AvaTax: Installation and Setup

This section provides instructions for setting up Avalara AvaTax for your dealerships. Topics in this section are:

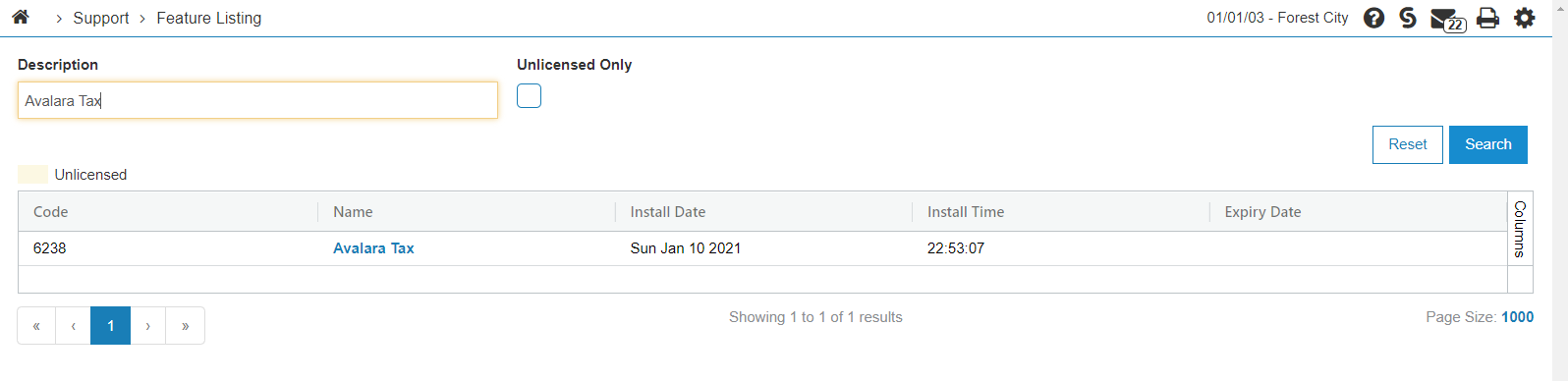

Prerequisite

Feature 6238 must be licensed for the AvaTax service to work. The dealer needs to obtain an Account Id, License Key and Company Code from their Avalara implementation specialist.

Verify your Location

The dealership's address is an important component in determining tax. This address represents where a customer would take possession of a good if they walked into the dealership to buy it.

