Things to know before you start:

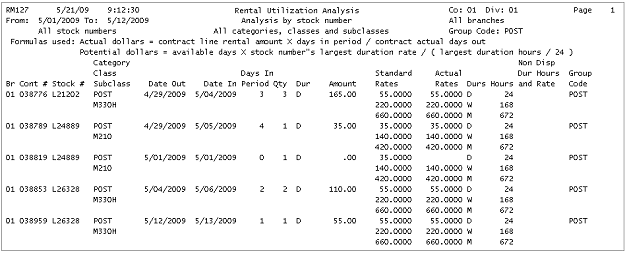

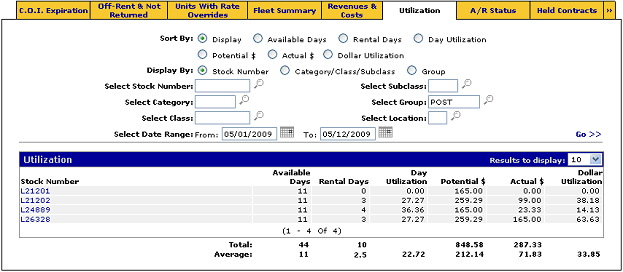

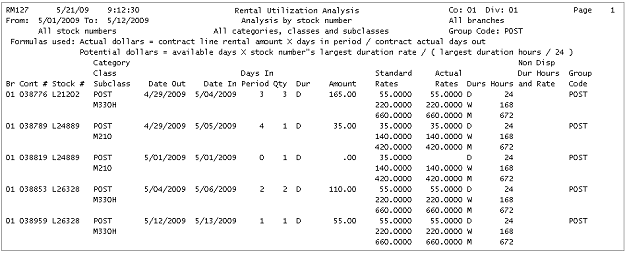

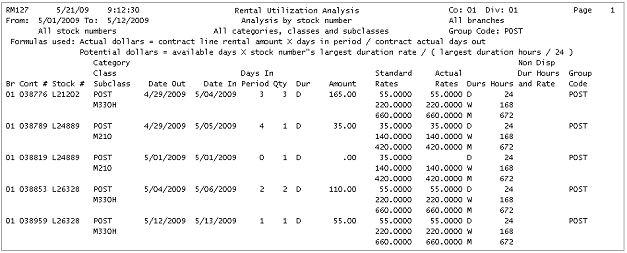

All fields except for the "Days In Period" are from the original details of the contracts, or from the contract, if there are no "standard rates" on file.

Days In Period is the number of days that the rental overlapped the selected analysis period, based on the date out and date in from the contract line.

Group code is the value from the equipment profile.

Cat/class/subclass marks the unit to be included in the analysis

Regardless of what a rental line's quantity and duration actually are, the date out and date in determine if the rental applies to the period being analyzed.

The user must realize that a rental line may fall partly or completely into the period being analyzed, and that the rental line's amount and days will be factored accordingly.

The # of available days and rented days is calculated as the difference between 2 given dates. For example, Feb 1 to Feb 28 is 27 days.

If an applicable rental line's contract is in use at the time of the analysis, that line is bypassed, and an indicator is passed back so that the user can be made aware.

The Calculations:

Potential dollars are calculated by first determining a base daily rate for the item. By taking the largest duration defined for the unit (usually a month and factoring that down to a per-day value, based on how many hours are in the duration. This per-day amount is then multiplied by how many days the unit was available in the analysis period to arrive at the potential dollars for that period.

Potential $ Amount

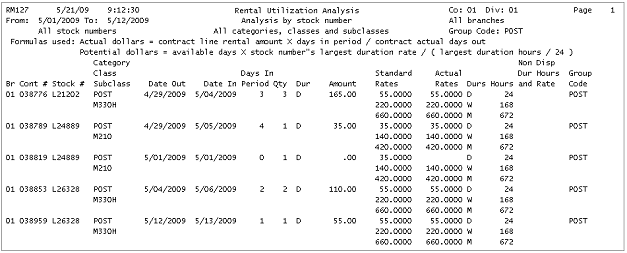

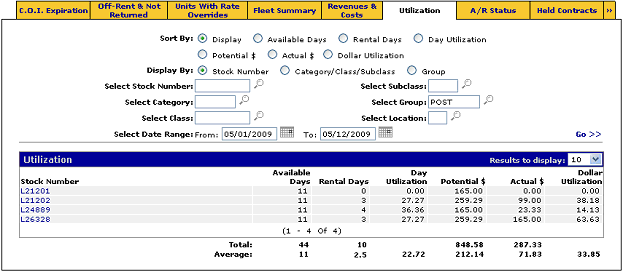

Looking at Unit L21202 - the potential amount is calculated at $259.29

Calculated by looking at the largest duration (being a month), and then factoring in the hours.

(672h/24h)= 28 days. One month is considered to be 28 days

$660.00(month $ amount)/28(days considered to be a month) = $23.57 (Daily $ amount)

$23.57(calculated daily $) * 11(days in selected period) = $259.29

Actual $ Amount

The actual dollar value is calculated by the contract amount multiplied by the days in my selected period, divided by the contract’s actual days out.

Looking at unit L21202 – the actual amount was calculated as $99.00

Calculated by the $ value of the contract ($165.00) * 3 (days in selected period) = $495.00

$495.00/5 (actual days out 04/29/2009 – 05/04/2009) = $99.00

Dollar utilization percent is then calculated from the actual rental dollars and potential dollars,

(Actual$/Potential$)*100

Calculated by ($99.00/$259.29)*100 = $38.18

Day utilization percent is calculated from the rented days and potential days.

(Rental days/available days)*100

Calculated by (3/11)*100 = 27.27

Average Rental and Available days are the totals of the rental and available days for the entire list, divided by how many items are in the list of results.

Available = (11+11+11+11)/4 = 11

Rental = (3+4+3)/4 = 2.5

Average day utilization percent is then calculated from the average rented and average potential days.

2.5/11*100 = 22.72

Average rented and potential dollars are the totals of the respective rental and potential dollars for the entire list, divided by how many items are in the list of results.

Average dollar utilization percent is then calculated from the average dollars and average potential dollars.

Further examples

Stock number L24889

Potential = $420.00/28*11 = $165

Actual = $35.00*4/6 = $23.33

Stock Number L26328

Potential = $660.00/28*11 = $269.29

The actual in this case is a combination of the two lines:

Actual = $110.00*2/2 = $110.00

Actual = $55.00*1/1 = $55.00

Therefore Actual = $110.00+ $55.00 = $165.00