AvaTax: Equipment

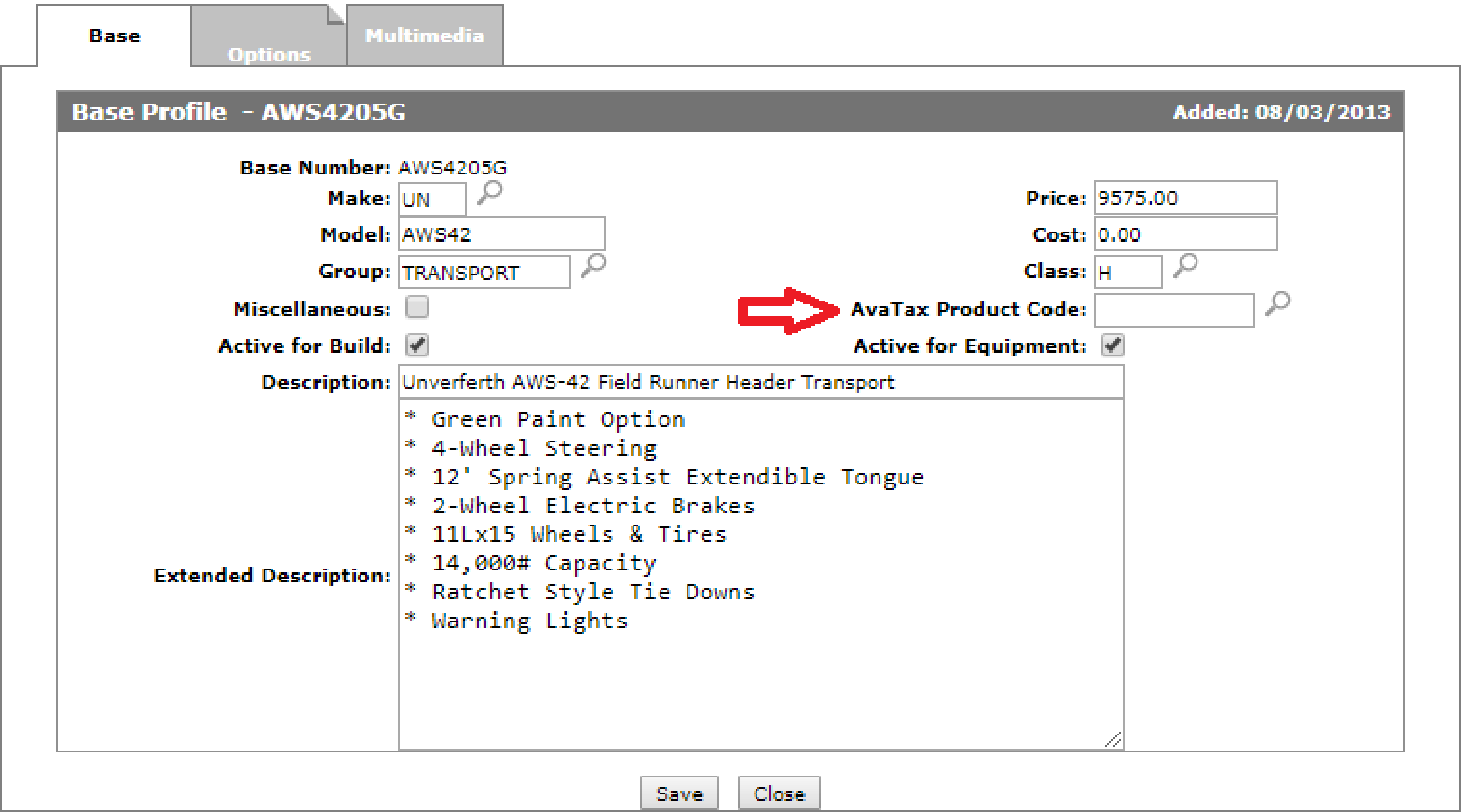

The Base and Options application allows you to configure a default AvaTax Product Code by base number. This number is assigned to the unit when it is set up and is used when selling a piece of equipment (see the Rental section for configuring a different product code for rental purposes).

