Note: The information contained in this topic pertains to the green screen portion of the IntelliDealer system and will be updated periodically. If you do not have access to green screen, contact your system administrator for more information. As best practice VitalEdge recommends using the IntelliDealer version of any of following tables whenever possible.

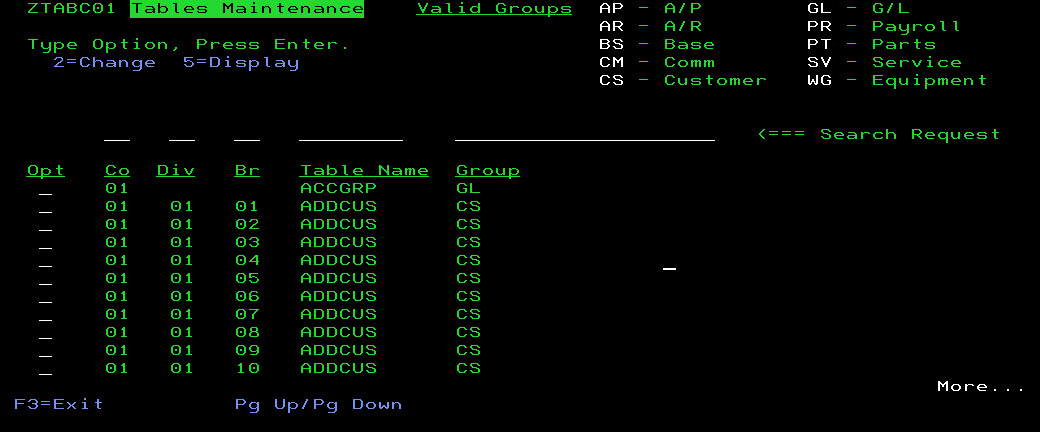

The following tables allow you customize the performance and operation of the IntelliDealer system. To access the tables, use the WRKPFWVAL command from anywhere within the green screen application to access the Tables Maintenance screen. The WRKPFWVAL program is protected by menu option security.

These fields typically appear in each table:

- COMPANY #—The company number that the selected record applies to.

- DIVISION #—The division number that the selected record applies to.

- BRANCH #—The branch number that the selected record applies to.

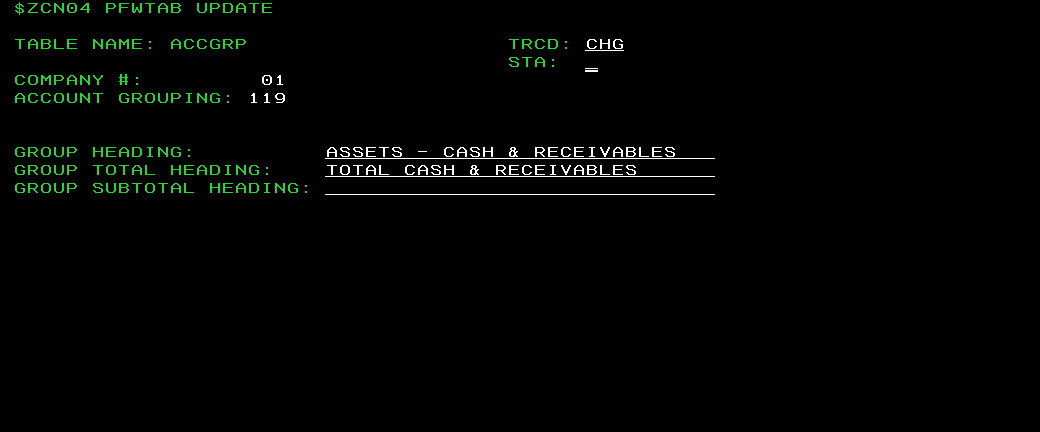

ACCGRP table

The ACCGRP table allows you to group Balance Sheet accounts into categories according to the first three digits of the account number. This grouping is reflected on your financial statements.

The CC1STACCT table should also be considered when setting up this table. The titles set up in ACCGRP will print each time there is a change in the first three digits of the account number. The titles set up in CC1STACCT print when there is a change in the first digit of the account number. Please refer to the CC1STACCT table for more information.The following fields appear on the ACCGRP table:

| Field | Description |

|---|---|

| Account Grouping | Enter the first three digits of the last account number that falls in this group. For example, the account grouping might be “123”. All account numbers which start with values smaller than 123 (e.g. 100, 110, 121) and larger than the previous account grouping number will be included in the account grouping 123. |

| Group Heading | Enter the title which will appear at the start of this group of accounts. Up to 30 characters are available. |

| Group Total Heading | Enter the text that will appear on a total line after this group of accounts. This line will describe the total for the group. A maximum of 30 characters is allowed. |

| Group Subtotal Heading | If a subtotal is desired, enter the subtotal text. A subtotal is the total of all accounts up to this point. For example, group 123 may have a total and group 150 may have a total: a subtotal will be the grand total of the accounts in those two groups. Up to 30 characters can be used for this description. If no subtotal is desired, leave this field blank. |

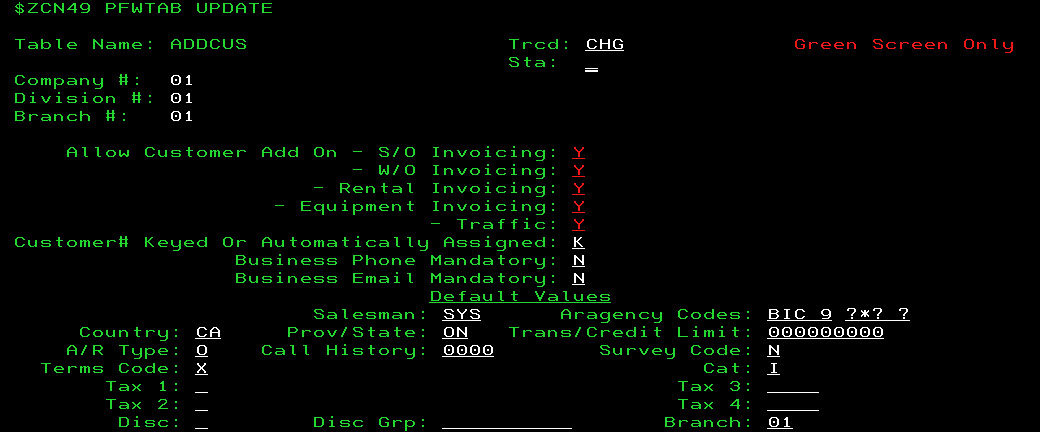

ADDCUS table

The ADDCUS table allows you to configure how Customer Profiles are added to your system, as well as the defaults that will automatically be loaded to a profile when a new customer profile is added in IntelliDealer.

The following fields appear on the ADDCUS table:

| Field | Description |

|---|---|

| Allow Customer Add On (Y/N) | Allows you to select which modules users will be able (Y) or unable (N) to quick-add customer profiles from in IntelliDealer; either S/O Invoicing (Sales Orders), W/O Invoicing (Work Orders), Rental Invoicing, Equipment Invoicing, or Traffic. The user who quick-adds the customer profile does not have the ability to determine the A/R type or Terms code (cash, charge, etc.) for the customer. Normally, the administration office periodically generates a report on all quick-added customer records and adjusts them as needed. |

| Customer # Keyed or Automatically Assigned (K/A) | Allows you to select whether quick-added customer profiles will have user-generated customer numbers (K) or system-generated customer numbers (A). System-generated numbers consist of the five-character search typed in by the user (usually the last name of the customer) plus a number. For example, SMITH001, SMITH002, etc. |

| Default Values | Allows you to configure the default values entered into each field when quick-adding a customer profile from any of the modules listed in the Allow Customer Add On field noted above. For details, see the table below. |

The following Default Values are configurable on the ADDCUS table:

| Value | Description |

|---|---|

| Salesman | Reports can be extracted on all customers defined with a specific salesman code. VitalEdge recommends using the salesman number “SYS” in this field, so that all quick-added customer records can be reported on and changed as necessary. |

| Aragency Codes | Specify the cash code which should be used as a default for quick-added customer records. Leave this field blank to indicate that quick-added customers are limited to cash only, or specify up to five valid default A/R agency codes to allow quick-added customers to an A/R agency. The first cash code in the list become the default cash code in the CMASAA file. If you leave the first character blank, the customer’s agency code defaults to cash, even if there are other codes on the list. As of IntelliDealer Insight, a second portion has been added to this field to default the Card Number associated to a cash code when quick-adding a customer profile to the system.For example, if the value in the first portion of the field is BI and the value in the second portion of the field is ?*, whenever a new customer is added to the system, the A/R agency codes B and I are added to the A/R Agency tab of the Customer Profile with ? and * as their respective card numbers. As a result of this change, all cash codes listed in the first portion of the Aragency Codes field must have an associated card number listed in the second portion of the field. * Do Not Save Card Number After Request - This means that when invoicing the customer, the user is prompted to enter the card number. After it is entered, it is not stored anywhere in the system and the prompt appears each time the card number is required. ? Save Card# After Request - This means that when invoicing the customer, the user is prompted to enter the card number. After it is entered there are three possible scenarios: a) For agencies coded as Payment Card Interface (with MERCHMGR in the ARAGENCY table under Agency Name) where the device is not an MX880, the system will save just the last four digits of the card on the profile (ie. XXXXXXXXXXXXX2222). b) For agencies coded as Payment Card Interface (with MERCHMGR in the ARAGENCY table under Agency Name) where the device is an MX880, nothing is saved c) For all other agencies, the card number keyed replaces the ? for that agency code on the A/R Agency tab of the customer profile and not prompt again User-defined codes can be used in this field. Please refer to the tables ARAGENCY and CASHTAB for further information on cash codes. |

| Province/ State | Two character codes representing states are predefined in the system. Codes 01 through 09 are used to denote Canadian provinces. Please consult VitalEdge for the appropriate code for your state or province. |

| Call History | Controls the number of calls that will be stored on the system. Any calls that exceed this value are purged at the end of the month provided that they are 2 years and older. |

| Trans/ Credit Limit | The default credit limit and transaction limit for the default A/R Agency code. For example, a credit limit and transaction limit of 999999 can be assigned when a customer is added in order to prevent the authorization prompt screen from appearing. |

| A/R Type (O/B/T) | Allows you to select the default A/R type used for new customers added to the system; either Open item (O), Balance forward (B), or True balance forward (T).

|

| Survey Code (Y/N) | This field is used by dealers using the strategy feed back interface. It indicates whether dealers participate in submitting the customer survey code information to the appropriate vendor. If you do not use the interface you can still use the code for internal purposes. |

| Terms Code | A terms code of “X” is recommended if you wish to limit quick-added customers to a cash only basis. Some sites allow their new customers to charge items to an in-house account immediately, in which case this field would be left blank. Whether new customers are limited to cash only is a matter of company policy. |

| Cat (Category) (I/B/N) | Specify the customer category which should be used as a default for quick-added customer records. The valid options are: (I) to denote an Individual, (B) to denote a Business, or (N) which indicates an Internal Customer. |

| Tax 1 (1-9/ A-Z) | If you are using Tax 1 in your organization and quick-added customers are subject to this tax, enter the code of the tax which should be defined on quick-added customer records. Valid codes which can be defined in the TAX1table (or on the Tax 1 screen in IntelliDealer) are numbers 1 through 9. Any letter(s) can also be defined in the TAX1 table to denote that no tax applies. The Tax 1 field can be left blank. If Tax 1 does not apply or is not being used, the letter “X” is usually used in this field to indicate the exemption. |

| Tax 3 | If you are using Tax 3 in your organization and quick-added customers are subject to this tax, enter the code of the tax which should be defined on quick-added customer records. Valid codes are defined in the TAX3 table (or the Tax 3 screen in IntelliDealer). |

| Tax 2 (1-9/ A-Z) | If you are using Tax 2 in your organization and quick-added customers are subject to this tax, enter the code of the tax which should be defined on quick-added customer records. Valid codes which can be defined in the TAX2 table (or on the Tax 2 screen in IntelliDealer)are numbers 1 through 9. Any letter(s) can also be defined in the TAX2 table to denote that no tax applies. The Tax 2 field can be left blank. If Tax 2 does not apply or is not being used, the letter “X” is usually used in this field to indicate the exemption. |

| Tax 4 | If you are using Tax 4 in your organization and quick-added customers are subject to this tax, enter the code of the tax which should be defined on quick-added customer records. Valid codes are defined in the TAX4 table (or the Tax 4 screen in IntelliDealer). |

| Disc (Discount) (1-9/ A-Z) | Enter the discount code which should be defined for quick-added customers. Numbers 1 through 9 represent valid discount codes as defined in the DISCOUNT table (or on the Add/ Change Discount screen in IntelliDealer). Any letter(s) can also be defined in the DISCOUNT table to denote that no discount should be given. Commonly, “X” or blank is used to represent no discount. |

| Disc Grp (Discount Group Code) | The default Pricing Group code applied to all new customers added to the system. |

| Branch | Specify the customer branch which should be used as a default for quick-added customer records. This field can be set to a valid branch value or left blank, in which case the customer is assigned to the current branch. |

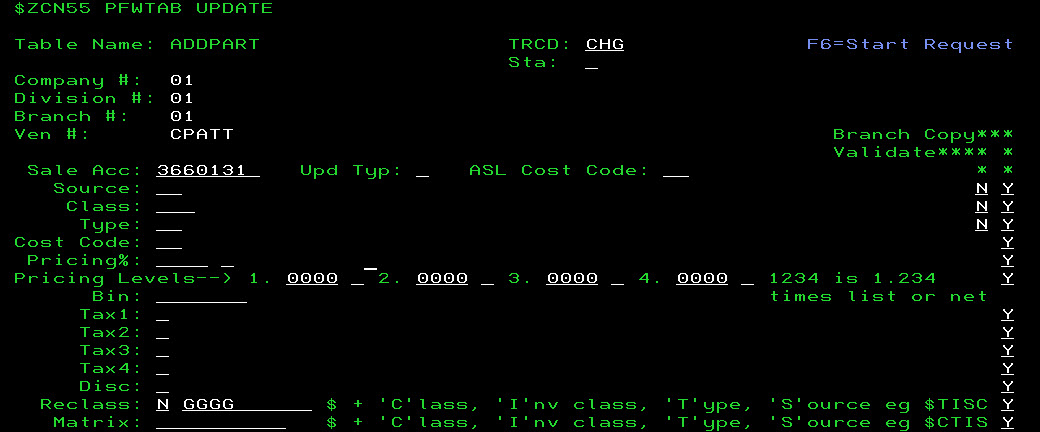

PartAdds table

The PartAdds table allows you to configure how Part Profiles are added to your system, as well as the defaults that will automatically be loaded to a profile when a new part is quick-added in IntelliDealer.Parts that are added through IntelliDealer are ones which are not in the Parts Master Maintenance file, and may or may not be in the Master Price file. The Master Price file is generated when a vendor’s price tape is loaded onto your system. The parts on the price tape(s) may or may not exist in your Parts Master Maintenance file.