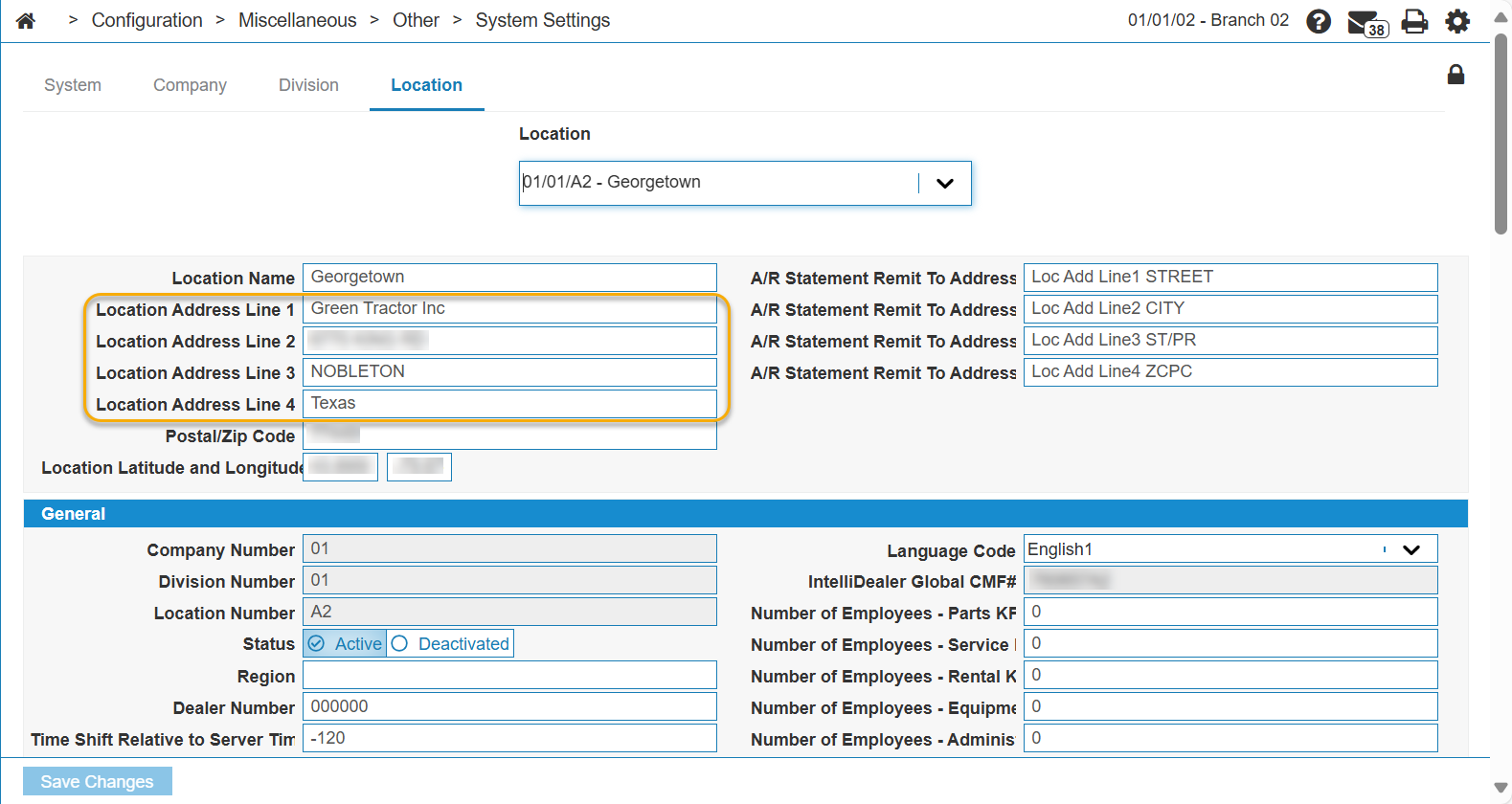

Perform these steps for each dealership location:

-

Navigate to Configuration > Miscellaneous > Other > System Settings.

-

Click the Location tab.

-

Validate your dealership address in the Location Address Line 1 - 4 fields.

Warning: The Location Address Lines must only contain address data, otherwise the incorrect tax may be applied. Do NOT put the name of the dealership into any of the Location Address Lines.