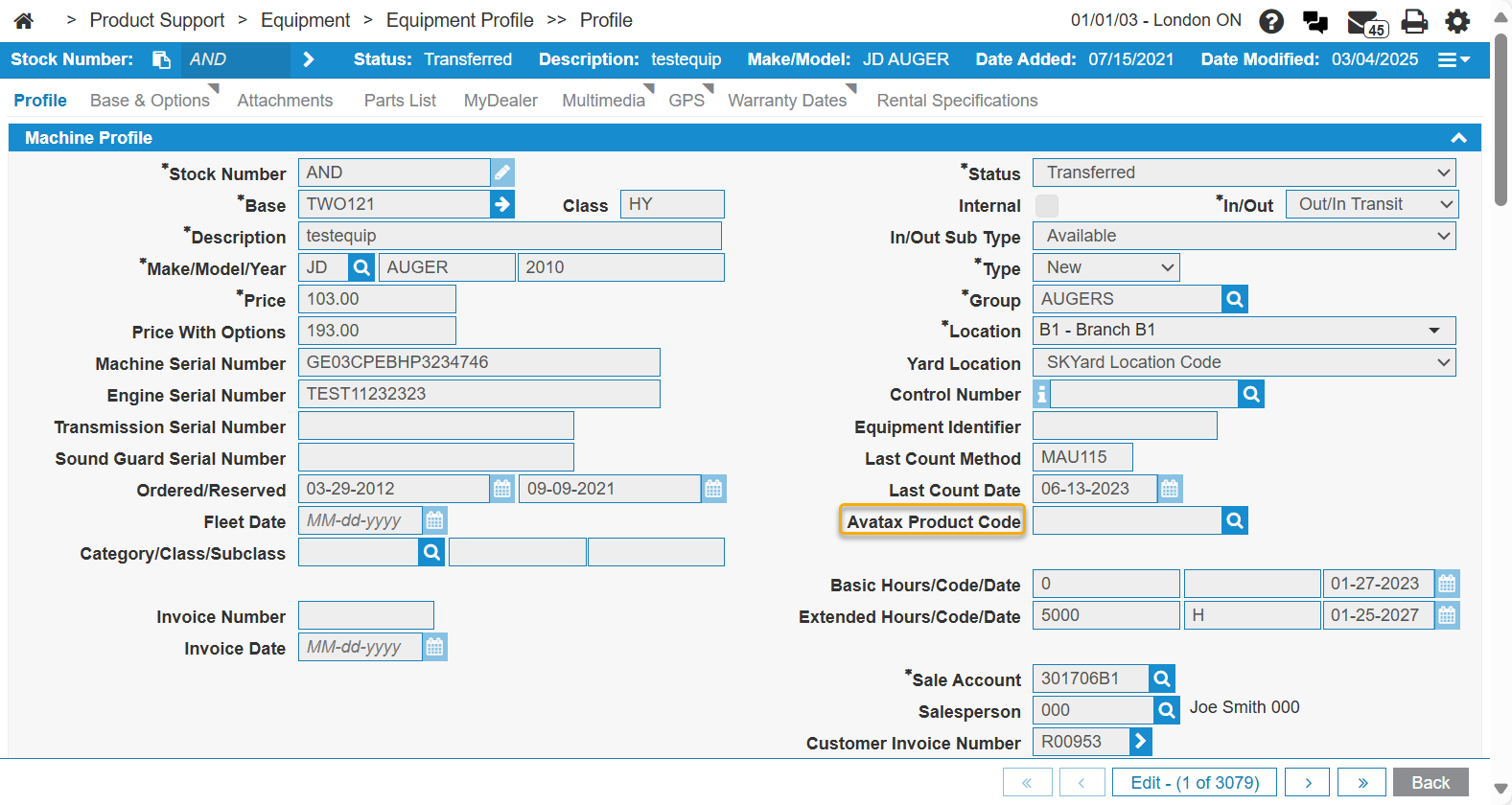

The Equipment Profile screen has an AvaTax Product Code to identify what kind unit it is. If loaded, this assigns the default value loaded on the base number when the stock number is added.

