Cash Receipts

The Cash Receipts screen allows you to view and search for outstanding batches by user or location and allows you to update or create a cash receipt.

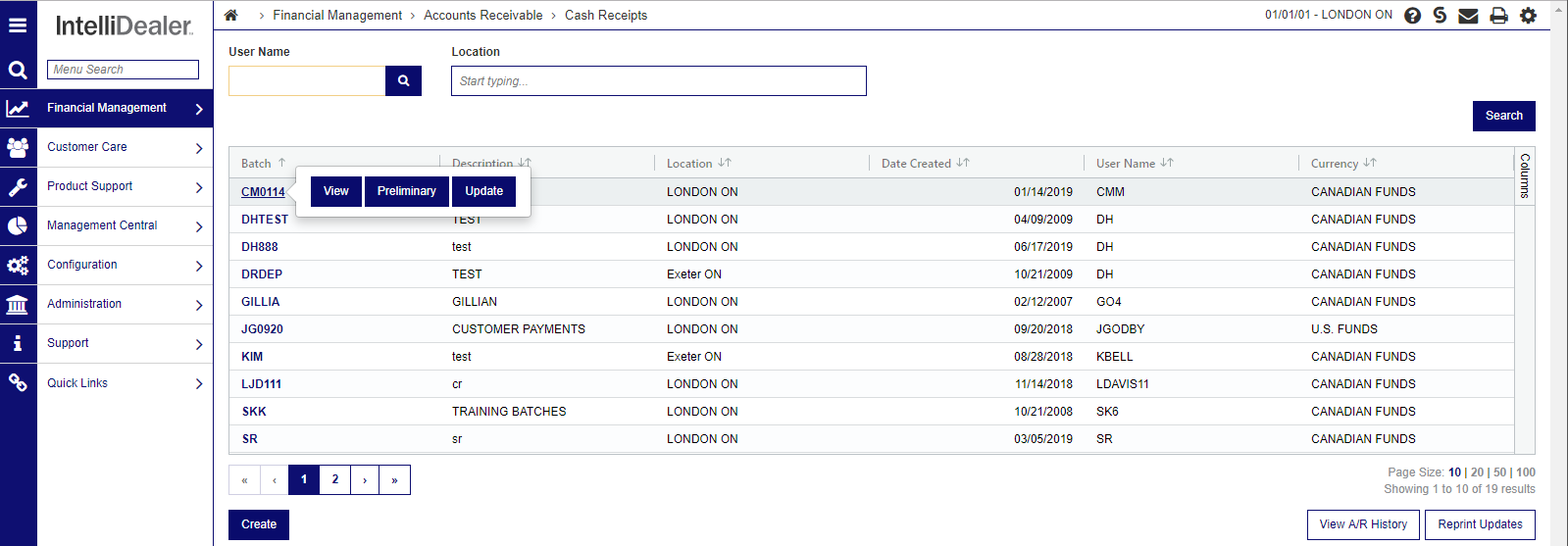

To access this screen navigate to Financial Management > Accounts Receivable > Cash Receipts.

Warning: Multiple users can access the same batch when security switch Edit/Update Other User Cash Receipts is checked.

Key Cash Receipts Option

The key cash receipts option can be used to:

-

Display all invoices that make up a customer's accounts receivable balance, including outstanding invoices, and invoices paid during the current A/R month.

Paid invoices are cleared from the cash receipts screen when A/R statements are printed. They are added to the A/R History screen.

-

Apply payments to a customer's account.

-

Match any credit invoices on a customer's account against the invoices being paid.

-

Write off late charges or enter any other type of adjustment.

-

Change an invoice to future due.

-

Display a customer's history of A/R transactions.

True Balance Forward

If the true balance forward method is being used (see Customer Profile A/R Type), then:

-

The system automatically matches all payments against the older invoices at month end.

-

All payments or adjustments are made using one of the invoicing systems rather than the Key Cash Receipts option (because the system automatically matches all payments against invoices at month end).

-

This screen is usually only used to display all the invoices the make up a customer's accounts receivable balance, to change invoices to a future due, or to use the Auto Apply feature.

