Labor Efficiency Overview

Topics in this section are:

Reporting Technician Efficiency

To measure the efficiency of shop technicians you can compare the difference between the Hours Worked and Hours Charged fields on the Time Card Entry screen. For example, say a Job Code assigned to a particular repair indicates that a technician should take 4.80 hours to complete the repair. However, the technician takes 5.50 hours to finish the repair. You can use either of these methods for reporting the technician's efficiency:

Using an Over/Under Allowance Account

Post the difference between the Hours Worked field and the Hours Charged field to a labor over/under allowance account. The amount of the labor sales lost or gained will appear in the general ledger reports.

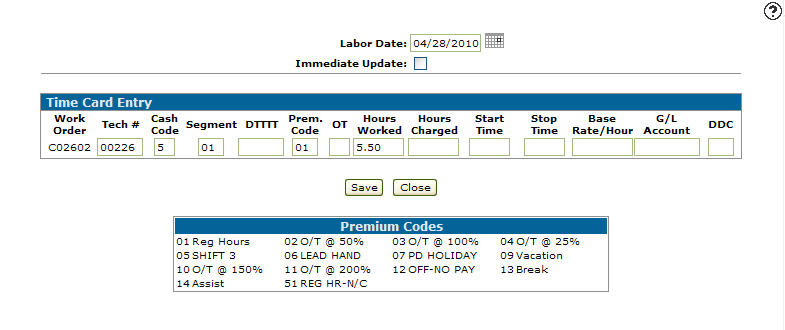

You would log the work as:

-

Enter 5.50 hours in the Hours Worked field. Click the Save button twice to post the labor to the work order.

-

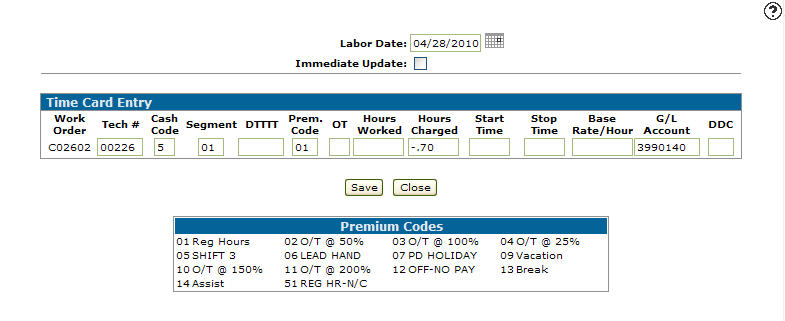

On a separate entry, enter 0.70 hours credit in the Hours Charged field and in the G/L Account field enter an over/under allowance account (e.g. 3990041). Click the Save button twice to post the labor to the work order.

-

The second entry for - 0.70 will credited the work order for 0.70 hours and debit the over allowance account for 0.70 hours (rather than the default labor sale account).

Without Using an Over/Under Allowance Account

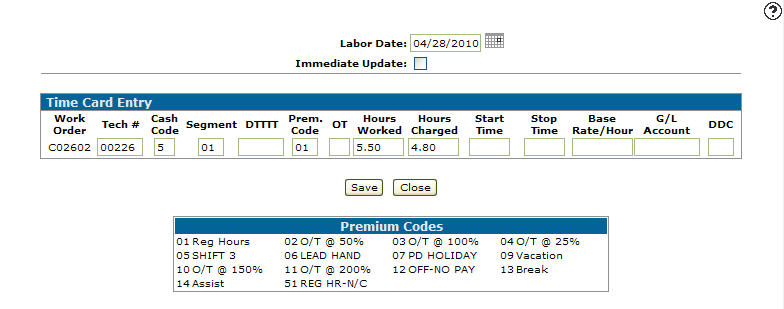

Do not charge the difference between hours worked and hours charged to a labor over/under allowance account. For this method, log the work as:

-

On the Time Card Entry screen enter 5.50 hours in the Hours Worked field and 4.80 hours in the Hours Charged field. Click the Save button twice to post the labor to the work order.

In this example the Hours Worked and Hours Charged are posted to the work order after all work has been complete.

-

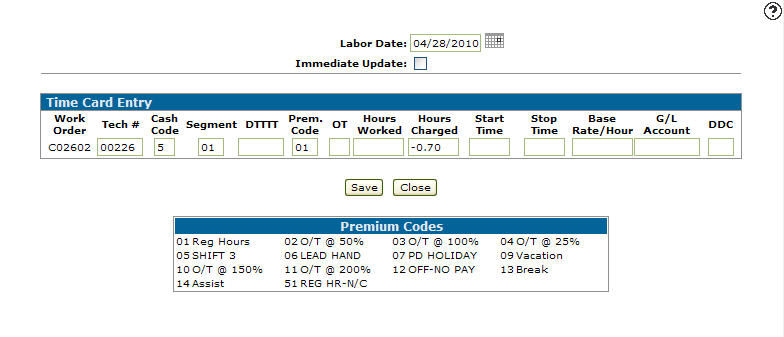

The Hours Worked value is usually posted to the repair on a daily basis. Several entries are needed to total 5.50 Hours Worked and Charged. In this case, before the Work Order is closed, credit the Hours Charges field for 0.70 hours and leave the Hours Worked field blank. Click the Save button twice to post the labor to the work order.

