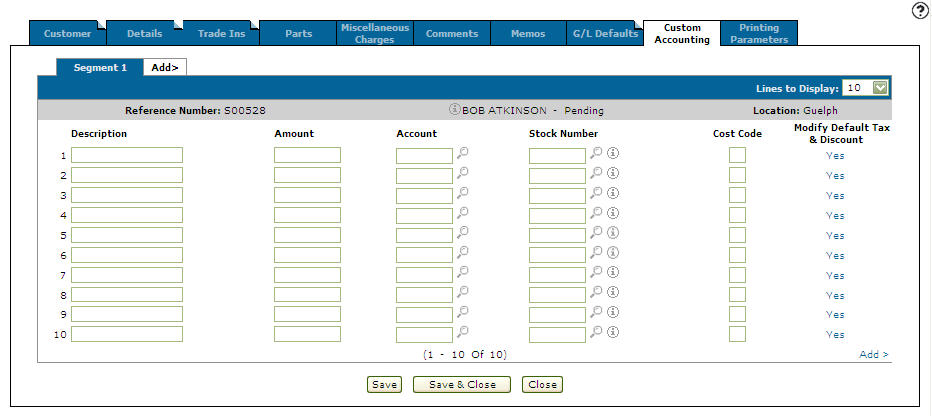

Equipment Invoicing: Custom Accounting

Use the Custom Accounting tab to perform any additional accounting entries related to the invoice that are not already performed as part of the sale.

To open the Custom Accounting tab, hover over a Reference Number on the Equipment Invoicing screen and select View or Edit from the pop-up menu, or click the Need to create a new invoice? Click here to add link. Selecting the Reference Number also opens the listing.

The system includes any Cost entries entered on this screen in the unit cost, if automatic costing has been previously activated.

If the selected invoice was created by converting an equipment quote, custom accounting entries created as a result of the Margin Programs, Margin Additional Costs, or Margin Reserves from the corresponding Margin Worksheet are protected.

The Information fields on the Custom Accounting tab are:

| Information | |

|---|---|

| Field | Description |

| Reference Number | The equipment quote or invoice reference number. |

| Customer Name | The name of the customer on the invoice. |

| Location | The location of the equipment quote or invoice. |

The fields on the Custom Accounting tab are:

| Field | Description |

|---|---|

| Description |

A brief description that prints on the sales analysis reports and is displayed in the subledger system. This data also updates the history data in the equipment system when a stock number is specified. |

| Amount | The amount posted to the G/L for this transaction. |

| Account |

A value is required only if the line being entered has an equipment, fixed asset or parts account and the part, equipment and/or fixed asset system is active. Enter a stock number or asset number, in any other case leave the field blank. Note: If the Account field is left blank and an inventory stock number is entered, the system automatically defaults to the inventory account of the stock number. |

| Stock Number |

The stock number of the unit on the selected invoice. A segment on an invoice can have multiple units. |

| Cost Code | Used when the equipment or fixed asset systems are active and an equipment inventory or fixed asset account is used. The non-stocking code field is required to indicate to the system whether the original cost is being loaded or the current cost is being adjusted. |

| Modify Default Tax & Discount | Allows you to change the default tax and discount codes for this transaction. |

To sort the listed accounting entries by unit, click the Sort By Stock# button.

The valid Cost Codes are:

| Cost Codes | |

|---|---|

| Code | Description |

| O | Load original cost. A history record is not added to the history file for this transaction. |

| C | Adjust current cost. A history record is added to the history file for this transaction. |

Use these buttons to complete your work on the Custom Accounting tab:

| Button | Function |

|---|---|

| Save | Save changes made on the Custom Accounting tab. |

| Save/Exit | Saves changes made on the Custom Accounting tab and closes the invoice. |

| Close | Closes the Custom Accounting tab without saving and returns to the Equipment Invoicing screen. |