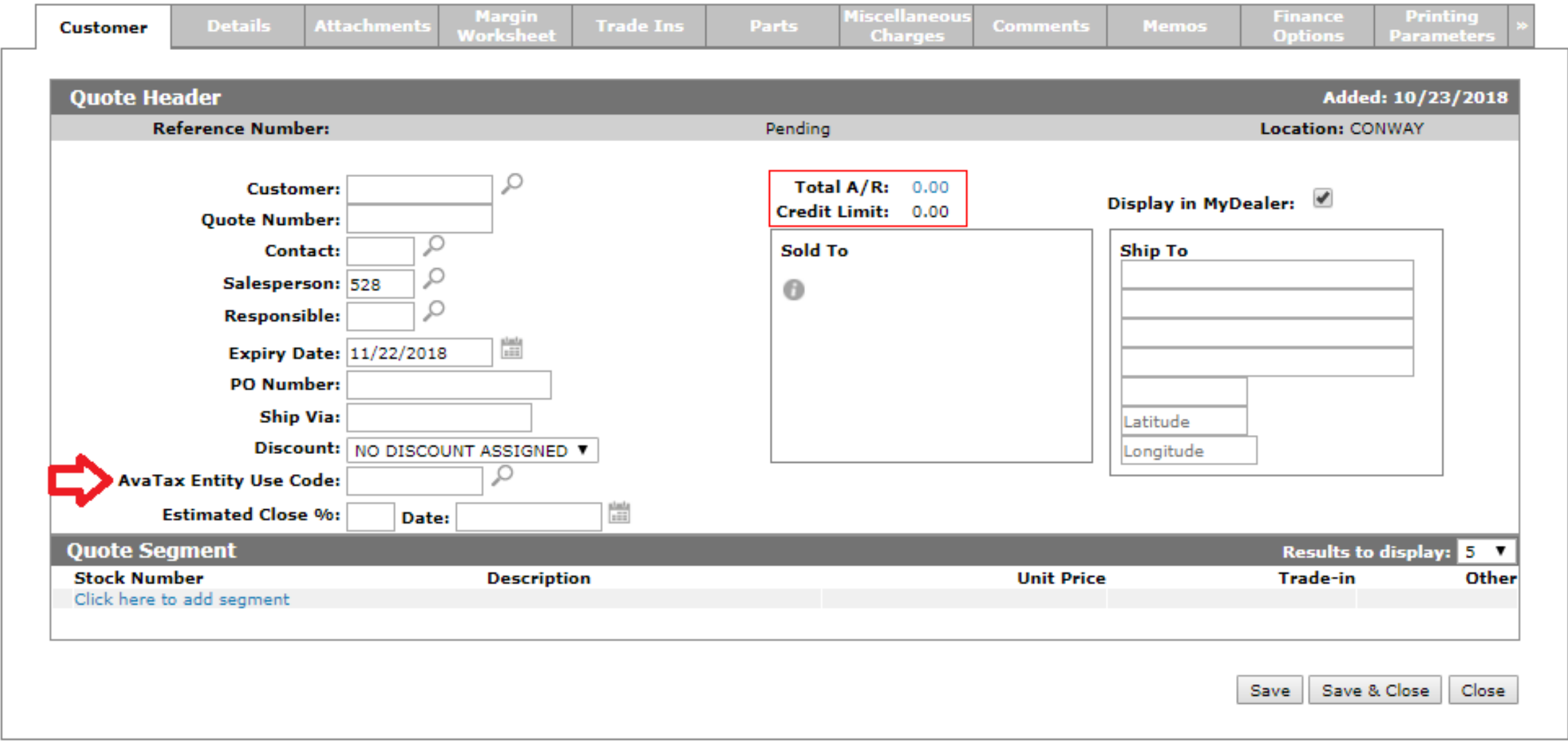

On the Customer tab of the Equipment Quoting/Invoicing applications, the AvaTax Entity Use Code field is available and it defaults according to the customer. If necessary, this can be overridden.

