Kubota: Invoice Download Interface

The Kubota Invoice Download interface automates creating A/P vouchers for Kubota invoices downloaded from the KOARS system. Once the invoice is downloaded, you can select the Kubota invoices in the IntelliDealer Accounts Payable system and convert them to an A/P voucher. The voucher is populated with the information provided by the downloaded invoice and with default G/L accounts configured by the dealer or pulled from the IntelliDealer Equipment and Parts modules.

Topics in this section include:

Pre-requisites

To use this interface, dealers should be using, or ready to use, the Parts Order receipts logic in parts and equipment. There must be receipts ready and available for the interface to match them and bring amounts into a voucher. For parts in particular (called parts accrual) the configuration to get receipts into the system is not simple and must be done carefully so the dealer understands accrual and has entries moving through the general ledger correctly.

The Kubota Invoice Download interface requires feature 6256 - Kubota Invoice Download to be licensed.

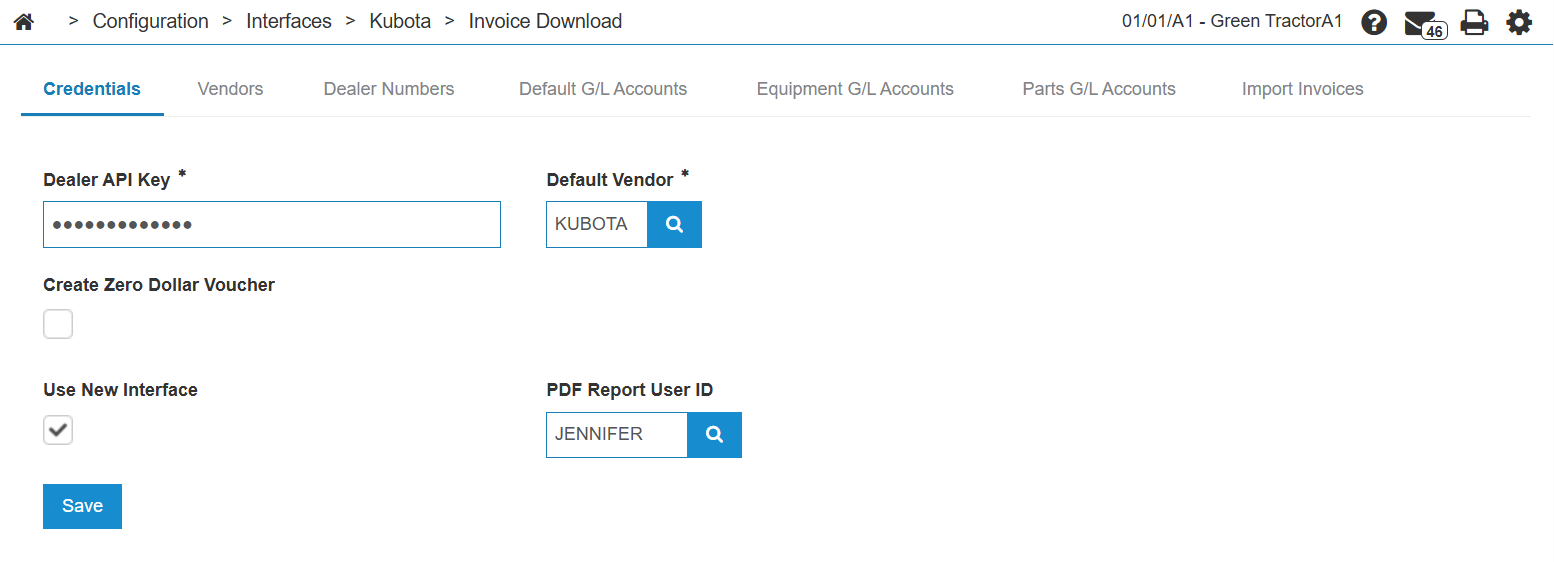

Credentials Tab

The fields on the Credentials tab are:

Vendors Tab

The Vendors tab shows a list of vendors with Kubota set as the Manufacturer Code. If no vendors are showing, configure at least one Kubota vendor by clicking the Assign Manufacturer button. The Vendor Profile screen opens so you can select a vendor.