If a dealer is using the PartAdds table and sets Pricing Levels make sure that if they add a level on Costthe factor is calculated in the Level fields and is based off List. If List changes it continues the same factor off of the new List value (factor is always off of the current parts list value). Dealers are better suited to use the customer parts pricing option as this gives them better control than the Pricing Level fields that store only a factor not a price. In IntelliDealer, the pricing levels are keyed as the price value, but stored as the factor of the List price. In the following example List price is $1000, Level price is 7.00 on the screen, but the stored factor would be 99.3:

A list price of 1000.00 and the level 1 price is 7.00 , the level 1 value in the PARTMAST file would show as 99.3. (99.3 % below the list price or 0.7 % of the list)

Calculation: 7 / 1000 x 100 = 0.7 (100 - 0.7 = 99.3)

99.3 would be how the factor is stored in the Pricing Levels field. The calculation would be adjusted by rounding so keep that in mind.

Some dealers use pricing levels if they want the Sales Account to go to a different G/L account. Pricing Levels must be less than 2 times the list price.

To remove a vendor from the PartAdds table, type 'R' in the status field, then press Enter.The vendor is immediately deleted from the PartAdds table.

The fields on the PartAdds table are:

| Field | Description |

|---|---|

| Sale Acc (Sale Account) | Enter the parts sale account which corresponds to the selected vendor code. When a part is added from the master price file for this vendor to the Parts Master Maintenance module, this is the sale account automatically be used for the part. |

| UPD TYP (Updated Type) (A/M) | Specify whether quick-added parts should be updated either: (A) Automatically when a price tape is run. (If the part is found on the price tape for the vendor, its information such as List and Cost is updated.) |

| ASL Cost Code (Authorized Stocking Lists Cost Code) | Deprecated. Enter the default Authorized Stocking Lists cost code to be used when a part is added to the system. |

| Source | Enter the source to which quick-added parts should default. If the part being quick-added is found in the PARTPRC file (i.e. on a Master Price file in the system), then the PARTPRC values are used instead of the value in this field. |

| Class | Enter the class to which quick-added parts should default. If the part being quick-added is found in the PARTPRC file (i.e. on a Master Price file in the system), then the PARTPRC values are used instead of the value in this field. |

| Type | Enter the type to which quick-added parts should default. If the part being quick-added is found in the PARTPRC file (i.e. on a Master Price file in the system), then the PARTPRC values are used instead of the value in this field. |

| Cost Code | Enter the default cost code to be used when a part is added to the system. Possible cost code values are stored in the COSTCODE table. |

| Pricing % | Enter the percent which should be applied to quick-added parts to obtain a selling price. This is a three-character field which contains two decimal places. For example, a percentage of ten percent would be entered as 010. In the second field, specify whether this percent is based on either the List price of the part (L), or the Net cost of the part (N). If the part being quick-added is found in the PARTPRC file (i.e. on a Master Price file in the system) and a Pricing Matrix applies to that file, the matrix is used instead of this percent. |

| Pricing Levels 1-4 (N/L) | The selling price for pricing level 1,2,3 and 4, as per the Part Master Maintenance module. Pricing levels usually refer to things such as wholesale price, fleet price, and jobber price. For example, 1234 is 1.234 times either the list or net price. If no pricing levels apply to the part, then leave these fields blank or zero. |

| Bin | Enter the bin which quick-added parts should default. It is recommended to use a value such as “NOBIN”. Reports on parts quick-added to the system can then be extracted by this bin value. |

| Tax1 | If you are using Tax 1 in your organization and quick-added parts are subject to this tax, enter the code of the tax which should be defined on quick-added parts records. Valid codes (which can be defined in the TAX1 table, or on the Tax 1 screen in IntelliDealer) are numbers 1 through 9 or a blank value. Any letter(s) can also be defined to denote that no tax applies. If Tax 1 does not apply or is not being used, the letter “X” is usually used in this field to indicate the exemption. If the application of Tax 1 should be determined by the customer master record, leave this field blank. |

| Tax2 | If you are using Tax 2 in your organization and quick-added parts are subject to this tax, enter the code of the tax which should be defined on quick-added parts records. Valid codes (which can be defined in the TAX2 table, or on the Tax 2 screen in IntelliDealer) are numbers 1 through 9 or a blank value. Any letter(s) can also be defined to denote that no tax applies. If Tax 2 does not apply or is not being used, the letter “X” is usually used in this field to indicate the exemption. If the application of Tax 2 should be determined by the customer master record, leave this field blank. |

| Tax3 | If you are using Tax 3 in your organization, specify whether quick-added parts are subject to this tax: (Y): Yes, Tax 3 is charged on the part if the customer purchasing the part is subject to TAX3 and a valid TAX3 code is defined on the customer’s account or (N): No, Tax 3 is not be charged on the part, regardless of the customer's tax status Valid Tax 3 codes are defined in the TAX3 table or on the Tax3 screen in IntelliDealer. |

| Tax4 | If you are using Tax 4 in your organization, specify whether quick-added parts are subject to this tax: (Y): Yes, Tax 4 is charged on the part if the customer purchasing the part is subject to TAX4 and a valid TAX4 code is defined on the customer’s account or (N): No, Tax 4 is not charged on the part, regardless of the customer's tax status Valid Tax 4 codes are defined in the TAX4 table or on the Tax4 screen in IntelliDealer. |

| Disc | If you are using discounts in your organization and quick-added parts are subject to the discounts, enter the discount code which should be defined on quick-added parts records. Valid codes (which are defined in the DISCOUNT table or on the Add/ Change Discount screen in IntelliDealer) are numbers 1 through 9 or a blank value. Any letter(s) can also be defined to denote that no discount applies. If discounts do not apply or are not being used, the letter “X” is usually used in this field to indicate the exemption. If the application of discounts should be determined by the customer master record, leave this field blank. |

| Reclass | Specify whether quick-added parts should be subject to OFC (Order Formula Code) reclassing. You can set-up the PartAdds table so that it calculates the Reclass and Matrix values based on a formula. This must be entered using the following syntax: Dollar Sign ($) followed by one or more of the following letters: C I S T (Where C = Class, I = Inventory Class, S = Source, T = Type) For example, if Source = AA, and Class = BBB, and Type = CC for a part, then the formula $SCT will tell the system to derive the value based on a concatenation of these 3 items. This would result in a value of AABBBCC. |

| Matrix | Specify a price matrix code to determine what the proper price increase % a part should be. You can set-up the PartAdds table so that it calculates the Reclass and Matrix values based on a formula.This must be entered using the following syntax: Dollar Sign ($) followed by one or more of the following letters: C I S T (Where C = Class, I = Inventory Class, S = Source, T = Type) For example, if Source = AA, and Class = BBB, and Type = CC for a part, then the formula $SCT tells the system to derive the value based on a concatenation of these three items. This would result in a value of AABBBCC. |

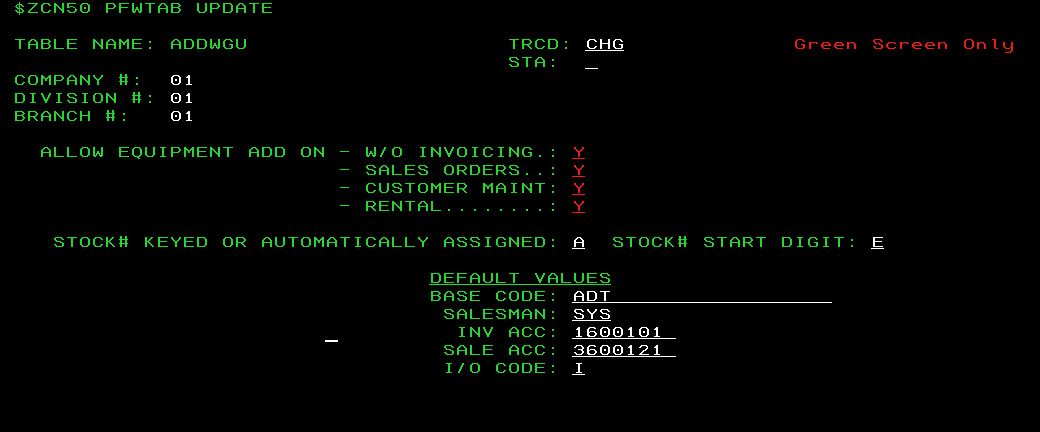

ADDWGU Table

The ADDWGU table allows you to configure the information added to customer-owned equipment units that were not previously recorded in the system. Typically, this happens the first time a unit is brought into the dealership for service or when it is acquired as part of a trade. When the unit is added to the system it is given a stock number; if the unit is quick-added through service, sales orders, or customer maintenance, the status of the unit is I (Invoiced); if the unit is quick added through an equipment invoice, the status of the unit is V (Inventory). Once recorded to the system, the unit is attached to the customer record and made available for future reference.

The fields appear on the ADDWGU table are:

| Field | Description |

|---|---|

| Allow Equipment Add On (Y/N) | Use this field to determine which IntelliDealer modules the user is (Y) or is not (N) be able to quick-add customer owned pieces of equipment to the system; either W/O Invoicing, Sales Orders, Customer Maintenance, or Rental. |

| Stock # Keyed or Automatically Assigned (K/A) |

Determines whether quick-added customer-owned units have stock numbers automatically assigned to them by the system (A) or force the user to key in the stock number upon adding the unit (K). System-assigned stock numbers are six-character sequential numbers. If a starting digit is used (see the Stock # Start Digit field below), it is followed by six numbers. The starting sequence number can be specified by contacting VitalEdge. |

| Stock # Start Digit |

If stock numbers are to be automatically assigned by the system (A is entered in the Stock # Keyed or Automatically Assigned field above), enter the start digit to be used as a prefix to the stock number. If no prefix is desired, leave this field blank. Only the letters A - Z and numbers 1 - 9 can be used as acceptable start digits. |

Default Values

If quick-added customer owned units are allowed at your dealership (ie. the Allow Equipment Add On switch is set to Y for any of the IntelliDealer modules listed), the options in this field allow you to set the system defaults that will be applied to each unit when they are added:

| Field | Description |

|---|---|

| Base Code |

The base code that will be applied to customer-owned units. VitalEdge suggests a miscellaneous base code (such as "MISSYS") so that customer-owned units are easily identifiable in the system. Miscellaneous base codes are configured on the Add Base & Options screen in IntelliDealer. |

| Salesman | Reports can be extracted on all equipment defined with a specific salesman code. VitalEdge recommends using the salesman number “SYS” in this field so that all quick-added customer equipment records can be reported on and changed as necessary. |

| Inv Acc |

Enter the default Inventory G/L account which should be used for quick-added equipment records. This account number is for reference only and no amounts are posted into the G/L for quick-added pieces of equipment. The account number entered in this field must be a Complete Good Inv. Comb. account as defined in the Application Type field on the Accounts Options screen. (Complete Good Inv. Comb. accounts are defined by an application type of "I" in Chart of Accounts Maintenance in the green screen application.) |

| Sale Acc |

Enter the default Equipment Sale G/L account which should be used for quick-added equipment records. This account number is for reference only, and no amounts are posted into the G/L for quick-added pieces of equipment. The account number entered in this field must be a Sale account as defined in the Application Type field on the Accounts Options screen. (Sale accounts are defined by an application type of "S" in Chart of Accounts Maintenance in the green screen application.) |

| I/O Code (I/O/B) | Enter the default In/Out indicator for newly added machines; either I for in, O for out, or B for branch transfer. |

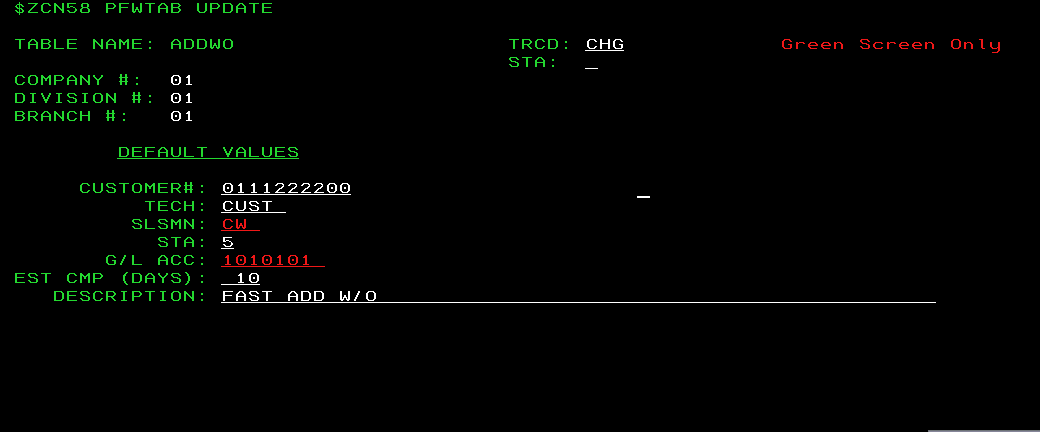

ADDWO table

The ADDWO table allows you to configure the default values that will be used when quick-adding a work order in IntelliDealer. The ability to quick add a work order allows the user to open a work order without having access to all of the Service functions. Quick-added work orders contain all of the basic information needed to proceed with work on a piece of equipment. The work order quick-add feature is often used for standard, recurring jobs, such as cleaning and inspection upon the return of a rental unit.

When a work order is quick-added through the Service menu, the technician ID, salesperson and estimated completion date are the only default values which apply.

