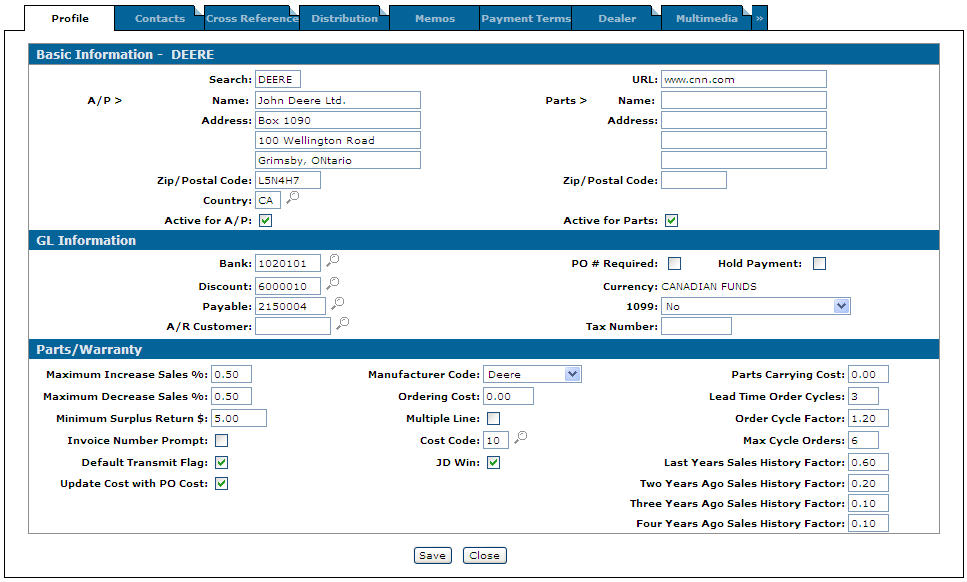

Vendor Profile: Details Tab

The Vendor Profile tab allows you to edit an existing vendor profile.

To open the Vendor Profile tab, click the Update/ View Profile link on the Vendor Profile screen.

The Vendor Profile tab has these sections:

The fields in the Basic Information section of the Vendor Profile tab are:

| Basic Information | |

|---|---|

| Field | Description |

| Search | Typically the first five characters of the vendor's name and is used to help locate a vendor when searching. |

| Name |

The vendor's name. If the selected vendor profile exists across multiple divisions, you must deactivate the profile at all divisions before you can edit or change the vendor's name. To do so, open the vendor profile at each division and deselect the Active for A/P and Active for Parts switches, then click Save. Once the profiles are deactivated at each division, change the vendor name at each division (ensuring that it is identical across all divisions), then click Save and reactivate the profiles. For more detailed steps, see Editing a Vendor Name. |

| Address | The address where the vendor resides. |

| Zip/Postal Code | The vendor's zip/postal code. |

| Country | The country where the vendor is located. |

| Active for A/P | If the selected vendor is able to be used when entering accounts payable vouchers. |

| URL | The vendor's website address. |

| Address | The address to use for printing parts labels and orders for the vendor. |

| Zip/ Postal Code | The zip/postal code to use for printing parts labels and orders for the vendor. |

| Miscellaneous Vendor | Denotes whether the selected vendor will be grouped with other vendors that have been marked as miscellaneous. |

| Active for Parts | If the selected vendor can be coded on a parts master record. |

| Suppress MyDealer Pricing | If activated, this switch suppresses the pricing from this vendor in MyDealer. Instead, MyDealer displays: "Call for Pricing". |

The fields in the G/L Information section of the Vendor Profile tab are:

| G/L Information | |

|---|---|

| Field | Description |

| Bank |

The G/L Account number where the funds will be taken out of when producing checks to this vendor (optional). |

| Discount | The G/L Account number that will be used if discounts are applied with this vendor (optional). |

| Payable | The G/L Accounts Payable Account number to be used when keying vouchers to this vendor (optional). |

| A/R Customer | Used when vouchers are loaded and need to be distributed to a subledgered receivable account. |

| PO# Required | This checkbox indicates that a PO number must be entered (or selected) for every voucher entered for this vendor. |

| Hold Payment | No checks will be issued to this vendor. All invoices entered into the system for this vendor will default to held status and the vouchers will need to be individually released from the held status using the adjust outstanding option. |

| Currency |

The currency type the vendor accepts payments in. This may also cause a currency verbiage to be printed on the check, depending on the value loaded on the Currency screen. Note: If the vendor has any pending or outstanding vouchers the Currency field will be locked preventing a user from selecting a currency option from the drop down list. |

| 1099 | U.S. dealers only. You may be required to remit 1099 forms to the

government for all vendors who you have purchased more than a specified

amount of goods from. Note: The 1099 field applies if there are three categories of vendors to select from: Non-employee compensation, other income, or rent. These classifications determine in which box the amount prints on the 1099 form. |

| Tax Number |

The government tax number assigned to this vendor. The tax number field appears on a number of reports including the POR38321 Parts Order, AP0012-1099 form, and AP7001-Vendor Analysis. |