The fields on the Vendors tab are:

| Field | Description |

|---|---|

| Vendor Number | The vendor number as configured on |

| Name | The name of the vendor. |

| Address | The vendor's address. |

| Phone Number | The vendor's phone number |

| Status | Whether the vendor is active or has been deleted from the system. |

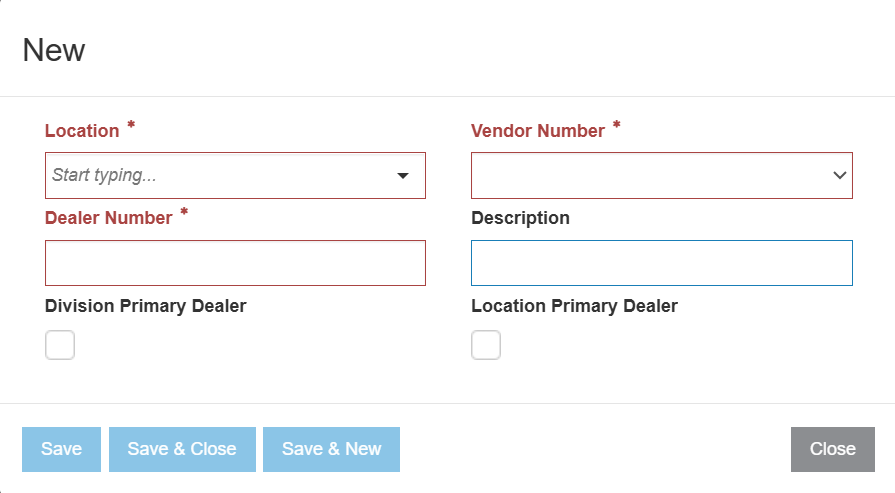

Dealer Numbers Tab

The Dealer Numbers tab shows a list of dealer numbers for vendors that have Kubota set as the Manufacturer Code. If no dealer numbers are showing, ensure the vendor is properly displayed on the Vendors Tab. If it is configured, and no dealer number is showing, then you must add the dealer's Kubota dealer numbers to their appropriate locations using the Create button.

The fields on the Dealer Numbers tab are:

| Field | Description |

|---|---|

| Dealer Number | The dealer's identification number. |

| Vendor Number | The vendor's number. |

| Location | The dealer's location. |

| Description | A brief description of the dealer. |

| Division Primary Dealer | Indicates whether this dealer is the Division Primary Dealer for that contract. |

| Location Primary Dealer | Indicates whether this dealer is the Location Primary Dealer for that contract. |

To create a new Vendor

-

On the Configuration > Interfaces > Kubota > Invoice Download screen, Vendors tab, click the Create button.

-

Fill in these fields (fields that are red and marked with an asterisk* are mandatory):

Field Description Location Select a dealer location from the dropdown. Vendor Number Select a vendor number from the dropdown. This field is not active until a location is set. Dealer Number Enter a Dealer Number. Description Enter a brief description for the vendor. Division Primary Dealer Select this checkbox to indicate that this dealer is the Division Primary Dealer for that contract. Location Primary Dealer Select this checkbox to indicate that this dealer is the Location Primary Dealer for that contract. -

Use these buttons to complete your work on the new vendor screen:

-

Save—saves your changes and keeps the screen open.

-

Save & Close—saves your changes and closes the screen.

-

Save & New—saves your changes and lets you enter another new vendor.

-

Close—closes the screen without saving.