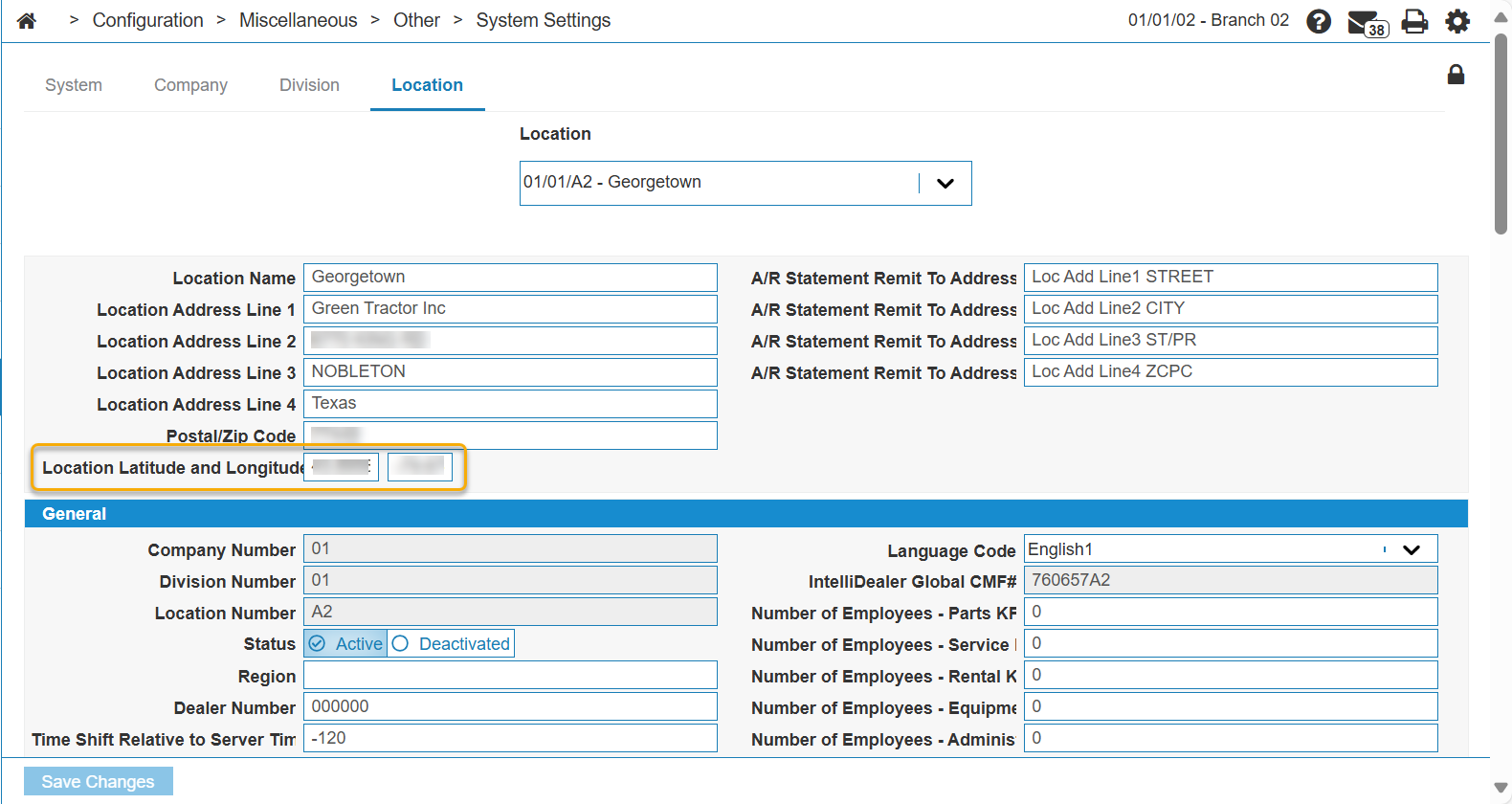

If the dealership location is in the United States, the system automatically checks to see if there is a latitude/longitude loaded in the Location tab. The latitude/longitude takes precedence over the address.

