AvaTax: Rental

Note: IntellilDealer does not receive AvaTax data for Integrated Rental since tax information is transmitted to Avalara by the Integrated Rental system. You must get the tax reports for Integrated Rental transactions from AvaTax.

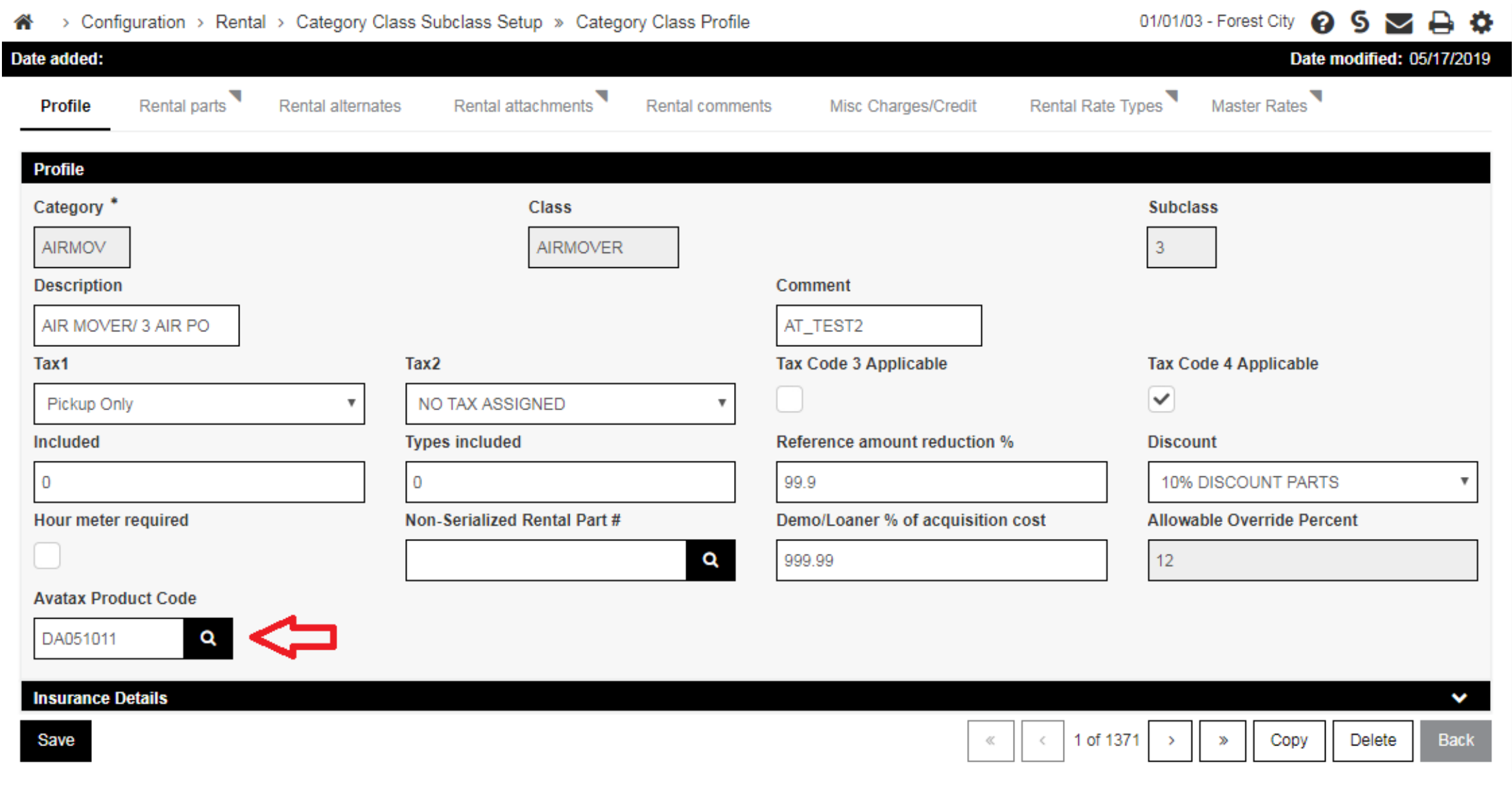

You must load an AvaTax Product Code into the Configuration > Rental > Category Class Subclass Setup for each entry. This product code represents the appropriate code for renting a piece of equipment. This is different than the product code loaded in Equipment Profile, which is meant to be used when selling a piece of equipment. The legacy tax indicators are still available because open transactions still exist when the AvaTax system is activated. The dealer is responsible for maintaining the legacy coding until all old transactions have been completed.

