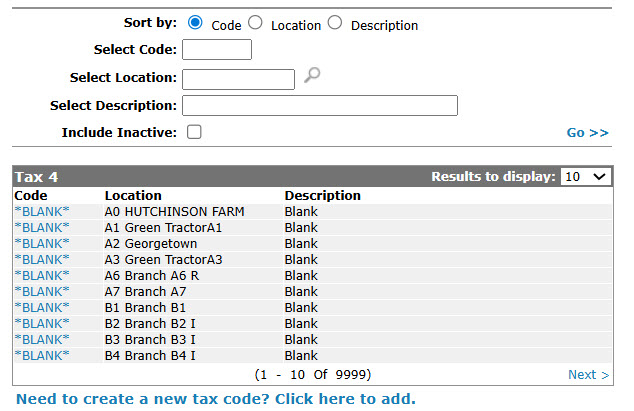

Configuration: Tax 3 Listing

The Tax 3 screen allows you to search for, edit and add tax 3 codes. The Tax 3 screen also shows the existing configuration of all previously defined Tax 3 codes.

To open the Tax 3 screen navigate to Configuration > CRM > Taxes Discounts > Tax 3.

Topics in this section are:

Adding a Tax 3 Code

-

From anywhere in IntelliDealer , navigate to Configuration > CRM > Taxes Discounts > Tax 3.

-

Click Need to create a new tax code? Click here to add .

-

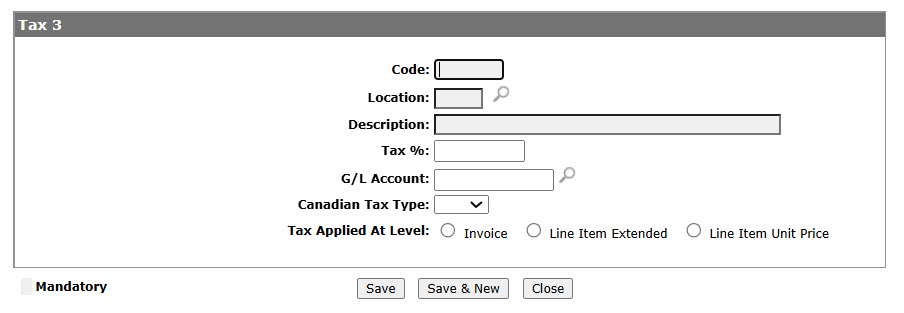

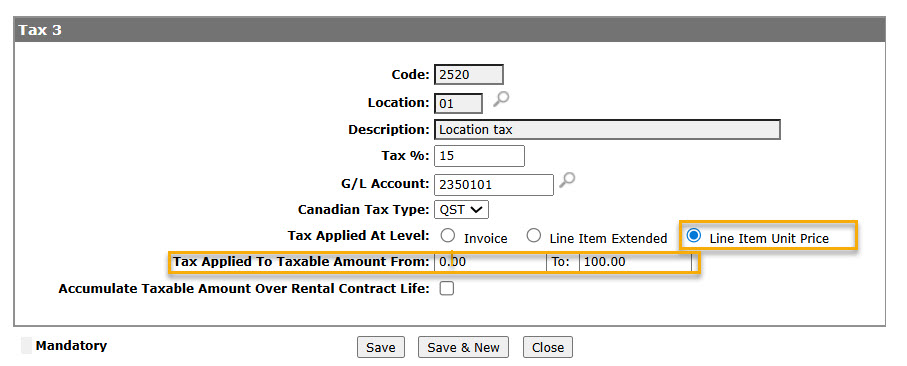

On the Tax 3 screen, enter a 4-digit alphanumeric code, select the applicable Location, add a brief Description, and enter the Tax %to apply on invoices and select the G/L Account where the tax amounts are posted.

-

(OPTIONAL) If you are a Canadian dealership, (CA is entered in the Country Company Located In field of the COTAB1 table), select the Canadian Tax Type you want to associate to the selected tax code; either GST, PST, HST, or QST.

