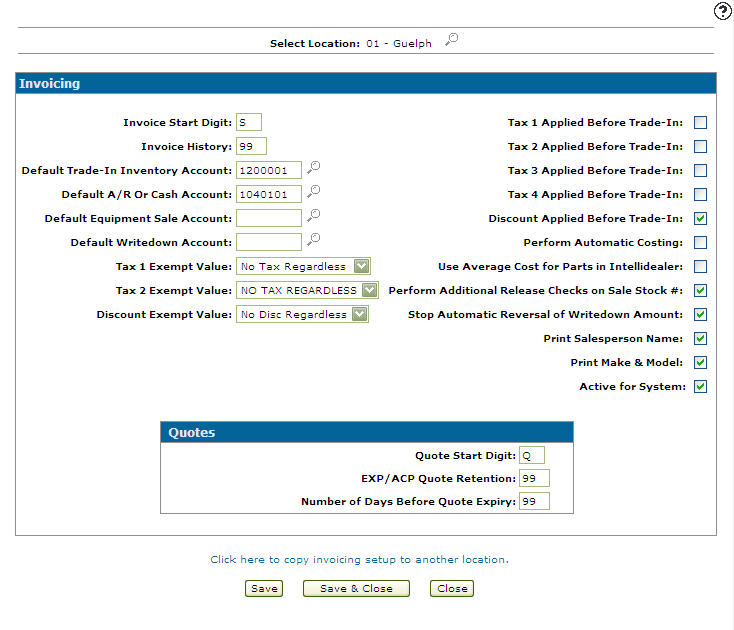

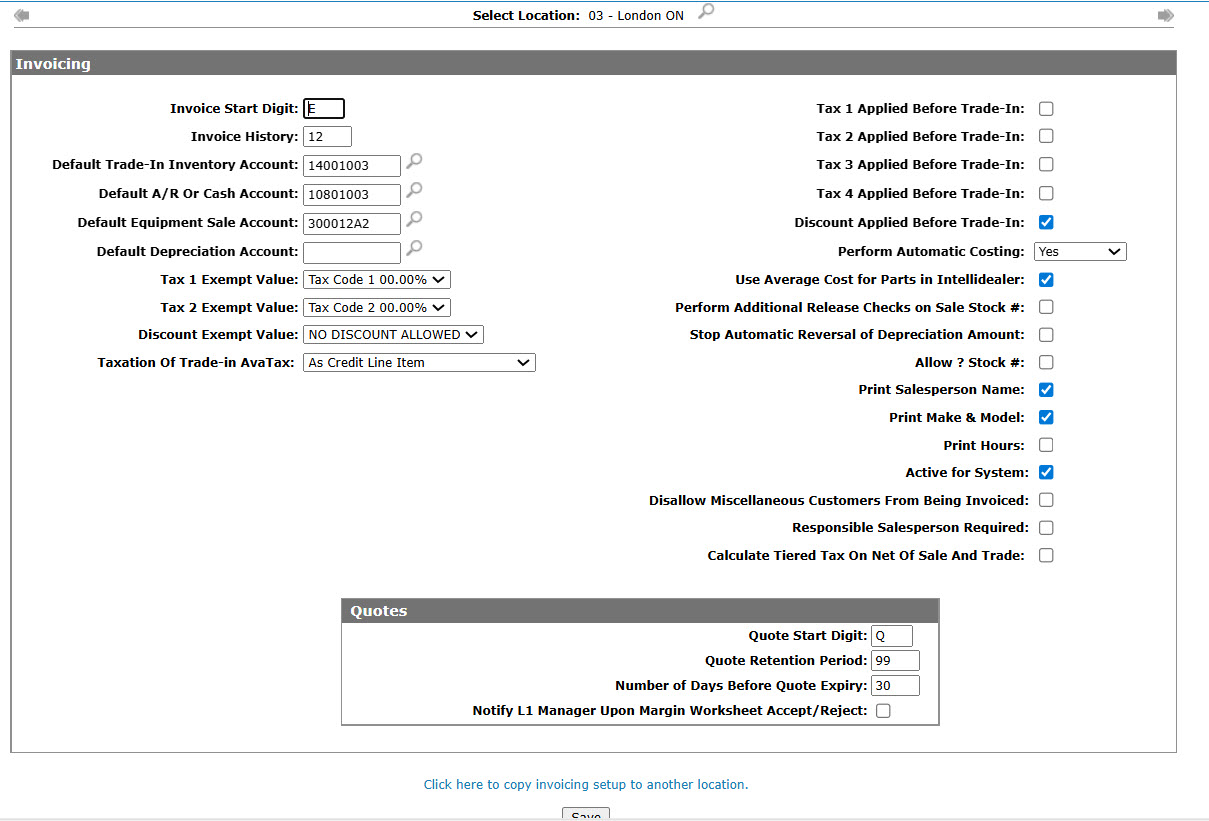

Configuration: Invoicing

Use the Equipment Invoicing configuration screen to set up invoicing/quoting parameters by location.