The result is 5.50 hours worked and 4.80(5.50 - .70) hours charged to the work order. This equals an 87% (4.80/5.50) technician efficiency for this repair.

Rework Labor Hours Adjustments

In some cases, you may need to adjust the number of hours being charged.

Example 1

For example, say 10.00 hours were changed to the customer work order, but due to poor workmanship management has decided that 1.50 hours will not be charged to the customer.

You would enter this work as:

-

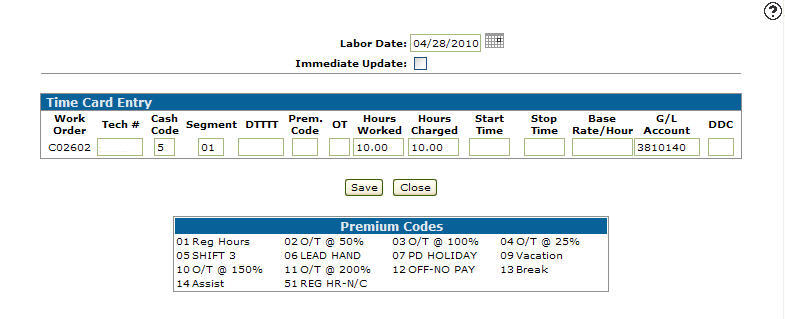

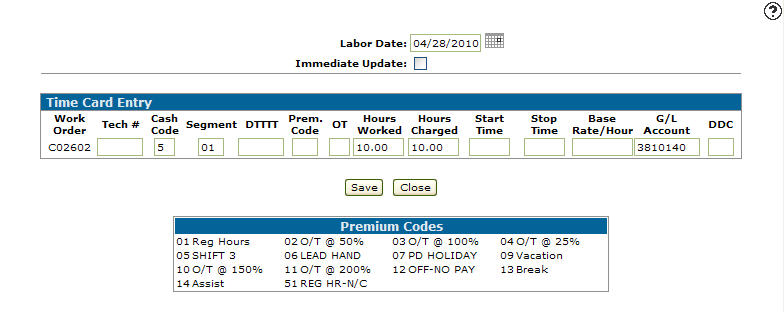

Enter 10.00 hours in the Hours Worked and 10.00 in the Hours Charged fields. Then enter the labor sales account you wish to credit in the G/L Account field (e.g. 3810140). Click the Save button twice to post the labor to the work order.

-

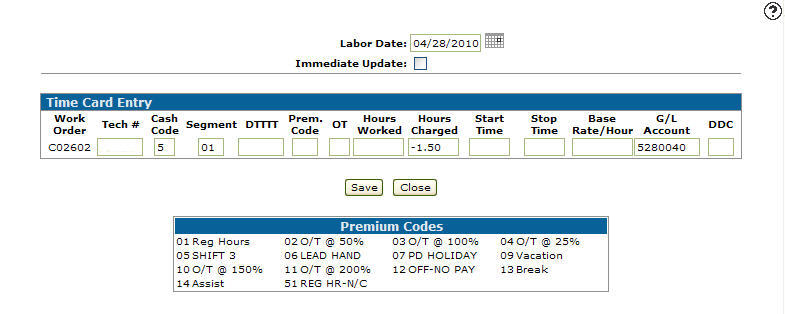

On a separate entry, enter the amount of the write off due to rework (1.50 hrs) in the Hours Charged field and enter the G\L account you wish to debit in the G\L Account field (e.g. 5280040). Click the Save button twice to post the labor to the work order.

Often the original work order is closed before the requirement for rework occurs. In which case, the second transaction should be posted to a different Work Order number.

The efficiency for the technician is 8.50 hours charged (10.00 - 1.50), 85% or 10.00 hours worked.

Example 2

In the previous example the total labor charge (10.00 hours) was reported in the G/L in the labor sale account (3810140). If only the net labor charge (10.00 - 1.50) is to appear in the labor sale account (3810140), then you should enter the following transactions (rework posted to a special labor sale account).