The fields in the Parts/Warranty section of the Vendor Profile tab are:

| Parts/Warranty | |

|---|---|

| Field | Description |

| Maximum Increase Sales % |

Used in the parts order calculation and represents the maximum sales increase factor allowed. For maximum increase sales %, the system compares the last 12 months of parts sales to the previous year's sales history to determine the sale increase factor. If the value calculated is greater than the amount specified here, the factor loaded in this field is used. This only applies to parts loaded with OFC value of 1. |

| Maximum Decrease Sales % |

Used in the parts order calculation and represents the maximum sales decrease factor allowed. For maximum decrease sales % the system compares the last 12 months of parts sales to the previous year's sales history to determine the sale decrease factor. If the value calculated is less than the amount specified here, the factor loaded in this field is used. This only applies to parts loaded with OFC value of 1. |

| Minimum Surplus Return $ | Determines which items, whose extended cost is greater than the set value established here in the vendor profile, will be listed on the surplus return report or return file. |

| Invoice Number Prompt | Creates a prompt for an invoice number when receiving parts. This is then transferred to the A/P purchase order receipt record. |

| Default Transmit Flag | If checked, the system defaults the transmit value to on (yes) on separate emergency orders created for this vendor. |

| Exclude From Cycle Counts | If checked, parts from a particular vendor can be excluded from the cycle count. |

| Update Cost with PO Cost |

If checked, the system automatically updates the cost field on the Parts Profile screen to newest receipted cost of the part on a Parts Order. This option only appears if the Activate Update of Part Cost with PO Cost is set to 'Y' in the DIVTAB1 table in Green Screen. Cost Code values and Discount values for purchases from this vendor are considered when calculating the new cost of the part. |

| Manufacturer Code | Used to cross-reference this vendor to the appropriate code in the warranty management system. The values for this field are maintained from the menu WARR01. |

| Ordering Cost |

The vendor's ordering cost for a part, factored in to the Economic Order Quantity (EOQ) Normally the ordering cost is set at $0.50 for Deere parts and $1.00 for non-Deere parts. If this vendor has an ordering cost other than these two values, enter it into the Ordering Cost field. A blank field uses the system defaults. The value loaded here applies only to parts loaded with OFC value of 1. |

| Multiple Line | Allows any parts (regardless of the vendor of the part) to be ordered through the parts order system with this vendor number. |

| Cost Code |

The Cost Code assigned to the selected vendor. This code determines the PO Cost and Landed Cost Only Order Creation cost codes can be entered in this field, however if there is a matching Order Update cost code, both codes are used on any applicable orders to calculate the Landed Cost of the part. If there is a Cost Code assigned to both the part and vendor on an order (or if the Cost Code is blank for either the part or vendor on the order), the system uses specific logic to calculate the Landed Cost of a part. For details, please see the Cost Code Logic topic. |

| JD Win | Used for John Deere vendor numbers in conjunction with the JD Win interface, which is used to transmit warranty claim information to John Deere, via DTF. |

| Parts Carrying Cost | Enter the default carrying cost that will be applied as factor to any parts acquired from this vendor and then carried in stock. |

| Lead Time Order Cycles |

Enter the number of order cycles to look at when calculating lead time for OFC M parts. This can be a value between 0 and 9. A value of 0 indicates that the lead time (in weeks) on the Parts Profile should be used. If the value is 1-9, and the number of order cycles is greater than or equal to the value in this field, then a lead time is calculated using the part's Average Order Cycle days. For more detailed information regarding how the values entered in the Lead Time Order Cycles, Order Cycle Factor, Max Cycle Orders and Sales History Factor fields effect OFC M parts for the selected vendor, see Order Formula Code Calculations. |

| Order Cycle Factor | Used to adjust the actual order cycle for the part. This factor for the vendor of this part is then applied to the Average Order Cycle of a part from this vendor (a factor of 1.0 leaves the Average Order Cycle unchanged). |

| Max Cycle Orders | Enter the top limit of how many order receipts to look at in calculating the Average Order Cycle time. |

|

Last Years Sales History Factor Two Years Ago Sales History Factor Three Years Ago Sales History Factor Four Years Ago Sales History Factor |

There are sales history factor values for the prior four years. They are used to place a weighting on how important those years are in determining the Average Order Cycle time for OFC Code M parts. The sales history factors are also used to calculate a weighted sales history from the previous four years sales, which in turn is used in the calculation of the sales during the lead time rather than just last year's sales as with other Order Formula Codes. The four values must add up to 1.00. |

Use these buttons to complete your work on the Vendor Profile tab:

| Button | Function |

|---|---|

| Save | Saves the changes made on the Vendor Profile tab. |

| Close | Closes the Vendor Profile tab without saving and returns to the Vendor Profile screen. |