The following fields appear on the ADDWO table:

| Field | Description |

|---|---|

| Customer # | Enter the customer number that defaults when quick-adding a work order from the Rental module only. |

| Tech |

Enter the technician number that will be defaulted to when quick-adding a work order from either the Service or Rental modules. |

| SLSMN |

Enter the technician number that defaults when quick-adding a work order from either the Service or Rental modules. VitalEdge recommends a non-standard code such as "SYS" in order to easily identify quick-added work orders by salesperson ID. |

| STA | Enter the work order status that defaults when quick-adding a work order from the Rental module only; either A (active work order), 5 (customer work order), 7 (warranty work order), 8 (internal work order). |

| G/L ACC |

Enter the general ledger account number that defaults when quick-adding a work order from the Rental module only. This is the general ledger account that the work order will be closed to. As such, VitalEdge recommends using the Rental Cleanup expense account. |

| EST CMP (Days) | Enter the number of days to use to calculate the default Estimated Completion Date for work orders that are quick-added from the Service or Rentals modules. For example, if the order is created on January 1st and 5 is entered in this field, the default Estimated Completion Date on the order would be January 5th. |

| Description | Enter the work order description that defaults when quick-adding a work order from the Rental module only. For example, "Clean and Prep Rental Equipment". |

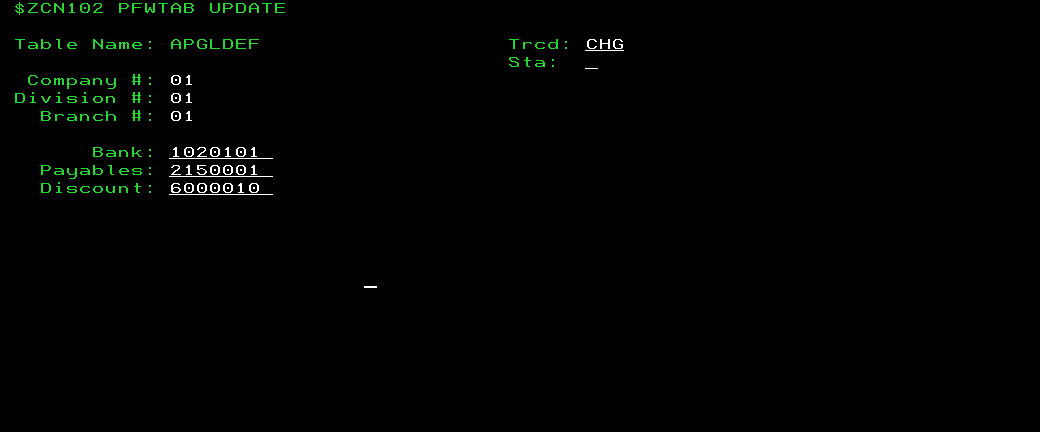

APGLDEF table

The APGLDEF table allows you to configure the default Accounts Payable and General Ledger payable accounts to use when creating A/P vouchers.

The fields on the APGLDEF table are:

| Field | Description |

|---|---|

| Bank | The default bank account number to use when creating the vouchers. |

| Payables | The default payables account number to use when creating the vouchers. |

| Discount | The default discount account number to use when creating the vouchers, if applicable. |

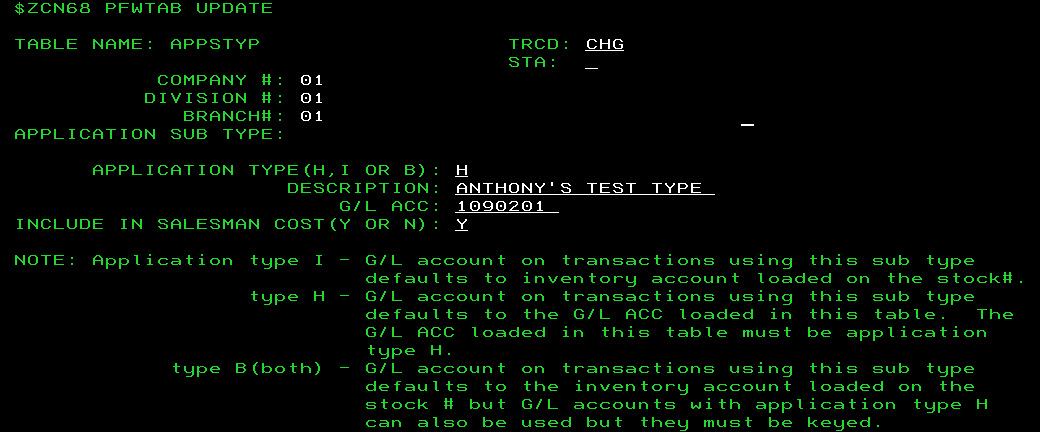

APPSTYP table

The APPSTYP table allows you to classify the History (H) and/ or Inventory (I) application types associated to the general ledger accounts used in the Equipment module of IntelliDealer.For example, a type and subtype combination of 'HF' could represent History of Freight costs; IA could stand for Inventory unit Attachments, etc.

Note: Application types are also configurable from the History Sub-Types screen in IntelliDealer.

For subtypes defined as Inventory (I) types, entries which use that subtype will default to the G/L inventory account used on the stock number. For subtypes defined as History (H) types, entries which use that subtype will default to the G/L account defined in this table. (Note that the General Ledger account entered in this table must be defined as an "H" application type.) If a subtype is used for Both Inventory and History (B), the default will be to use the G/L account on the stock number, but the G/L account entered in this table can be used if it is keyed in manually.

Note: The following application types and subtypes already hard-coded in the system are:

Types (first digit):

F - Finance Expense

H - History

I - Inventory

M - Maintenance Exp

N - Notes Payable

O - Over Allowance

P - Parts

R - Rent

S - Sales

W - Write Down

Subtypes (second digit):

O - Original Cost

C - Current Cost

S - Service

I - Internet

R - Rental Costing

T - Traffic

X - No Charge Rental Contracts

The following fields appear on the APPSTYP table:

| Field | Description |

|---|---|

| Application Sub Type | The one-character application sub type code you want to configure. |

| Application Type |

Specify whether the selected subtype code is used as either a History subtype code (H), Inventory subtype code (I), or Both a history and inventory subtype code (B). Transactions using a History subtype code default to the G/L Account configured in the field below. Transactions using an Inventory subtype code default to the inventory account configured on the stock number related to the transaction. Transactions using a subtype code configured as both History and Inventory application types default to the inventory account on the stock number. However, if the user manually enters the G/L account from the field below, it is accepted. |

| Description | A brief description of the sub type code. |

| G/L Account | If H or B are selected in the Application Type field above, specify the account number that defaults (application type H) or which can be used when the user types it in manually (application type B). |

| Include In Salesman Cost (Y/N) |

If set to Y, any equipment history entries related to the stock number to which the selected subtype code applies appear in the Sales Cost column of the Equipment Costing screen. This is only applicable for subtypes that have the Application Type field set to I (Inventory) or H (History); subtypes set to B (Both) not appear. The accounts loaded in the APPSTYP table should not be loaded in the Equipment Costing Maintenance window (command CNFIGPFW> option 19> option 13). |

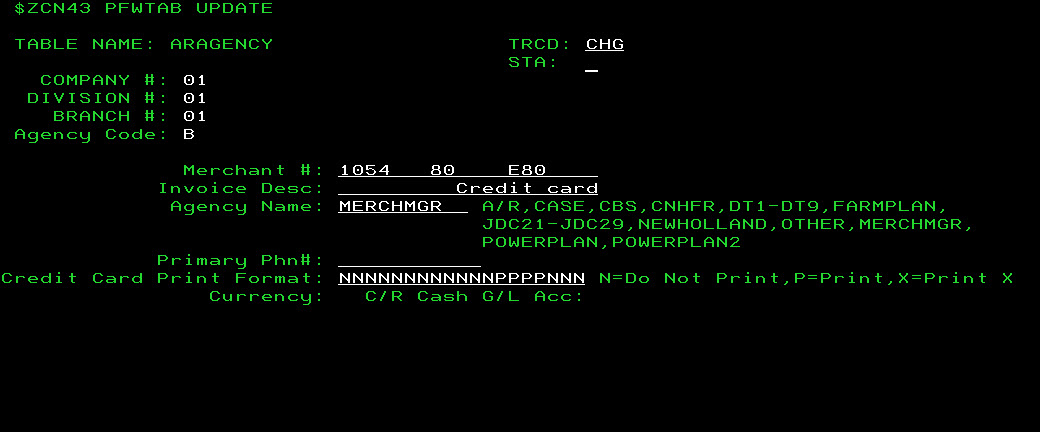

ARAGENCY table

The ARAGENCY table allows you to configure internal and external Accounts Receivable Agencies. These agencies can then, in turn, be assigned to customers on the A/R Agency tab of the customer profile. Once assigned on the A/R Agency tab, separate transaction and credit limits can be assigned to each code.

Codes defined in this table must also be defined in the CASHTAB table, however the codes must first be entered in the ARAGENCY table and then in the CASHTAB table.The following fields appear on the ARAGENCY table:

| Field | Description |

|---|---|

| Agency Code | The code representing the A/R agency you are about to configure. 1,9,B,C,D,E,G,H,I,J,K OR L - Branch.2 - Cash 3 - Parts Warranty 0, 4- Lost Sale Parts, Lost Sales Record 5 - Customer Service 6 - Lost Sale Service 7 - Service Warranty 8 - Service Internal |

| Merchant# | The merchant number should be provided by the specific credit agency you are currently working on. For example, when configuring the A/R agency code for JDC cards, JDC should provide you with a specific number to enter into this field. When configuring the A/R agency code for Case Freedom Pay (CNHFR) however, you should leave this field blank and use the ARAGENC1- 3 tables instead. |

| Invoice Description | Enter a description which will print on the bottom of each invoice. If left blank, the default description is “TOTAL CHARGE”. For aesthetic reasons, VitalEdge recommends that you right justify any text that you enter in this field. In order to use this feature, the field ONLY ONE A/R ACC PER INV in the CMBR1 table must be set to Y (yes). |

| Agency Name | The name of the agency you are configuring the code for. The valid values are:

|

| Primary Phn# | If the A/R agency requires a modem, enter the telephone number to use for dialing out to authorize the credits. |

| Secondary Phn | If the A/R agency requires a modem, enter the secondary telephone number to use for dialing out to authorize the credits. |

| Credit Card Print Format | Enter the print format you want to use for the credit card number associated to the selected A/R agency code.

|

| Currency | The currency code to which the amount of a parts invoice using this A/R agency code is converted. The Parts Invoice program cross reference the currency code to the corresponding CURRENCY table entry, retrieve the 'Sales' exchange rate from that table and divide the parts invoice amount by the Sales exchange rate to calculate the correct parts invoice amount. For example, if the amount of the parts invoice is $10.00 CDN and the A/R agency being used has the 'A' currency code assigned to it and the Sales exchange rate for that currency code is 1250000, the amount of the parts invoice is $10.00/1.250000 (or $8.00). This field is password protected. Please contact VitalEdge for details. |

| C/R Cash G/L Acc | The cash account to be used when posting cash receipts in IntelliDealer to batches that have the selected currency code assigned to it. This will allow an account to be loaded only if the currency code is not blank. This field is password protected. Please contact VitalEdge for details. |

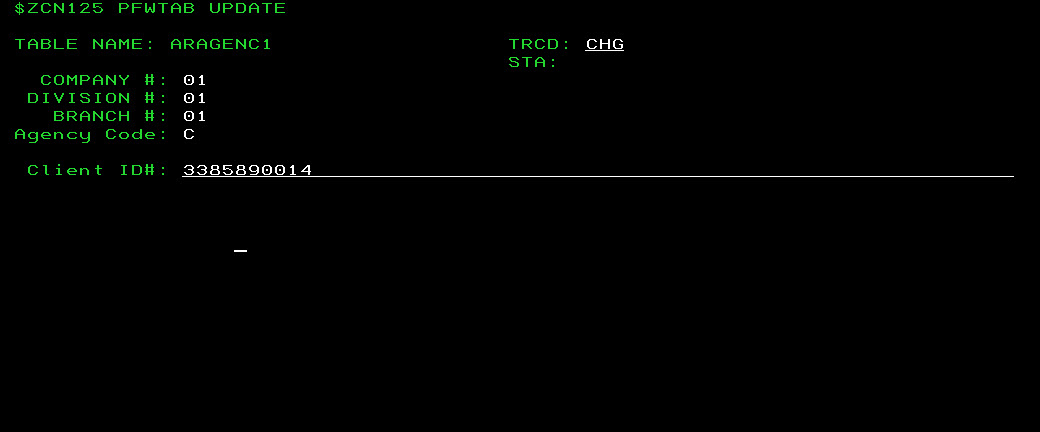

ARAGENC1 table

The ARAGENC1 table allows you to configure the client identification number for the Case Credit Card/ Freedom Pay interface (A/R agency code CNHFR).

The following fields appear on the ARAGENC1 table:

| Field | Description |

|---|---|

| Agency Code |

The code representing the A/R agency you are about to configure, as stored in the ARAGENCY table. Code 1 is typically reserved for internal A/R agencies. |

| Client ID# | The Case Credit Card/ Freedom Pay interface client ID number, as supplied by Case. |

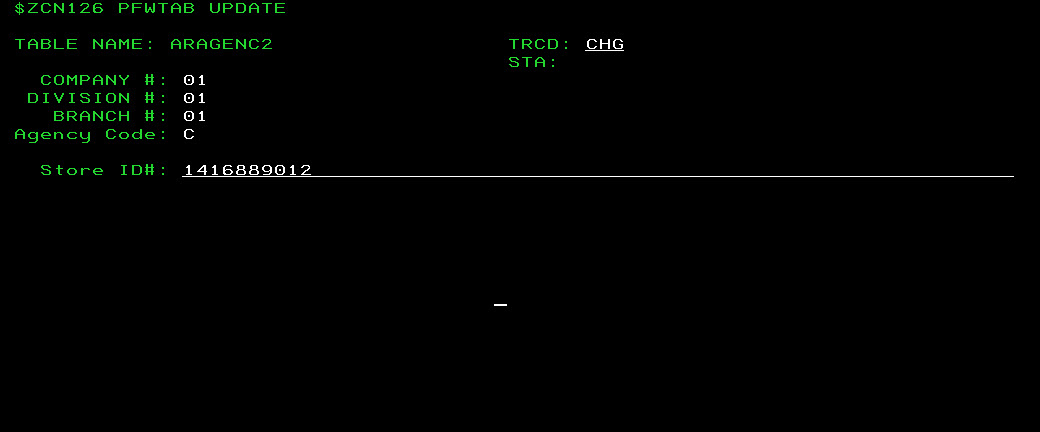

ARAGENC2 table

The ARAGENC2 table allows you to configure the store identification number for the Case Credit Card/ Freedom Pay interface (A/R agency code CNHFR).

