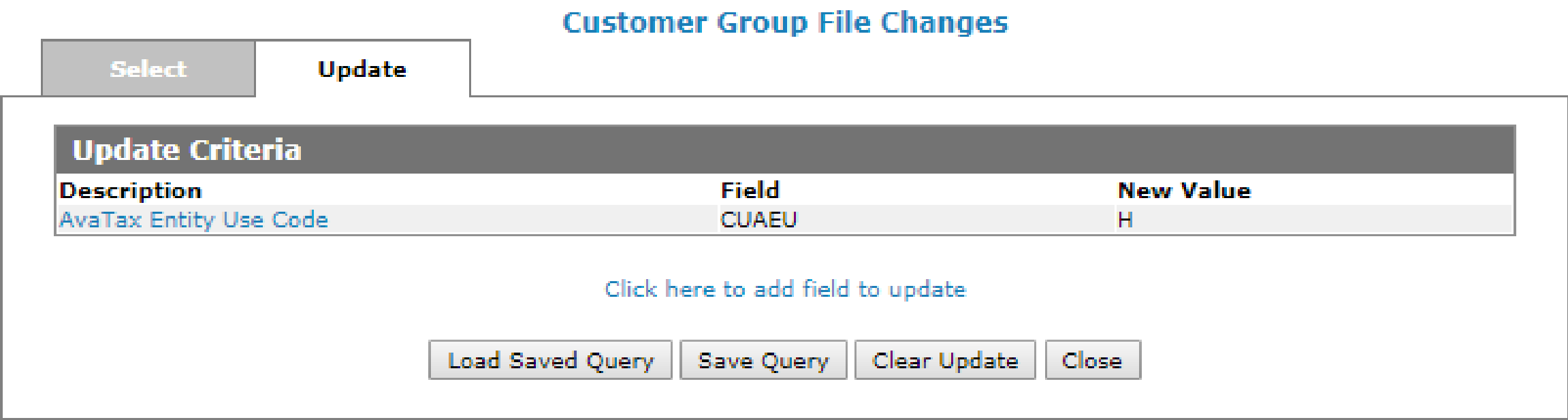

If you set exempt codes on the Profile tab of Customer Profile, you can use the Mass Update facility to set the Entity Use Codes accordingly. For example, all farm exempt customers might have been coded with an ‘F’ in Tax 2 code. You can use this coding to set the proper AvaTax Entity Use Code. You need only perform this procedure during setup.

Navigate to Financial Management > Accounts Receivable > Customer Profile and click the Mass Update button on the bottom of the page .

On the update tab, select the AvaTax Entity Use Code field set the code accordingly. You may have to run the Mass Update multiple times to set the codes on all of the applicable customers.

Note: You must perform this procedure for each company/division combination that is using this interface.

If you are not familiar with the AvaTax service yet, you should consult with your Avalara implementation specialist for any questions about what AvaTax Entity Use Codes to use.

Location Tax Utility

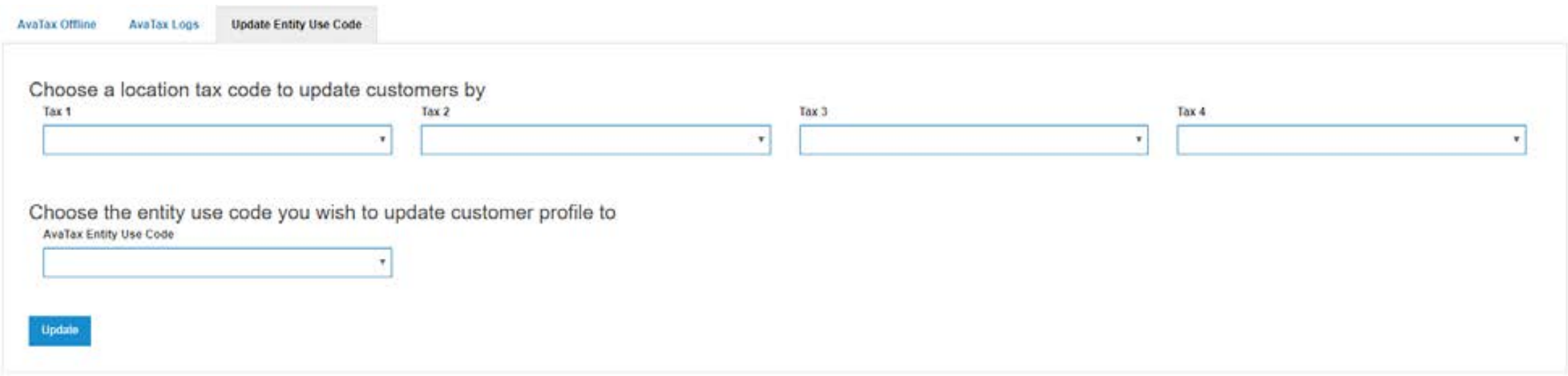

If you set up exempt codes on the Location Tax tab of Customer Profile, you can use the Update Entity Use Code utility to set the Entity Use Codes accordingly based on the Location Tax configured on customers. You need only perform this procedure during setup.

