Account Profile

Use the Account Profile screen to update and view an existing account profile and allows you to set up and code chart of accounts.

To access the Account Profile screen:

-

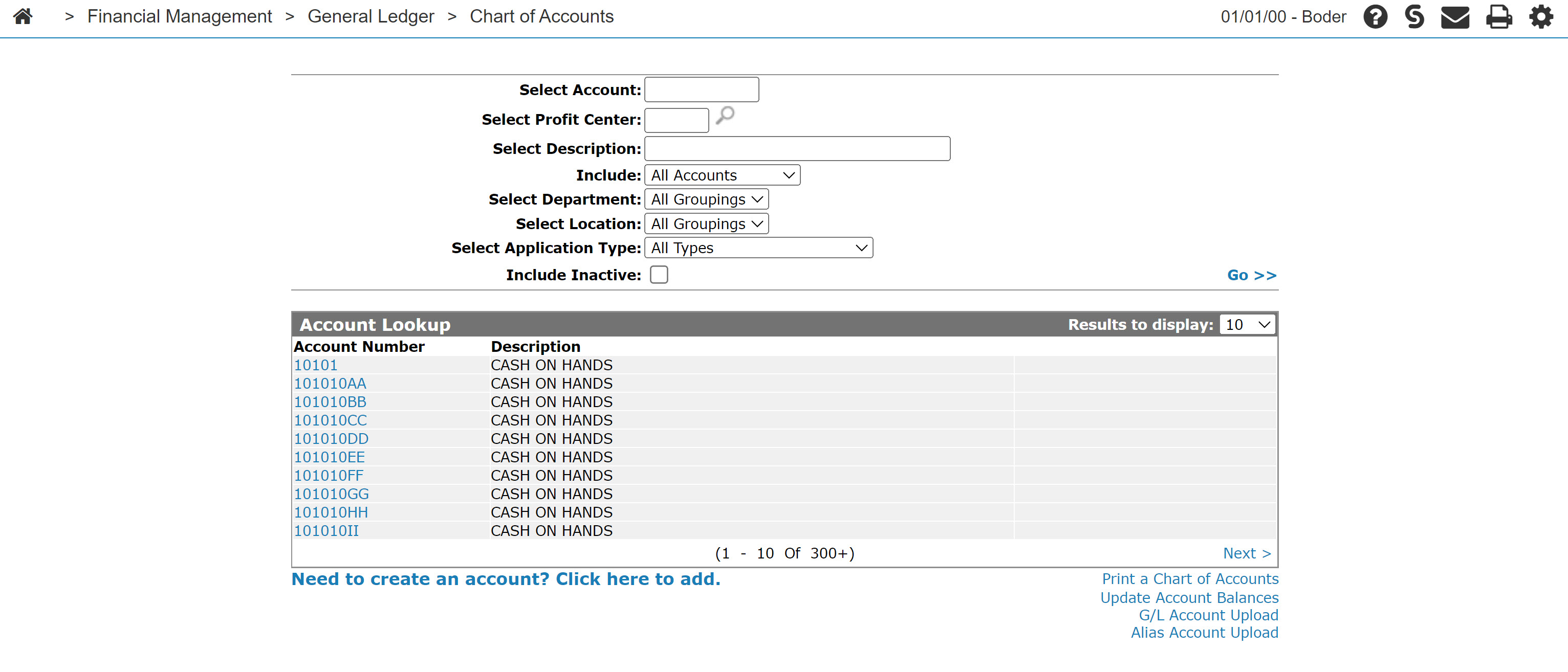

Navigate to Financial Management > General Ledger > Chart of Accounts.