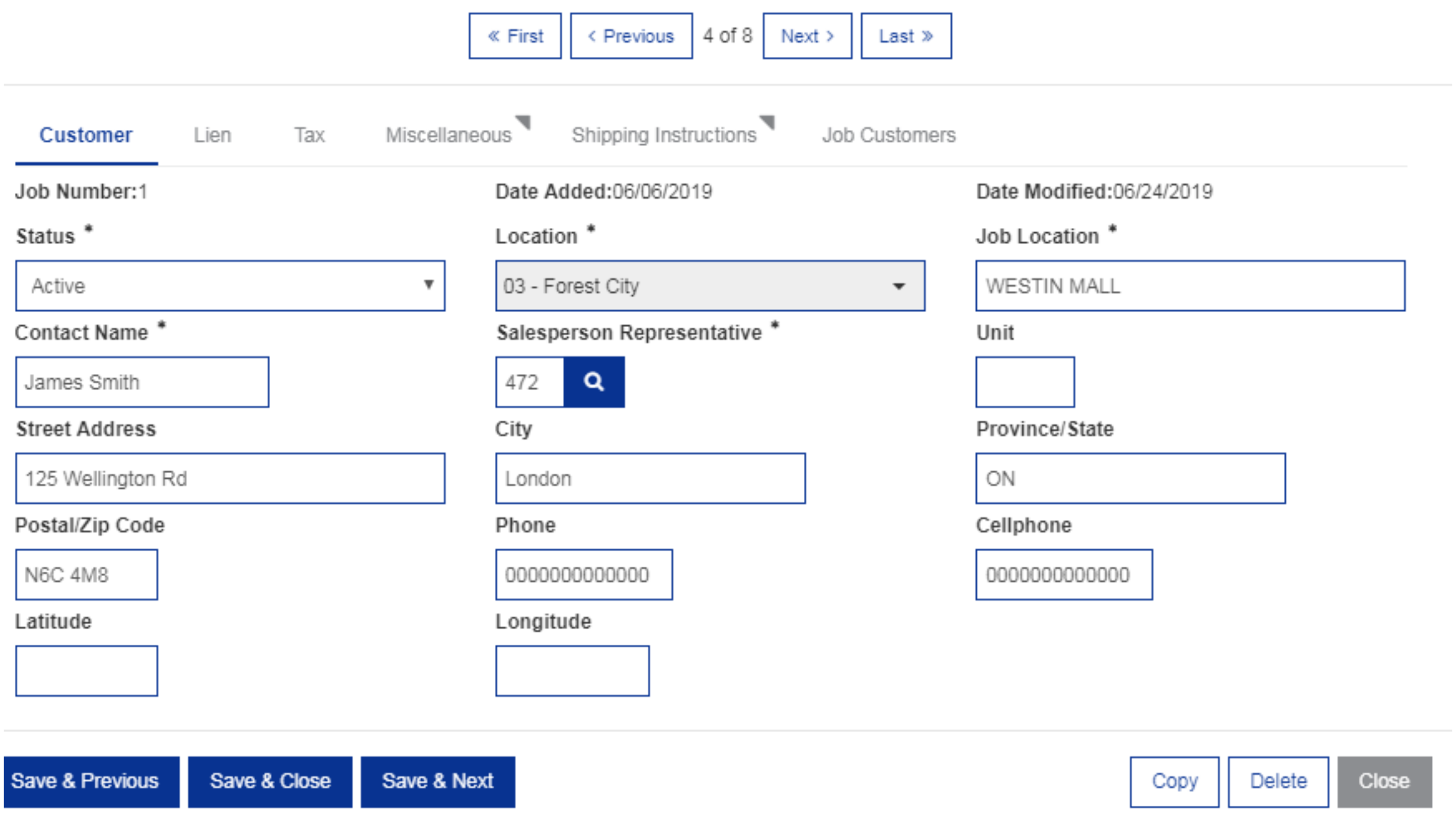

If an address is added or modified on a Job Site, the system attempts to validate the address keyed, provided that a latitude/longitude has NOT been specified. Latitude/Longitude takes precedence for tax calculation if the address is in the United States.