You must first select a value for either Tax 1, Tax 2, Tax 3 or Tax 4 which represents the code you loaded in the Location Tax tab of Customer Profile for exempt sales (eg. Agricultural, Government, Resale, etc.).

Note: Only one of the four tax codes can be selected at a time.

Next, select the AvaTax Entity Use Code that corresponds to the legacy tax code selected. This will update the Customer Profile Avatax Entity Use Code field accordingly. You should run this utility multiple times, once for each unique exemption code. This run will only process customers in the company and division you are currently assigned to.

Navigate to Financial Management > General Ledger > AvaTax - Update Entity Use Code tab.

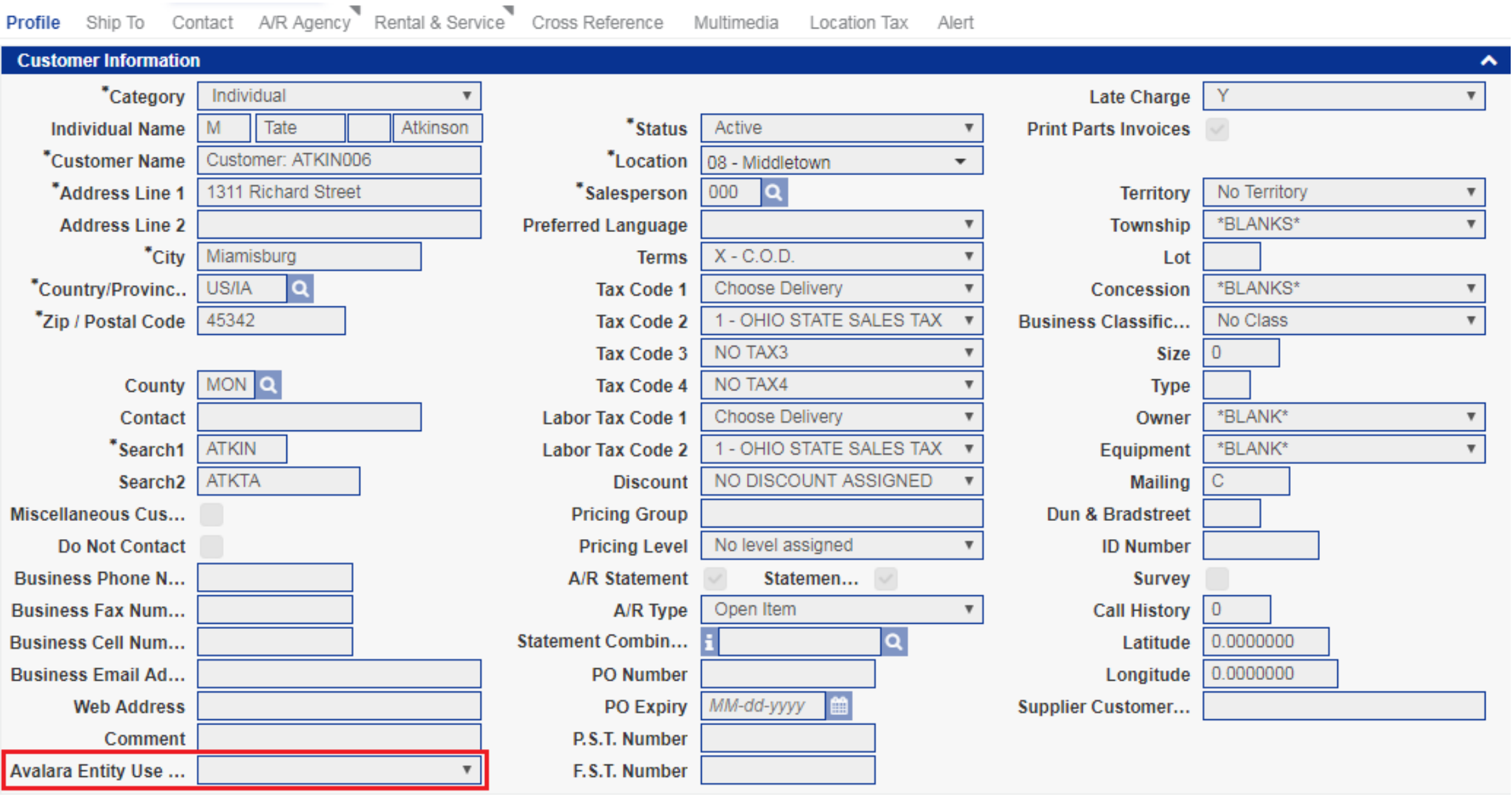

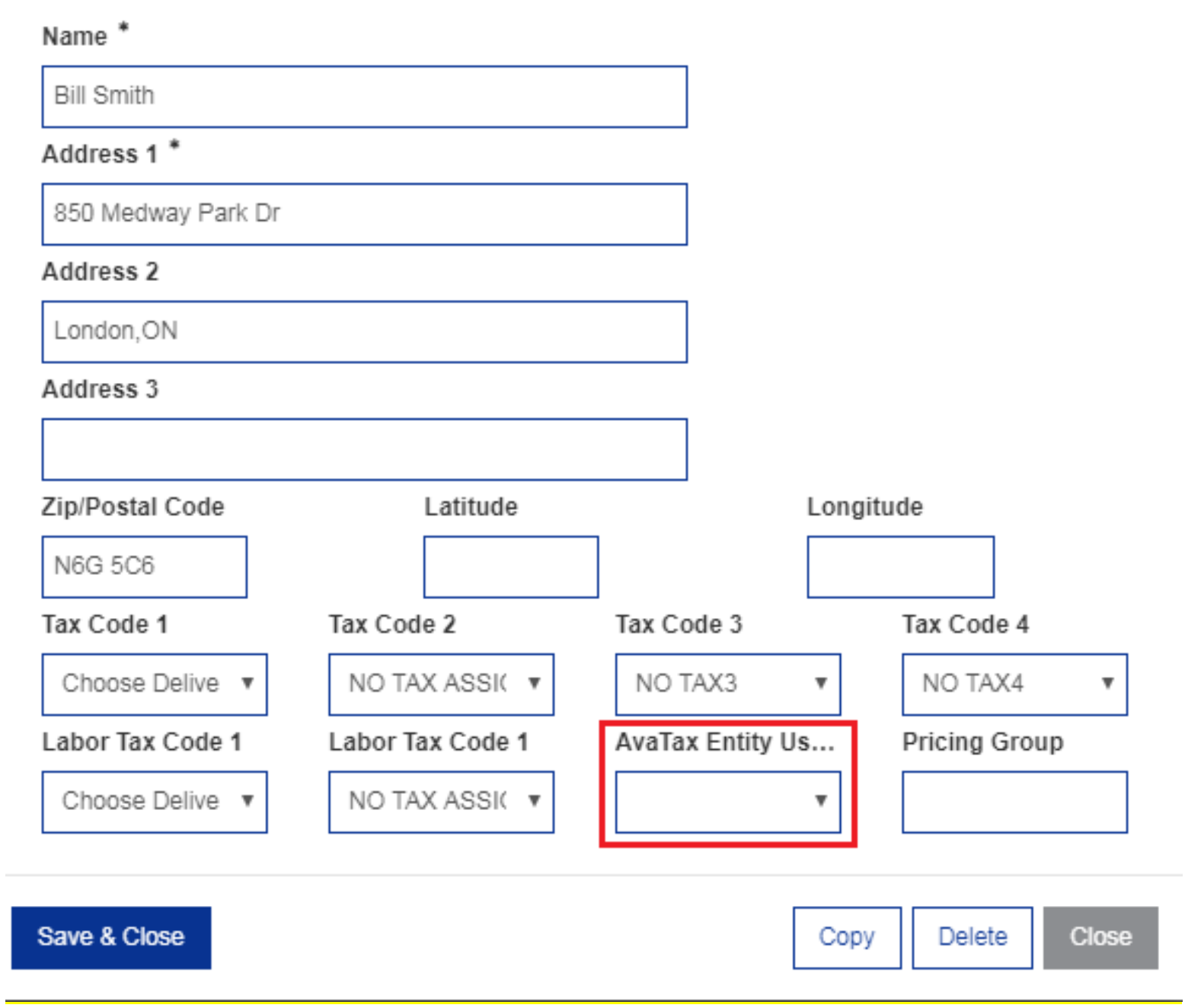

The Customer Profile screen has an AvaTax Entity Use Code to identify what kind of customer it is. The legacy tax codes are still available because open transactions will still exist when the AvaTax system is activated. The dealer is responsible for maintaining the legacy coding until all old transactions have been completed.

If not using ECM, load a default AvaTax Entity Use Code on the Ship To’s loaded on customers. The legacy tax codes are still available because open transactions will still exist when the AvaTax system is activated. The dealer is responsible for maintaining the legacy coding until all old transactions have been completed.