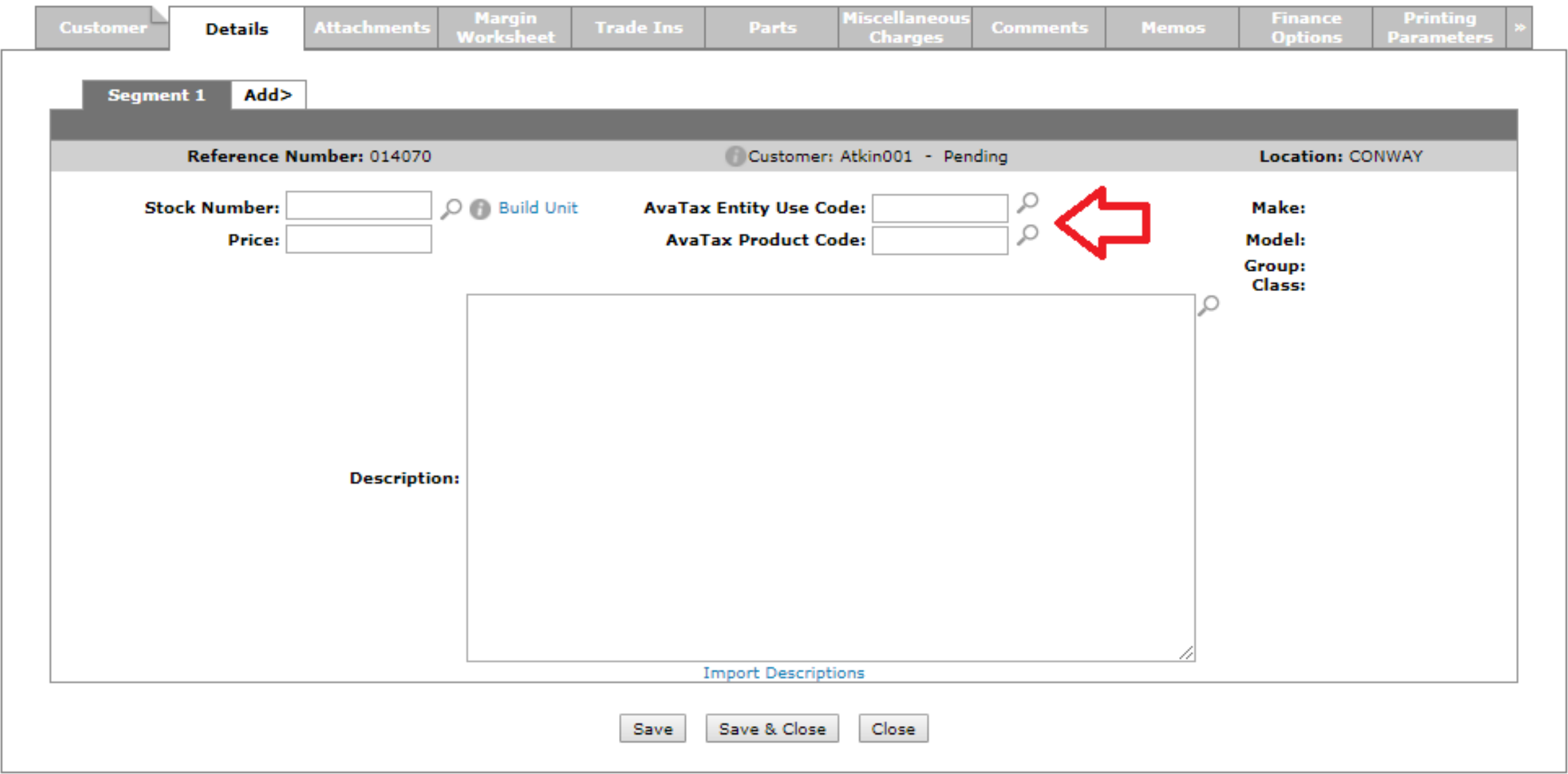

When you are on the Details tab of the invoice/quote, the AvaTax: Exemptions and AvaTax Product Code fields are available to override as necessary. If the AvaTax Entity Use Code is left blank, the system uses the AvaTax Entity Use Code configured on the Customer tab when communicating to AvaTax.

Special product codes for the AvaTax Entity Use Code field are:

-

CDKOMIT—these items are not reported to AvaTax. Use this code for transactions that are non-taxable.

-

FOREIGN—for items being shipped internationally, and are therefore not subject to your country's tax laws.