This information records on applicable credit card transactions and sends to the credit card company during submission using the Authorization Maintenance screen. -

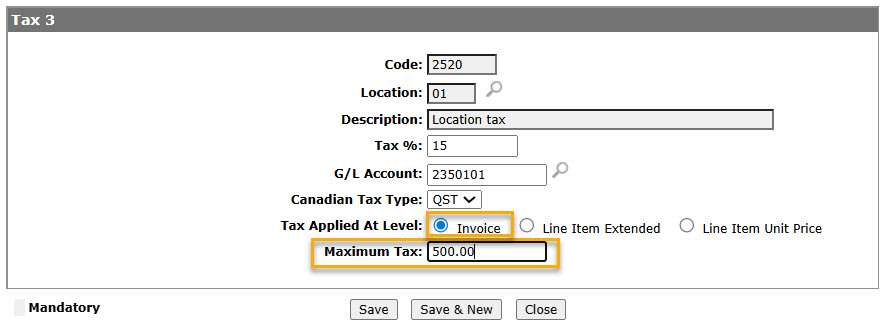

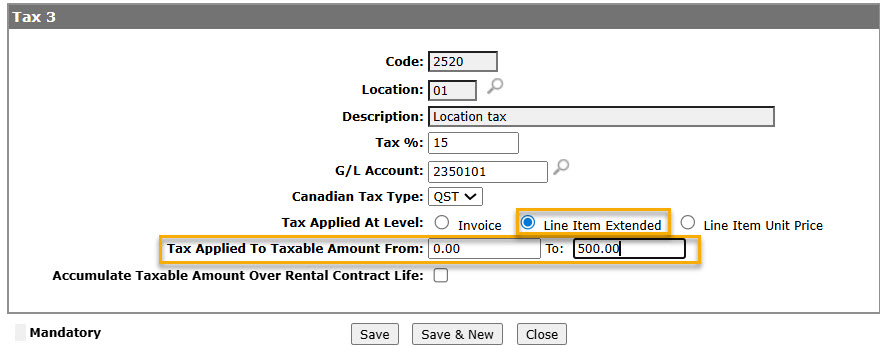

In the Tax Applied At Level field, select the taxing method you want to configure for the tax code.

For more information about taxing method options, see the Tax 3 or Tax 4 help topics. -

If the Invoice taxing method is selected, enter theMaximum Amount tax amount the code applies to an invoice.

-

(OPTIONAL) If you select the Line Item Extended taxing method in the Tax Applied At Level field, enter the total line item price range that the tax code will be applicable for in the Tax Applied To Taxable Amount field. The Line Item Extended taxing method is currently only applicable within the Rental system.

-

(OPTIONAL) If you select the Line Item Unit Price taxing method in the Tax Applied At Level field, enter the individual line item price range that the tax code will be applicable for in the Tax Applied To Taxable Amount field.

-

(OPTIONAL) If you select either the Line Item Extended or Line Item Unit Price taxing method, select the Accumulate Taxable Amount Over Rental Contract Life switch to force the system to accumulate the taxable amount on rental contract invoices that use the selected tax code.

-

After making your selections, click the Save button to save the new tax 3 code and return to the Tax 3 screen.

- or -

Click the Save & New button to save the new tax 3 code and refresh the Tax 3 screen, allowing you to create another tax 3 code.

Screen Description

The sorting options on the Tax 3 screen are:

| Sort by | |

|---|---|

| Field | Description |

| Code | Sort the search results by tax code number. |

| Location | Sort the search results by branch location. |

| Description | Sort the search results by tax code description. |

The search fields on the Tax 3 screen are :

| Field | Description |

|---|---|

| Select Code | Search for a tax 3 code by entering the tax code number. |

| Select Location | Search for a tax 3 code by entering a branch location. |

| Select Description | Search for a tax 3 code by entering the tax code description. |

| Include Inactive | If selected, inactive tax 3 codes will be included in the search results. |

The fields on the Tax 3 screen are :

| Field | Description |

|---|---|

| Code | The tax 3 code number. |

| Location | The branch location that the selected tax applies to. |

| Description | A brief description of the tax code. |