-

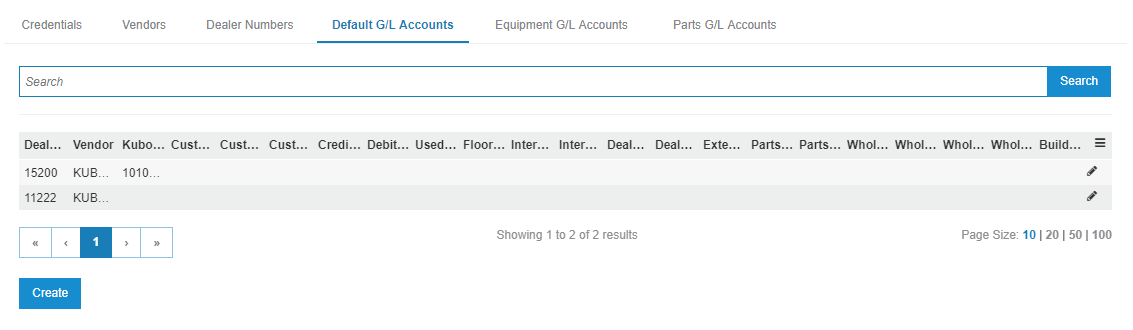

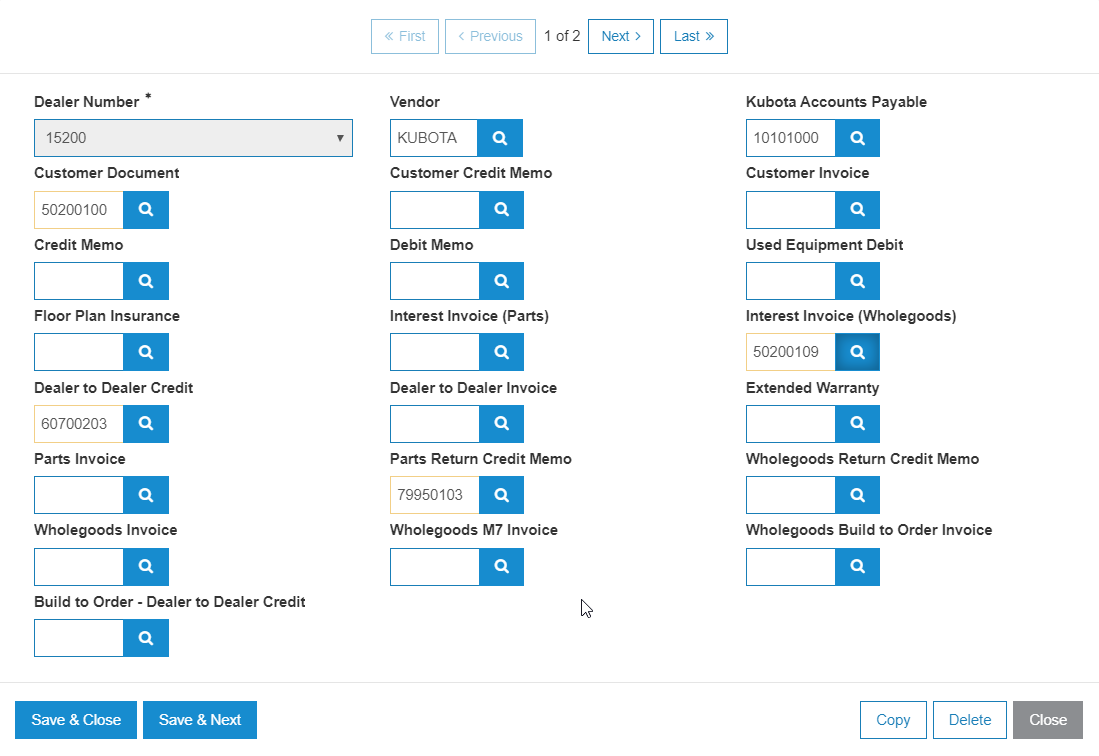

Default G/L Accounts Tab

Use the Default G/L Accounts tab to configure default G/L accounts for all of Kubota's invoice types that are available for download through the interface.