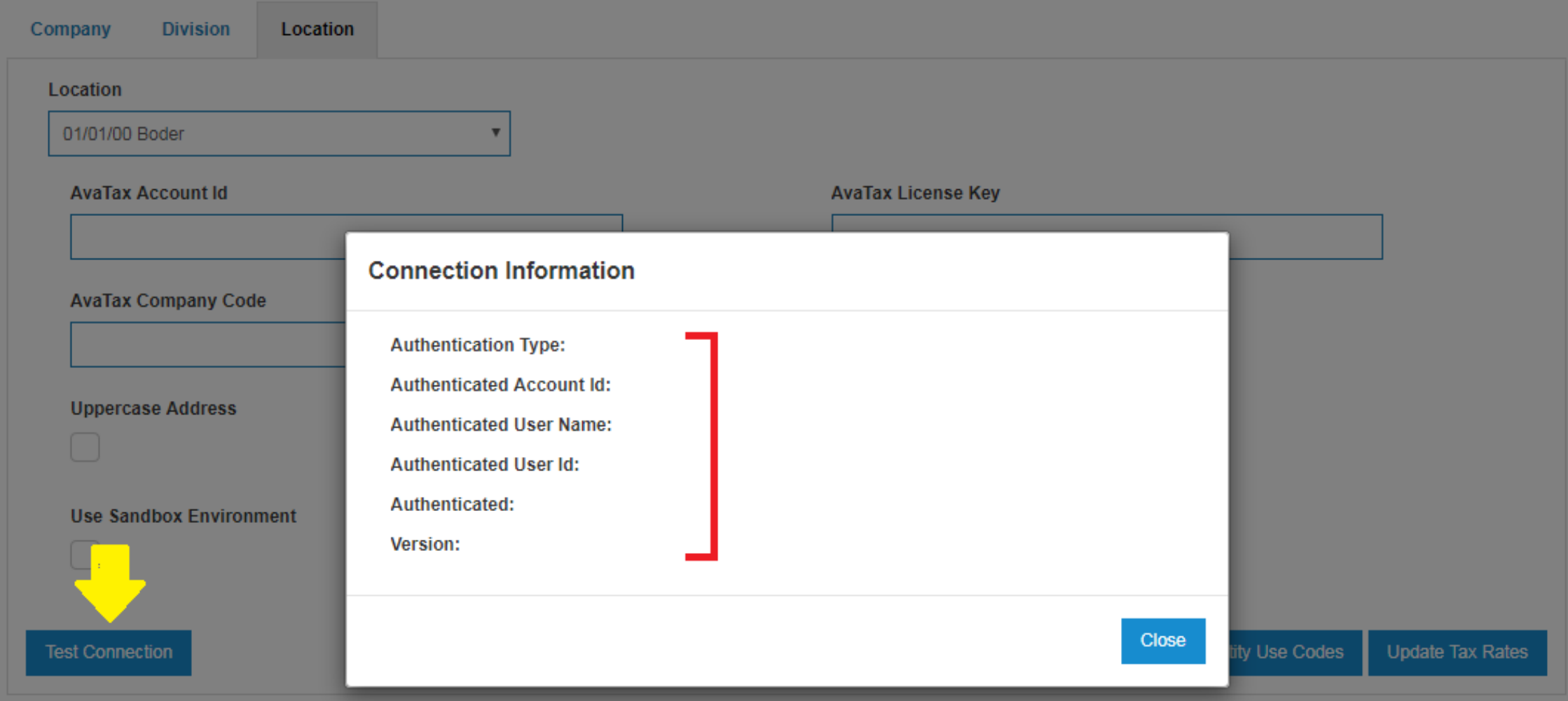

Configure Connection Credentials

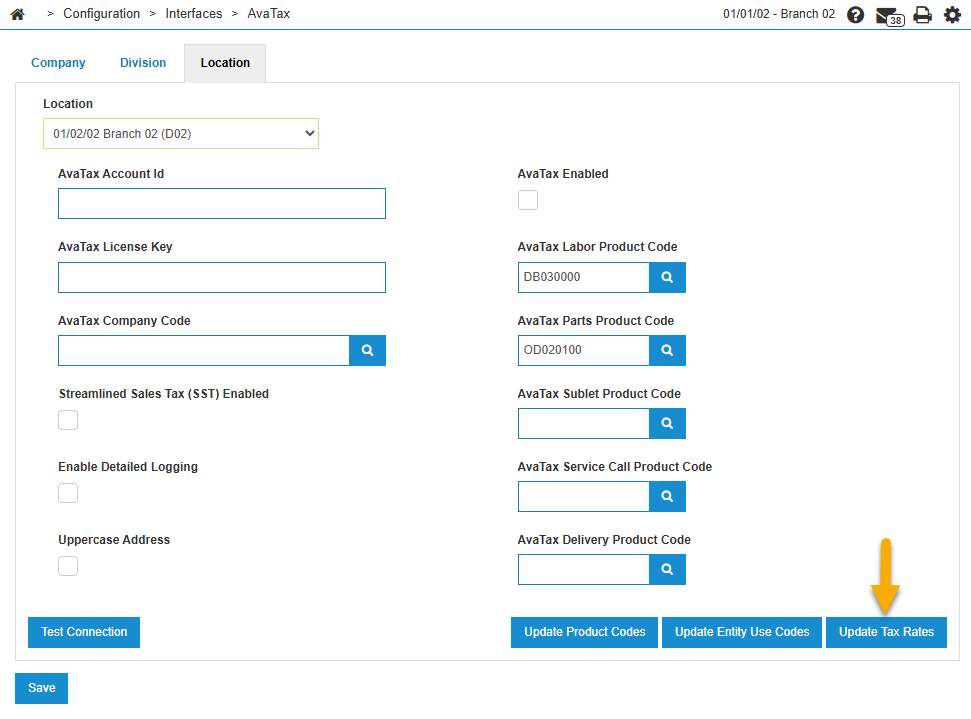

Configure the connection credentials in the Configuration > Interfaces > AvaTax option.

Credentials can be configured at a company, division or location level. This gives you the flexibility to match how your locations are registered with the government. It also grants you the ability to use the interface for only some companies, divisions, and locations, and not others. However, the system does NOT support the ability to calculate for some states but not others. See AvaTax Interface.

Test Connection

After loading the information, use the Test Connection button to ensure that you can successfully connect to the AvaTax server. Use this to troubleshoot any suspected connectivity issues.

