Running a 1099 Form Print

A Department of Treasury Internal Revenue Service Miscellaneous Income Form 1099 is a tax form that lists how much income a vendor was paid by the dealership in a calendar year. 1099 forms can be printed for the previous calendar year from IntelliDealer when all Accounts Payable month ends have been completed for the previous calendar year.

The report produced is:

| AP0012 | 1099 Form Print |

Topics in this section are:

Pre-requisites to Printing

-

The vendor profile must be setup to track 1099s. Open a Vendor Profile in edit mode and set the 1099 field to one of these values:

-

Non-employee compensation

-

Other Income

-

Rent

-

-

The vendor profile must be active. On the Vendor Profile, select the Active for A/P checkbox.

-

The Vendor Profile's Zip/Postal Code must be all numbers, indicating a US address.

-

The total paid by the dealership to the vendor via Check Runs must be over $600 for the vendor to print a 1099 form.

-

The Accounts Payable year must be closed before 1099s will print for that year. To see when the next month end will run, navigate to Configuration > Miscellaneous > Other > System Settings, scroll to the bottom of the Division tab and check the field Next Month End - Accounts Payable.

For example, if the next A/P month end is December 2024, then you must wait until A/P for December is closed. This is to ensure no discrepancies between the yearly total paid to the vendor and the printed 1099 form.

Printing the 1099 Form

-

From any IntelliDealer screen, navigate to Financial Management > Accounts Payable > A/P Reports > 1099-Form Print.

-

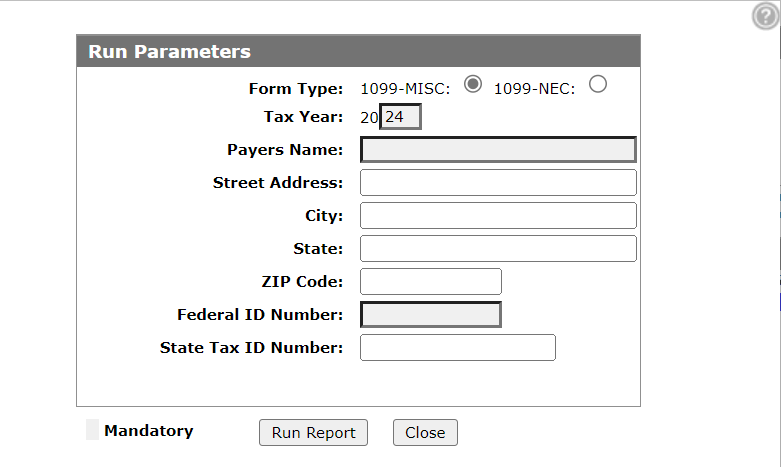

Fill in the fields, referring to the table below:

1099 Form Print  This option is used to print the Department of Treasury Internal Revenue Service Miscellaneous Income Form 1099.

This option is used to print the Department of Treasury Internal Revenue Service Miscellaneous Income Form 1099.

Field Description Form Type - 1099-MISC - Vendors must be set up as either 1099 - Other Income or Rent

- 1099-NEC - Vendors must be set up as Non-Employee Compensation

Payers Name The name of the company or business making payments. Street Address The street address of the contractor making payment. City The city where the contractor is located. State The state where the contractor is located. Zip Code The contractor's zip code. Federal ID Number The federal ID number. State Tax ID Number The state tax ID number. Printer The printer selected to print the report. -

Click Run Report to submit the financial A/P outstanding aged report.

1099 Forms Information

A 1099 form can be obtained here from the IRS.gov website: 1099 Form

Example of Fiscal History Rounding

Fiscal history rounds each voucher to the nearest dollar.

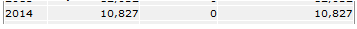

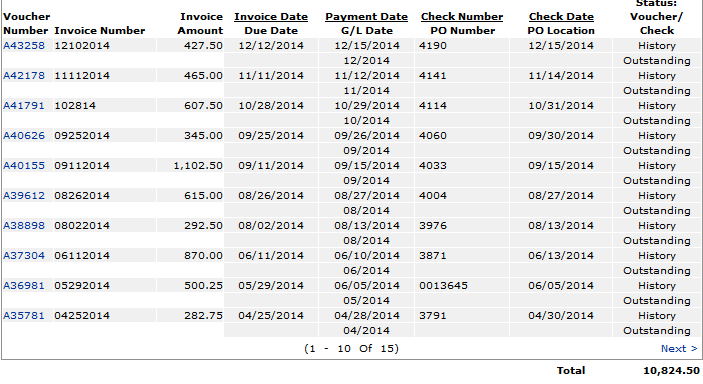

For example, the fiscal history for 2014 is:

While the history for this vendor shows as:

This discrepancy occurred when each of the vouchers was rounded and subtotaled, leaving a variance of $2.50.

Security: 601 - Accounts Payable, Other - Access A/P Reports

Revision: 2026.02