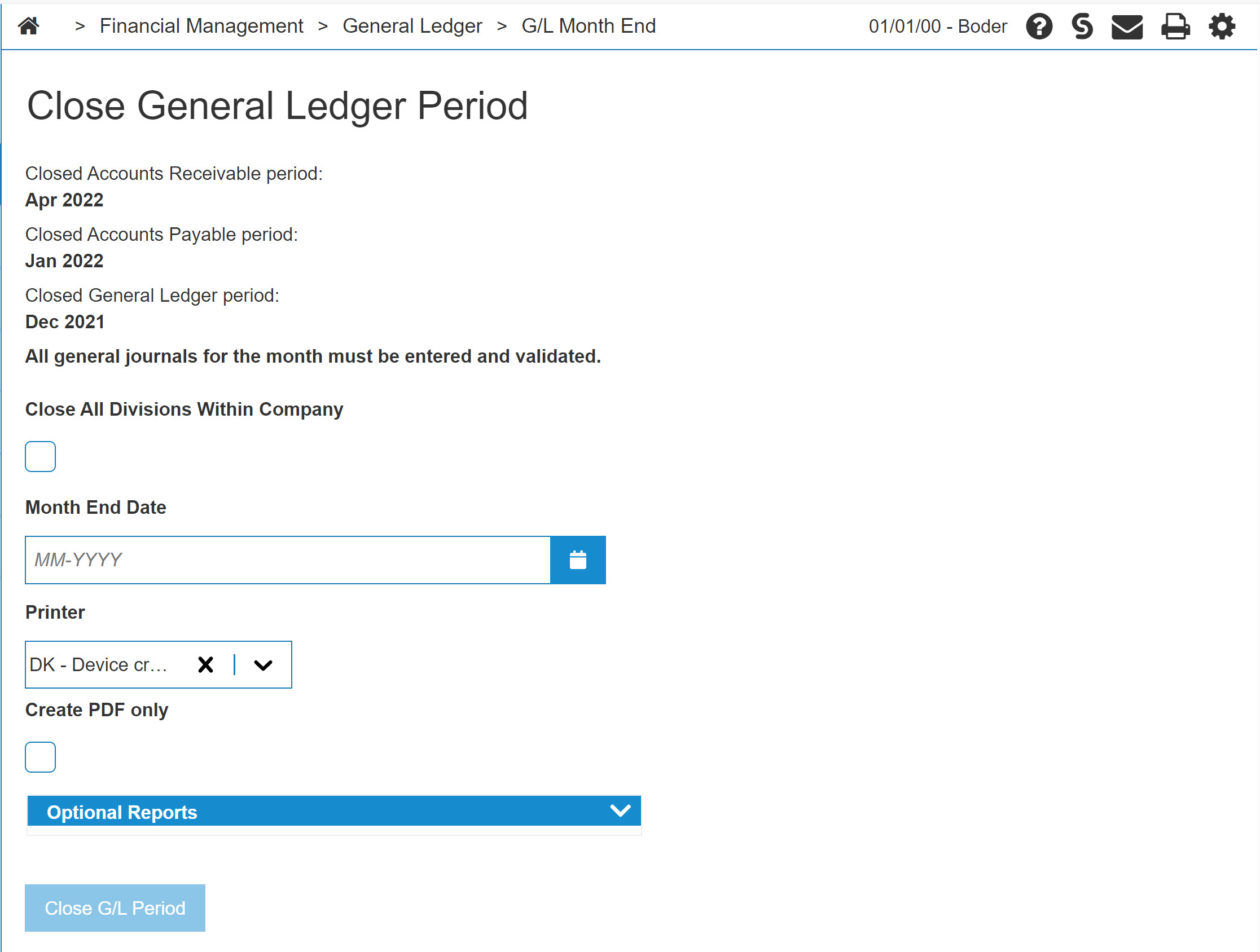

Close General Ledger Period

The Close General Ledger Period screen allows you to close the general ledger month and prints the general ledger month end reports. Once this option has been run, the general ledger is closed for the month and can not be modified. Any errors found in the general ledger final can only be corrected in the following months by adjusting journals. Several journals are automatically posted to the general ledger from other systems. See Automatically Posted Journals .