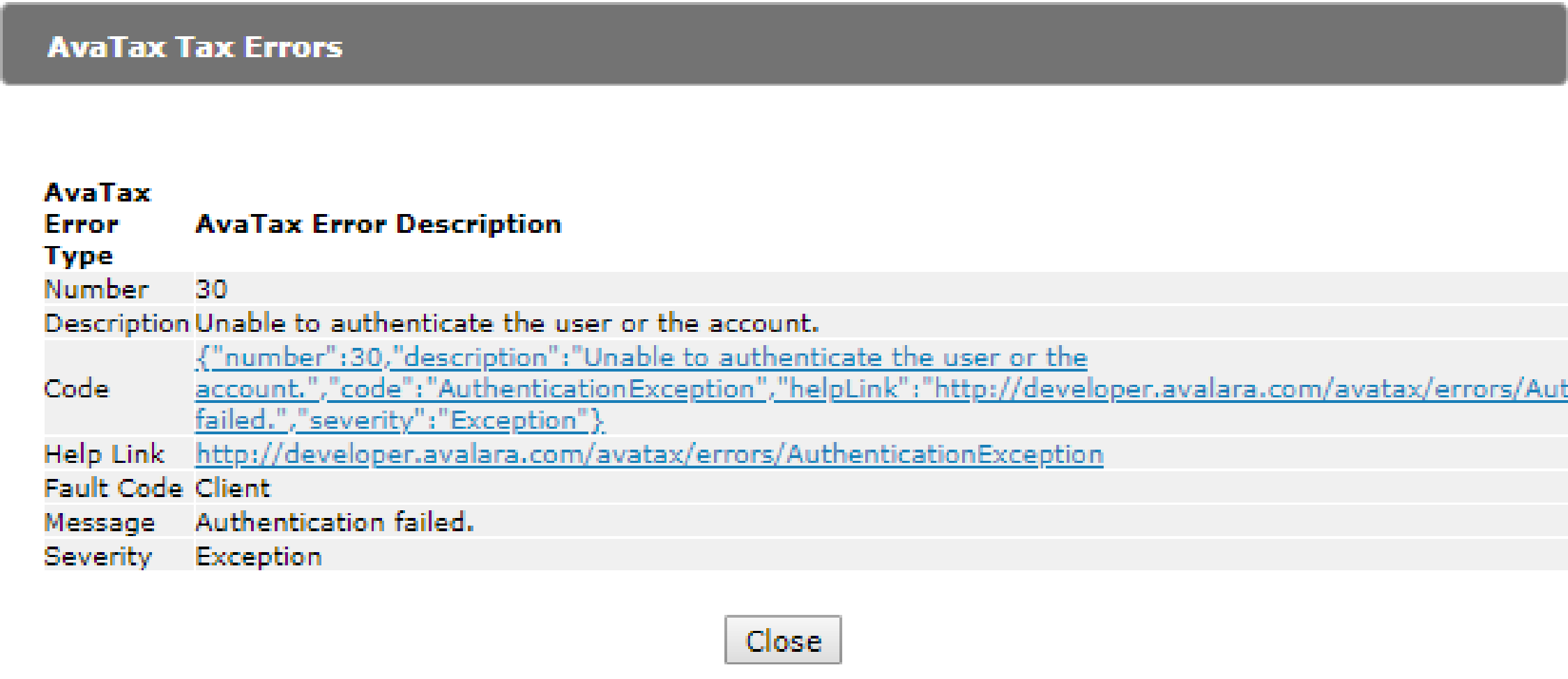

If the credentials are not validated and you attempt to use the Avatax service in a quoting or invoicing application, you may receive the an error stating that the system cannot authenticate the account.