Note: You can use the magnifying glass to set the latitude/longitude. More information can be found in the Latitude/Longitude Finder section.

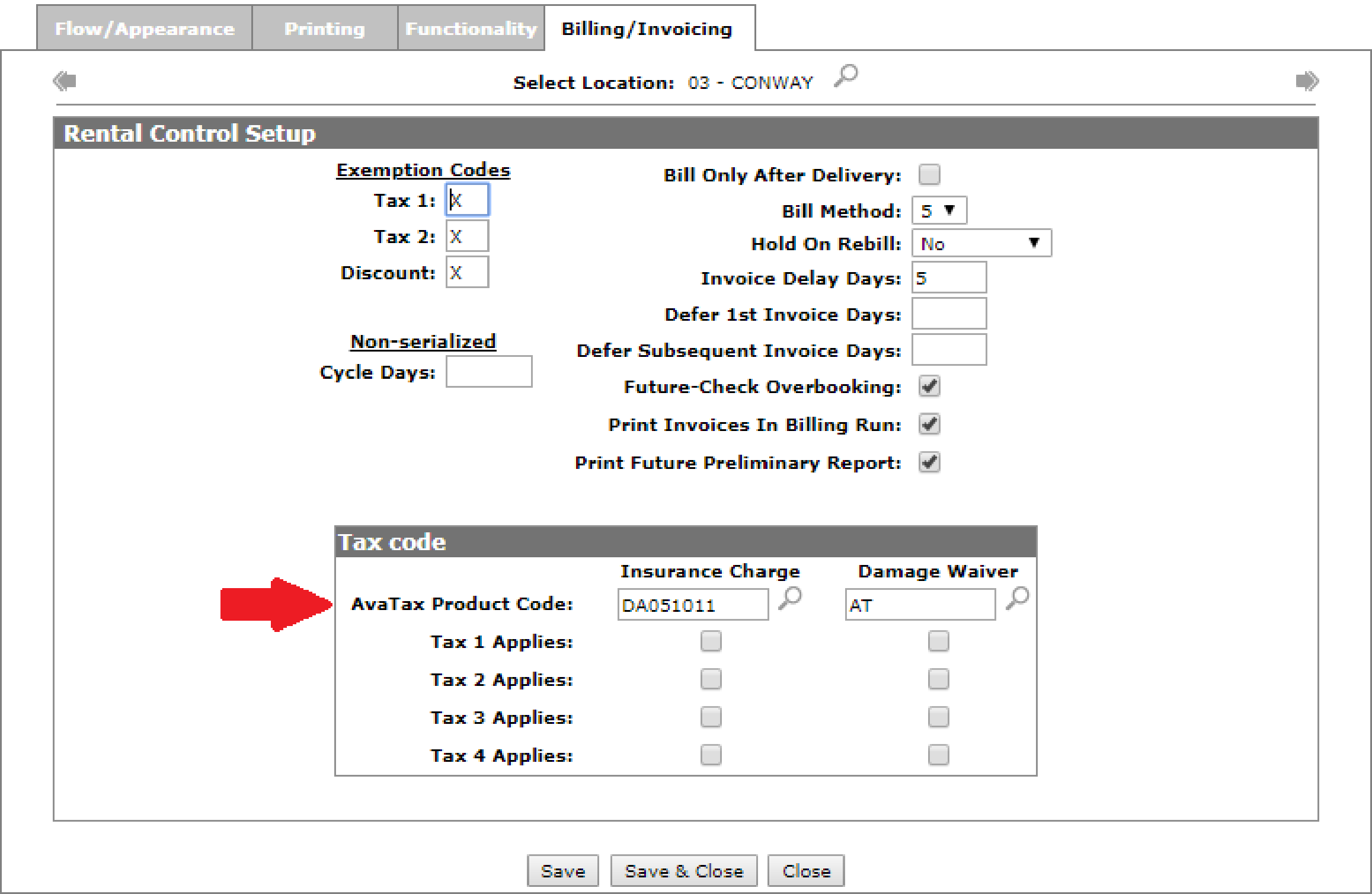

For the Insurance Charge and Damage Waiver, load an AvaTax Product Code into the Configuration > Rental > Rental Control Setup Billing/Invoicing tab. The legacy tax indicators are still available because open transactions still exist when the AvaTax system is activated. The dealer is responsible for maintaining the legacy coding until all old transactions have been completed.