You can access the Close G/L Period screen by navigating to Financial Management > General Ledger > G/L Month End.

Before you start the final run, ensure that these steps are complete for the division(s) that you are running the G/L month end final:

-

The previous months G/L month end final has been run.

-

The accounts receivable month end for this month has been run.

-

The accounts payable month for this month has been run.

-

The equipment costs of sales journal should be entered.

-

All other general journal entries should be entered.

-

At least one G/L month end preliminary has been run to ensure that all postings have been made properly.

Topics in this section are:

Closing a G/L Period

Prerequisites: Before closing a G/L period, you should run a G/L Month End Preliminary report to verify the accounts.

-

From anywhere in IntelliDealer, navigate to Financial Management > General Ledger > G/L Month End.

-

In the Month End Date field, enter a date or click the Calendar icon to select one.

-

Select or enter the Printer you want the reports sent to, or select the Create PDF only checkbox to only generate a PDF file.

-

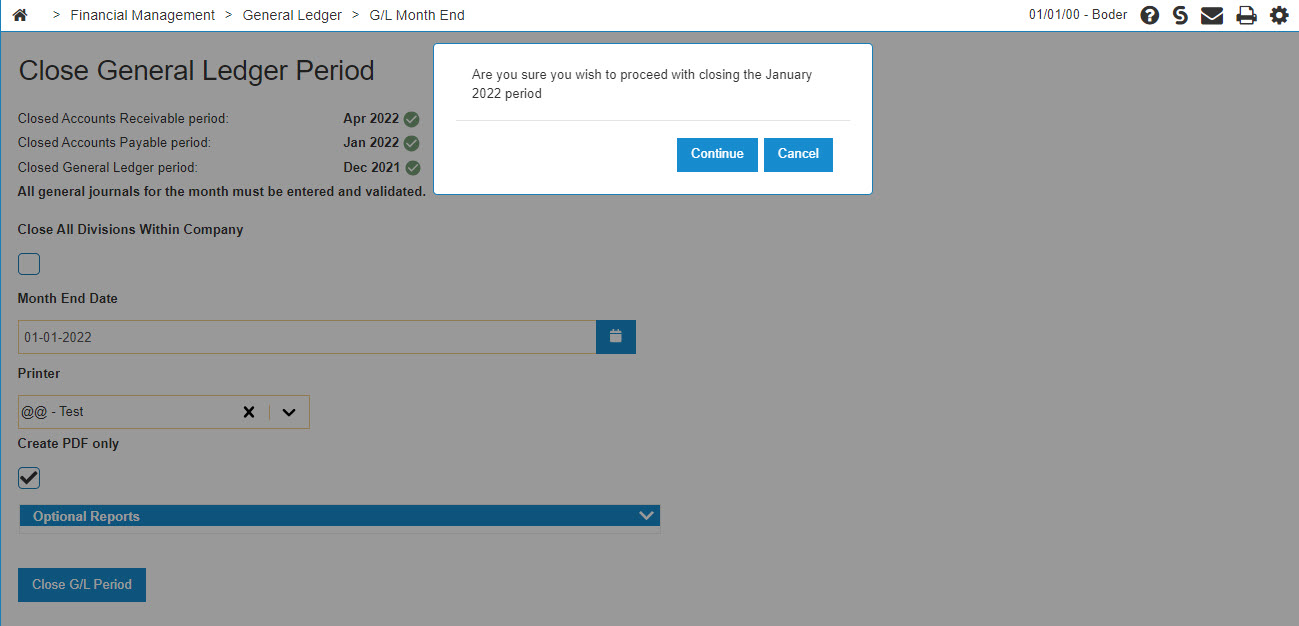

Click Close G/L Period.

