Tax1/ Tax2

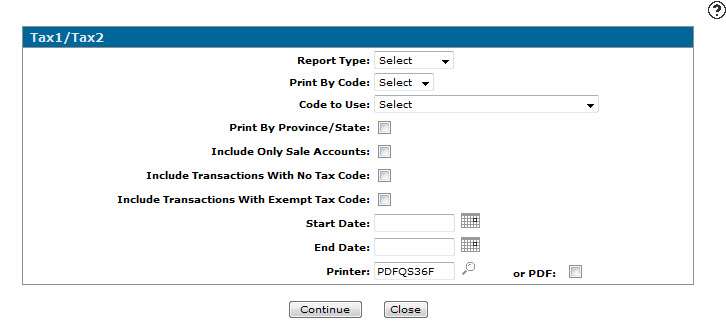

Click on the Tax1/ Tax2 link on the Tax Analysis screen to open the Tax1/ Tax2 screen.

The Tax1/ Tax2 screen allows you to create a tax analysis report for tax codes 1 and 2, the city tax code, and the county tax code.

The fields on the Tax1/ Tax2 screen are:

| Field | Description |

|---|---|

| Report Type |

Select whether to run:

|

| Print by Code |

Select whether to run the report for Tax 1, Tax 2, the City Tax Code, or the County Tax Code. Note: The City Tax Code and County Tax Code only appear as options from the drop down list if the XMIT table switch Default Via to FST Exempt# Y or N is activated in green screen. |

| Code to Use | Select whether to run the report based on Invoice Tax Code or the Current Customer Master Tax Code. |

| Print By Province/ State | Select whether to show separate totals for each tax code by province or state. If this option is selected, the province or state currently assigned to each customer in the customer master file is used. If this option is not selected, the report will include totals for each tax code regardless of the province or state of the customer. |

| Include Only Sale Accounts | Select whether to include all G/L accounts or only sale G/L accounts on the report. |

| Include Transactions With No Tax Code | Select whether transactions with no tax code will be included on the report. |

| Include Transactions With Exempt Tax Code | Select whether transactions with an exempt tax code will be included on the report. |

| Start Date | The start date for the report. |

| End Date | The end date for the report. |

| Printer | The printer to be used for printing the report. |

| or PDF | Creates a PDF file of the report which can be viewed via the PDF Viewer. |

The following reports are produced:

| BIL921 | Tax Analysis |

| BIL977 | Tax Analysis Summary |

Use these buttons to complete your work on the Tax1/ Tax2 screen:

| Button | Function |

|---|---|

| Continue | Runs the Tax Analysis report. |

| Close | Closes the Tax1/ Tax2 screen and returns to the Financial Reporting Runs screen. |