Advance Deposits

Advanced Deposits are also called Received on Account (ROA). This generally refers to money received from a customer where the specific invoice or purpose of the payment is not immediately clear, or when a customer makes a partial payment on an outstanding balance. This could be for internal accounts receivable; for example when a customer makes a payment on their account at the parts counter. Or it could be used to describe third-party credit card authorizations for vendors cards that allow this (such as Farmplan, JDC2, or CNH). Regular credit cards do not work this way though, only vendor cards such as JDC2.

Within IntelliDealer, you must first create an ROA part which you can use to accept the payment against the customer's account. Payments from customers are received through the Parts Invoicing module. For all intents and purposes, the ROA part is treated like any other part would be on an invoice.

Ensure that the dollar value keyed is positive. Since an accounts receivable G/L account is being used as the part's sale account, IntelliDealer makes two entries:

-

A debit to the cash code G/L used on the invoice (e.g. Cash, Credit Card)

-

A credit to the customer's A/R outstanding

Once the billing run goes through, you will see the credit on the customers account.

Topics in this section are:

Setting up an ROA Part

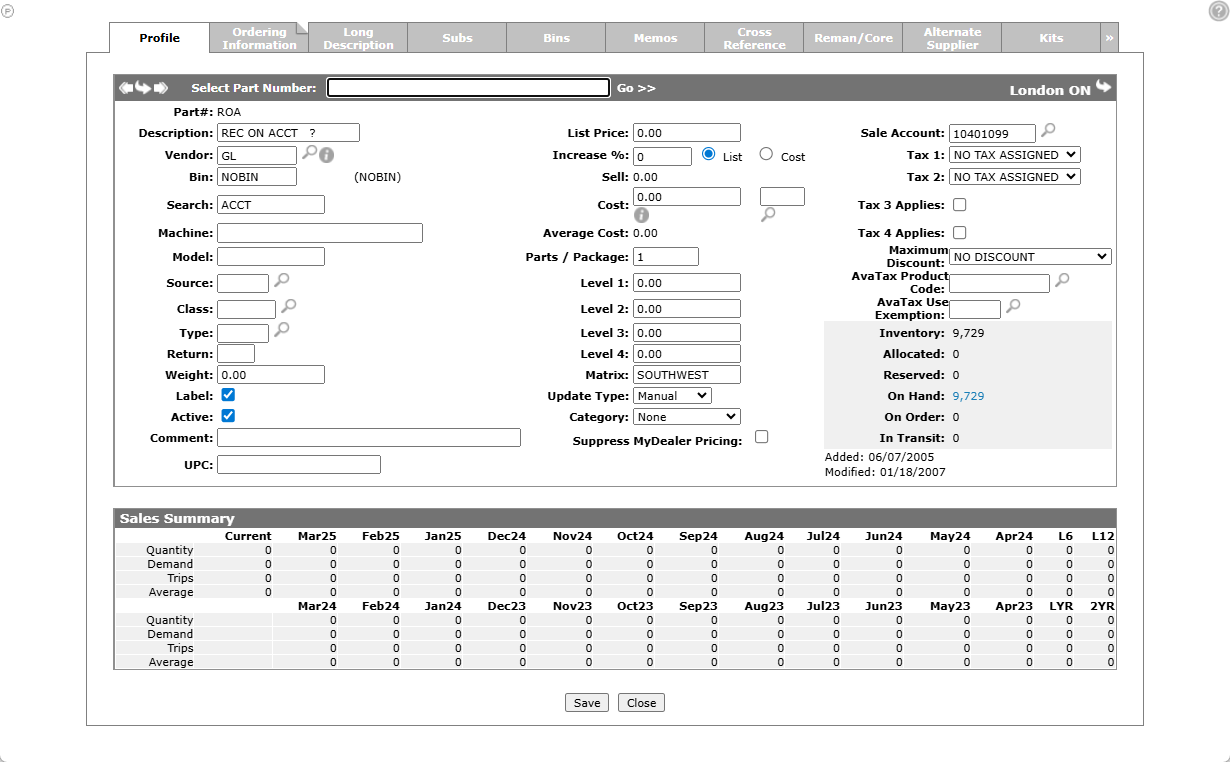

Create a new part and give it these settings:

-

Vendor number—set to GL which marks this as a miscellaneous part.

-

List —set to $0.00 to prompt the user to enter a sell price when adding the ROA part to a customer document

Cost—set to $0.00 to prevent accidental costing being done for this part when it is used.

-

Sale Account—set to the accounts receivable G/L account.

-

Tax 1, Tax 2 and Discount— set to code X to override any customer profile settings as there should be no taxes charged on a payment on account. If present, Tax 3 and Tax 4 boxes should remain unchecked.

