Deposit: Parts

IntelliDealer uses a part number to identify the associated General Ledger account and generate a deposit receipt. You must create a separate part number for each deposit type: Parts, Work Orders and Equipment. This is so the deposits can be tracked in the General Leger separately. In addition, each location can have its own configuration for each type of deposit part number.

Topics in this section include:

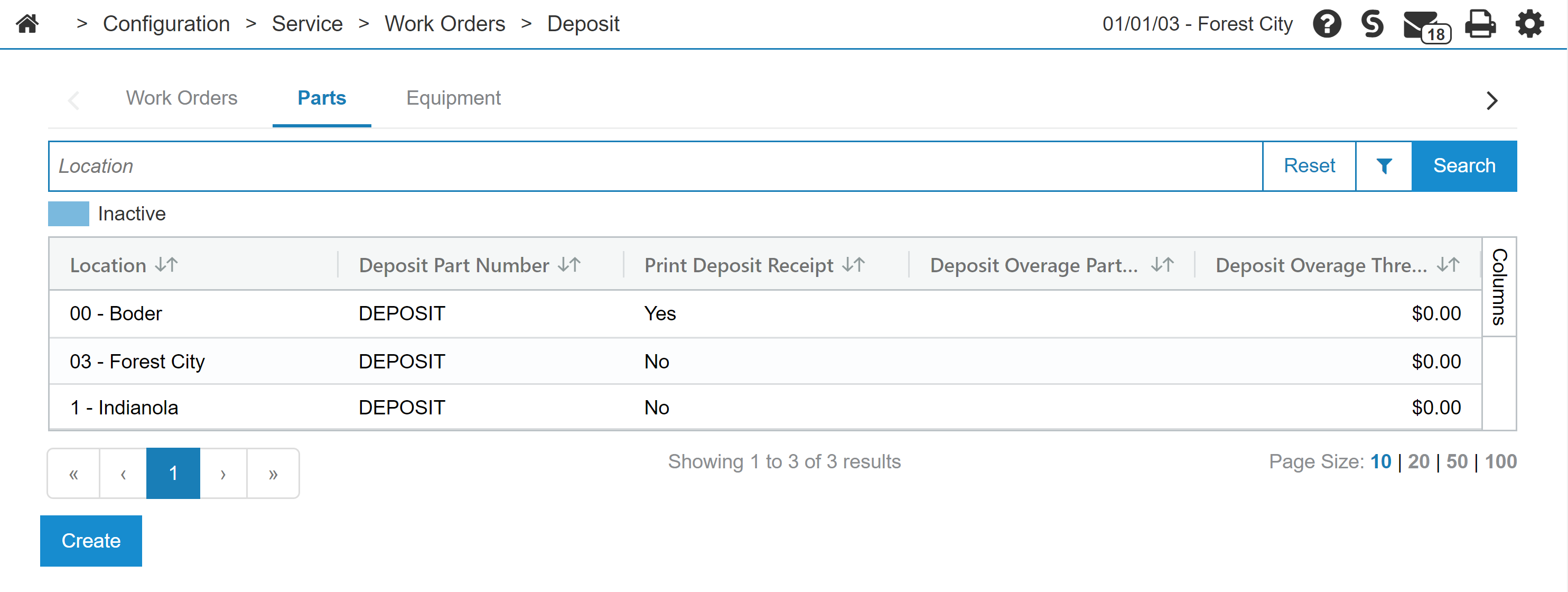

Using the Deposit screen

The Deposit screen is used to add a deposit part number if deposits are being taken in parts invoicing. The Deposit screen allows you to specify what part number to use for deposits on parts transactions at each location and whether or not a deposit receipt is to be printed. Once set, this is the part number that appears on invoices showing deposit amounts applied to the transaction.

To open the Deposit screen:

-

From anywhere within IntelliDealer, navigate to Configuration > Parts > General > Deposit.

-

Ensure that the Parts tab is selected.

-

In the Search field, enter a location to search for. You can set up a deposit part number for each branch location.