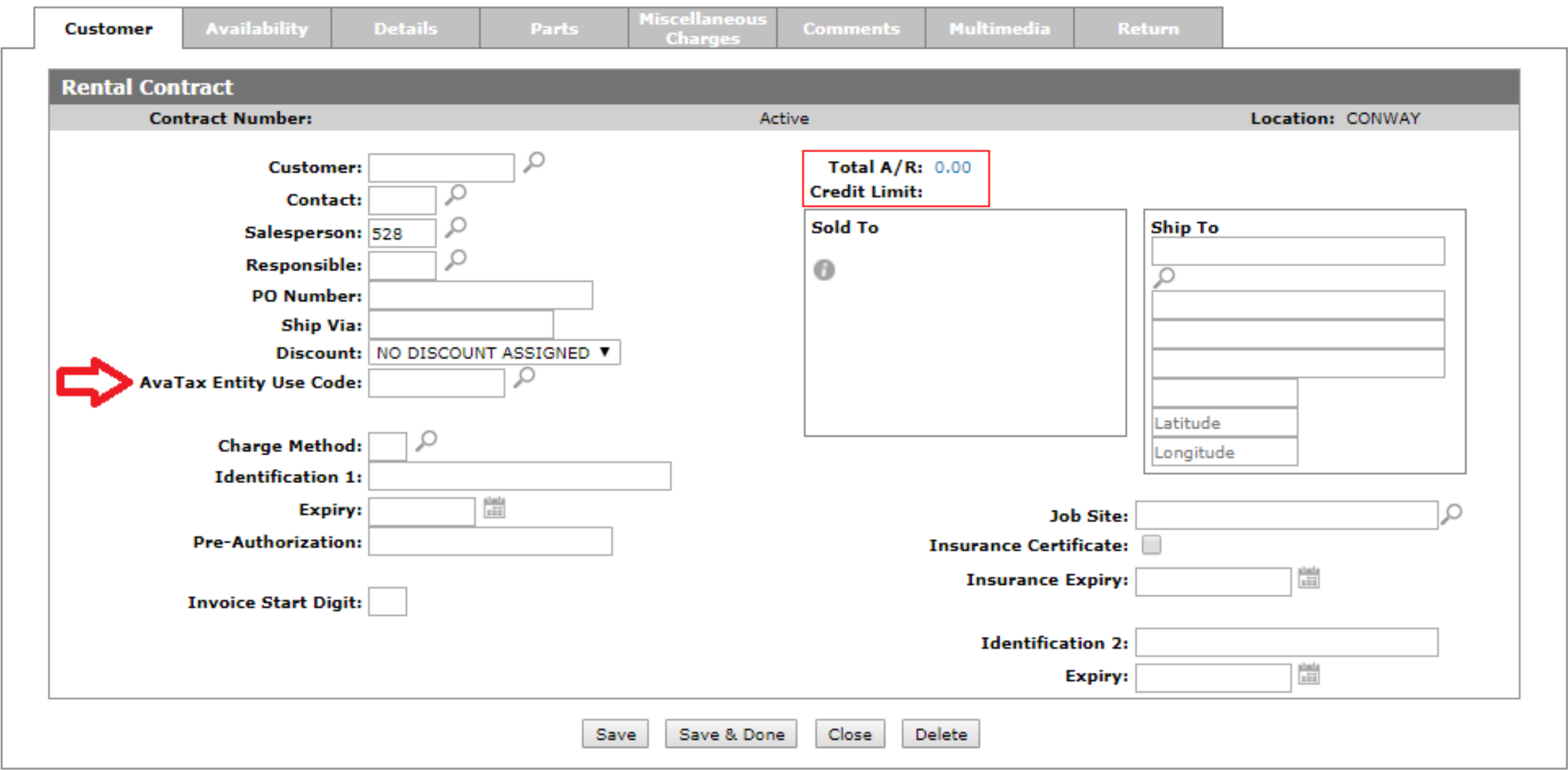

On Customer tab of Rental Counter, the AvaTax Entity Use Code field is available and defaults according to the customer. If necessary, this can be overridden.