-

All features of the Key Cash Receipts screen will work for true balance forward customers, so if desired, a payment can be manually matched against invoices that are not the oldest invoices.

The actual procedure used by the system during the month end run for true balance forward customer is:

-

All credit transactions are accumulated to get one credit total.

-

All credit transactions are removed from the customer's account.

-

The credit total is applied against the older invoice.

-

If the invoice can be paid off completely, the credit total is reduced by the amount of the invoice paid off, and the procedure returns to step (3) using the remaining credit total. If the invoice cannot be paid off completely, the invoice is left on the customer's account, and the remaining credit is posted to the customer's account as a credit transaction. The reference date will be the date of the last invoice (that could not be paid off completely) and the reference # will be SYSGEN.

Note: Invoices entered using any invoicing system will not appear on the cash receipts window until the corresponding billing run has been made.

Main Listing Screen

The main listing screen displays all batches:

A cash receipts batch created through MyDealer has the name format "MXXXX" under the user MYDEALER. These batches need to be reviewed. Once reviewed, the user is changed to the ID of the person who reviewed it. If new payments are received, the batch user is updated to MYDEALER, indicating that it needs to be reviewed again.

The search fields on the Cash Receipts screen are:

| Field | Description |

|---|---|

| User Name | Search for outstanding batches by entering a user name. |

| Location | Search for outstanding batches by entering a location. |

The fields that on the Cash Receipts screen are:

| Field | Description |

|---|---|

| Batch | The number of the outstanding batch. |

| Description | A brief description of the batch. |

| Location | The location for the cash receipts entered. |

| Date Created | The date the batch was created. |

| Currency | The currency of the batch. |

| User Name | The name of the user who created the batch. |

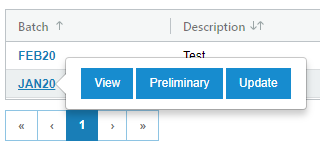

Hover over a Batch number and select one of:

-

View—view/edit the entry.

-

Preliminary—run a Cash Receipts Batch Preliminary report (WFMARCR01).

-

Update—open the Update screen.

You can also:

-

Click the View A/R history link to view accounts receivable history.

-

Click the Reprint Updates link to reprint cash receipt updates.

-

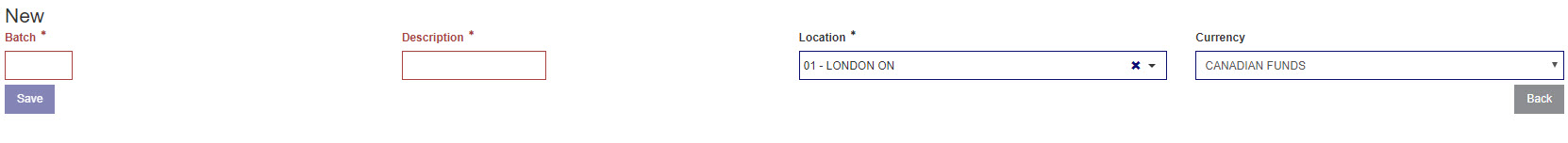

Click the Create button to open a new window to add and save a new entry:

Invoices tab

The Cash Receipts - Invoices tab shows the customer (summary) or invoice by customer (detail) that have had invoices cleared as part of this batch.

Searched customers in Outstanding Accounts Receivable is displayed with totals.

Note: Customers with invoices that have been cleared will automatically open to the Key Cash Receipts screen.