-

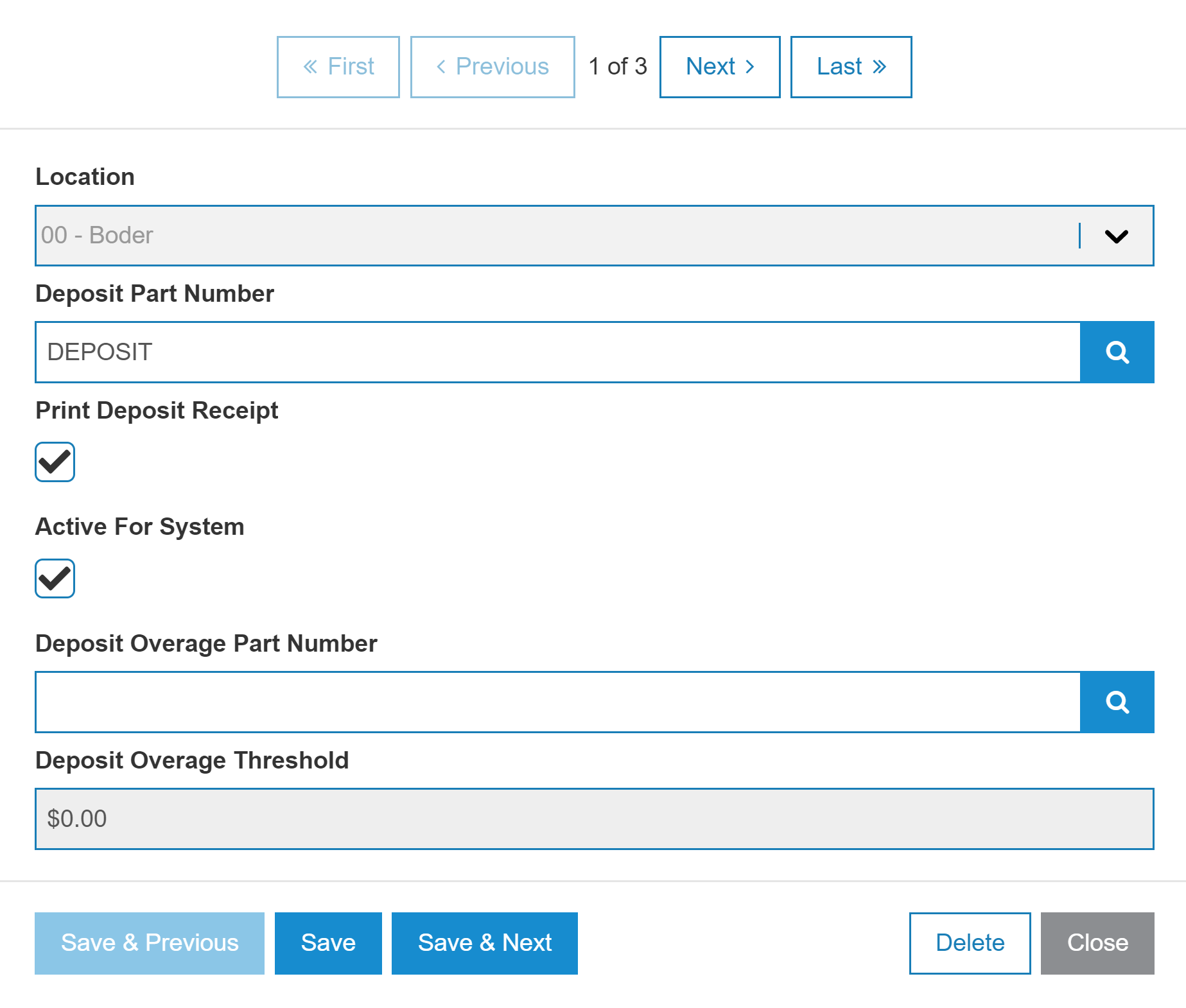

Click on the location. A location modal opens.

-

Use the buttons at the top of the modal to switch between branch locations.