-

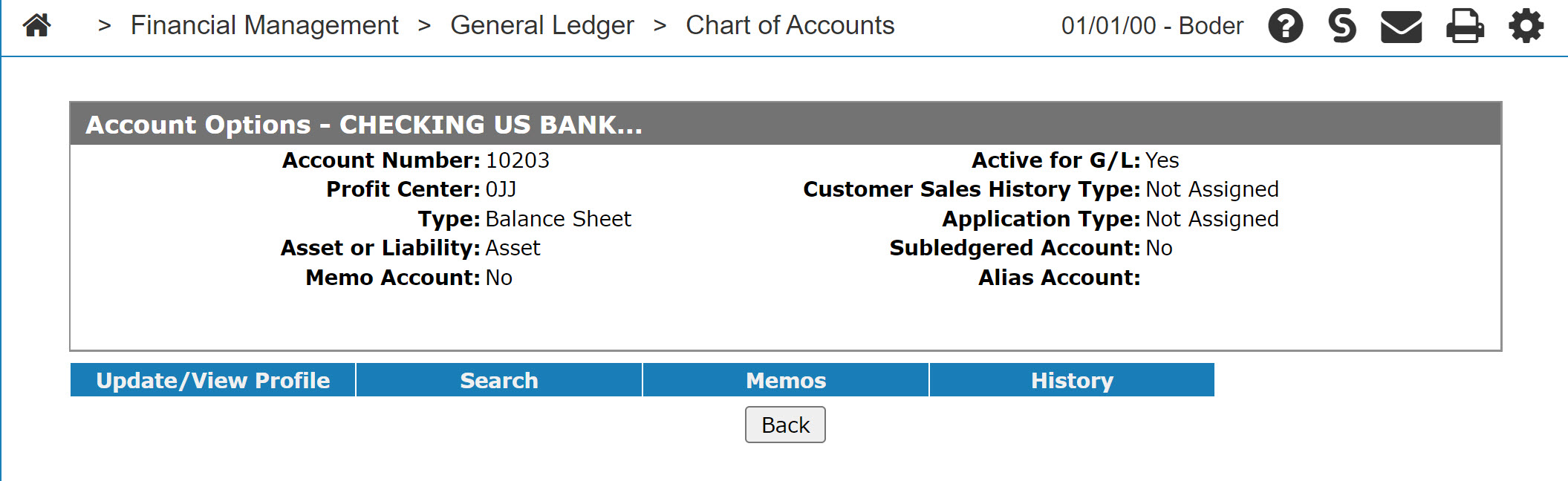

Search for an account and click the account number. The Account Options screen opens.

-

Click the Update/View Profile link.

Topics in this section include:

Adding a New Account

Allows you to set up a list of all accounts that can be tracked by a single accounting system.

-

From anywhere in IntelliDealer screen, navigate to Financial Management > General Ledger > Chart of Accounts.

-

Click Need to create an account? Click here to add link.

-

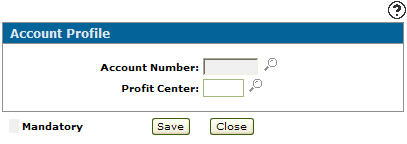

Enter an Account Number and a Profit Center or search for them.

-

Click Save.

The Account Options screen appears.

-

Click Update/View Profile link.