The following fields appear on the ARAGENC2 table:

| Field | Description |

|---|---|

| Agency Code |

The code representing the A/R agency you are about to configure, as stored in the ARAGENCY table. Code 1 is typically reserved for internal A/R agencies. |

| Store ID# | The Case Credit Card/ Freedom Pay interface store ID number, as supplied by Case. |

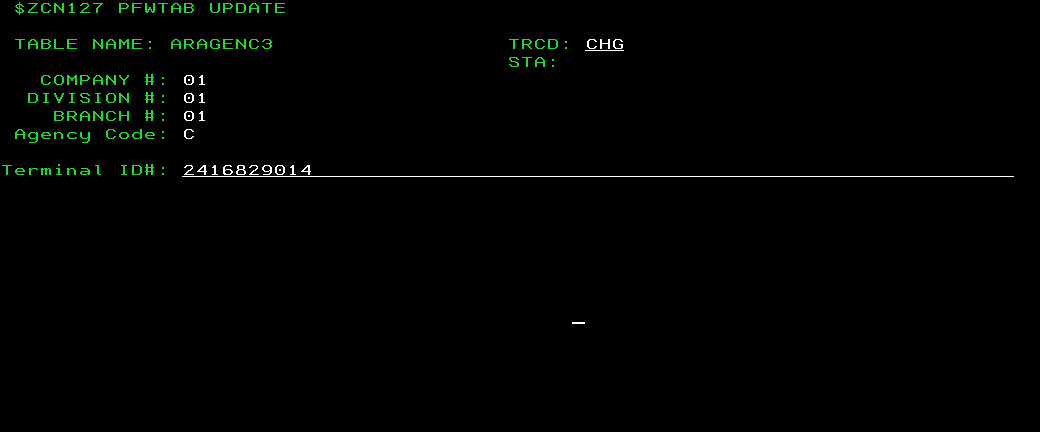

ARAGENC3 table

The ARAGENC3 table allows you to configure the terminal identification number for the Case Credit Card/ Freedom Pay interface (A/R agency code CNHFR).

The following fields appear on the ARAGENC3 table:

| Field | Description |

|---|---|

| Agency Code |

The code representing the A/R agency you are about to configure, as stored in the ARAGENCY table. Code 1 is typically reserved for internal A/R agencies. |

| Terminal ID# | The Case Credit Card/ Freedom Pay interface terminal ID number, as supplied by Case. |

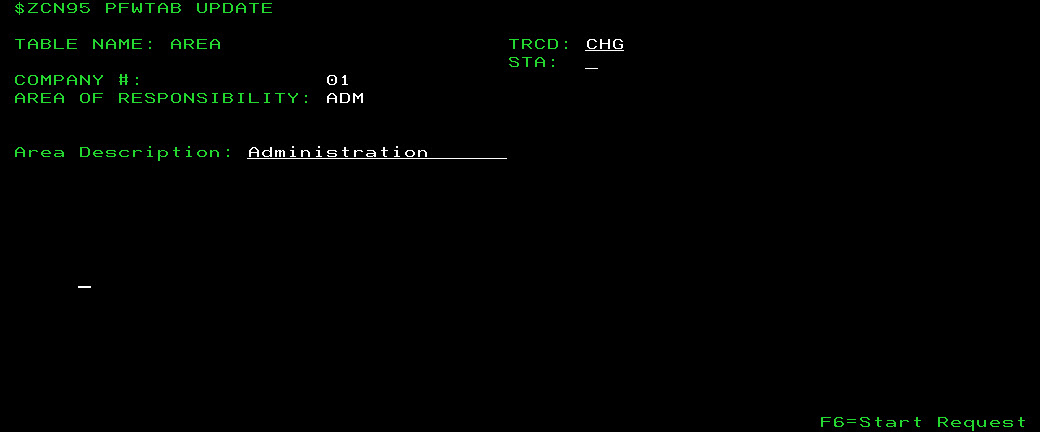

AREA table

The AREA table allows you to configure area codes which, in turn, allow you to define the area of responsibility for a customer contact on the Edit Contact/ Add Contact screen.

Area codes can also be configured from the Areas screen in IntelliDealer.The following fields appear on the AREA table:

| Field | Description |

|---|---|

| Area of Responsibility | A three character code that represents the area of responsibility. You may enter an alphanumeric code, however VitalEdge recommends using letters in order to avoid confusion. For example, a code of “ADM” is more logical than a code of “001” to denote the Administration department. |

| Area Description | A brief description of the area of responsibility. If the selected area code is active, (as defined by the STA field at the top of the table), the value entered in this field will appear as a selectable option in the Areas field of the Edit Contact/ Add Contact screen in IntelliDealer. |

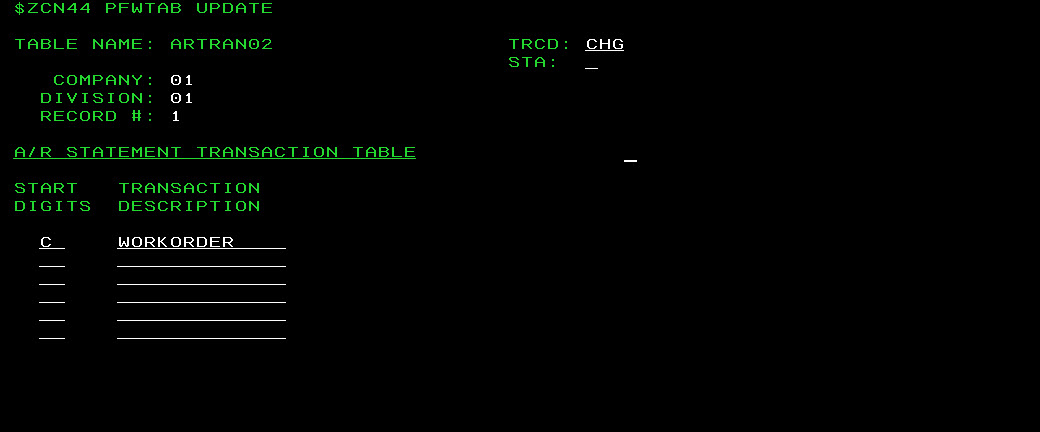

ARTRAN02 table

The ARTRAN02 table allows you to configure the invoice transaction description that appears on the A/R statement based on the starting digits of the invoice number. The start digits can be defined as either the first digit or the first two digits of the invoice. If only the first digit is used, all invoices starting with that digit and a numeric second character in the invoice number print the corresponding transaction description. For example, if the start digit R is assigned a Transaction Description of "Rental" and start digits RA are assigned a Transaction Description of "Received on Account", all invoices beginning with R and whose next digit is a number are called "Rental" on the A/R statement; all invoices beginning with R and whose next digit is an alpha character will be called "Received on Account" on the A/R statement.

The following fields appear on the ARTRAN02 table:

| Field | Description |

|---|---|

| Record # (0-9) | The record number for this set of transaction descriptions. Up to 6 descriptions are allowed per record (60 transaction descriptions in total.) |

| Start Digits | The invoice start digit for which you want to configure the A/R statement transaction description. |

| Transaction Description | The transaction description that will appear on the A/R statement for all invoices that begin with the selected Start Digit. |

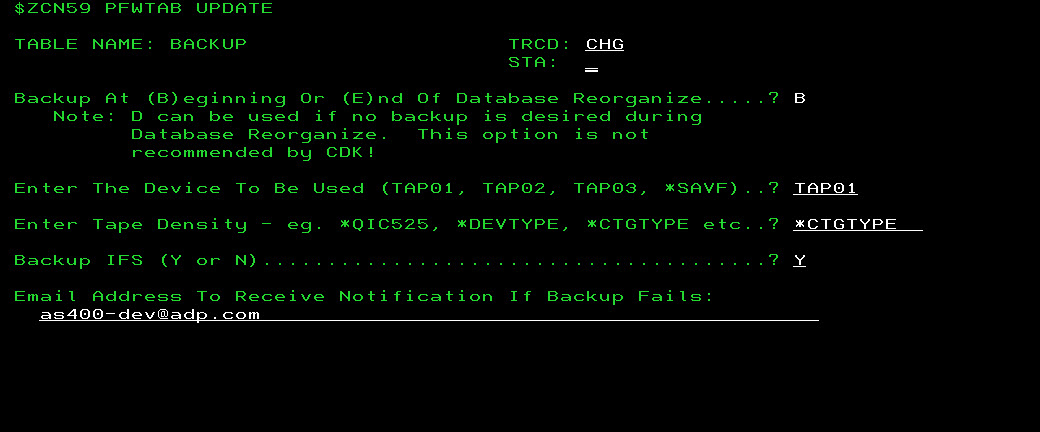

Backup table

A backup of your system data is done as part of the nightly procedure, during which billing runs and a reorganization of the database files also occur. The BACKUP table allows you to configure when and how the backup is performed as part of this nightly procedure.

All of the settings stored in the BACKUP table are not applicable for ASP dealers, with the exception of the Email Address To Receive Notification field.Performing a backup requires a dedicated server.The fields on the BACKUP table:

| Field | Description |

|---|---|

| Backup At Beginning or End of Database Reorganize | Select whether to run the backup either at the beginning (B) or end (E) of the database reorganization. You can also enter D to not run a backup at all, but this is not recommended unless you are an ASP dealer. If your dealership's backup uses one tape, select option B. If your dealership's backup uses two tapes or more, select option E. |

| Enter The Device To Be Used | Enter the name of the device that will be used to perform the backup. Normally this is the name of your tape drive (eg. TAP01). You may also enter *SAVF to backup to a save file on your network instead. The library into which the save files will be stored will be the first 8 characters of the files library name with the suffix 'SF'.(e.g. QS36FSF) In order to ensure that one files library backup is not overwritten by another files library backup, the files library name must be no longer than 8 characters. The save file name which will hold the files library objects will be the first 7 characters of the files library name plus the first 2 characters of the current day-of-the-week, plus the letter 'L'. For example, 'QS36FMOL' - holds the QS36F files library objects from Monday; 'QS36FTUL' - holds the QS36F files library objects from Tuesday, etc. If the Backup IFS switch is turned on, then the save file name which will hold the IFS files will be the first 7 characters of the files library name plus the first 2 characters of the current day-of-the-week plus the letter 'I' (e.g. QS36FWEI).The save file name which will hold the QDLS/PFW folder will be the first 7 characters of the files library name plus the first 2 characters of the current day-of-the-week, plus the letter 'Q'. (e.g. QS36FTHQ). When saving, if the save file already exists, it is cleared and then the new data is saved to it. With this naming format, one week's worth of backups can be saved, providing there is enough disk space. If the system detects a shortage of disk space, then the user will see receive a warning message on screen (if run interactively), or an email will be sent to the recipient specified in the Email Address to Receive Notification If Backup Fails field. Save files require a large amount of disk space. VitalEdge recommends that your dealership moves the save files daily in order to ensure that there will be room to save the next day’s backup. |

| Enter Tape Density | Enter the capacity of the tape which will be used for the backup. This capacity depends on the size of the tape drive and the tape being used. A tape may be smaller than the drive size but not larger. Enter *DEVTYPE in this field if the tape and the drive are the same size. Please contact VitalEdge support if you are not certain which parameter to choose. VitalEdge recommends using *CTGTYPE in this field. This setting represents a cartridge type and will automatically sense the density of the tape in the drive and adjust as necessary. Different density tapes can be used without causing a problem. |

| Backup IFS (Y/N) | This switch indicates whether or not the Integrated File System (IFS) will be saved during the backup, which includes interface files, signature files, PDF files, etc. Please contact VitalEdge for more information regarding the IFS. |

| Email Address to Receive Notification If Backup Fails | The address entered here is the recipient email address to which a message is sent in the event of a backup failure. This field is mandatory. The IntelliDealer Database will not present the backup option if the files library starts with “PFWF”. ASP customers will have a files library starting with “PFWF”. For these customers, backup will be done instead by the ASP provider. |

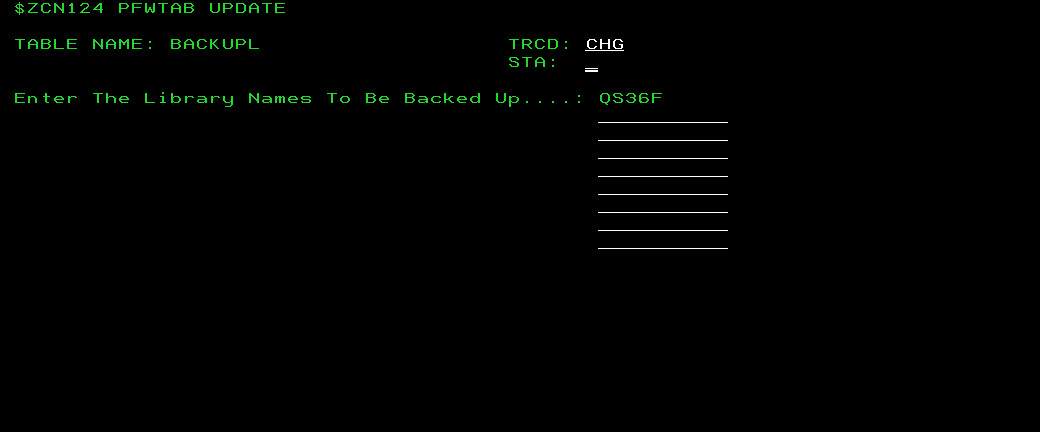

BACKUPL table

The BACKUPL table allows you to list up to 8 additional libraries you want to backup during the nightly process, in addition to the normal IntelliDealer data library that is backed up (as per the specifications in the BACKUP table). You might also consider using this table to backup any query libraries or alternate testing libraries (commonly named ALTLIB).