The fields on the Deposit screen are:

| Field | Description |

|---|---|

| Location | The location. |

| Deposit Part Number |

Enter the part number that is set up in this location for deposits. The part number you enter here must be coded with a vendor GL and have a deposit asset assigned to it. |

| Print Deposit Receipt |

If yes, the system prints a receipt showing how much money has been accepted as a deposit, regardless of whether or not parts have been sold to the customer on the invoice. |

| Active for System | If yes, the part is active in the system. If no, the part is inactive and no deposit button will be available in equipment invoicing. |

| Deposit Overage Part Number | Enter the part number that is set up in this location to handle deposit overages. The part number you enter here must be coded with a vendor GL and have a deposit asset assigned to it. |

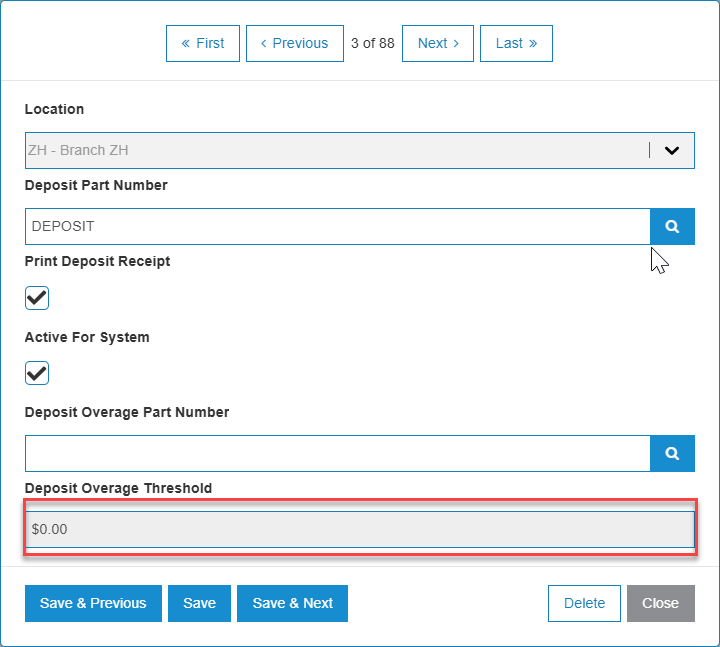

| Deposit Overage Threshold |

The maximum amount the system can automatically add as an overage amount to a part. This amount is used when calculating taxes that result in rounding errors as charges for parts are separated into multiple invoices. IntelliDealer includes logic to handle fractional amounts but occasionally, the rounding may not balance to zero. The Deposit Overage Threshold ensures the invoice can be balanced. For example, a customer pays the full deposit amount on a sales order consisting of three parts. The tax calculation results in a value ending in a fraction of a cent (.006), which is automatically rounded up to one cent (.01). However, if all the parts are not in stock, the order is split into more than one invoice and the fractional part of the tax calculation (.002) is rounded down for each part to zero. The result is a deposit overage of one cent (.01) on the final invoice. |

Use these buttons to complete your work on the Deposit screen:

| Button | Function |

|---|---|

| Create | Allows you to enter information to create a new location. |

| Save | Saves changes made on the Deposit screen. |

| Save & Previous | Saves changes made on the Deposit screen and navigate to the previous location. |

| Save & Next | Saves changes made on the Deposit screen and navigates to the next location. |

| Delete | Deletes this location. |

| Close | Closes the Deposit screen without saving and returns to the Configuration Quick Links screen. |

Understanding the Deposit Overage

When a user creates a parts invoice with multiple quantities, they may take a deposit for the entire sales order amount upfront. However, in some states, sales tax calculations can extend to multiple decimal places.

If the user invoices the order in multiple transactions instead of all at once, small discrepancies can occur due to tax rounding differences.

For example:

When selling two parts together, the total tax may round differently than when invoicing them separately. This can result in the final tax amount being slightly lower than the original estimate, leaving the deposit a cent or two higher than necessary.

At the time of the last invoice, the system may show that the customer has overpaid by a small amount. The user then faces two options:

-

Refund the excess amount (often just a cent or two).

-

Sell an item for the exact overage amount to balance the sales order.

The Deposit Overage Part automates this process to avoid unnecessary refunds.

Other Notes on Deposits

If the total deposit exceeds the final invoice amount, the system automatically adds the deposit overage part to the invoice.

This ensures that the sales order balances without requiring manual intervention.

The deposit configuration also includes the Deposit Overage Threshold field, which defines the maximum overage amount that can be automatically adjusted.

LOCGRP

Revision: 2026.01