To open the Invoicing screen, navigate to Configuration > Equipment > General > Invoicing.

Use the Previous![]() and Next

and Next![]() icons at the top of the screen to switch between locations.

icons at the top of the screen to switch between locations.

Topic in this section

Setting up Invoice/Quote Parameters

-

From anywhere in IntelliDealer screen, navigate to Configuration > Equipment > General > Invoicing.

-

Select a Location by clicking on the Search

icon next to the Select Location field.

icon next to the Select Location field. -

Click Location.

- Click on the Previous

or Next

or Next icon to scroll to the next branch location or back to a previous branch location.

icon to scroll to the next branch location or back to a previous branch location. - The options on the Invoicing screen are completely customizable allowing the user to setup only the functions that they wish to apply to their work order quoting an parts quoting systems.

- If selected the Tax 1 value is applied to the amount of the sale only (whole tax).

- If not selected the Tax 1 value is applied to the invoice after the trade-in amount is calculated into the total sale price (net tax).

- If selected the Tax 2 value is applied to the amount of the sale only (whole tax).

- If not selected the Tax 2 value is applied to the invoice after the trade-in amount is calculated into the total sale price (net tax).

- If selected the Tax 3 value is applied to the amount of the sale only (whole tax).

- If not selected the Tax 3 value is applied to the invoice after the trade-in amount is calculated into the total sale price (net tax).

- If selected the Tax 4 value is applied to the amount of the sale only (whole tax).

- If not selected the Tax 4 value is applied to the invoice after the trade-in amount is calculated into the total sale price (net tax).

- If selected will allow the user to enter a discount code for the trade-in.

- If not selected, the user will not be allowed to enter a discount code for the trade-in.

Invoice Start Digit, The number of days a quote will remain active within the system. The quote expiry date is automatically calculated by the system by adding the value entered this field to the current date. The resulting date will be printed on the quote.

Invoice History, Indicate the number of days a billed invoice (e.g. the status of the invoice in the equipment module is INV) will remain on the Equipment Invoicing screen.

Default Trade-In Inventory Account, the inventory account number entered will be suggested to users by the system to be used for posting Trade Ins.

Default A/R or Cash Account, the accounts receivable account or cash account number entered will be suggested to users by the system to be used for posting charges for equipment invoices.

Default Equipment Sales Account, the sale account number entered will be suggested to users by the system to be used for posting equipment sales for equipment invoices, if no sale account is found on the unit. The system will automatically use the sales account on the unit instead one the account defined in this field.

Default Writedown Account, the writedown account number entered will be suggested to users by the system to be used to recapture depreciation when selling a defined asset.

Tax 1 Applied Before Trade-In:

Tax 2 Applied Before Trade-In:

Tax 3 Applied Before Trade-In:

Tax 4 Applied Before Trade-In:

Tax 1 Exempt Code, select a tax 1 code from the drop down list to be used as the default tax 1 exempt code on equipment invoices.

Tax 2 Exempt Code, select a tax 2 code from the drop down list to be used as the default tax 2 exempt code on equipment invoices.

Discount Applied Before Trade-In:

Discount Exempt Code, select a discount code from the drop down list to be used as the default discount exempt code on equipment invoices.

Perform Automatic Costing, whether of not the system will perform automatic costing when an equipment invoice is processed through a billing run.

Use Average Cost for Parts in IntelliDealer, if selected, the Margin field calculation on the Parts tab will use the Average Cost field on the Parts Profile tab instead of the cost.

Perform Additional Release Checks on Sale Stock #, if selected, an error message will appear for released invoices that include a stock number that is referenced in another system with an inventory account warning the user of the transaction.

Stop Automatic Reversal of Writedown Amount, if selected, prevents billing runs from automatically reversing writedown amounts when an equipment unit is invoiced.

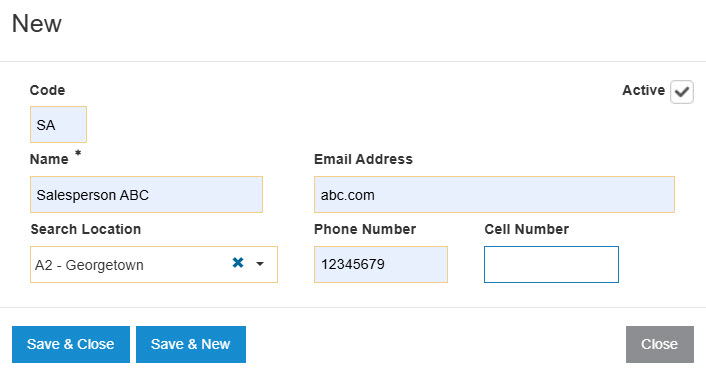

Print Salesperson Name, if selected, includes the salespersons name in the header section of the equipment quote when it is printed.