-

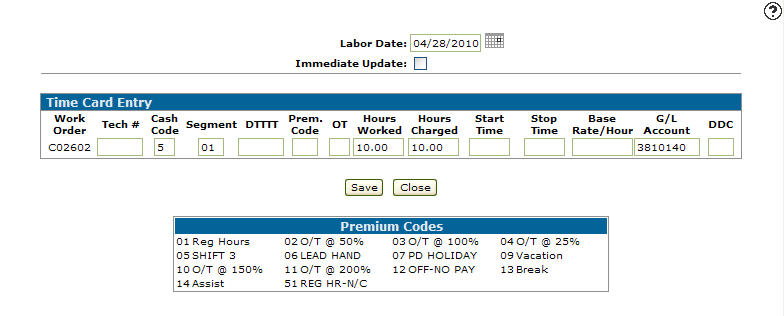

Enter 10.00 hours in the Hours Worked and 10.00 in the Hours Charged fields and enter the G\L account you wish to credit in the G\L Account field (e.g. 3810140). Click the Save button twice to post the labor to the work order.

-

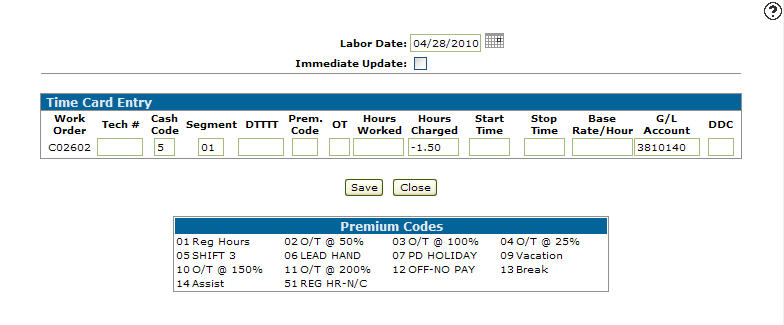

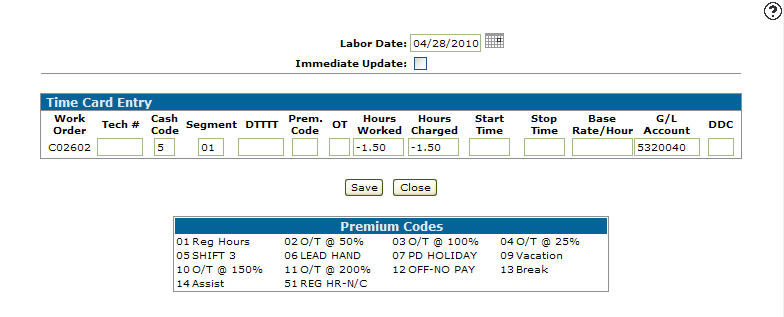

In a separate entry, enter - 1.50 in the Hours Charged field and enter the G/L account you wish to debit in the G/L Account field (e.g. 3810140). Click the Save button twice to post the labor to the work order.

-

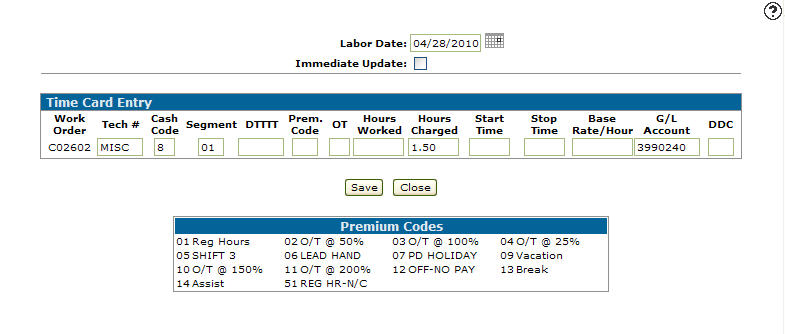

On a separate entry, enter the specified data in these fields:

-

Tech #—MISC (to record efficiency correctly)

-

Cash Code—8 (indicating an internal charge)

-

Hours Charged— 1.50

-

G/L Account—the labor allowance account you wish to credit (with the amount of rework) (e.g. 3990240).

-

-

Click the Save button twice to post the labor to the work order.

This could also be accomplished by posting the third labor transaction to a special work order, which can then be used to accumulate all rework charges for the entire month (the work order must be closed before month end).

Policy Labor Hours Adjustment

Consider the case where a policy adjustment occurs. The original charge was for 10.00 hours, but because of some reason not related to the technician, the charge is to be reduced by 1.50 hours.

-

Enter 10.00 hours in the Hours Worked field and 10.00 hour in the Hours Charged field crediting the G/L account enter in the G/L Account field (e.g. 3810140).

-

On a separate entry, enter the policy adjustment amount - 1.50 hours in the Hours Worked and Hours Charged fields debiting the G/L account enter in the G/L Account field (e.g. 5320040).

-

The technician efficiency remains at 100% since the policy adjustment is not a result of poor workmanship by the technician (8.50 hrs worked, 8.50 hrs charged).

Often the original work order would be closed before the requirement for rework occurs. If this is the case, the second transaction would be posted to a different Work Order number.