The fields on the Default G/L Accounts tab are:

| Field | Description |

|---|---|

| Dealer Number |

The dealer's identification number. The Dealer Number drop-down at the top of the screen is populated with a list of dealer numbers configured on the Dealer Numbers Tab |

| Vendor |

The vendor's number. This field allows an optional vendor to be configured specifically for invoices downloaded for the dealer number. If no vendor is provided, the system falls back to the default vendor number on the first Credentials Tab. |

| Kubota Accounts Payable |

A G/L account of the specified type. It is not mandatory to configure all account types on setup, but the interface will throw an error if you attempt to create an invoice for an invoice type that is not configured for the dealer number. See also: Account Lookup. |

| Accounting Document | |

| Customer Document | |

| Customer Credit memo | |

| Customer Invoice | |

| Credit Memo | |

| Debit Memo | |

| Cancellation of Invoice | |

| Invoice Debit | |

| Used Equipment Debit | |

| Adj, FP & Int Debit | |

| Floor Plan Insurance | |

| Interest Invoice (Parts) | |

| Interest Invoice (Wholegoods) | |

| Invoice Credit | |

| Dealer to Dealer Credit | |

| Dealer to Dealer Invoice | |

| Extended Warranty Invoice Cancel | |

| Extended Warranty | |

| Wholegoods M7 Invoice | |

| Parts Invoice | |

| Parts Return Credit Memo | |

| Wholegoods Return Credit Memo | |

| Wholegoods Build to Order Invoice | |

| Build to Order - Dealer to Dealer Credit | |

| Build to Order - Dealer to Dealer Invoice | |

| Wholegoods Invoice |

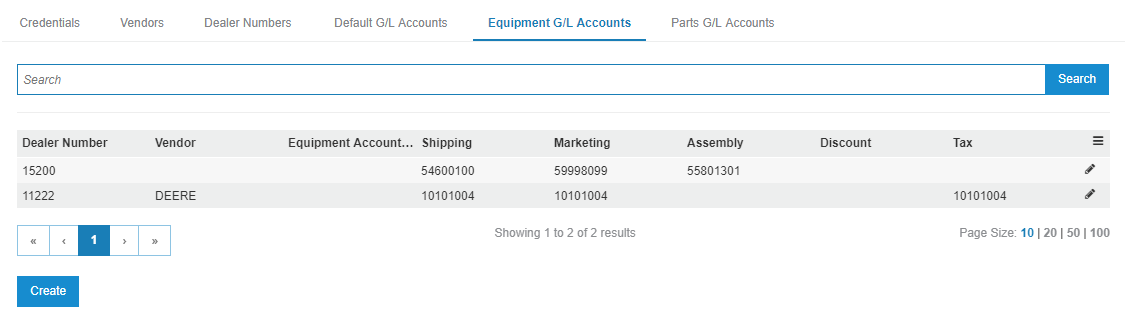

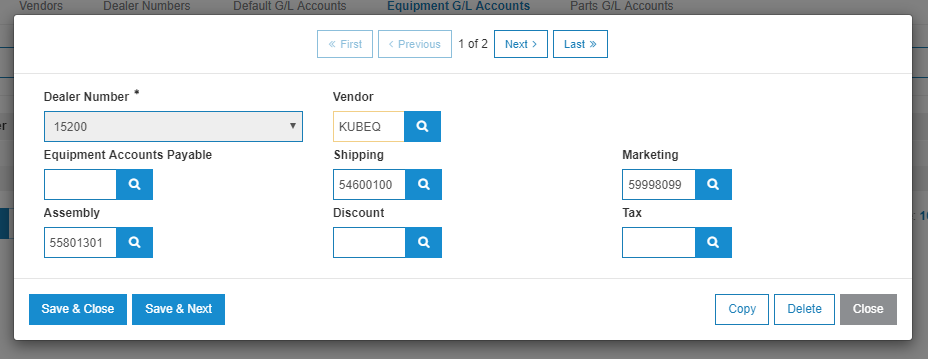

Equipment G/L Accounts Tab

Use the Equipment G/L Accounts tab for a more granular configuration of equipment invoices. The fields on the Equipment G/L Accounts tab are:

| Field | Description |

|---|---|

| Dealer Number |

The dealer's identification number. The Dealer Number drop-down at the top of the screen is populated with a list of dealer numbers configured on the Dealer Numbers Tab |

| Vendor |

The vendor's number. This field allows an optional vendor to be configured specifically for invoices downloaded for the dealer number. If no vendor is provided, the system falls back first to a vendor from the Default G/L Accounts Tab, and if that fails, then to the default vendor number on the first Credentials Tab. |

| Equipment Accounts Payable |

A G/L account for equipment. If you do not configure any equipment accounts payable accounts, the system falls back to the accounts payable account on the Default G/L Accounts Tab. |

| Shipping |

A G/L account of the specified type. It is not mandatory to configure all account types on setup. If accounts are not configured for specific miscellaneous charges, the dollar amounts for these charges will be rolled up into the amount charged to the main equipment account voucher distribution line. If separate accounts are configured for miscellaneous charges, these will show as their own voucher distribution lines. |

| Marketing | |

| Assembly | |

| Discount | |

| Tax | |

| Surcharge |

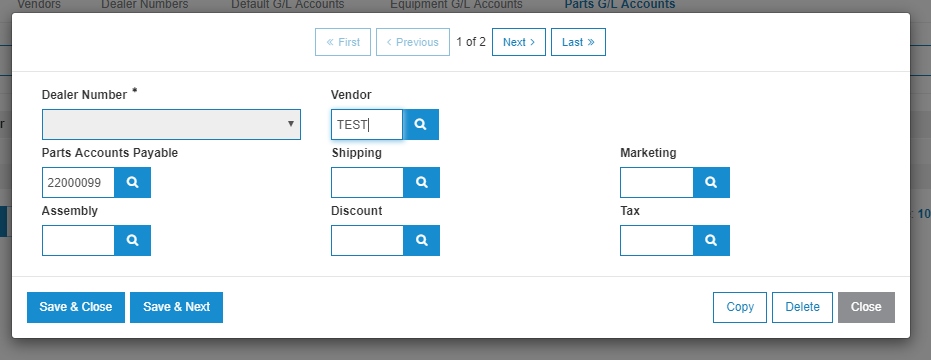

Parts G/L Accounts Tab

The Parts G/L Accounts tab functions almost the same as the equipment G/L accounts tab, save for the references to a Parts Accounts Payable instead of Equipment. The same logic applies with vendor and account fallbacks.

The fields on the Parts G/L Accounts tab are:

| Field | Description |

|---|---|

| Dealer Number |

The dealer's identification number. The Dealer Number drop-down at the top of the screen is populated with a list of dealer numbers configured on the Dealer Numbers Tab |

| Vendor |

The vendor's number. This field allows an optional vendor to be configured specifically for invoices downloaded for the dealer number. If no vendor is provided, the system falls back first to a vendor from the Default G/L Accounts Tab, and if that fails, then to the default vendor number on the first Credentials Tab. |

| Parts Accounts Payable |

A G/L account for parts. If you do not configure any parts accounts payable accounts, the system falls back to the accounts payable account on the Default G/L Accounts Tab. |

| Shipping |

A G/L account of the specified type. All part account types must be configured. This ensures that the value of only the parts on the invoice is properly split out and compared to the parts receipts. |

| Marketing | |

| Assembly | |

| Discount | |

| Tax | |

| Surcharge | |

| Allow Automatic Write-off |

Indicates whether automatic write-off is permitted for this account. Write-off allows for an automatic write-off of the remaining invoice value after the invoice has been applied to the available value on the purchase order receipts. For example, consider a $20.00 invoice, a $10.00 configured write-off threshold, and a $15.00 purchase order receipt. Normally a PO adjustment is performed to ensure the full $20.00 invoice could be applied to the purchase order receipt. With the write-off functionality enabled, the $5.00 difference that exists between the PO and the invoice can be assigned to the configured write-off account. This $5.00 is written as an additional voucher distribution line when the voucher is created. |

Import Invoices Tab

Use the Import Invoices to manually download invoices into IntelliDealer. Normally this process happens automatically with a nightly job, but this tab allows the process to be run manually for a specific date range.