Code X has special meaning. It is not only exempt from taxes but also will never be overridden by any other tax code under any circumstances. Other exempt codes can be overridden based on tax table settings. See code X.

Accepting Customer Advance Deposits

Use this procedure to receive a customer payment to their account in advance of future purchases on that account.

-

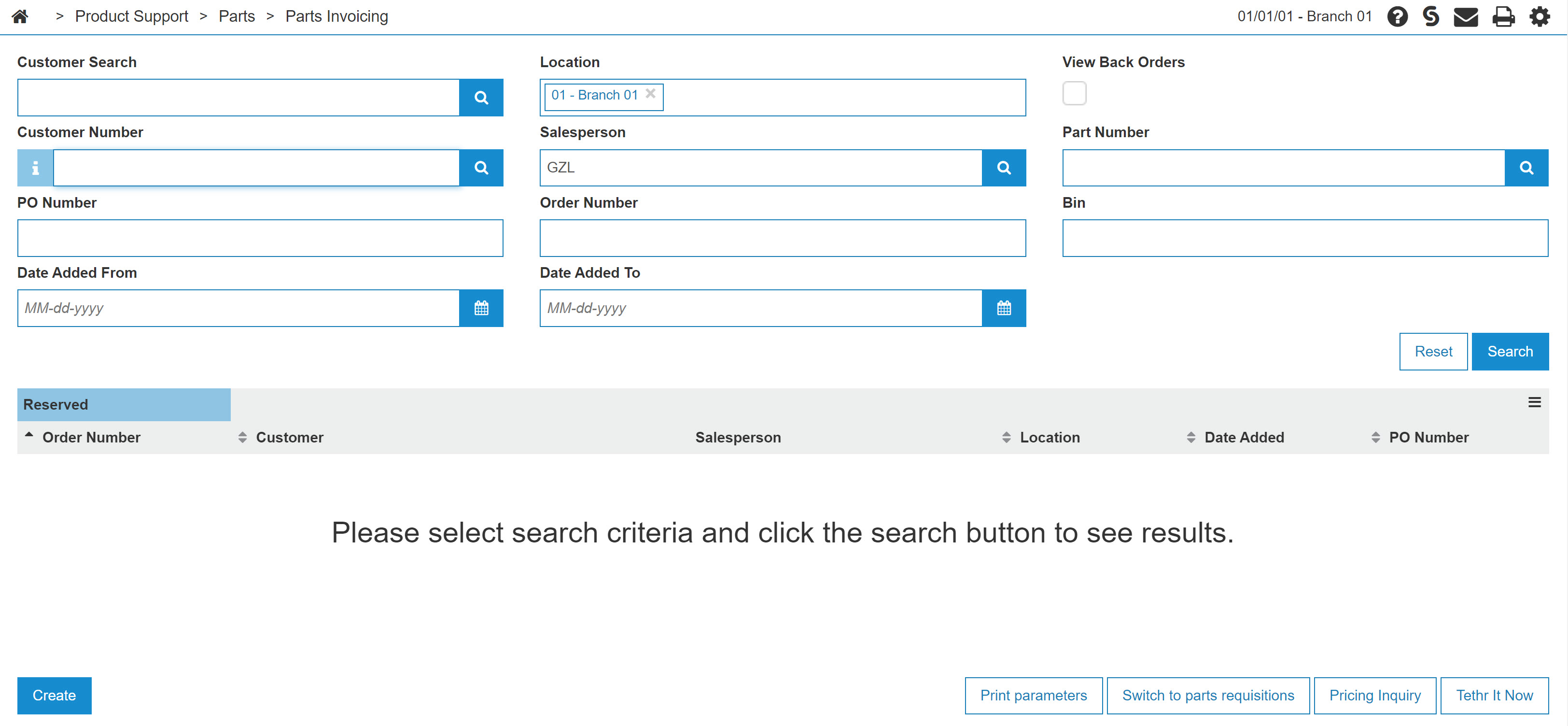

Navigate to Product Support > Parts > Parts Invoicing.

-

Click Create.