The fields on the Cash Receipts - Invoices tab in the Outstanding Accounts Receivable section are:

| Field | Description |

|---|---|

| Customer Search |

The name of the customer associated with the invoice. You can edit previously cleared invoices by clicking on the desired customer. |

| Customer Number | The number of the customer associated with the invoice. |

| Invoice Number | The total amount of the cleared invoice. |

| Include Zero Balance | When this box is checked, zero balance entries are listed in the search result. |

Use these Buttons to refine your search on the Cash Receipts - Outstanding Accounts Receivables:

| Button | Function |

|---|---|

| Reset | Clears all search fields. |

| Search Customers with Balance | Limits results to customers with a balance on an existing invoice. |

| Search All | Searches for all customers. |

Use these buttons to complete your work on the Cash Receipts - Cleared Invoices screen:

| Button | Function |

|---|---|

| Total | Displays a summary of the general ledger postings that correspond to the invoices cleared. |

| Preliminary | Runs the Cash Receipt Batch Preliminary report (WFMARCR01) for all invoices being cleared on this batch. |

| Auto Apply - All Customers | This option matches any credits against the corresponding invoice. |

The Switch to Detailed/Summarized View button can toggle more details on the Cleared Invoices section of the screen.

Key Cash Receipts screen

The Key Cash Receipts screen consists of a list of entries that may be used to record payments on accounts.

To open the Key Cash Receipts screen, click a Name on the Cash Receipts - Outstanding Accounts Receivable screen.

The fields on the Customer Details section of the Key Cash Receipts screen are:

| Field | Description |

|---|---|

| Last Invoice | The date of the customer's last invoice. |

| Type | The type of A/R account, options include: Open Item, Balance Forward, and True Balance Forward. |

| Terms | The customer's payment terms. |

| Last Payment | The date of the customer's last payment. |

| Average Payment Days |

Average number of days, from the date of invoice to the date of complete payment of the invoice, for the last 50 charge invoices on this customer account. The Average Payment Days uses the current number of average payment invoice (CUAPI) number in its calculations (rather than just averaging what is currently in AR history) for the new month. This means the result could include invoices that have been purged from the AR history file (ARFILE). If the API field is greater than the amount of invoices in AR history, then the accuracy/origin of the number can't be verified. Also, only paid invoices are used for this number. Customers that never pay their invoices will have a 0 listed so it can't be used to gauge delinquencies. |

| A/R Agency Default |

The customer's default A/R agency code. A group of codes set up on the customer's profile which references a specific method of payment (e.g. cash, credit card or house account). |

Auto Apply

The Auto Apply section of the screen matches any credits against the corresponding invoice. It is recommended that you perform an auto apply at least once a month.

The Auto Apply process is:

-

If there are any credits currently on the customer's account, the system scans all the outstanding invoices to see if there is an outstanding invoice whose amount matches the amount of the credit (e.g. the amounts offset each other). If there is a match, both the invoice and the credit are updated to paid, based on the default payment date.

-

The amount of each unmatched credit is added to the auto apply amount field to obtain an adjusted payment amount.

-

The system then takes the adjusted payment amount and checks to see if this matches the oldest invoice. If it doesn't, the system checks to see if this matches the oldest plus the second oldest invoice, then the oldest plus the second oldest plus the third oldest, etc. until a match is found or all invoices have been checked.

-

If a total match of credits equals a match in debits, then the date, amount and check number for all invoices making up the matching total are updated.

Note: Future due invoices are not processed during this procedure (an invoice is considered as future due if its reference year and month are greater than the current accounts receivable year and month). Invoices already having payment information beside them are also not processed by this procedure.

The fields displayed in the Auto Apply section are:

| Field | Description |

|---|---|

| Amount |

Enter an amount that is automatically distributed for the payment of outstanding invoice amounts. If there are credits on the customer's account, the system will scan all the outstanding invoices to see if there is an outstanding invoice whose amount matches the amount of the credit (e.g. the amounts offset each other). If there is a match, both the invoice and the credit will be updated to paid, using the default payment date. The amount of each unmatched credit will be added to the payment amount entered on the auto apply line to obtain an adjusted payment amount. The system then takes the adjusted payment amount and checks to see if this matches the oldest invoice, if it doesn't the system checks to see if this matches the oldest plus the second oldest invoice, then the oldest plus the second oldest plus the third oldest, etc. until a match is found or all invoices have been checked. If a total match of credits equals a match in debits, then the date, amount and check number for all invoices making up the matching total will be updated. |

| Account | Enter the specific account you want the Auto Pay function applied to. |

| Check Number |

Enter the number of the check whose value is being automatically distributed by the Auto Pay function. |

The Cash Receipt Quick Links opens A/R History, A/R Memo, A/R Agency respectively.