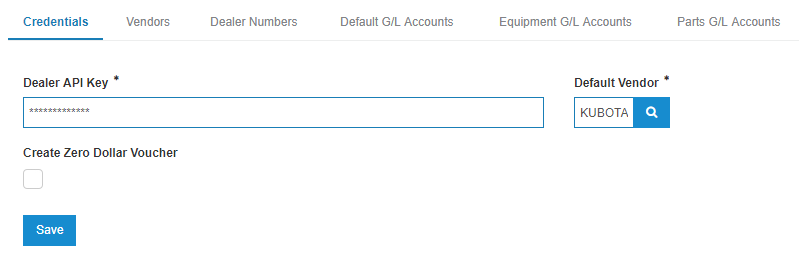

Old Interface

- The configuration screen for the interface can be found at Configuration > Interfaces > Kubota > Invoice Download.

- The Credentials is as follows:

The Dealer API Key should be provided by Kubota when setting up a dealer for this interface

The Default Vendor field is to configure a default vendor under which vouchers will be created if no other configured vendors are found (more on this in the setup of the next few tabs)

There is also an option for the dealer to have the interface create zero dollar vouchers if this is their preferred voucher creation style

Contact Kubota for credentials.

-

The Vendors tab shows a list of vendors with Kubota set as the Manufacturer Code. If no vendors are showing, you will need to use the Assign Manufacturer button to properly configure at least one Kubota vendor.

-

The Dealer Numbers tab shows a list of dealer numbers for vendors that have Kubota set as the Manufacturer Code. If no dealer numbers are showing, ensure the vendor is properly displayed on the previous vendors tab. If it is configured, you will need to add the dealer's Kubota dealer numbers to their appropriate locations using the Create button.

-

The Default G/L Accounts tab is an extensive tab that allows the dealer to configure default G/L accounts for all of Kubota's invoice types that are able to be downloaded through the interface:

-

There are a significant number of invoice types available, so configuration can be complex:

-

The Dealer Number drop-down at the top will be populated with a list of dealer numbers from the Dealer Numbers tab configured in a previous step.

-

The Vendor field allows an optional vendor to be configured specifically for invoices downloaded for the dealer number. If no vendor is provided, the system will fall back to the default vendor number on the first Credentials tab.

-

It is not mandatory to configure all account types on setup, but the interface will throw an error if you attempt to create an invoice for an invoice type that is not configured for the dealer number.

-

-

The Equipment G/L Accounts tab is used for more granular configuration for equipment invoices.

-

Equipment invoices are these three types: Wholegoods Invoice, Wholegoods M7 Invoice, and Wholegoods Build to Order Invoice

-

This screen functions similar to the previous configuration screen, with a dealer numbers drop-down and an optional vendor configuration spot. If no vendor is configured on this screen, the interface will fall back to a vendor from the Default G/L Accounts tab, before falling back again to the Credentials tab default vendor

-

As with the previous screen, not all accounts are required to be configured. If no equipment accounts payable account is configured, the system will fall back to accounts payable account configured on the Default G/L Accounts tab.

-

However, if accounts are not configured for specific miscellaneous charges, the dollar amounts for these charges will be rolled up into the amount charged to the main equipment account voucher distribution line.

-

If separate accounts are configured for miscellaneous charges, these will show as their own voucher distribution lines.

-

-

The Parts G/L Accounts tab functions almost exactly the same as the equipment G/L accounts tab, save for the references to a Parts Accounts Payable instead of Equipment. The same logic applies with vendor and account fallbacks, as well as how miscellaneous charges are handled on the voucher distribution lines: