Adding a User Defined Depreciation Schedule

Allows you to create user defined depreciation schedules. Up to fifty different user defined methods can be set up. Each schedule can span up to 40 years, be declining balance or straight line and have its own purchase and disposal convention. User Defined Depreciation codes load onto the system are used as valid user defined depreciation codes within the fixed asset system. The User Defined Depreciation codes will appear on the Select Method screen, accessed by selecting the Search ![]() icon next to the Method field on the Fixed Asset Profile tab.

icon next to the Method field on the Fixed Asset Profile tab.

-

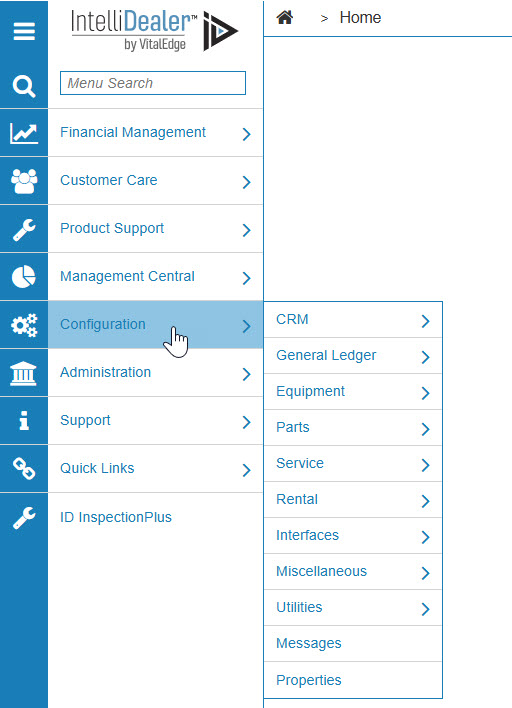

From any IntelliDealer screen, click on the Configuration tab.

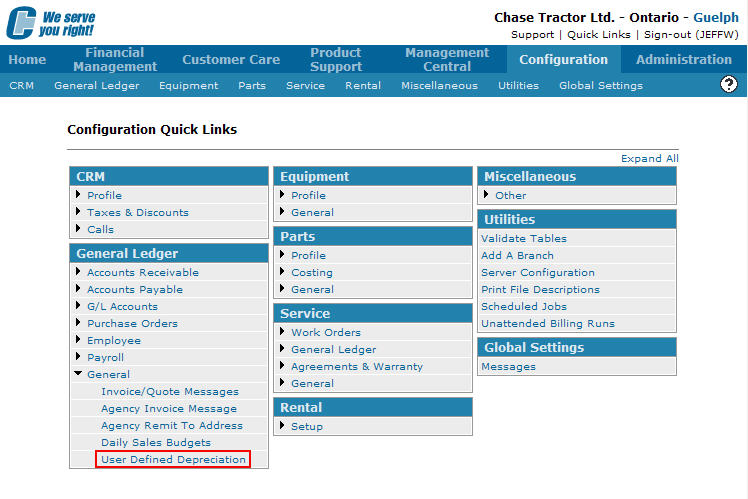

The Configuration Quick Links screen will appear.Configuration Quick Links screen

-

From the General Ledger list, click the General link and select User Defined Depreciation from the drop down list.

Configuration Quick Links screen

-

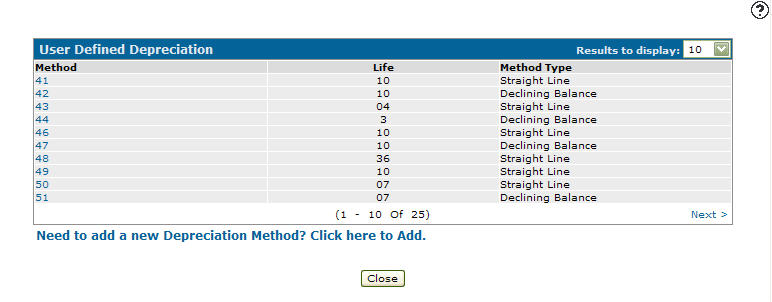

The User Defined Depreciation screen will appear.

User Defined Depreciation screen

-

On the User Defined Depreciation screen, click on the Need to add a new depreciation method? Click here to add link.

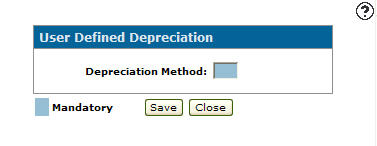

The User Defined Depreciation screen will appear.User Defined Depreciation screen

-

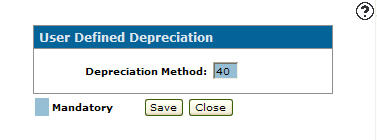

On the User Defined Depreciation screen, enter a Depreciation Method (a valid code is a number between 40 and 89).

User Defined Depreciation screen

-

Click on the Save button.