Print Make & Model, if selected, includes the type of sale unit and the make and model when printing an equipment quote.

Active for System, controls whether the invoicing parameters are active for use within the system.

Quote Start Digit, the character entered Indicates the prefix assigned to every equipment quote number upon creation. The start digit assigned will be used to identify the quote as an equipment quote within the system.

EXP/ACP Quote Retention, enter the number of months a quote will remain in the system. After the number of months expires, equipment sales quotes will be purged from the system.

# of Days Before Quote Expiry, enter the number of days a quote will remain valid before expiring.

After selecting your settings on the Invoicing screen for the selected location, click the Save button to the apply changes to the invoicing system.

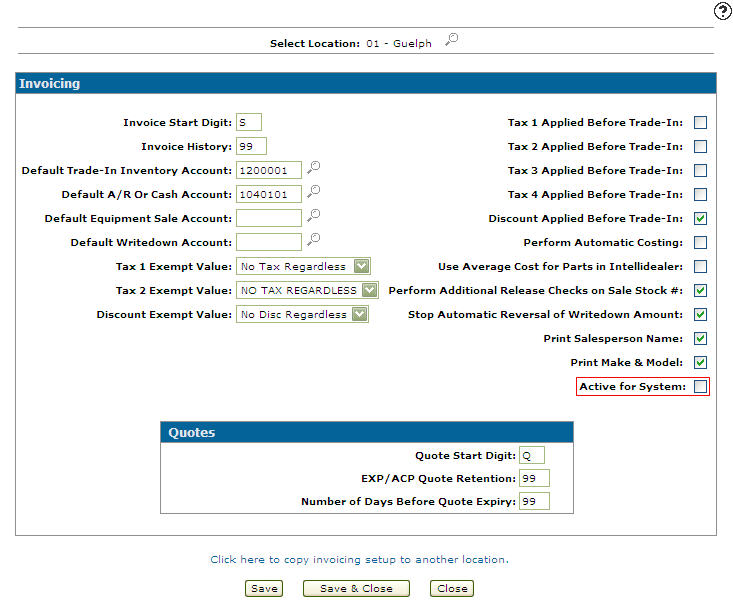

Deactivating Invoice/Quote Parameters

-

From anywhere in IntelliDealer screen, navigate to Configuration > Equipment > General > Invoicing.

-

Select the Active for System field, removing the checkmark.

-

Click the Save button to deactivate the invoicing parameters within the work order quotes and parts quote systems.

Screen Description

The search field on the Invoicing screen is:

| Field | Description |

|---|---|

| Select Location |

Invoice control parameters configurations apply to the location selected. The parameters listed appear throughout the equipment module for the selected location. |

The fields on the Invoicing screen are:

| Field | Description |

|---|---|

| Invoice Start Digit |

The prefix assigned to every equipment invoice number upon creation. The start digit assigned is used to identify the invoice as an equipment invoice within the system. To configure prefixes for other invoices, see System Settings - Location, Financial section. |

| Invoice History |

Indicates the number of months a billed invoice will remain on the Equipment Invoicing screen. Running a database procedure removes billed invoices that exceed the amount specified in this field. Enter 00 to remove a billed invoice from the Equipment Invoicing screen right after it has been invoiced. If necessary, billed invoices can be viewed from the Invoice History screen. |

| Default Trade-In Inventory Account |

The inventory account number that will appear on the Trade-Ins tab. Authorized users can overwrite the default inventory account. |

| Default A/R or Cash Account |

The accounts receivable account or cash account number that will be used on the invoice. Authorized users can overwrite the default account receivable account or cash account. The account used in this field is also defined on the Special Accounts screen. |

| Default Equipment Sale Account |

The sale account number that will be used on the invoice. The equipment sales account loaded is used only if no sale account is found on the unit. Authorized users can overwrite the default sale account. |

| Default Depreciation Account | |

| Tax 1 Exempt Value |

Select a tax 1 code from the drop down list to be used as the default tax 1 exempt code on equipment invoices. Tax 1 codes are set up on the Tax 1 screen. |

| Tax 2 Exempt Value |

Select a tax 2 code from the drop down list to be used as the default tax 2 exempt code on equipment invoices. Tax 2 codes are set up on the Tax 2 screen. |

| Discount Exempt Value |

Select a discount code from the drop down list to be used as the default discount exempt code on equipment invoices. Discount codes are set up on the Discounts screen. An exempt code must be selected for discounts to be deducted from the value of the trade-in recorded in the equipment invoicing module. |

| Taxation Of Trade-in AvaTax |

For dealers using AvaTax, equipment trade-ins can be sent as a credit line item to AvaTax. This field, together with Discount Exempt Value, configures the default setting. Chose from one of these values in the drop-down list:

See also Trade Ins. |

| Tax 1 Applied Before Trade-In |

If selected, the Tax 1 value is applied to the amount of the sale only (whole tax). If not selected, the Tax 1 value is applied to the invoice after the trade-in amount is calculated into the total sale price (net tax). |

| Tax 2 Applied Before Trade-In |

If selected, the Tax 2 value is applied to the amount of the sale only (whole tax). If not selected, the Tax 2 value is applied to the invoice after the trade-in amount is calculated into the total sale price (net tax). |

| Tax 3 Applied Before Trade-In |

If selected, the Tax 3 value is applied to the amount of the sale only (whole tax). If not selected, the Tax 3 value is applied to the invoice after the trade-in amount is calculated into the total sale price (net tax). |

| Tax 4 Applied Before Trade-In |

If selected, the Tax 4 value is applied to the amount of the sale only (whole tax). If not selected, the Tax 4 value is applied to the invoice after the trade-in amount is calculated into the total sale price (net tax). |

| Discount Applied Before Trade-In |

If selected, allows the user to enter a discount code for the trade-in. If not selected, the user cannot enter a discount code for the trade-in. If no discount code is selected on the Discount Exempt Code field, discounts entered on the Customer-Invoice Header tab are deducted from the selling price. If the Discount Exempt Code field has a discount code load and the Discount Applied Before Trade-In field is not selected, the discount entered is deducted from the net value. |

| Perform Automatic Costing |

Controls how the Perform Automatic Costing switch on the G/L Defaults tab operates which, in turn, controls whether or not the system performs automatic costing when an equipment invoice is processed through a billing run. Costing entries involve crediting the inventory account and debiting a cost of sales account. Options are:

|

| Use Average Cost for Parts in IntelliDealer |

If selected, the Margin field calculation on the Parts tab will use the Average Cost field on the Parts Profile tab instead of the cost. If the Average Cost field on the Part Profile tab is zero and the field is selected, the cost field value will be used to calculate the Margin field value on the Parts tab. |

| Perform Additional Release Checks on Sale Stock # |

If selected, the system performs additional error checks related to the stock number being sold. When releasing the invoice, the system will issue an error message if any of these conditions are met:

|

| Stop Automatic Reversal of Depreciation Amount | If selected, prevents billing runs from automatically reversing depreciation amounts when an equipment unit is invoiced. |

| Allow '?' Stock # | If selected, allows the use of a '?' symbol in place of a stock number. A '?' can be used when an invoice is still pending. |

| Print Salesperson Name | If selected, includes the salesperson's name in the header section on the equipment quote/invoice when it is printed. |

| Print Make & Model | If selected, includes the make and model when printing an equipment quote/invoice. |

| Print Hours | If selected, includes the machine Hours, as well as the attachment Type and Description (if applicable) when printing an equipment quote/invoice. |

| Active for System |

Controls whether the invoicing parameters are active for use within the system.

|

| Disallow Miscellaneous Customers From Being Invoiced | If selected, prevents users from releasing invoices with miscellaneous customers. |

| Responsible Salesperson Required | If selected, forces users to enter a salesperson ID in the Responsible field on the Customer - Invoice Header tab. |

| Calculate Tiered Tax On Net Of Sale And Trade |

If selected, calculates the sales tax on based on the net total of the sales and trade in amounts on the invoice (Total sale amount minus Trade In Total amount). If not selected, the system applies the tax separately to the sale unit and the trade-in unit. |

These fields appear on the Quotes section on the Invoicing screen:

| Quotes | |

|---|---|

| Field | Description |

| Quote Start Digit | The prefix assigned to every equipment quote number upon creation. The start digit assigned is used to identify the quote as an equipment quote within the system. |

| Quote Retention Period | Enter the number of months a quote will remain in the system. After the number of months expires, equipment sales quotes are purged from the system. |

| Number of Days Before Quote Expiry | Enter the number of days a quote will remain valid before expiring. |

| Notify L1 Manager Upon Margin Worksheet Accept/ Reject | If selected, Level 1 managers are notified after a Level 2 manager has accepted or rejected a forwarded worksheet. |

To complete your work and save your changes on the Invoicing screen click Save.