Since AvaTax can only validate addresses in the US and in Canada, you should use one of the above product codes when shipping outside of these areas.

Note: Do not use CDKOMIT if you are using Integrated Rental.

The AvaTax Product Code defaults to the product code configured in the unit's Equipment Profile or the product configured on the base number if using the Build Unit facility. It can be overridden if desired.

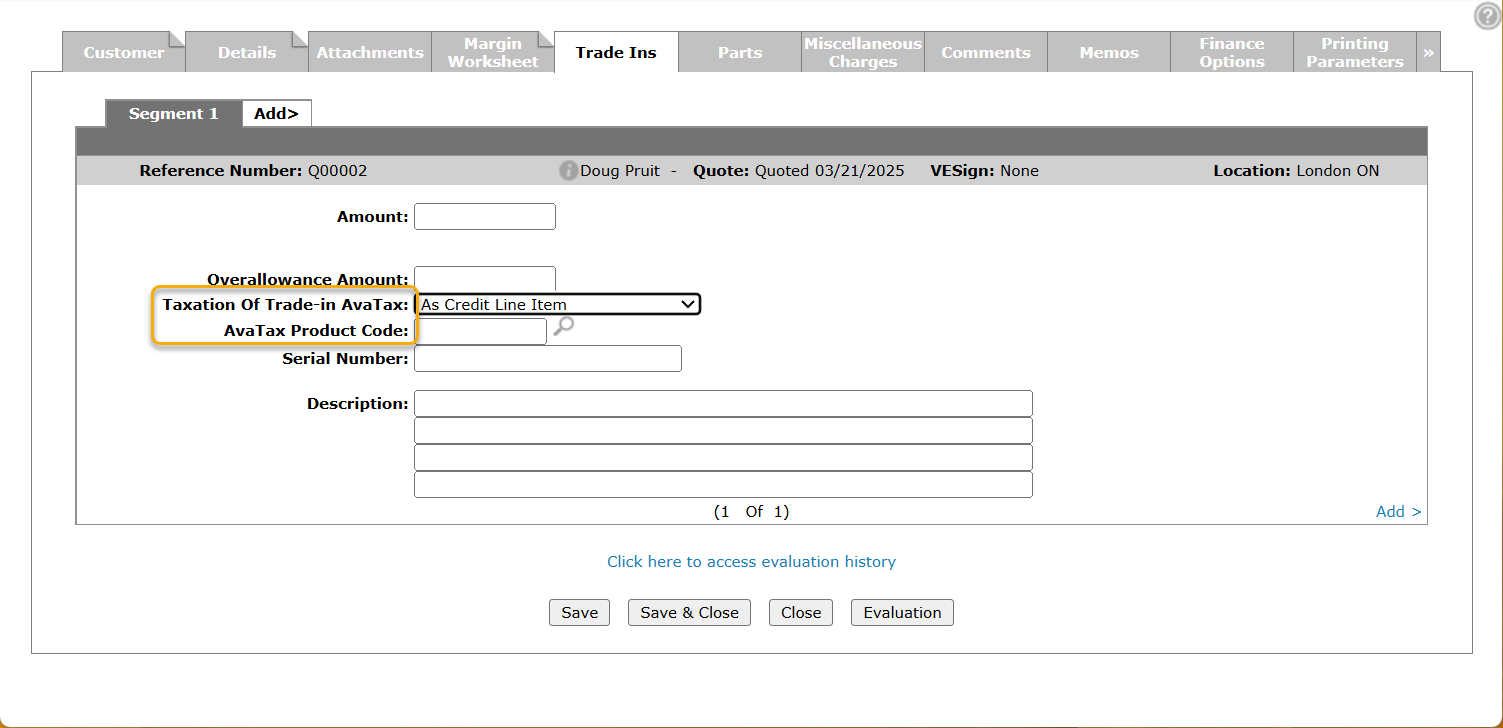

Trade-Ins

You must give special consideration to trade ins. Depending on the jurisdiction, taxes may be collected before the trade in is deducted. The AvaTax Product Code defaults to the product code configured on the Invoicing table.

If the default value in the table is not loaded, it then defaults to the product code on the unit in Equipment Profile or the product configured on the base number if using the Build Unit facility. It can be overridden if desired.