These fields can be searched at the top of the Key Cash Receipts screen:

| Field | Description |

|---|---|

| Invoice Number | Search by the invoice number. |

| Invoice Amount | Search by the total amount on the invoice. |

| Account Number | Search by individual customer account numbers. |

| Payment Date | Search by the date the payment was made. |

The results are listed in these fields:

| Field | Description |

|---|---|

| Payment Amount |

The amount the customer is paying towards the invoice. The payment amount, payment date and check number fields can be entered manually, or will be filled in by the system automatically. |

| Payment Date | The date the payment is made, the date must be a day in the current accounts receivable month. |

| Check Number | Is the number applied to the invoice. |

| Invoice Number | The invoice number. |

| Date | The date the invoice was created. |

| Account Number | The account number associated with the invoice. |

| Invoice Amount | The total amount payable for this invoice. |

| Outstanding Amount | The amount remaining to be paid off by the customer on the invoice. |

Beneath the displayed results are options you can apply to the invoice. These options become applicable once invoices are selected by the checkbox to the left of the Payment Amount field.

If a conflict occurs, for example if a customer has other invoices on another batch, these entries are not editable.

Use these buttons to complete your work:

| Button | Function |

|---|---|

| Adjustment | Opens the Adjustment screen which can be used to record an adjusting entry for the customer. If you use the same invoice number as an existing outstanding line, the amounts will be combined with the next statement run. Also see the Reverse and Copy options below, which are essentially adjustments but with specific logic built in to automate those tasks and reduce keying time and potential errors. |

| Write Off |

Select at least one Outstanding Amount using the checkbox in order to use the Write Off button. Once selected, it opens the Account Number window, allowing you to select a G/L account for which to create and post a write off entry for the selected Outstanding Amount(s). After selecting an account and clicking Save on the Account Number window, the Key Cash Receipts screen will show the original line paid AND add a new line containing the write off entry for the account selected. |

| Pay | Select at least one Outstanding Amount using the checkbox in order to use the Pay button. Once selected, all lines checked will be paid on the Key Cash Receipts Screen. The system will record the payment amount and payment date. Check number is optional. |

| Pay and Done | Select at least one Outstanding Amount using the checkbox in order to use the Pay & Done button. Once selected, all lines checked will be paid on the Key Cash Receipts Screen. The system will record the payment amount and payment date. Check number is optional. If there are no errors, the entries will be paid and you will be returned to the Cash Receipts Outstanding Accounts Receivable screen. |

| Subtotal | Select at least one line using the chec box in order to use the Subtotal button. Once selected the Subtotal screen will pop up and show the subtotal of all lines selected and also prompt for a check number if you choose to use to make a payment there, or you can clear or Close the Subtotal screen. Receive a sub total for more than one invoice. |

| Clear | Select at least one line using the checkbox in order to use the Clear button. Clears previously paid (but not updated) entries. |

| Reverse | Select at least one line using the checkbox in order to use the Reverse button. Once selected, the Reverse screen will open and allow you to change details before saving. This option is intended to reverse the payment on a preexisting invoice. |

| Copy | Select at least one line using the checkbox in order to use the Copy button. Once selected, the Copy screen will open and allow you to change any details before saving. This option is intended to copy an entry as a new line in the Cash Receipts Screen. |

| Distribute | Allows one invoice to be split into multiple invoices. Invoice dates can be specified, and invoice amounts can be either dollar amounts, or a percentage of the total. |

Data Source: CR

Security: 600 - Accounts Receivable

Learning Resources: Processing a Bank Desposit via Cash Receipts; Cash Receipts - Making a Partial Payment; Cash Receipts - Reversing a Payment; Cash Receipts - Making a Payment with No Invoice; Cash Receipts - Pay an Invoice with an Exisitng Partial Payment; Cash Receipts: Writing off an Invoice

Revision: 2024.01