-

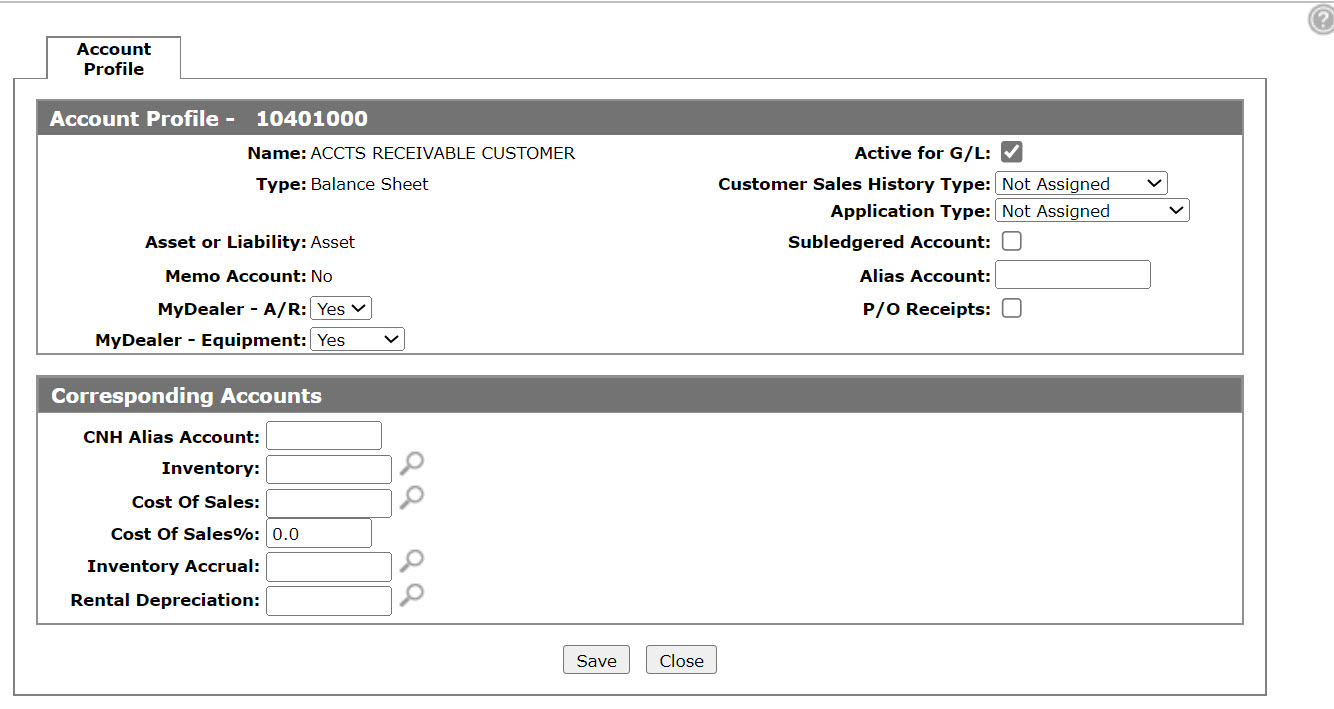

In the Account Profile section, enter or select the appropriate information describing the Account and its status.

-

In the Corresponding Accounts section, enter or select the appropriate information describing the corresponding accounts.

-

Click Save button to record your account profile entry, or click Close to exit the Account Profile tab without saving any of the information.

Screen Description

The fields on the Account Profile screen are:

| Field | Description |

|---|---|

| Name | The name of the account will represent the account throughout the system and on any reports where the G/L number appears. |

| Type | The type of account determines where the account will show on financial reports. |

| Asset or Liability | Used on balance sheet accounts and denotes which side of the balance sheet this account will appear on. |

| Memo Account | A memo account prints only on financial statements and does not affect the G/L balancing procedure. Memo accounts are used to represent a number corresponding to a financial value. For example, if your G/L equipment inventory account was 12000, you might set up a memo account 12001 so that the total number of units that represent the inventory value could be listed on financial reports. |

| MyDealer - A/R |

For dealers using MyDealer, this identifies which invoices are to appear in the My Account and Purchase History sections of MyDealer. Select Yes on all accounts receivable and cash accounts that you would want your customers to see (e.g. A/R, CASE Credit, Farmplan, CASH). Select No on any accounts you don't want this information displayed (e.g. warranty receivable). Select Tax to allow your customers the ability to display a tax breakdown window for the accounts coded. |

| MyDealer - Equipment | For dealers using MyDealer, this identifies which invoices are to appear on the Service History section of My Equipment application in MyDealer. Select Yes to display the history record but not allow the invoice details to be displayed. Select Display to display the history record and allow the invoice details to be displayed. Select No if you do not wish to display the history record. |

| Active for G/L |

If selected, indicates that the account is active for use within the general ledger system. If this box is not selected it will indicate an inactive account and stop the system from using the account. Transactions that went against this account will show up for up to 2 years on some of the canned financial reports. |

| Customer Sales History Type |

Controls where the system posts sales history for each customer. This field should not be left blank when adding or editing a sales account. However, assigning a Customer Sales History Type to non-sale accounts is not recommended because it will affect the customer's purchase history amounts. The Customer Sales History Type information is accumulated into five invoicing categories and is displayed in the customer profile section under purchase totals. General ledger sales accounts should be identified with one of these categories: other sales (key invoices), parts sales, rental sales, service sales, and equipment sales. |