-

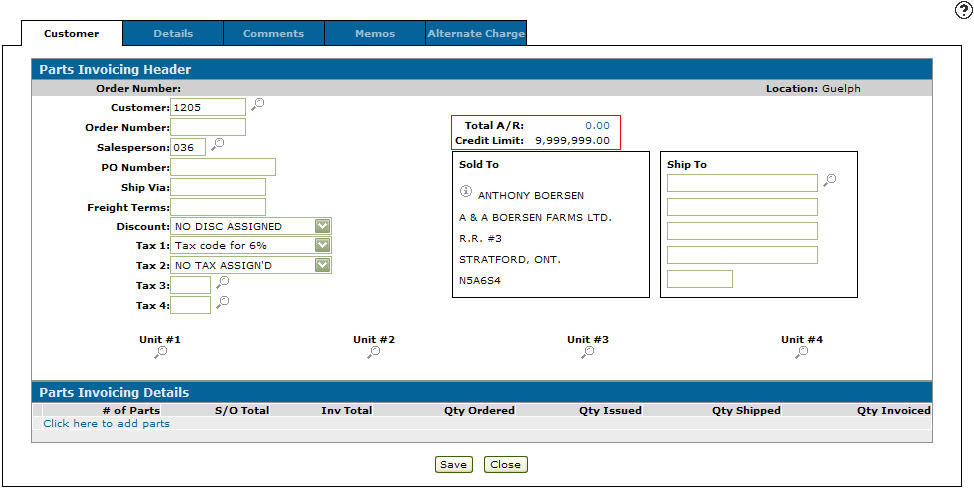

Enter a Customer number or click the Search

icon to search for a customer.

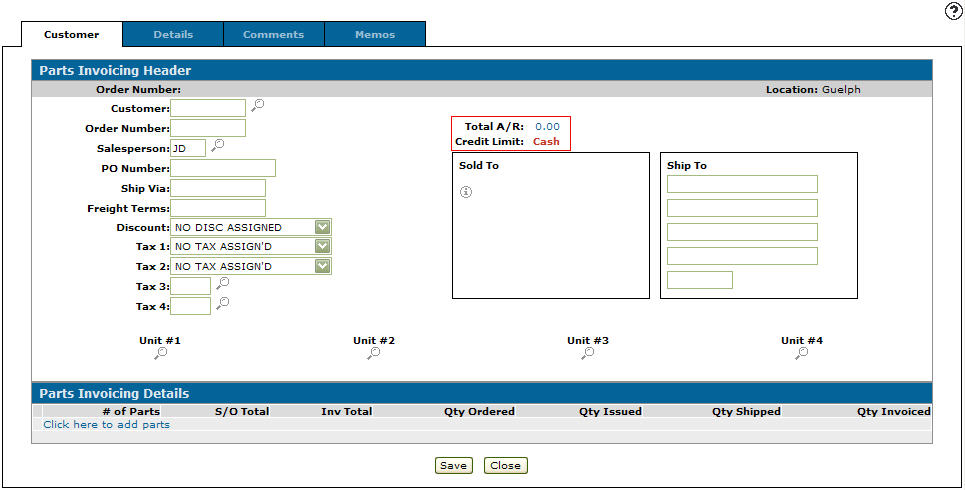

icon to search for a customer.The Customer - Parts Invoicing Header tab appears with the selected customer number in the Customer field and the customer's Sold to address filled out.

-

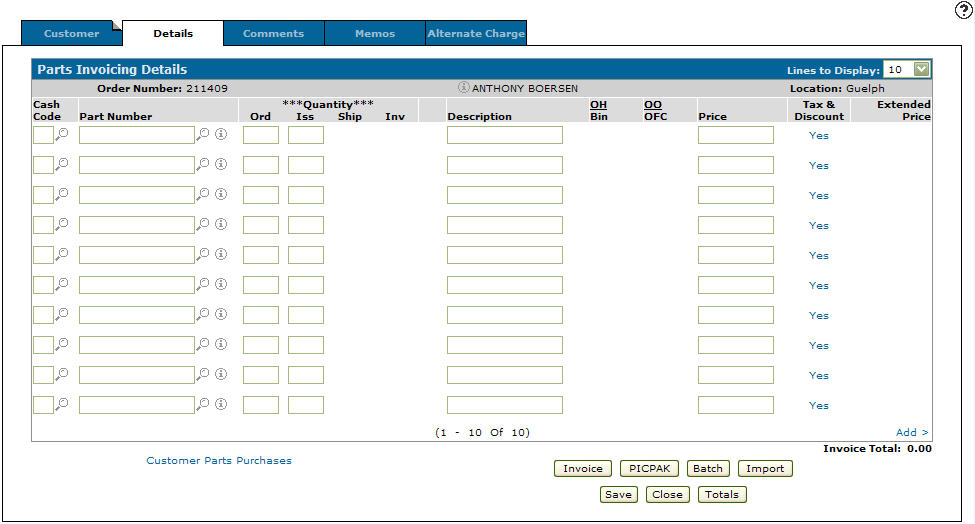

Select the Click here to add parts link -or- click the Details tab.