Example

In the previous example, the total labor charge (10.00 hrs) was charged to the G/L Labor sale account. If the actual labor charge was (10.00 - 1.50)

In the previous example, the total labor charge (10.00 hours) was reported in to G/L in the labor sale account. If the actual labor charge only (10.00 - 1.50) is to appear in the G/L in the labor sale account (3810140), then the following transactions would have to be entered (policy adjustment labor posted to a special labor sale account).

-

The G/L account 3810140 would be credited for the net labor charge (.e. 10.00 hours less 1.50 hours). The labor allowance account 3990340 would be credited with the amount of rework (1.50 hours).

-

The technician efficiency is 100% (e.g. hours worked = 10.00 - 1.50 + 1.50 = 10.00 hours charged = 10.00 - 1.50 + 1.50 = 10.00).

Often the original work order would be closed before the requirement for the policy adjustment occurs. If this is the case, the second and third transactions would be posted to a different Work Order number.

-

The third transaction must be cash code 8 (internal).

-

This could also be accomplished using a special work order to put the 3rd transaction to. This special work order can then be used to accumulate all policy adjustments for the entire month (the work order must be closed before the month end).

-

The net result of the above transaction will be: 8.50 hrs credited to 3810140, 1.50 hrs credited to 3990240, and 1.50 hrs debited to 5320040.

Using Technician OTHER to Transfer Charges

On occasion it may be necessary to transfer charges on a work order. Consider the case where it is decided that a work order will be split 50/50 between the customer and the dealership. It is also possible to do this using one work order, by charging all parts and labor on the work order to either customer (cash code 5) or internal (cash code 8). Then before the work order is closed the credit the internal charge (cash code 8) for half and charge this amount to the customer (cash code 5).

Example

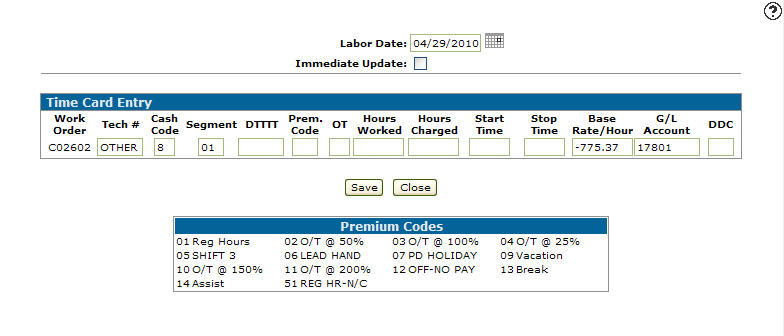

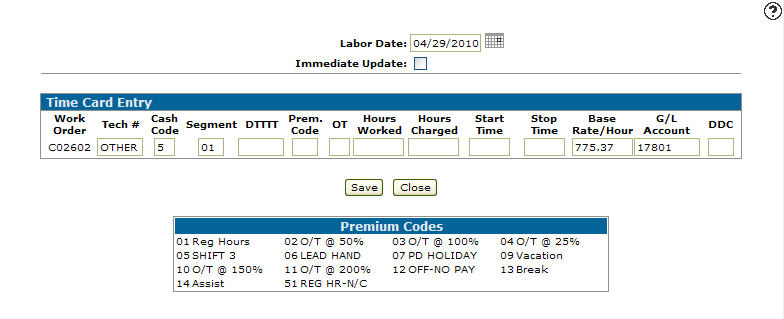

An entire repair cost was $1550.75, all of this has been previously charged to internal (cash code 8). We now want to credit the internal charge (cash code 8) for half of 1550.75 ($775.37) and charge this amount to the customer (cash code 5).

-

Enter OTHER in the Tech # field. Enter an 8 in the Cash Code field indicating an Internal charge. Enter half of the total repair cost (1550.75 / 2 = 775.37) in the Base Rate/Hour field. Enter the G/L account you wish to use in the G/L Account field (e.g. 17801).

The G/L account used on this screen must always be the work in process account where the Tech # field is OTHER.

-

Enter OTHER in the Tech # field. Enter an 5 in the Cash Code field indicating an Internal charge. Enter half of the total repair cost (1550.75 / 2 = 775.37) in the Base Rate/Hour field. Enter the G/L account you wish to use in the G/L Account field (e.g. 17801).

The G/L account used on this screen must always be the work in process account where the Tech # field is OTHER.

On the work order Segments tab, the A/R account should be entered in the Customer G/L field and the internal account should be entered in the Internal G/L Account field.

-

Any number of transactions can be entered using technician OTHER. The transactions can be posted to different repairs within the same work order or even to different work order number's. By doing this, one work order can be split among any number of G/L accounts.

The total of all debits and credits posted to technician OTHER on one screen must equal zero.

Revision: 2025.06