You can specify how the trade in affects the calculated taxes using the Taxation Of Trade-in AvaTax drop down. Available options are:

-

Tax Applied Before Trade-in—tax is calculated on the full segment amount.

-

Trade-in Deducted from Segment—the trade-in amount is deducted from the segment value before it is sent to AvaTax.

-

As Credit Line Item—the trade-in amount is sent as a credit and AvaTax calculates it as a tax credit. If this option is selected, then the AvaTax product code is also sent to AvaTax.

Note: If the Trade In Product Code is not specified, the Product Code from the trade in unit in Equipment Profile is used.

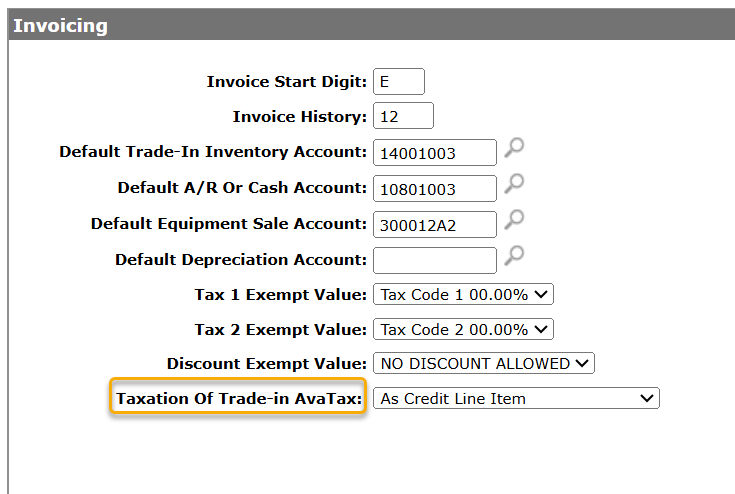

The default value of the Taxation Of Trade-in AvaTax drop-down is set on the Configuration > Equipment > General > Invoicing screen.