The first time you attempt to edit this table, you need to add it to the system.The following field appears on the BACKUPL table:

| Field | Description |

|---|---|

| Enter the Library Names to be Backed Up | The names of the additional libraries you want to back up during the nightly process. You do not need to list your IntelliDealer data library (commonly named QS36F) as this library is already backed as part of the day end process. |

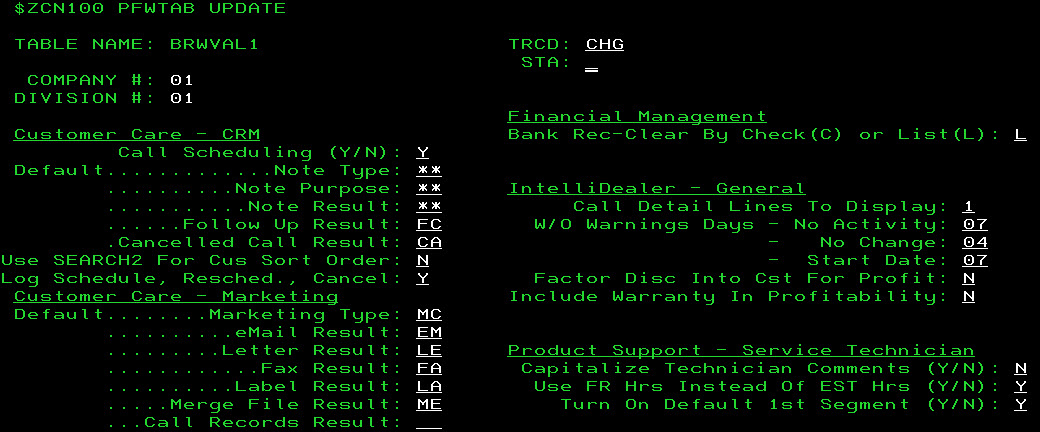

BRWVAL1 table

The settings configured in the BRWVAL1 table control various functions in multiple IntelliDealer modules.

The following fields appear in the BRWVAL1 table:

| Customer Care - CRM | |

|---|---|

| Field | Description |

| Call Scheduling (Y/N) | If activated (Y), allows the user to access the Call Schedule screens in IntelliDealer. If deactivated, the link to these screens does not appear. |

| Default Note Type |

The default note Type loaded to the system when adding a note to a customer profile from the Call History screen in IntelliDealer. See the CALLTYPE table for details. |

| Default Note Purpose |

The default note Reason loaded to the system when adding a note to a customer profile from the Call History screen in IntelliDealer. See the CALLPUR table for details. |

| Default Note Result |

The default note Result loaded to the system when adding a note to a customer profile from the Call History screen in IntelliDealer. See the CALLRES table for details. |

| Follow Up Result |

The default call Result loaded to the system when scheduling or following up a call from the Call History screen in IntelliDealer. See the CALLRES table for details. |

| Cancelled Call Result | The default call Result added to the call record when canceling a call. See the CALLRES table for details. |

| Use Search2 For CUS Sort Order |

Determines whether the Select Search 1 or 2 field on the Your Customers screen uses the 5-character Search 1 term (switch set to N), or the 10-character Search 2 term (switch set to Y). The Search 1 and Search 2 terms are defined for each customer on the Search 1 and Search 2 fields of the Customer Profile. |

| Log Schedule, Resched., Cancel (Y/N) | If activated (Y), this field enable call logging for scheduled, rescheduled and cancelled calls. If deactivated (N) logging does not occur. |

| Customer Care - Marketing | |

| Default Marketing Type | If the Create call entry switch is activated on the Campaign screen when editing or creating a new marketing campaign, this field determines the default call Type assigned to any calls created for the campaign. |

| Default eMail Result | If the Create call entry switch is activated on the Campaign screen when editing or creating a new marketing campaign, this field determines the default call Result assigned to any calls created for the campaign. |

| Default Letter Result | If the Create call entry switch is activated and Letter is selected in the Method field on the Campaign screen when editing or creating a new marketing campaign, this field determines the default call Result assigned to any calls created for the campaign. |

| Default Fax Result | If the Create call entry switch is activated and Fax is selected in the Method field on the Campaign screen when editing or creating a new marketing campaign, this field determines the default call Result assigned to any calls created for the campaign. |

| Default Label Result | If the Create call entry switch is activated and Label is selected in the Method field on the Campaign screen when editing or creating a new marketing campaign, this field determines the default call Result assigned to any calls created for the campaign. |

| Default Merge File Result | This field has yet to be implemented. |

| Default Call Records Result | This field has yet to be implemented. |

| Financial Management | |

| Bank Rec - Clear By Check (C) or List (L) |

Enter C in this field to force the user to manually enter individual check numbers and amounts for reconciliation on the Reconcile Checks screen. Enter L in this field to display a list of amounts for reconciliation on the Outstanding Checks screen. Note: The Check Reconciliation option only appears if the Reconciliation Type is set to Check Reconciliation. This field is password protected however, so if you want to change the value of the field contact your system administrator. |

| IntelliDealer - General | |

| Call Detail Lines to Display | Controls the number of call detail lines to display on the Call History screens in IntelliDealer. |

| W/O Warnings Days- No Activity |

Controls the number of days before to wait before the system will issues a warning for each of the following scenarios:

|

| Factor Discount Into Cost For Profit (Y/N) | This field has yet to be implemented. |

| Include Warranty In Profitability (Y/N) | If activated, this switch will control whether warranty information will be included in the profitability calculations displayed on the Customer Profitability screen. |

| Product Support - Service Technician | |

| Capitalize Technician Comments (Y/N) | If activated, comments added to a work order in IntelliDealer will be capitalized. |

| User FR Hours Instead Of EST Hours (Y/N) |

The Logged On Technician time count is relative to the work order hours assignment, which can be set to use flat-rate hours (Y) or estimated hours (N). If a job code is being used, the estimated hours will default to the actual average hours for this job code (determined by the previous usages of the job code). |

| Turn On Default 1st Segment (Y/N) | Enter Y to default the Based On First Segment checkbox to checked status or N to unchecked. This affect the selection process when selecting work orders by technician. |

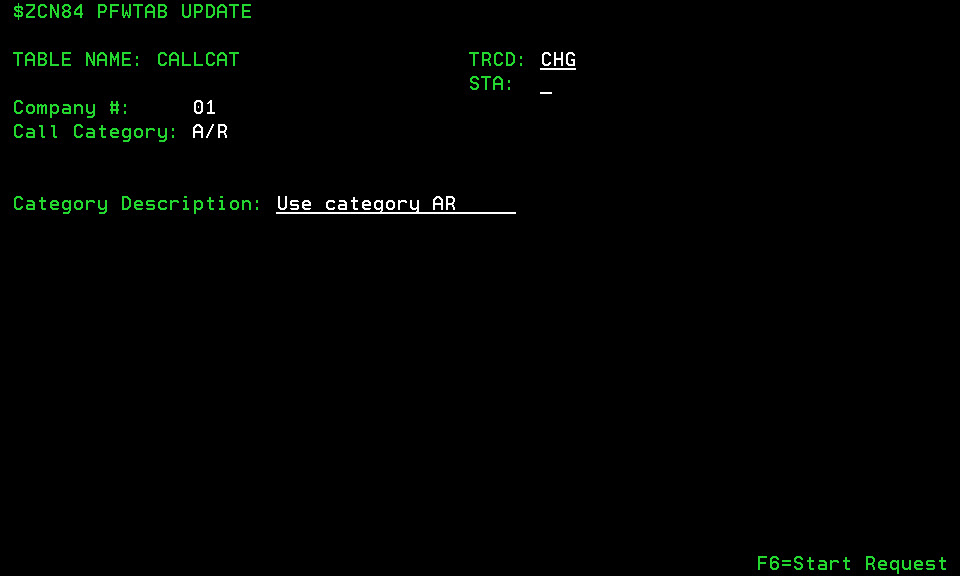

CALLCAT table

The CALLCAT table allows you to define different kinds of call categories within the system. Once a code is defined in this table, it can be used to classify calls made to a customer. Valid category codes appear as an option on the Area of Interest drop down list on the Schedule a Call screen in the Customer Profile application.

The following fields appear in the CALLCAT table:

| Field | Description |

|---|---|

| Call Category | The code representing the call category. |

| Category Description | A brief description of the call category. |

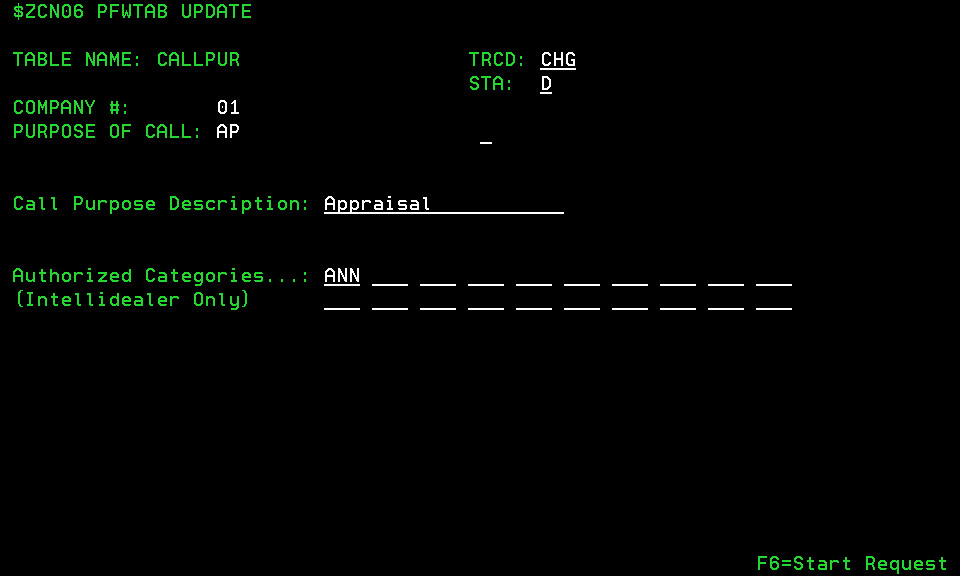

CALLPUR table

The CALLPUR table allows you to define the call purposes (defined as "reasons" in IntelliDealer) that can be used when making calls to customers. Once a code is defined, it can be used as a valid call reason code used to record the calls made to a customer. Valid call reason codes will appear on the Select Reason screen accessed by clicking on the Search![]() icon next to the Select Reason field.

icon next to the Select Reason field.

The following fields appear in the CALLPUR table:

| Field | Description |

|---|---|

| Purpose Of Call | The call reason code. |

| Call Purpose Description | A brief description of the call reason code. |

| Authorized Categories | A list of call categories that can use this call reason. Up to 20 categories can be specified, including an "N/A" category. Enter *AL in this field if you want the selected code to apply to all categories. |

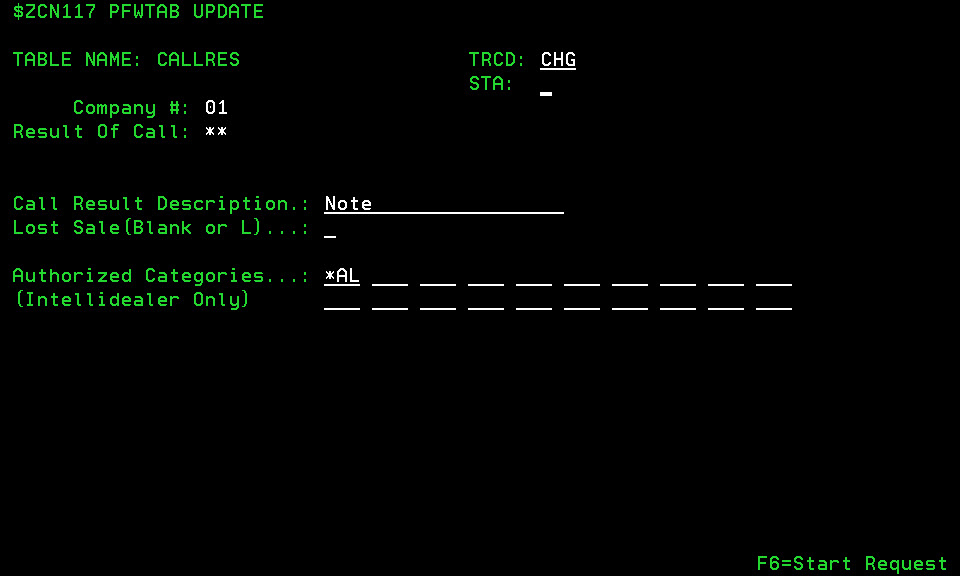

CALLRES table

The CALLRES table allows you to define different kinds of call results that can be applied by a user when making calls to customers. Once a code is defined, it can be used as a valid call result code used to record the calls made to a customer. Valid call result codes will appear on the Select Results screen accessed by clicking on the Search![]() icon next to the Select Results field.

icon next to the Select Results field.

The fields in the CALLRES table:

| Field | Description |

|---|---|

| Result Of Call | The call result code. |

| Call Result Description | A brief description of the call result code. |

| Lost Sale (Blank or L) | If L is entered in this field, the user will be prompted for equipment lost sales information when recording a call while using the selected call result code. Accumulated Lost sales information can be analyzed on the Lost Sales screen. |

| Authorized Categories | A list of call categories that can use this call result. Up to 20 categories can be specified, including an "N/A" category. Enter *AL in this field if you want the selected code to apply to all categories. |

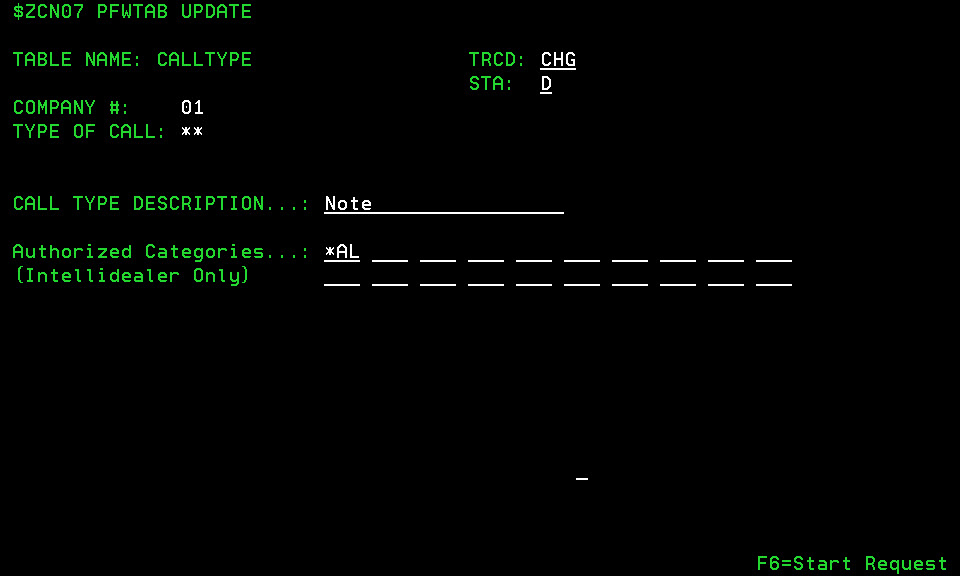

CALLTYPE table

The CALLTYPE table allows you to define different kinds of call types within the system. Once a code is defined, it can be used as a valid call type code used to record the calls made to a customer. Valid call type values will appear on the Select Type screen accessed by clicking on the Search![]() icon next to the Type of Call or Select Type field.

icon next to the Type of Call or Select Type field.