| Application Type |

Controls how the system functions when postings to certain general ledger accounts. See Application Types. |

| Subledgered Account | Specifies whether or not this account is subledgered in the business system. The subledger is a detail listing of all items that reconcile to the total amount in that account. Accounts receivable and accounts payable accounts should not be checked as these accounts have their own subledger system. |

| Alias Account |

Used when financial information is being sent to your supplier. This field is used to cross-reference your account to the supplier's chart of accounts. When this field is loaded, the alias account field is used in place of your account number. |

| P/O Receipts |

Whether or not the account is active for parts PO receipt creation. The P/O Receipts checkbox must be checked to activate the account as a parts accrual account. |

| The fields below only appear if the account in question has been configured in Configuration > General Ledger > G/L Accounts > Special Account with the keyword Bank. See Special Accounts. | |

| Bank Routing Number |

A combination of a five-digit transit number (also called a branch number) and a three-digit financial institution number that identify a bank. Warning: Do not populate this field and Account Number if you have checks that have MICR encoding. |

| Account Number |

A unique string of numbers and, sometimes, letters or other characters, that identifies the owner of the account. Warning: Do not populate this field and Bank Routing Number if you have checks that have MICR encoding. |

Use these buttons to complete your work on the Account Profile screen:

| Button | Description |

|---|---|

| Save | Saves changes made to the Account Profile screen. |

| Close | Closes the Account Profile screen without saving changes and returns to the Account Options screen. |

The Application Type values are:

| Application Type | |

|---|---|

| Field | Description |

| Finance Expense | Adds or subtracts the amount of any transaction using a whole goods finance expense account to or from the finance expense total for the stock number specified with the transaction. |

| Adds a record to the equipment history file indicating the amount, G/L account and description of the transaction that was applied to the specified stock number. | |

| History Only | No costs are updated in the equipment system. |

| Adds a record to the equipment history file indicating the amount, G/L account and description of the transaction that was applied to the specified stock number. | |

| Usually used after sales or cost of sales accounts. | |

| Inventory | Adds the amount of any transaction using an equipment inventory account to the current cost of the stock number specified with the transaction. |

| Using accounts payable, the original cost of the stock number specified can be loaded. | |

| Adds a record to the equipment history file indicating the amount (G/L account) and the description of the transaction that was applied to the specified stock number. | |

| When the equipment inventory system is activated and the account coded, charges processed against a unit will increase the current cost value and net book value of the unit in the equipment system. | |

| Maintenance Exp | Adds or subtracts the amount of any transaction using an equipment maintenance expense total for the stock number specified with the transaction. |

| Adds a record to the equipment history file indicating the amount (G/L account) and the description of the transaction that was applied to the specified stock number. This account is used for maintenance expense or rental units. | |

| Notes Payable | Adds or subtracts the amount of any transactions using a notes payable account to or from the notes payable total for the stock number specified with the transaction. |

| Overallowance | Adds the amount of any transaction using an equipment over allowance account to the over allowance total for the stock number specified with the transaction. |

| Adds a record to the equipment history file indicating the amount (G/L account) and the description of the transaction that was applied to the specified stock number. | |

| Parts | Updates the parts system. |

| When the parts system is activated and the accounts are coded, the system will update the part master on hand quantities and sales history for each part sold. The system will also create a cost of sales journal entry for any account coded as parts. | |

| Rent | Adds the amount of any transaction using an equipment rental account to the rental total for the stock number specified with the transaction. |

| Adds a record to the equipment history file indicating the amount (G/L account) and the description of the transaction that was applied to the specified stock number. | |

| Sale | Changes the status of the equipment to invoiced and loads the customer number, name, salesperson, invoice number, invoice amount, invoice date and sale account for the stock number specified in the sales transaction. |

| Adds a record to the equipment history file indicating the amount (G/L account) and the description of the transaction that was applied to the specified stock number. | |

| Deprecation | Adds the amount of any transaction using an equipment write down account to the write down total for the stock number specified with the transaction. |

| Adds a record to the equipment history file indicating the amount (G/L account) and the description of the transaction that was applied to the stock number specified. | |