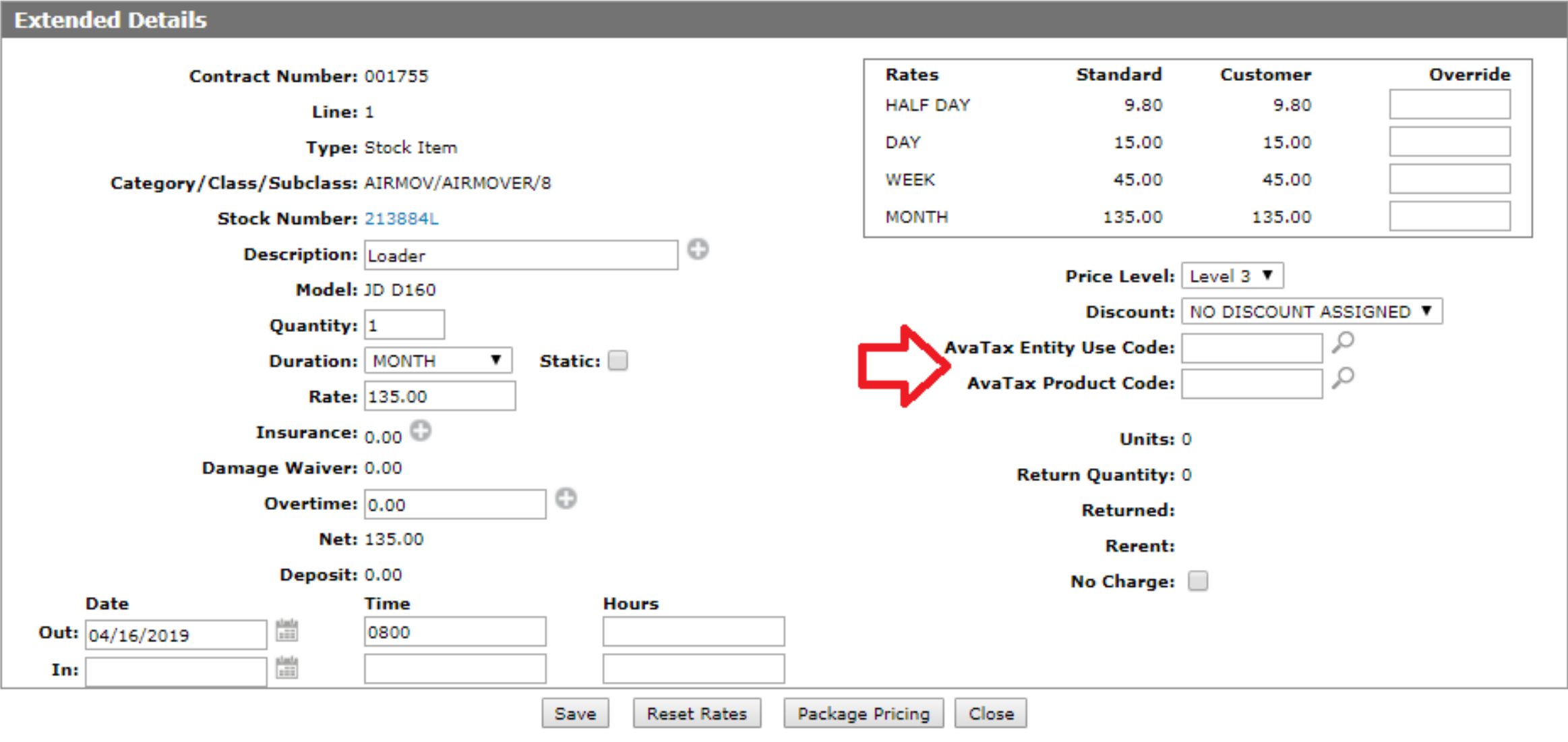

When you are on the Details tab of a rental contract, you can access a unit’s Extended Details by clicking the Details button. The AvaTax Entity Use Code and AvaTax Product Code fields are available to override as necessary. If the AvaTax Entity Use Code is left blank, the system uses the AvaTax Entity Use Code configured on the Customer tab when communicating to AvaTax. The AvaTax Product Code defaults to the product code configured on the category/class/subclass and can be overridden if desired.