The following fields appear in the CALLTYPE table:

| Field | Description |

|---|---|

| Type Of Call | The call type code. |

| Call Type Description | A brief description of the call type code. |

| Authorized Categories | A list of call categories that can use this call type. Up to 20 categories can be specified, including an "N/A" category. Enter *AL in this field if you want the selected code to apply to all categories. |

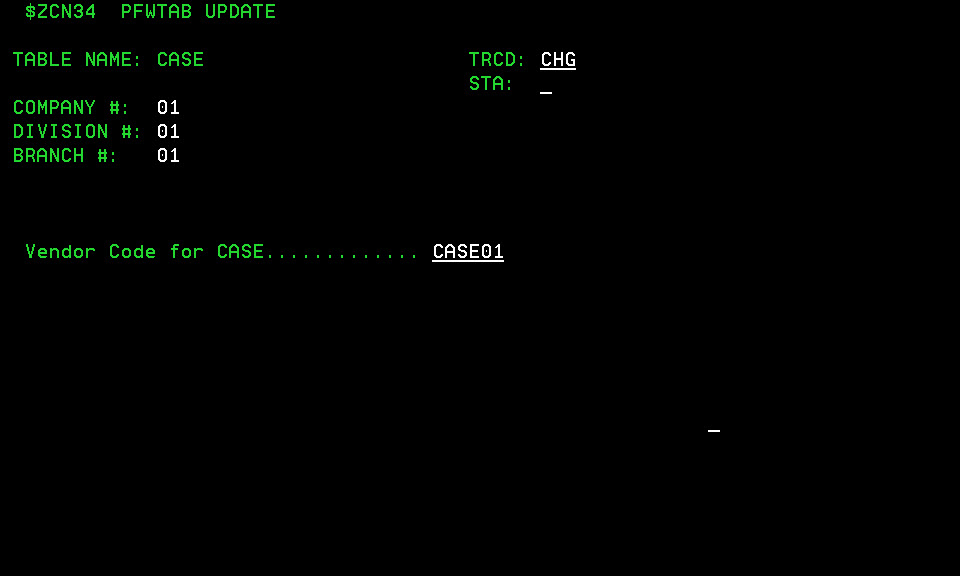

CASE table

The CASE table allows you to configure the CASE vendor number that will be used on machine down and weekly stock orders to Case New Holland ,or for the CCN WEB interface.

The following field appears in the CASE table:

| Field | Description |

|---|---|

| Vendor Code for CASE | The CASE vendor number for the selected branch location. |

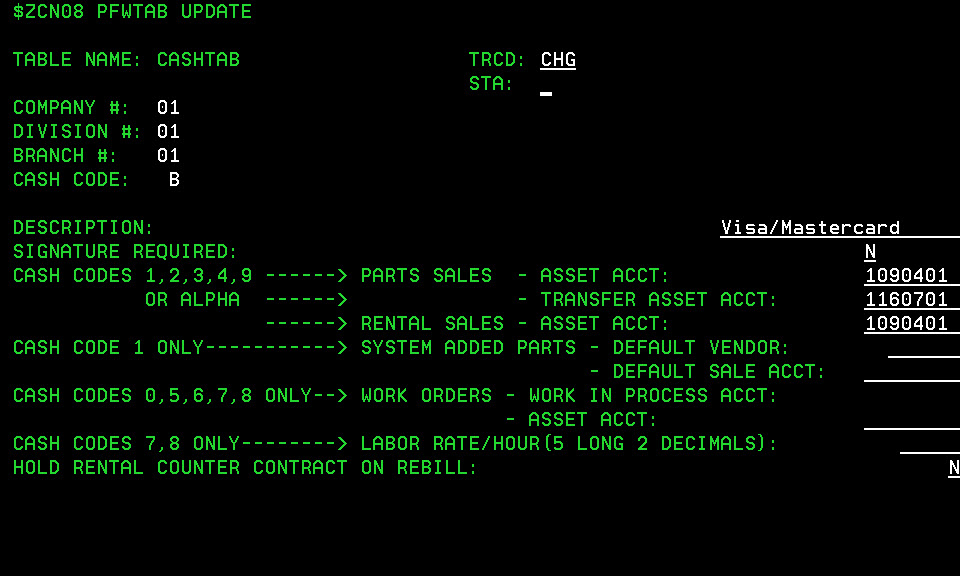

CASHTAB table

The CASHTAB table allows you to define the default G/L accounts to be used with the various cash codes.Cash codes are used to represent different forms of payment within the various invoicing modules (such as cash, charge, credit card, etc.) Cash codes 0 to 8 are hard-coded in the system, but codes 9, B,C ,D ,E ,G ,H ,I ,J ,K and L can be defined by the user. Also, the different forms of payment can be driven to separate General Ledger accounts.

In order to be defined and assigned to a G/L account in the CASHTAB table, a cash code must first be defined in the ARAGENCY table.The following fields appear in the CASHTAB table:

| Field | Description |

|---|---|

| Cash Code | The cash code you want to configure. The following are the available options:

|

| Description | A brief description of what the selected cash code represents. This field is for informational purposes only and will not be printed anywhere in the system. |

| Signature Required (Y/N) | If activated (Y), a signature must be captured whenever the G/L account associated to the selected cash code is used on an invoice or work order. |

| Cash Codes 1, 2, 3, 4, 9 Or Alpha | |

| Parts Sales - Asset Account | Enter the General Ledger Asset account which should be debited when a Parts sale is made. This is usually a Cash or an Accounts Receivable account. In the case of Cash Code 4, which represents a counter Lost Sale, the Asset account is irrelevant since no entries get posted for a Lost Sale. This account is also used by other invoicing systems (i.e. work orders and equipment sales). |

| Parts Sales - Transfer Asset Account | Enter the General Ledger Asset account which should be charged when a transfer of Parts is made between branches. This account maintains a zero balance since the value of parts is both debited and credited to this account when an inter-branch transfer occurs. The offset to the debit or credit is the Parts Inventory Asset account at each branch. This Transfer Asset account is also used for customer records defined with a Terms Code of “T”. When parts are sold to those customers, the parts Sale account is not involved. The entry is between the inventory account and the account defined in this field. See the POTOSO table for more information. In the case of Cash Code 4, which represents a counter Lost Sale, the Transfer Asset account is irrelevant since no entries get posted for a Lost Sale. This can be a different account for each branch, or the same account for all branches recommended. If different accounts are used for each branch, remember that the aggregate will total zero, but the individual accounts will hold a balance. |

| Rental Sales - Asset Account | Enter the General Ledger Asset account which should be debited when a Rental is posted. This is usually a Cash or Accounts Receivable account. In the case of Cash Code 4, which represents a counter Lost Sale, the Asset account is irrelevant since no entries get posted for a Lost Sale. |

| Cash Code 1 Only | |

| System Added Parts - Default Vendor | Enter the default Vendor number which should be used in the Part Master Maintenance module when parts are quick added to the system. When adding a new part number the system follows the steps below to retrieve the default parts information:

Because of this enhancement you should start loading all default sales accounts through the PartAdds table and blank out the current default sales accounts loaded in your PARTPRC table. If you follow these steps the only table you will have to maintain is the PartAdds table. The PARTPRC table is used to control how updates should be done on certain fields during a price update. The only time you need to maintain default sales accounts through the PARTPRC table is if you have 2 different vendor codes for the same vendor.VitalEdge recommends using a vendor number which is not one of the common parts lines carried by the dealer. If the vendor number entered here is used for a majority of parts in the system, it could prove difficult to detect a wrong vendor number on a quick added part. Users in the Parts Department should also be trained to watch the vendor numbers being used on quick added parts. |

| System Added Parts - Default Sale ACCT | Enter the default parts sale G/L account which should be used in the Part Master Maintenance module when parts are quick added to the system. When adding a new part number the system follows the steps below to retrieve the default parts information:

Because of this enhancement you should start loading all default sales accounts through the PartAdds table and blank out the current default sales accounts loaded in your PARTPRC table. If you follow these steps the only table you will have to maintain is the PartAdds table. The PARTPRC table is used to control how updates should be done on certain fields during a price update. The only time you need to maintain default sales accounts through the PARTPRC table is if you have 2 different vendor codes for the same vendor.VitalEdge recommends using a parts sale account which is not used by one of the common parts lines carried by the dealer. If the account code entered here is used for a majority of parts in the system, it could prove difficult to detect a wrong account on a quick added part. |

| Cash Codes 0, 5, 6, 7, 8 ONLY | |

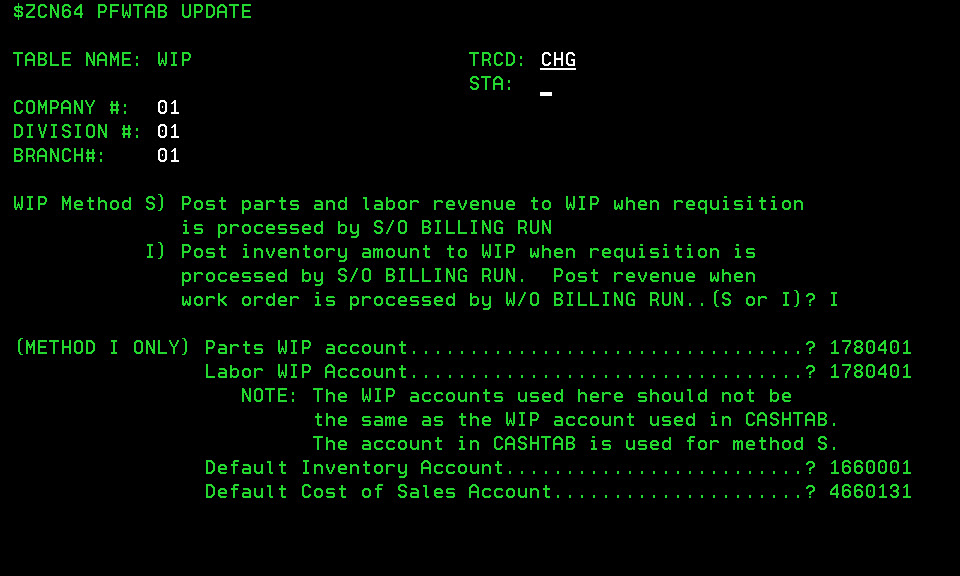

| Work Orders - Work In Process ACCT | There are three Work In Process (WIP) methods available in the system. - The first is Traditional WIP (method S in the WIP table), in which WIP is valued at retail. Revenue (and cost, if applicable) is recognized immediately when components are posted to a Work Order and a billing run is performed, even if the work order is still open. One G/L account is used for all WIP transactions. - The second method is Alternate WIP (method I in the WIP table), in which WIP is valued at cost. Only cost is recognized when components are posted to a Work Order and a billing run is performed. The revenue is not recognized until the Work Order is Closed (and a billing run performed). - The third method uses different G/L accounts for WIP Parts and WIP Service (see the WIP table for more information) and Miscellaneous transactions (defined at this field) Enter the General Ledger Work In Process account to be used for WIP transactions. For Traditional WIP(method S), this account will be used for all transactions. For Alternate WIP (method I), this account will be used for miscellaneous and non-costing transactions (ie. it is not used for Parts or Labor WIP transactions). In the case of Cash Codes 0 and 6, which represent Lost Sales, the WIP account is irrelevant, since no entries get posted for a Lost Sale. For simplicity, dealers should use the same WIP account for all codes. |

| Work Orders - Asset Account | Enter the General Ledger account which should be debited when a Work Order is closed to the selected Cash Code. In the case of Cash Codes 0 and 6, which represent Lost Sales, the Asset account is irrelevant, since no entries get posted for a Lost Sale. Most dealers use the system clearing account at this field for Cash Codes 0 and 6. For Cash Code 5 (Customer), a cash account is usually used; for Cash Code 7 (Warranty), a Warranty A/R account, and for Cash Code 8 (Internal), an internal expense or inventory account is commonly entered in this field. When Code 8 is used and the unit on the Work Order is not Invoiced (status “I”), the debit amount is driven to the Inventory account defined on the stock number of the unit on the Equipment Profile. |

| Cash Codes 7, 8 Only | |

| Labor Rate/ Hour | Enter the Labor Rate per hour which should be charged on Work Orders. The default labor rate per hour on a work order is determined by a number of factors. For details, see the About Default Labor Rates topic.This field is five numeric characters in length and consists of two decimal places. A labor rate of $57.50 per hour would be entered as 05750. |

| Hold Rental Counter Contract On Rebill | If set to Y and the Hold On Rebill switch on the Billing/ Invoicing tab in IntelliDealer is set to Cash Code, whenever the selected cash code is used on a rental contract no invoices will be generated when re-billing the contract until an authorization number is entered into the system (the contract will be put on hold.) |

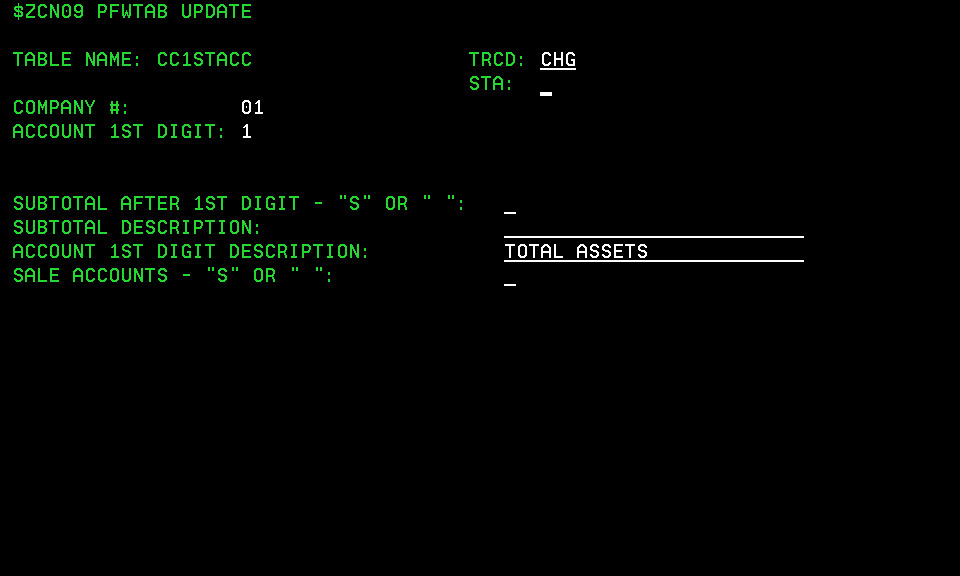

CC1STACC table

The CC1STACC table allows you to configure the first digits for the accounts that will be used in your General Ledger Chart of Accounts. Valid first digits are 1, 2, 3, 4, 5, 6, 7, 8, 9. VitalEdge recommends using the following structure:

- 1= Assets

- 2= Liabilities and Equities

- 3= Sales

- 4= Cost of Sales

- 5= Expenses

- 6= Miscellaneous Income

- 7= Miscellaneous Expenses

- 8= Adjustments

- 9= Other

The following fields appear in the CC1STACC table:

| Field | Description |

|---|---|

| Account 1st Digit | The first digit value used to represent the type of account. Up to nine single digit numbers can be defined. |

| Subtotal After 1st Digit - "S" OR " " | Indicate for each first digit defined in the previous field whether a subtotal should appear on your financial reports. If you indicate an “S”, then the system calculates a subtotal of all accounts which start with the immediately preceding digit less all amounts which start with the current digit. For example, an “S” is usually specified on the cost of sale first-digit (4) so that a subtotal will be printed showing total sales (3) less cost of sales. If no subtotal is desired, leave this field blank. |

| Subtotal Description | A brief description of the subtotal that appears on your financial reports. Up to 25 alphanumeric characters are available for each description. |

| Account 1st Digit Description | A description that will appear on the total line on preliminary and final month end G/L reports after all accounts using the associated 1st digit are printed. The Description set up on the Add Account Grouping/Change Account Groupings screen (ACCGRP table) print each time there is a change in the first three digits of the account number.The descriptions set up in this field print when there is a change in the first digit of the account number. |

| Sale Accounts - "S" or " " | Indicate which account first digit(s) represent your sale accounts. An “S” represents a sale account, a blank entry will indicate that an account starting with that number is not a sale account. The purpose of this field is to provide the option to run a Tax Analysis report (BIL921) with only sale accounts listed. |

CLASS table

The CLASS table allows you employee class codes which, in turn, allow you to differentiate between the different types of employees at your dealership (eg. technicians, administrative staff, parts counter employees, etc.). Classes assigned to different employees

The following fields appear on the CLASS table:

| Field | Description |

|---|---|

| Employee Class | A one or two character alphanumeric code used to define the class code within the system. A distinct class code is only required for each unique five-digit core account. The profit center will be determined by the profit center loaded on each Employee Profile.For example, if the wages of owners and managers should be posted to core G/L account 52000, only one code is needed for both. |

| Description | A brief description of the selected class code. A maximum of 20 characters can be used in this field and the value entered here will be the options listed in the Class field of the Employee Profile tab. |

| G/L Account | The gross earnings for any employee assigned to this class code will be posted to this account. The system checks the Employee Profile to determine the profit center to use for the class code (eg. 5200UB). If there is a G/L account loaded in the Company Expense Account (Debit) field of the table EARNDEDN (for an earnings or benefit code) that account would override the G/L account listed in the CLASS table. |

| Sub Class (T or Blank) | If T is entered in this field, any employees assigned to this class appears on the Technician Selection screen, accessible from the Segments tab of a work order by clicking the magnifying glass next to the Technician field. Among other requirements, an employee must be assigned to a class code with a sub class of T in order to appear on the Work Order Service Scheduling screen. For details, see the Drag and Drop Service Scheduling Overview topic. |

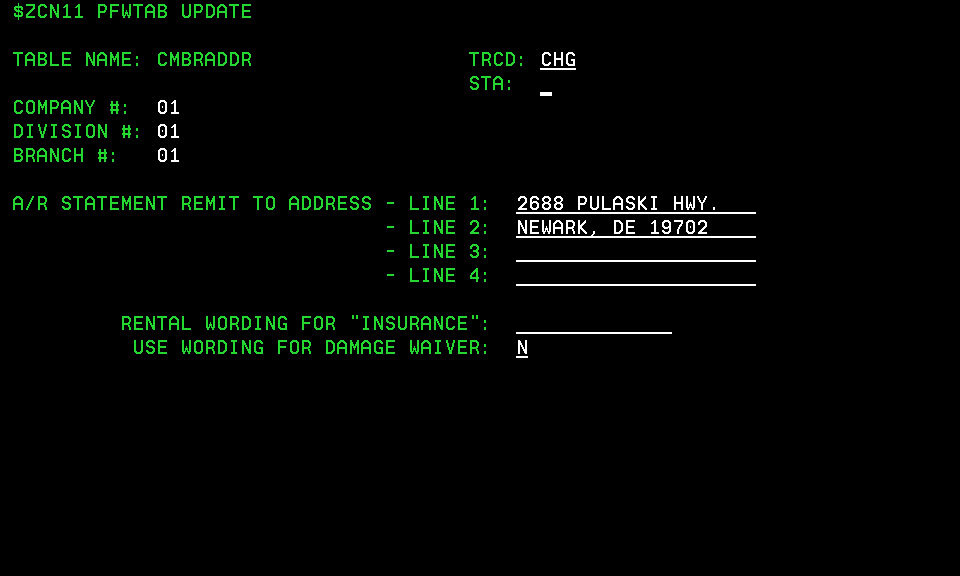

CMBRADDR

The CMBRADDR table allows you to configure the Remit To address for A/R statements generated at the selected branch and wording variables for rental contracts and invoices.

The following fields appear on the CMBRADDR table:

| Field | Description |

|---|---|

| A/R Statement Remit To Address | The address entered in this field prints in the REMIT TO box of the A/R statements generated at the selected branch. |

| Rental Wording For "Insurance" |

The language variable that the system uses to replace instances of "Insurance" on rental invoices and contracts. Leave this field blank to continue printing "INSURANCE" on rental contracts and invoices. |

| Use Wording for Damage Waiver | If activated (Y), the text "DAMAGE WAIVER" print on rental contracts and invoices. |

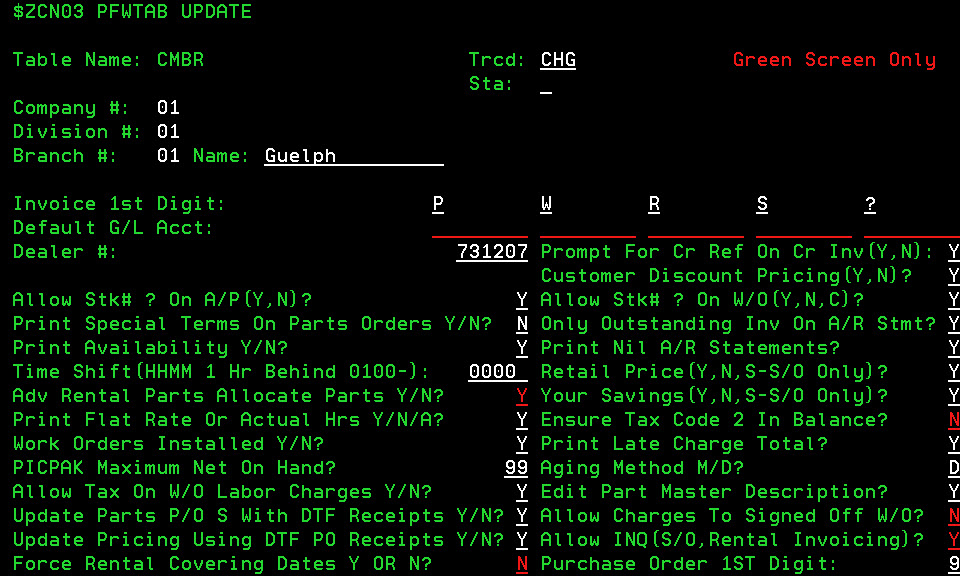

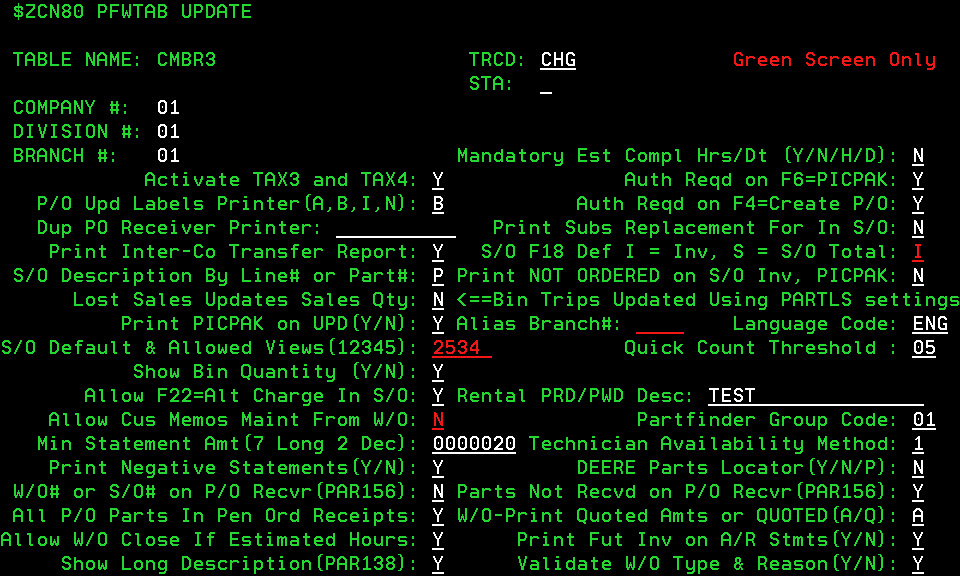

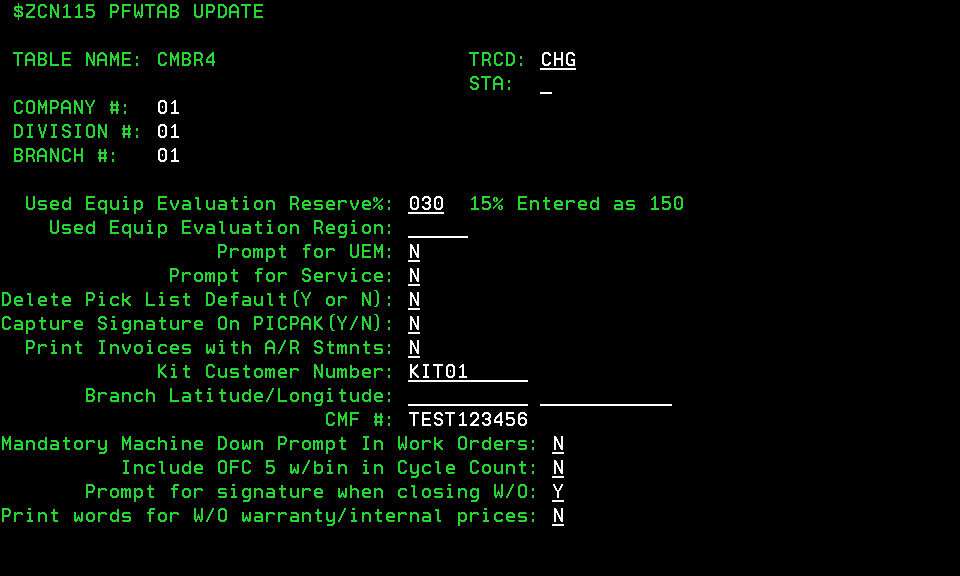

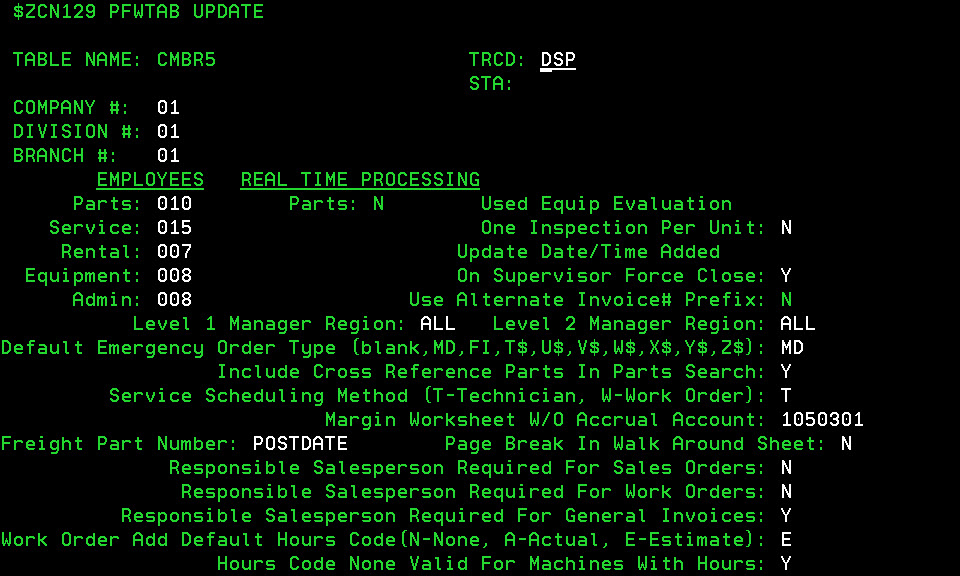

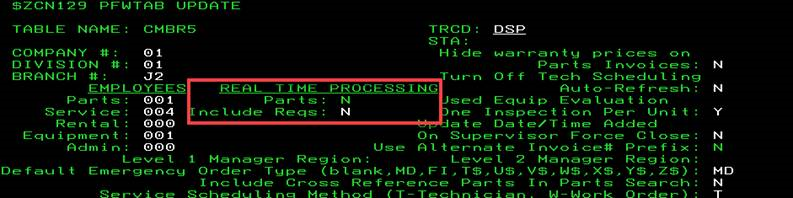

CMBR table

The CMBR table allows you to configure a variety of settings for a specific branch.