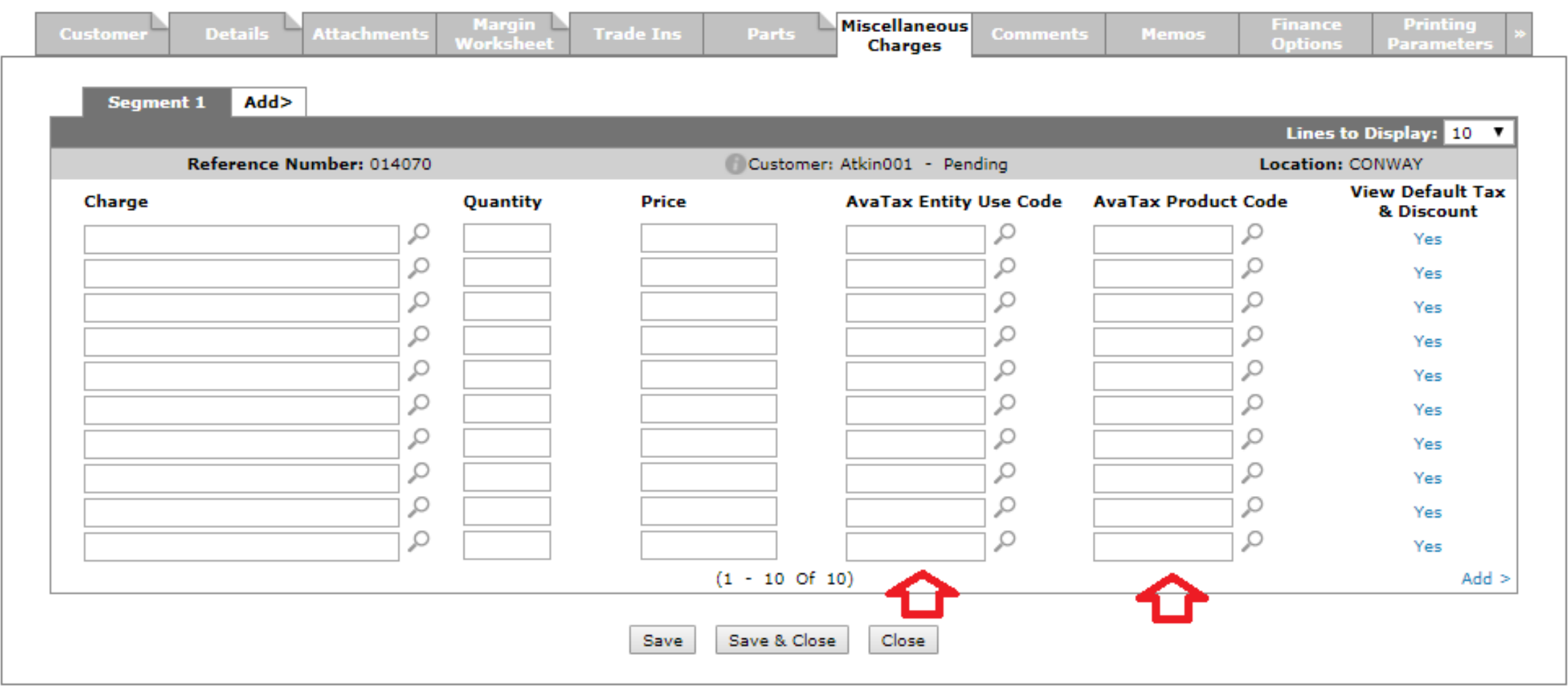

When you are on the Miscellaneous Charges tab of the invoice/quote, the AvaTax Entity Use Code and AvaTax Product Code fields are available to override as necessary. If the AvaTax Entity Use Code is left blank, the system uses the AvaTax Entity Use Code configured on the Customer tab when communicating to AvaTax. The AvaTax Product Code defaults to the product code configured on the miscellaneous charge in the Configuration > Equipment > General > Miscellaneous Charges Credits table and can be overridden if desired.

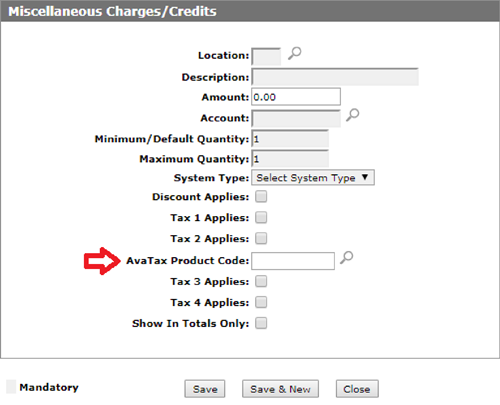

The Configuration > Equipment > General > Miscellaneous Charges Credits table has been modified to allow an AvaTax Product Code to be assigned.

Note: There are certain miscellaneous charges/credits that are not considered saleable items. For example, down payment, that is used to reduce the total amount owing. It reduces the amount owing but has no effect on the taxable sale amount on the invoice.To tell the system that a product is to calculate no tax, a special product code called NT is available to use.

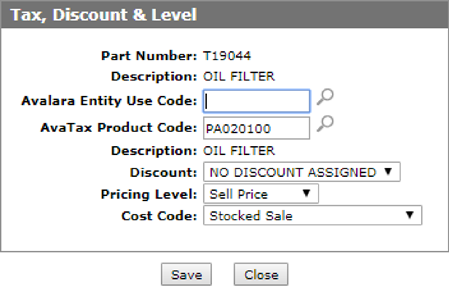

When you are on the Parts tab of the invoice/quote, you can access the Tax, Discount & Level window. The AvaTax Entity Use Code and AvaTax Product Code fields are available to override as necessary. If the AvaTax Entity Use Code is left blank, the system uses the AvaTax Entity Use Code configured on the Customer tab when communicating to AvaTax. The AvaTax Product Code defaults to the product code configured in the Parts Profile and can be overridden if desired.

Note: Anything keyed on the Custom Accounting screen is NOT transmitted to AvaTax. Please be aware that no taxable ‘sales’ should be keyed via the Custom Accounting screen on an invoice. For an Equipment Invoice reversal, the system communicates with AvaTax during the billing run and sends a special ‘refund’ transaction for the original invoice. IntelliDealer includes logic to prevent the invoice from being reversed more than once.