AvaTax: AvaTax Interface

The AvaTax interface is used to set up your credentials for Avalara tax. Your Avalara User Id and Password are issued by Avalara when you contract with them for this service. See AvaTax: Introduction to Avalara's AvaTax

To configure the AvaTax interface, navigate to Configuration > Interfaces > AvaTax.

Credentials can be set up at the Company, Division or Locations level. Setting up credentials at the Company level applies those settings to all other divisions and locations unless otherwise set at a lower level.

Topics in this section are:

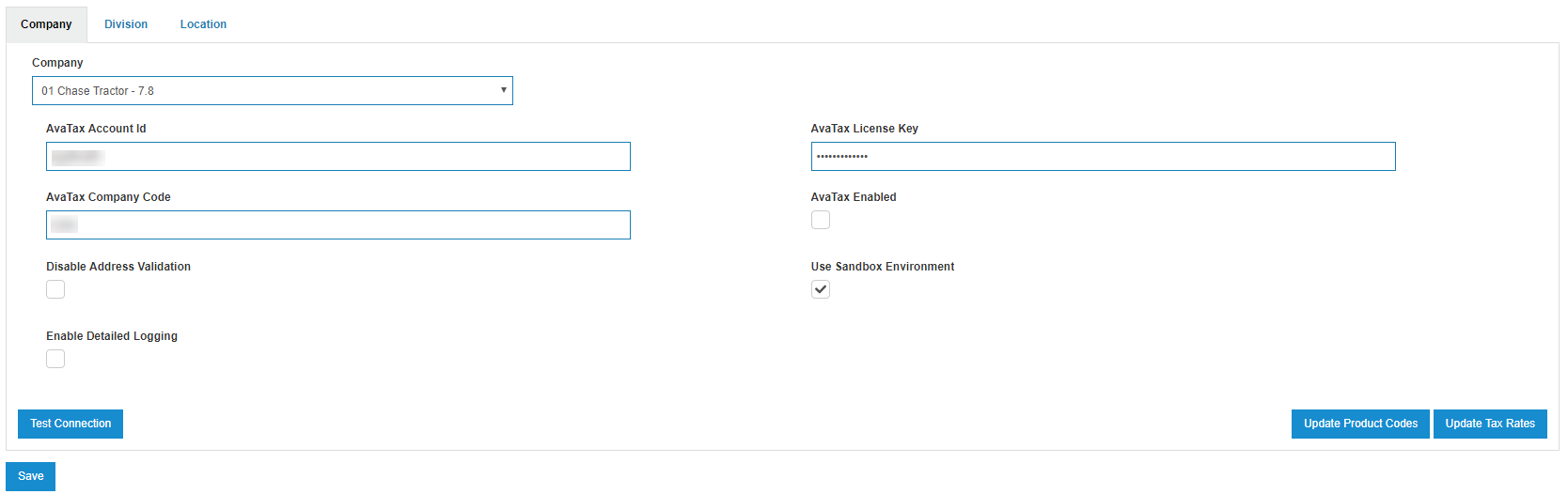

Company Tab

The fields on the Company tab are:

| Field | Description |

|---|---|

| Company | A drop-down list of company entries. |

| AvaTax Account Id | The user ID provided by Avalara Automated Tax. |

| AvaTax License Key | The license key provided by Avalara Automated Tax. |

| AvaTax Company Code | The company code used with your AvaTax credentials. |

| AvaTax Enabled |

If checked, activates AvaTax for this Company/Division/Location entry. Leave it unchecked to continue to use the legacy tax system, thus allowing the dealer time to configure the IntelliDealer and Avalara systems before going live. |

| Streamlined Sales Tax (SST) Enabled | If checked, removes the ability to use latitude and longitude for Ship To addresses. See Streamlined Sales Tax (SST). |

| Uppercase Address | If checked, when the system encounters a suggested address, that address is brought into the screen using all capital letters. Use this option if your system requires all addresses to be in uppercase. |

| Enable Detailed Logging | If checked, all data sent and received is logged in the log master (LOGMASTR) file. To reduce calls to AvaTax, VitalEdge recommends checking this box. |

Division Tab

The fields on the Division tab are the same as those on the Company tab, but allow you to configure unique settings for the specified Division. An additional field is:

| Field | Description |

|---|---|

| Avalara AvaTax General Ledger Account | A general ledger account for recording AvaTax transactions. |

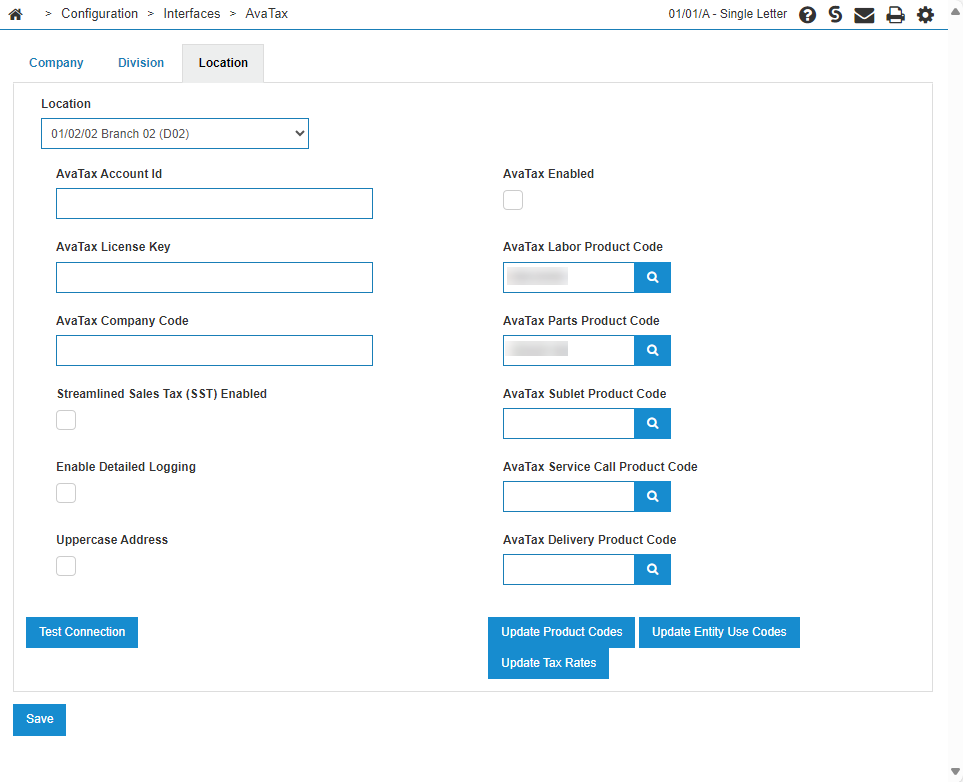

Location Tab

The Location tab includes these additional fields, which are used when creating quotes through the Quote/Estimate tab on a Work Order:

| Field | Description |

|---|---|

| AvaTax Labor Product Code | A default AvaTax code used for the labor charged or quoted on a work order. |

| AvaTax Parts Product Code | A default AvaTax code used for parts in a quoted work order. |

| AvaTax Sublet Product Code | A default AvaTax code used for work contracted out to a third-party quoted in a work order. |

| AvaTax Service Product Code | A default AvaTax code used for service calls on a quoted work order. |

| AvaTax Delivery Product Code | A default AvaTax code used for delivery services on a quoted work order. |

The available buttons are:

-

Test Connection—click this button to test the user credentials entered for the Avalara tax interface. A pop-up window confirms your authentication if the credentials are correct.

-

Update Entity Use Codes —click this button to update the entity use codes used to define the customer exemption status. When clicked, IntelliDealer clears the local list of tax codes in the Entity Tax Code file (AVATAXE ), then downloads the generic list of codes from Avalara, and any custom codes the dealer has configured.

-

Update Product Codes—click this button to update the product codes used to evaluate the goods being taxed. When clicked, IntelliDealer clears the local list of tax codes in the Product Tax Code file (AVAETC), then downloads the generic list of codes from Avalara, and any custom codes the dealer has configured.

Product codes are updated automatically on Monday at 11pm Eastern time. Click the Update Product Codes button anytime you need an earlier update. The process updates all companies, divisions, and locations in the dealership.

-

Update Tax Rates—click this button to download all current tax rates from Avalara by zip code for each dealer location stored in Configuration > Miscellaneous > Other > System Settings on the Locations tab, in the fields Parts Order Location Address Line 1-4 and Postal/Zip Code. These rates are also stored in the AVARATEH and AVARATED files when a connection to Avalara is not available.

Note: A successful address validation also updates the tax rates in these files.