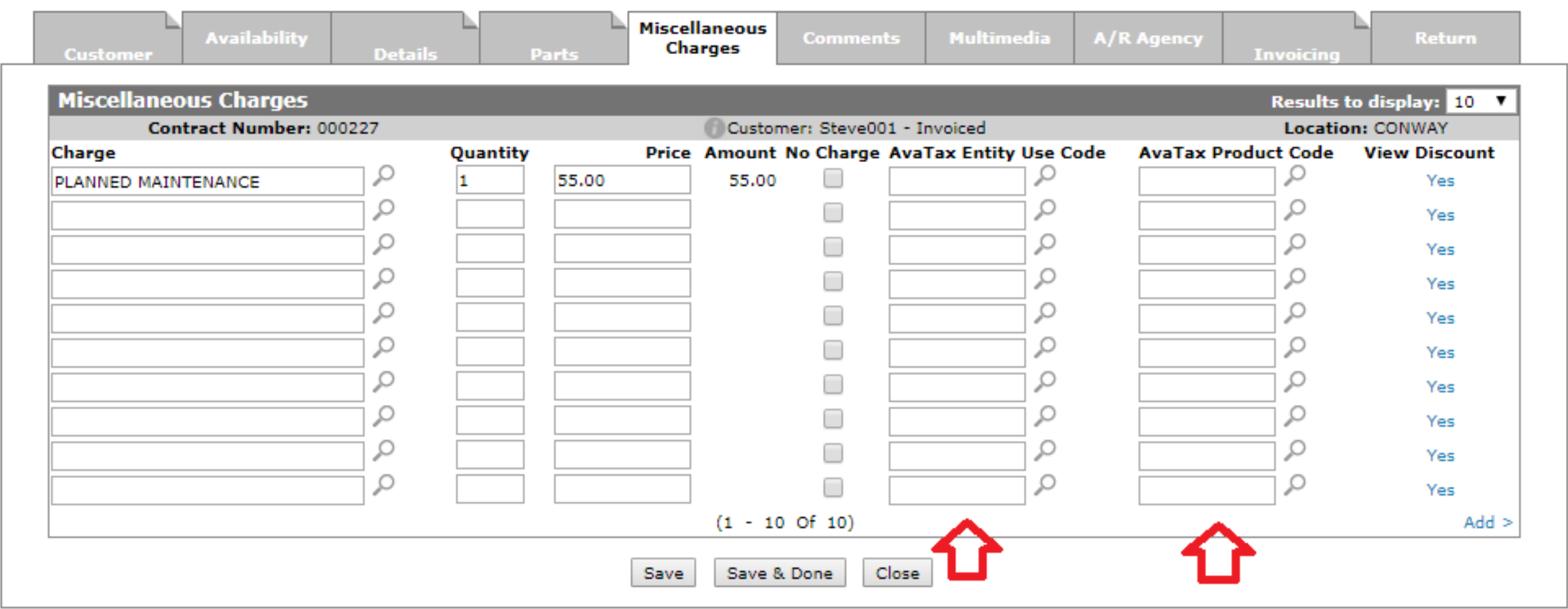

When you are on the Miscellaneous Charges tab of Rental Counter, the AvaTax Entity Use Code and AvaTax Product Code fields are available to override as necessary. If the AvaTax Entity Use Code is left blank, the system uses the AvaTax Entity Use Code configured on the Customer tab when communicating to AvaTax. The AvaTax Product Code defaults to the product code configured on the miscellaneous charge in the Configuration > Equipment > General > Miscellaneous Charges Credits table and can be overridden if desired.

