Customer Profile: Location Tax

Data Source: CMASTX

The Location Tax tab allows you to set a default tax by location that will be used for a specific location for all customers (Configuration - CRM) or a specific location for an individual customer (Customer Profile).

The fields on the Location Tax tab are:

| Field | Description |

|---|---|

| Location |

The location where the location tax codes are to be applied. Since all customers are taxed based on where they buy a product/service, the location tax should always be the starting point when assigning the correct tax code. In most states/provinces there could be a different tax code assigned if the product/service is shipped to another location. This can be handled through ship to tax code defaults. If you are using location tax, then there is no longer a need to load default tax codes on the customer profile screens. Once set up, the location tax is valid in both IntelliDealer and in the Legacy system, although you must use IntelliDealer to set up/maintain location tax codes. |

| Tax 1 |

The Tax 1 code to be used for the specific location. Taxes 1 and 2 include these standard codes:

|

| Tax 2 | The Tax 2 code used for the specific location. |

| Tax 3 | The Tax 3 code used for the specific location. |

| Tax 4 | The Tax 4 code used for the specific location. |

| Labor Tax 1 | The Tax 1 code used for labor transactions for the selected location. |

| Labor Tax 2 | The Tax 2 code used for labor transactions for the selected location. |

| Tax 3 applicable | If the Tax 3 code is applicable. |

| Tax 4 applicable | If the Tax 4 code if applicable. |

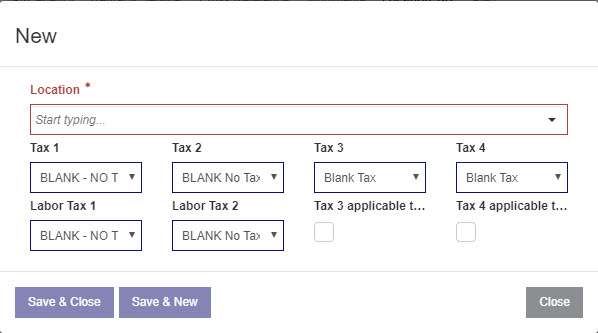

Click Create to open a new window where a new entry can be created:

Click Save & New to save the information in all fields and open another new entry window.

Click Save & Close to save the information in all fields and close the window.