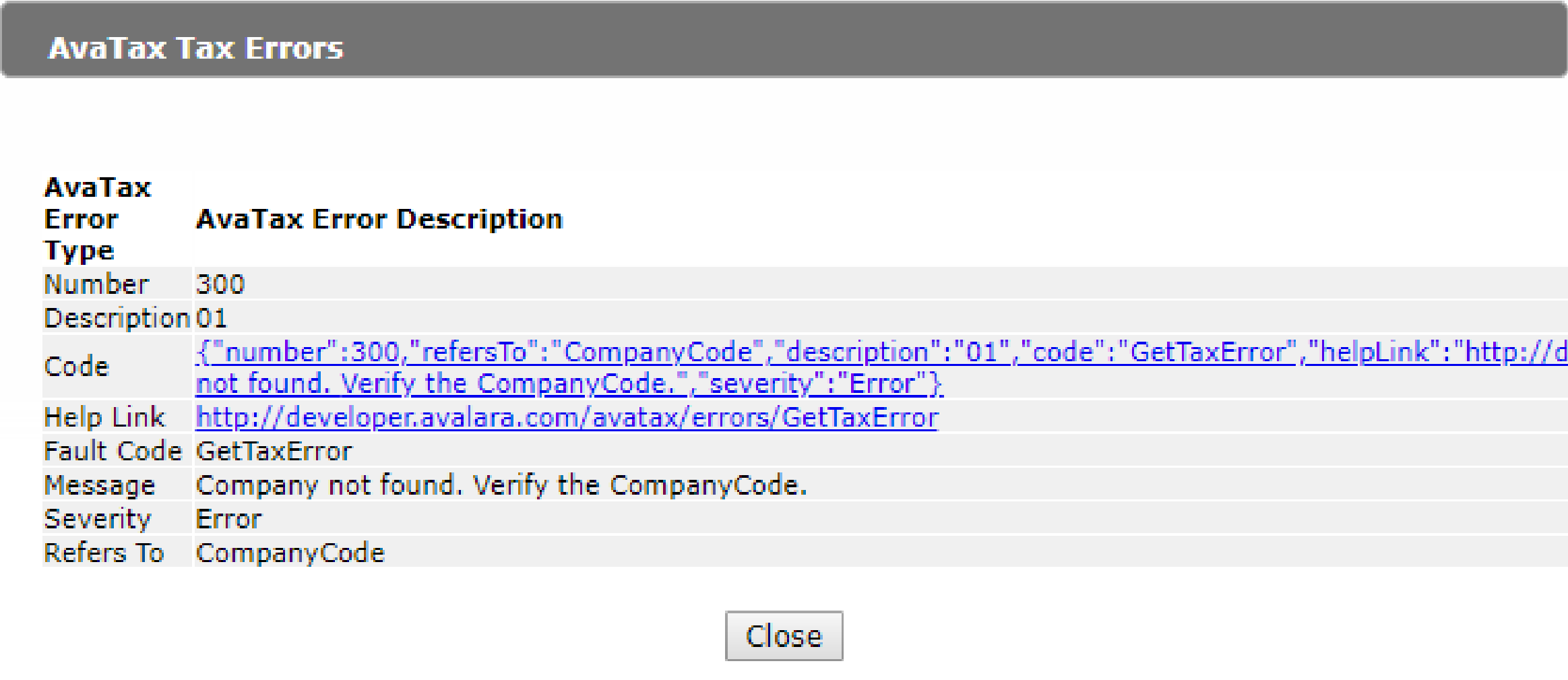

If you receive the error (300) when attempting to use the Avatax service in a quoting or invoicing application, either the Company is not configured or it is not active. Check the Avatax configuration or consult with your Avalara representative.