-

Click Continue to close the general ledger month and print the general ledger month end.

For information about the reports that are produced see Produced Reports

Screen Description

The fields on the Close G/L Period screen are:

| Field | Description |

|---|---|

| Close All Divisions Within Company |

If selected, closes the general ledger month for all divisions within the company. This field only appears for dealerships that have multiple divisions. |

| Month End Date | The run date for the general ledger month end report. |

| Printer | The printer selected to print the reports. |

| Create PDF only |

Creates a PDF file of the general ledger month end report which can be viewed via the PDF Viewer. |

| Optional Reports |

Click the arrow to display the list of optional reports. Select one or more to be produced. Click the arrow again to collapse the list. |

Click Close G/L Period to close the general ledger month and generate any selected reports.

Automatically Posted Journals

The journals that automatically post to the general ledger from other systems are:

-

A billing system journal.

-

A journal containing all accounts updated in any billing run during the month the G/L is being run for.

-

An accounts payable system journal.

-

A journal containing all accounts posted to in the accounts payable system during the month the G/L is being run.

-

A journal containing all accounts posted to in the cash receipts system during the month the G/L is being run. The journal will also include the general ledger postings for any late charges applied to overdue customer accounts during A/R Month End.

-

A payroll journal.

-

A journal containing all accounts posted to in the payroll system (check runs, history adjustments runs and vacation pay runs) during the month the G/L is being run.

-

A parts costs of sales journal.

-

A journal containing the costing information for all parts sold using any billing run during the month the G/L is being run for.

The cost of sales and inventory accounts are determined from the sale account used at the time of sale. The actual average cost of the part is used if the part had a cost loaded at the time of the sale. If the part did not have a cost loaded at the time of the sale, then the cost will be estimated according to the percentage specified on the sale account in the chart of accounts.

Produced Reports

Note: Many of the reports listed below are controlled by table GLREPORT.

The reports that can be produced when closing the G/L month end are:

| Report Name | Report Number | Automatic or Optional? | Notes |

|---|---|---|---|

|

Year-end Closing Journal |

Automatic | Only printed during G/L final for the last month of the fiscal year. | |

| Journal Voucher Proof List | GL1000 | Automatic | All manual journals plus sales analysis, accounts payable, cash receipts, payroll, and parts cost of sales. |

| 11 - Balance Sheet Accounts | GL1070 | Automatic | |

| 11 - Profit And Loss Account Summary | GL1080 | Automatic | |

| 11 - Expense Item Accounts | GL1090 | Automatic | |

| Trial Balance | GL1115 | Automatic | |

| Statement of Changes in Financial Position | DE1171 | Optional | |

| Balance Sheet Analysis |

|

Optional | |

| Income Summary By Profit Center Grouping | DE1100-010 | Optional | Account within profit center. |

| Income Summary by Division | DE1150 | Optional |

Totals by account within division. |

| Income Summary By Profit Center - Summary | DE1100-S | Optional | |

| Income Summary by Area Of Responsibility | DE1120 -1 | Profit center summary within first profit center grouping. | |

| Income Summary by Profit Center Grouping - Summary | DE1160 | Optional | Account within first profit center grouping. |

| Income Summary by Division - Summary | DE1150 -S | Optional |

Prints accounts first digit total line for each division, division total line, and the company total line. |

| Journal Summary by Profit Center | DE2000 | Optional | |

| Key Stats Report - Sales | DE1140 | Optional | |

| General Ledger by Profit Center - Balance Sheet | GL1071-1100 | Optional | |

| General Ledger by Profit Center - Profit & Loss | GL1071-1010 | Optional | |

| General Ledger by Profit Center - Expense Item | GL1070-1001 | Optional | |

| Summarized Financials | GL1120 | Optional | Configuration required. See Summarized Financials. |

Security: 602 - Access Close G/L Period

Revision 2024.05