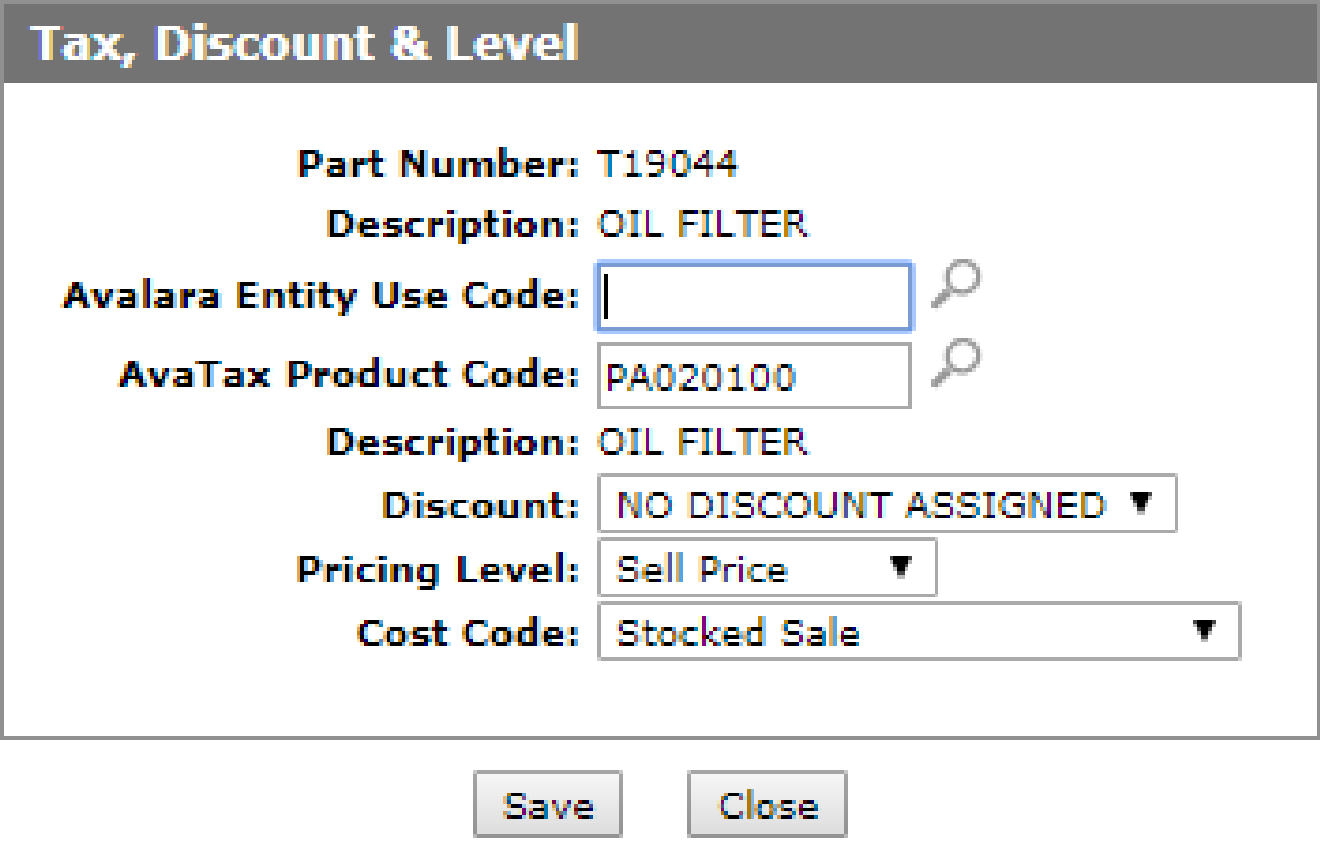

When you are on the Parts tab, you can access the Tax, Discount & Level window. The AvaTax Entity Use Code and AvaTax Product Code fields are available to override as necessary. If the AvaTax Entity Use Code is left blank, the system uses the AvaTax Entity Use Code configured on the Customer tab when communicating to AvaTax. The AvaTax Product Code defaults to the product code configured on the part in Parts Profile and can be overridden if desired.

Note: For a Rental Invoice reversal, the system communicates with AvaTax during the billing run and sends a special ‘refund’ transaction for the original invoice. The invoice cannot be reversed more than once.

Rental Cat/Class/Subclass: AvaTax Product Codes

These product codes represent the appropriate code for renting a piece of equipment.

The fields displayed on the AvaTax Product Codes screen are:

| Field | Description |

|---|---|

| AvaTax Product Code |

The code assigned to products being rented in IntelliDealer. |

| Description | A brief description of the rental tax code. |