The following fields appear in the CMBR table:

| Field | Description |

|---|---|

| Name | The name of the branch location, as it appears on invoices and reports. This field allows for a maximum of 15 characters. |

| Invoice 1st Digit |

This digit has been moved to CMBR3 Allows you to specify an alphanumeric digit to be used as the first character for each invoice type generated at your dealership, in the following order:

For example, based on the screen shot above, any invoices generated from the Parts Counter for the Guelph branch would begin with "P" and Work Order invoices would begin with "W". One benefit of configuring a 1st digit for the different types of invoices at your dealership is that it allows you to run the Accounts Receivable Aging reports by 1st digit which, in turn, allows you to extract an aged A/R report of only Parts tickets. Only characters A-Z, numbers 1-9 and "?" can be used in these fields. "?" is recommended in the Key Invoices field, as the "?" allows any start digit to be used in that module. Start digits Q, L and R should be reserved for sales order invoice values. Do not use these start digits for other purposes. |

| Default G/L Account |

Allows you to configure the default G/L account for each of the invoice types noted in the Invoice 1st Digit field above (Parts Counter, Work Orders, Rental Contracts, Sales Orders, Key Invoices.) You cannot configure a default G/L account for Key Invoices if a question mark ("?") is entered in the Invoice 1st Digit field above. |

| Dealer # | If you are a John Deere or CNH dealership, please indicate the dealer number, as assigned to you by Deere or Case New Holland. |

| Allow Stk#? On A/P (Y/N) | Specify whether the system allows "?" for a stock number. |

| Print Special Terms On Parts Orders (Y/N) | Determines whether special terms information is printed on stock order reports PAR007, PAR190, and STO003. |

| Print Availability (Y/N) | Determines whether the selected branch is included when generating parts report PAR016 (only available through green screen.) |

| Tim Shift (HHMM 1 Hr Behind 0100-) | Determines whether the selected branch should have the time zone offset. This is so the local time is printed on sales order invoices, rental invoices, and work orders. |

| Adv Rental Parts Allocate Parts (Y/N) |

If activated (Y), the system updates the on hand quantity as soon as each rental invoice is completed. If not activated (N) the system does not update the on hand quantity until the billing run is made, and allow the invoice to be edited before the billing run. It is recommended that this switch be set to Y. |

| Print Flat Rate Or Actual Hrs (Y/N/A) | Hours may only be printed on a work order under the following circumstances: - The status of the work order has to be C or closed. - If there are no customer labor charges on the order, then the Flat Rate hours are printed (only internal and/or warranty allowed) - If there are customer labor charges on the order, then the hours printed will depending on the value configured for this switch. Allows you to configure whether or not Flat Rate or Actual hours will be printed on closed work orders:

|

| Work Orders Installed (Y/N) | This switch controlled access to the work order module in the green screen application. As the module has since been removed, this switch is no longer valid. |

| PICPAK Maximum Net On Hand |

Determines the Net On Hand quantity that will be printed on picpaks generated at the branch. If 0, then no quantity will be displayed. If the value is 99, then any quantity up to a maximum of 99 will be printed. The default value for this field is 0. |

| Allow Tax On W/O Labor Charges (Y/N) | If activated (Y), tax will be applied to labor charges at your dealership, based either on the tax code assigned to the associated customer profile, or manually entered on the Work Order. |

| Update Parts P/Os With DTF Receipts (Y/N) | Allows the activation or deactivation of the update of John Deere DTF P/O receipt data. This allows a dealer to ignore receipt data but still update pricing information sent with the receipt records. |

| Update Pricing Using DTF PO Receipts (Y/N) | Allows the activation or deactivation of the update to pricing data that comes with DTF P/O receipt data. Pricing information is updated as if the pricing information actually came in on pricing records rather than receipt records - whatever is currently updated with standard pricing records will also be updated with the pricing information on the receipt records. |

| Force Rental Covering Dates (Y/N) | If activated (Y), users will be forced to enter the dates covered by a rental invoice if more than one invoice is involved. |

| Prompt For Cr Ref On Cr Inv (Y/N) | If activated (Y) and the total amount of an invoice is a credit amount, users will be prompted to enter a credit reference number in all IntelliDealer invoicing applications. |

| Customer Discount Pricing (Y/N) |

If activated (Y), controls whether or not the branch will recognize the Customer Pricing records/discounts configured at your dealership. If this switch and the Yours Savings switch below are both activated, a "Your Savings" line is included on all parts invoices created for customers that have an existing Customer Pricing record. |

| Allow Stock # ? On W/O (Y/N/C) |

If activated (Y), users can use a "?" in the stock number field when creating a work order. This would be used, for instance, when the Service department wants to open a work order for a unit but is waiting for the accounting office to assign the unit a stock number. If C is entered in this field, work orders can be opened using a "?" stock number, but cannot be closed until a valid stock number is entered. If N is entered in this field, a "?" can never be used. If this switch is activated, you can still control whether a "?" is allowed at the user level with the Allow ? Stock Number switch on the Authorization List For Product Support - Work Orders screen. |

| Only Outstanding Inv On A/R STMT (Y/N) |

If activated (Y), only outstanding A/R invoices are included on the A/R statements generated at the selected branch. If deactivated (N), all invoices and the matching payments are printed. |

| Print Nil A/R Statements (Y/N) |

If activated (Y), statements with a zero balance ($0) are printed at the selected branch. If deactivated (N), only A/R statements with a debit balance are printed at the selected branch. (Statements with a credit balance will print depending on the value set in the CMBR3 table). Statements with a zero balance always print for miscellaneous customers. |

| Retail Price (Y/N, S-S/O Only) |

Retail price refers to the regular selling price from the Parts Master files. (Regular selling is after any price increase percent is applied). This field applies to both the Parts Counter and Sales Orders. If a part is sold above retail price, retail price does not show on the invoice in any case.The options are available for this field:

|

| Your Savings (Y/N, S-S/O Only) | If activated (Y) and the customer on a parts invoice has had discounts applied to the invoice (ie. the Customer Discount Pricing switch above is set to Y, and there is a Customer Pricing record for the customer on the invoice), a "Your Savings" line be printed on the invoice displaying the total discount that was applied. |

| Ensure Tax Code 2 In Balance (Y/N) |

This field applies to the Rental and Key Invoices modules. If Tax Code 2 is being used and this switch is activated (Y), the system check to ensure that the tax amount entered to the tax liability account is correct according to the percentage to be charged. Valid tax 2 percentages are configured on the Tax2 screen. |

| Print Late Charge Total (Y/N) | If activated (Y), display total late charges as a separate line item on printed A/R statements. |

| Aging Method (D/M |

Allows you to configure whether you age by Day or Month. For example, a transaction dated August 29 would be aged as follows, depending on the selected method:

|

| Edit Part Master Description (Y/N/D) |

Controls whether part master descriptions will be uniform across all branches of the dealership:

|

| Allow Charges To Be Signed Off W/O |

If activated (Y), users are able to post labor and/or parts to work orders that have been Signed Off, but not Closed (Status "S"). |

| Allows Inq (S/O, Rental Invoicing) (Y/N) |

If activated, allows you to create a parts inquiry invoice using the INQ customer number. The use of parts inquiry invoices is optional. This option can only be done in Green Screen and is no longer supported in IntelliDealer and eventually be removed entirely. |

| Purchase Order 1st Digit | Allows you to configure the first digit for all parts purchase orders generated at the selected branch. |

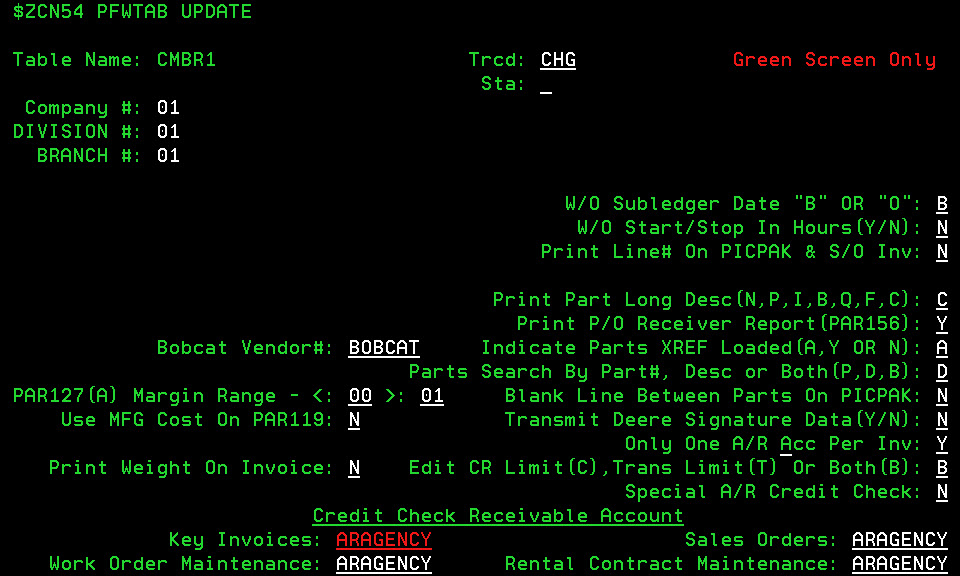

CMBR1 Table

The CMBR1 table allows you to configure a number of settings regarding the IntelliDealerParts module and the accounts receivables sections for different areas of the business.

The following fields appear on the CMBR1 table:

| Field | Description |

|---|---|

| W/O Subledger Date "B" or "O" |

If subledgered G/L accounts are used on a work order (the account on the work order has the Subledgered Account field selected on the Account Profile screen), those accounts will be updated during a work order billing run. This field will determine whether the date used on those invoices in the subledger will reflect:

|

| W/O Start/Stop In Hours (Y/N) |

Allows you to configure whether the start and stop time on work orders will be recorded in minutes of the hour (1/60) (Y), or in hundredths of an hour (N). For example, a start time of 1630 hrs would be recorded as 4.30 in minutes (switch set to Y) and as 4.50 when using hundredths (switch set to N). |

| Print Line# On PICPAK & S/O Inv (Y/N) | If activated (Y), an extra line for each item on a picpak or sales order with the text "Line X" will be printed at the left margin of the sales order body. |

| Print Part Long Desc (N, P, I, B, Q, F, C) |

Allows you determine whether short or long part descriptions should be printed on picpaks and sales order invoices:

|

| Print P/O Receiver Report (PAR156) |

When a purchase order is received and the system is updated with the new inventory levels, if this switch is activated (Y) the PAR156 report will automatically be printed detailing the part numbers ordered, back ordered and received, as well as the individual and extended costs of the order. Usually, this report is attached to the packing slip received with the shipment and forwarded to the Accounts Payable department to ensure that the vendor’s invoice is correct for the goods received. If the CMBR3 table is set to produce a duplicate report (see that table for details), it will be identical in every way except that it is spooled as PAR156A. |

| Bobcat Vendor # | Enter the Bobcat vendor number for the selected location. This field is required for certain Bobcat interfaces throughout the system. This field is required for dealers choosing to send parts and service information to Bobcat via DTF. |

| Indicate Parts XREF Loaded (A, Y, N) | This switch will determine when and if cross referenced parts are indicated in IntelliDealer; either always (A), only when there is not enough on hand quantity to fill the order with the original part (Y), or never (N). |

| Parts Search By Part #, Desc or Both (P, D, B) | This field is related to the green screen application only and will not affect IntelliDealer functionality. This switch determines the default setting of the Search field on the Parts Profile for parts that are quick-added to the system; either the part number (P), description (D), or a combination of both (B). |

| PAR127 (A) Margin Range |

The Parts Cost Analysis Summary(PAR127) and Parts Cost Analysis Detail reports (PAR127A) indicate the profit earned per part. The margin entered in this field dictates which parts will be included on the reports. For example, if <05 and >50 are entered, only parts with a profit margin less than 5% or greater than 50% will be included on the report. To capture all parts, set the range to <01 and >00. All branch transfers go though the system at a 0% profit margin (regardless of the actual percentage) as most people don't want to see these on an exception report. For example, if you want to see all parts that have a loss of over a 40% margin, you would use the range <0 and >40. This can cause confusion as all branch transfers (T's on the BIL900 report) will be excluded because they are on this report with a 0% profit margin even though they might have been the cause of a loss on the day in question.If you still want to see all parts that have a loss of over a 40% margin with all branch transfers, you would need to set the range up as <01 and >40. |

| Blank Line Between Parts On PICPAK |

If activated (Y), the system automatically include a blank line between parts on picpaks and sales orders. |

| Use MFG Cost on PAR119 |

If activated (Y), the manufacturer's cost is printed on the parts order faxes (PAR119). If deactivated (N), the landed cost is printed instead. |

| Transmit Deere Signature Data (Y, N) | This switch is no longer in use and is scheduled for removal in the next software release. |

| Only One A/R Acc Per Inv |

If activated (Y), only one A/R agency is allowed per invoice. This switch is forced to Y if the Edit CR Limit (C), Trans Limit (T), or Both (B) switch below is set to anything other than No (N). More than one cash code is still allowed on an invoice if the Activate TAX3 and TAX4 switch in the CMBR3 table is activated (Y). |

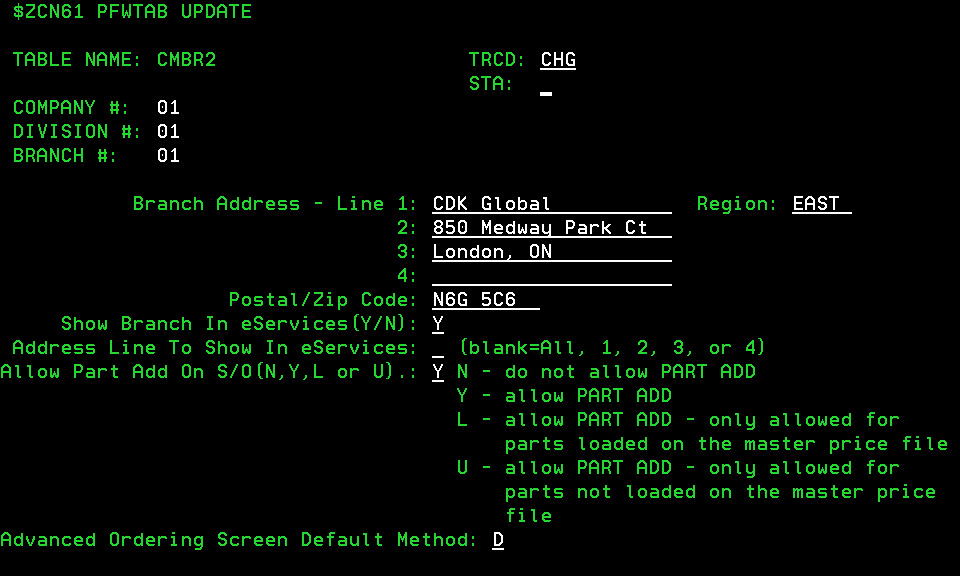

| Print Weight on Invoice | If activated (Y), the total weight of all parts on an invoice is printed on sales orders and picpaks. |