-

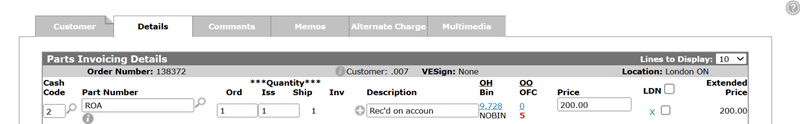

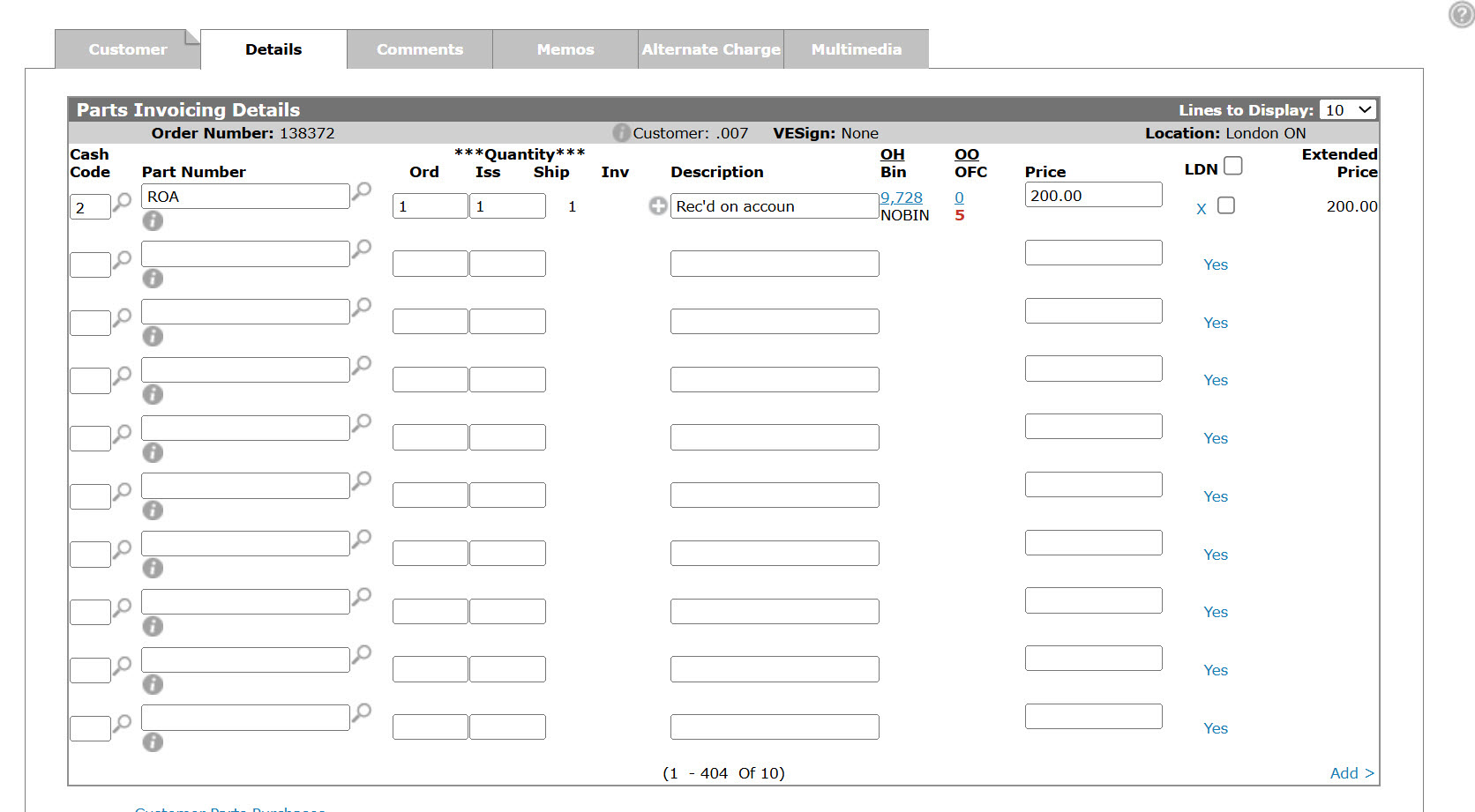

Enter cash code 2 in the Cash Code field.

-

Enter RECD or ROA in the Part Number field, depending on your systems accounts.

Using the RECD or ROA part number applies the payment to the right A/R account.

-

Enter 1 in the Ord amount field.

-

Enter a description that indicates this is an ROA payment.

-

Enter the amount of the payment in the price field.

-

Click Save.

-

Click the Invoice button to complete the process.

Revision: 2025.07