The fields displayed in the Corresponding Accounts section on the Account Profile screen can change depending on the type of account you selected. The fields on the Corresponding Accounts section on the Account Profile screen are:

| Corresponding Accounts | |

|---|---|

| Field | Description |

| CNH Alias | The CNH Alias account. |

| Inventory | The account selected for inventory. |

| Cost of Sales | The account selected for cost of sales. |

| Cost of Sales % | If a cost is not loaded for the part, sales amount or rental the system will use the cost of sale percentage. |

| Inventory Accrual |

(OPTIONAL) The account selected for inventory accrual. |

| Rental Write Down | The account selected for rental write down. |

When sales, expenses & others, or P & L account types are selected the fields on the Corresponding Accounts section on the Account Profile screen are:

| Corresponding Accounts | |

|---|---|

| Field | Description |

| Level |

Used to redirect a transaction to a different sales account. The Levels are setup on the Parts Profile and correspond to the level entered in this field. For example, when a transaction is posted to a sales account if Level values filled out on the corresponding parts profile match the Level filled out on the account profile to corresponding sales account is used instead of the original sales account selected. |

| Sales Account | The sales account set up for the corresponding level. |

| Cash Code |

Used to redirect a transaction to a different sales account based on the cash code used on the transaction. For example, when a transaction is posted to a sales account if sales accounts are setup for individual cash codes the transaction will be posted to the sales account associated with the cash code instead of the original sales account selected. |

| Sales Account | The sales account for the corresponding cash code. |

Additional Notes

Corresponding Account Setup

-

For Profit/Loss accounts with a parts or rent application type, the corresponding inventory, cost of sales, and cost of sale % must be specified. The inventory accrual account is an optional field (inventory account must be left blank for application type rent). The inventory account is picked up from the stock number on the work order.

-

For Parts accounts, each part is coded with a default sale account on the part master, so when a part is sold the system automatically credits that particular sale account. The sale account assigned to the part must be coded with an application type of part.

-

For Part Inventory Accrual accounts each part sale account can be coded with a valid inventory accrual account. When you receipt a parts order through parts order maintenance and during the evening database reorganize, a journal entry starting with "IA" followed by the month it is debited to the parts inventory account and credited to the inventory accrual account for any part on the order whose part sale account has an inventory accrual account. If there are any differences between receipt cost and the invoice cost, the amount will be left in the inventory accrual account and will need to be reconciled and cleared out.

-

For Rental accounts, each contract has a rental sale account so that when a unit is rented, the system automatically credits that particular sale account. The sale account must be coded with an application type of rent. As well as recording the sale, the corresponding cost of sale and inventory account on the equipment unit will be debited and credited, respectively, by the cost of sales percentage of the sale amount.

-

For Service Labor Costing accounts, the labor sale account needs to be coded with an application type of parts. Also, ensure that the proper inventory, cost of sale account and default percentage are loaded. The default is used only if technicians have no Work Order Cost loaded in employee master maintenance.

Separate Sale Accounts

If you need separate sale accounts for different pricing levels used in sales orders, then you must enter the sale account corresponding to each level. Normal list price uses the main account. For example, if pricing level 2 was used on the parts sale invoice, the system will use the account that corresponds to the level 2 G/L account, instead of the sale account on the part. The sale account is then used to determine if a cash code sale account exists.

If you need separate sale accounts for the different cash codes used on a sales order invoice, then you must enter the sale account corresponding to each cash code. Cash code 1 will use the main account. If cash code 2 was used on the part sale invoice, the system will use the account entered here for cash code 2 instead of the sale account on the part. The parts inventory, parts costs of sales and default cost of sale % for the cash code 2 account are also used instead of those for the sale account on the part master for the part sold. If the cash code 2 did not have an account entered, the main account will still be used. The same applies for cash codes 3, 5, 7 and 8.