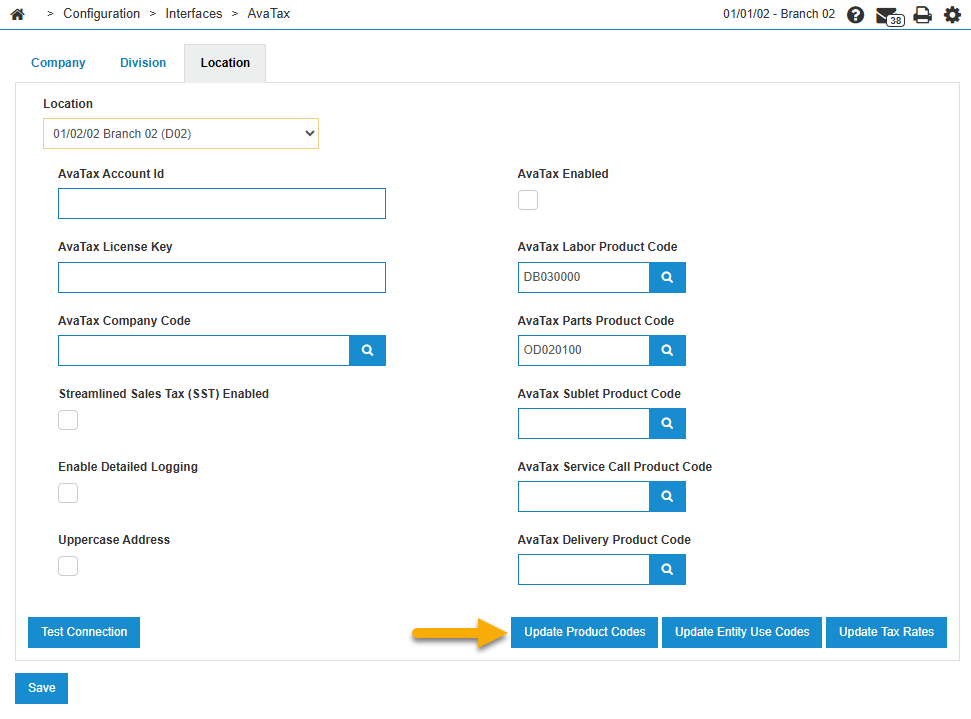

Download the AvaTax Codes

The Configuration > Interfaces > AvaTax screen includes buttons you can use to manually download:

Product Codes

The AvaTax Product codes are assigned to products being sold in IntelliDealer. See Product Codes.

Product codes are updated automatically on Monday at 11pm Eastern time. Click the Update Product Codes button anytime you need an earlier update. The process updates all companies, divisions, and locations in the dealership.

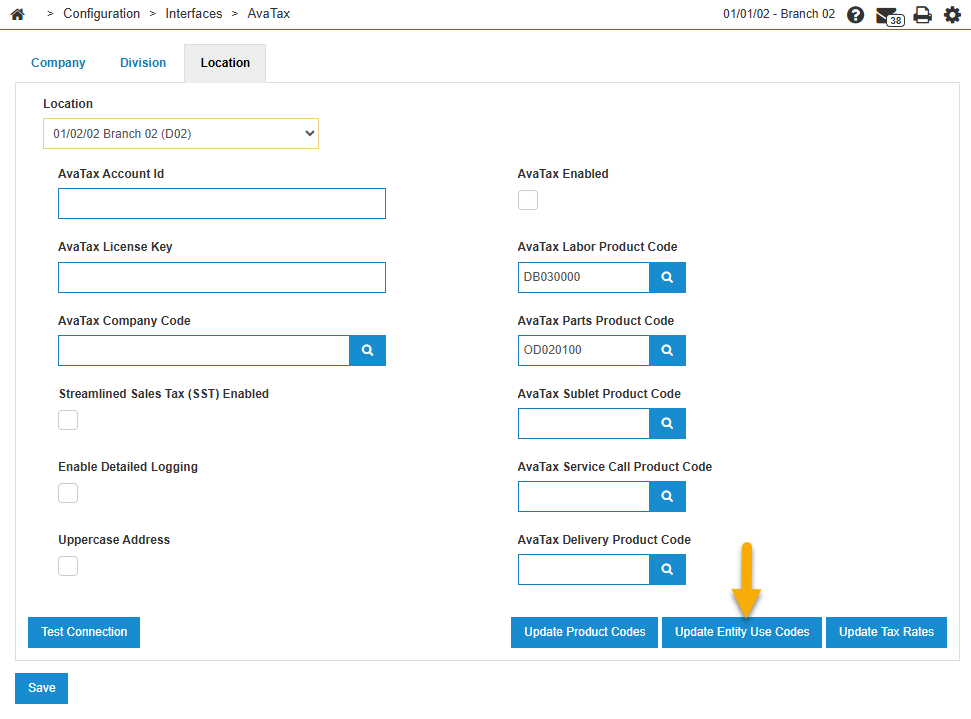

Entity Use Codes

AvaTax Entity Use Codes are assigned to customers in IntelliDealer.

Note: Only press this button once, regardless of the number of company, division, or locations you have. This process is automatically performed at 11 pm each Monday.

The options for maintaining customer exemptions are:

-

manually entering Entity Use Codes in IntelliDealer.

This is a list of all the valid AvaTax Entity Use Codes:

| AvaTax Entity Use Code Selection | |

|---|---|

| A | Federal Government |

| B | State Government |

| C | Tribal Government |

| D | Foreign Diplomat |

| E | Charitable / Exempt Org |

| F | Religious / Educational Org |

| G | Resale |

| H | Agriculture |

| I | Industrial Prod / Manufacturers |

| J | Direct Pay |

| K | Direct Mail |

| L | Other / Custom |

| N | Local Government |

| P | Commercial Aquaculture |

| Q | Commercial Fishery |

| R | Non-Resident |

| TAXABLE | Not exempt - Taxable customer |

Tax Rates

Download the tax rates for the dealership locations so that if the AvaTax service is down, the system can still calculate taxes.