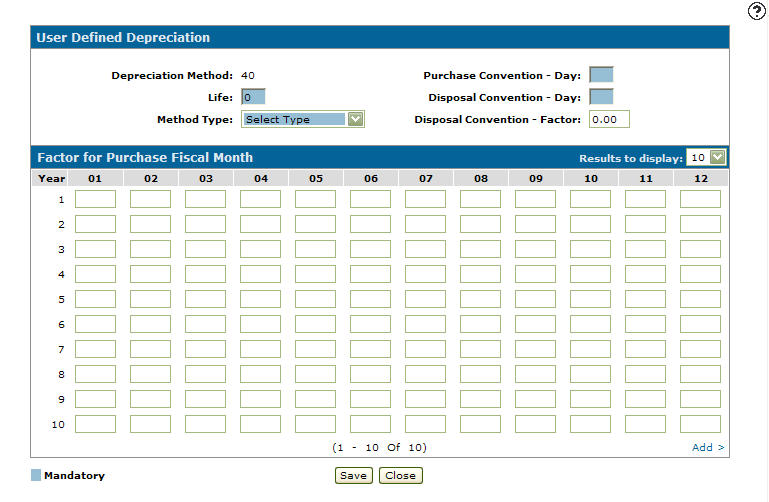

The User Defined Depreciation screen will appear.User Defined Depreciation screen

-

On the User Defined Depreciation screen, enter a Life value. The life value is the number of years to depreciate the asset.

-

Select a Method Type (Straight Line or Declining Balance) from the drop down list, used to calculate the depreciation on a fixed asset.

-

Enter a Purchase Convention - Days value. Anything entered as a fixed asset with a depreciation date on or before the purchase convention day is depreciated by the factor for the month entered.

-

Enter a Disposal Convention - Days value. Anything sold before the disposal convention day will not be depreciated in that month. Sale of equipment stock number automatically will stop the depreciation in the month of disposal.

-

Enter a Disposal Convention - Factor value. The factor used for the current month if the asset is sold prior to the days specified in the Purchase Convention - Days and the Disposal Convention - Days fields (Not valid for an equipment stock number).

-

Enter the monthly depreciation for each corresponding month.

The basic formula for the monthly depreciation is:

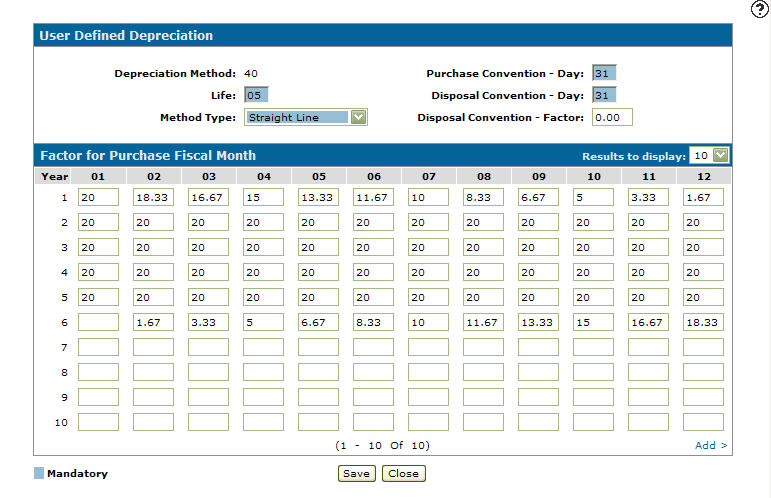

Straight Line:

Total Depreciable Amount divided by number of years of depreciation, called the Yearly Depreciation amount. In percentages for a five year this would be 20% per year. Figures are entered as percents with two decimals 20.00 is 20%.

Each column in the table must add to 10000 or 100 percent(i.e. depending on the month the depreciation begins the entire depreciation amount can be depreciated over the remainder of the fiscal year. Factors in row 1 must be reduced so that the flat monthly rate is depreciated each month).

Straight Line Depreciation Method

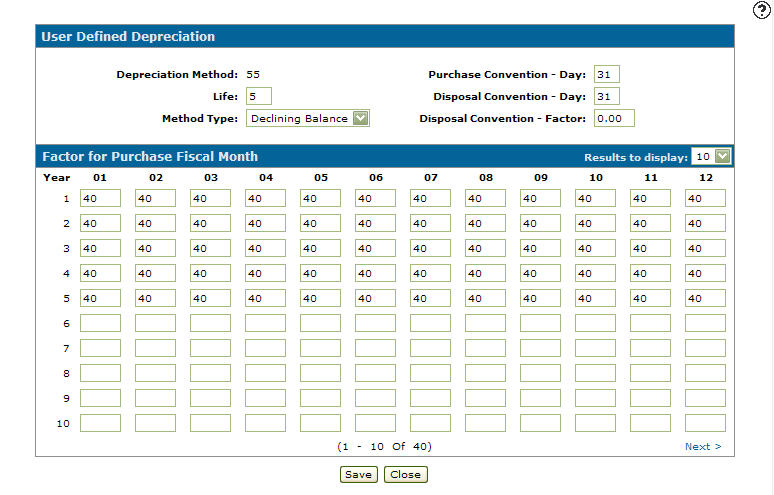

Declining Balance:

The system calculated the percentage amount for the year and will depreciate this amount equally by the percentage factor.

The following years yearly depreciation for the year is calculated by the percentage factor of the original depreciation amount less the depreciation taken in previous years.

The importance of the first year is depending on which month the depreciation starts, the total yearly amount is evenly depreciated over the remained of the fiscal year.

Each column in the table must add up to be greater than 100.00.

Declining Balance Depreciation Method

-

Click on the Save button, to save the depreciation schedule.