Note: Only press this button once, regardless of the number of company, division, or locations you currently have. However, this should be done whenever you add a new location or if one of your existing locations physically moves to new location.

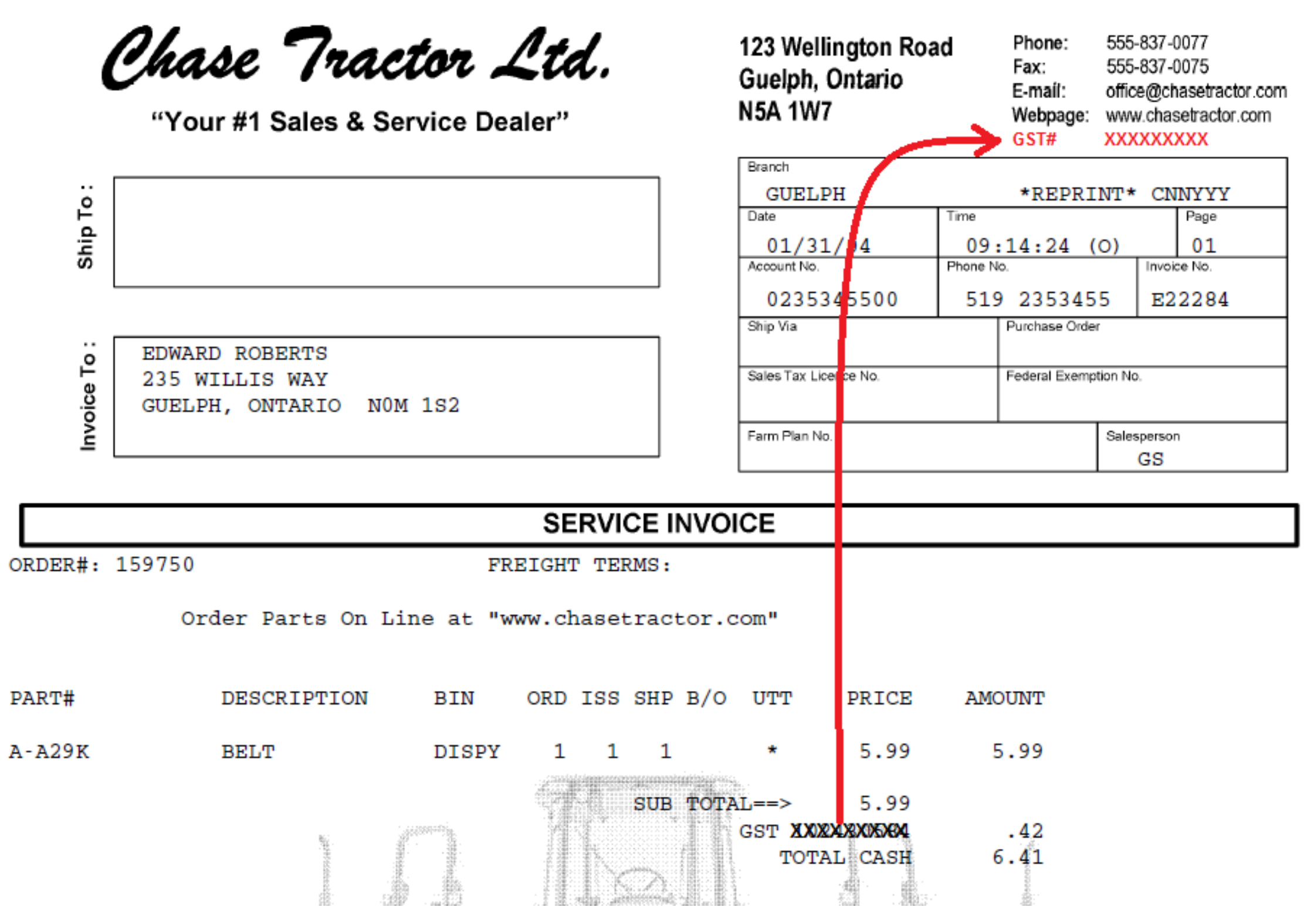

Canadian GST

For dealers doing business in Canada, the invoice overlay must contain the GST number. Previously, some dealers specified their GST number in the description of the tax but once AvaTax is implemented this is no longer supported. Contact the VitalEdge Client Services help desk for more information on having your overlays modified.