Selective Reports/Year End/Month End

You can use the Selective Reports screen run and print reports for the selected fixed asset.

The Selective Reports screen can be accessed from the Fixed Assets screen by clicking on either the Generate Fixed Asset reports link or the Run depreciation year end/month end finals link.

Topics in this section are:

Generating a Fixed Asset Report

This procedure describes the process for generating any of the fixed asset reports and uses the Fixed Asset Master as an example.

-

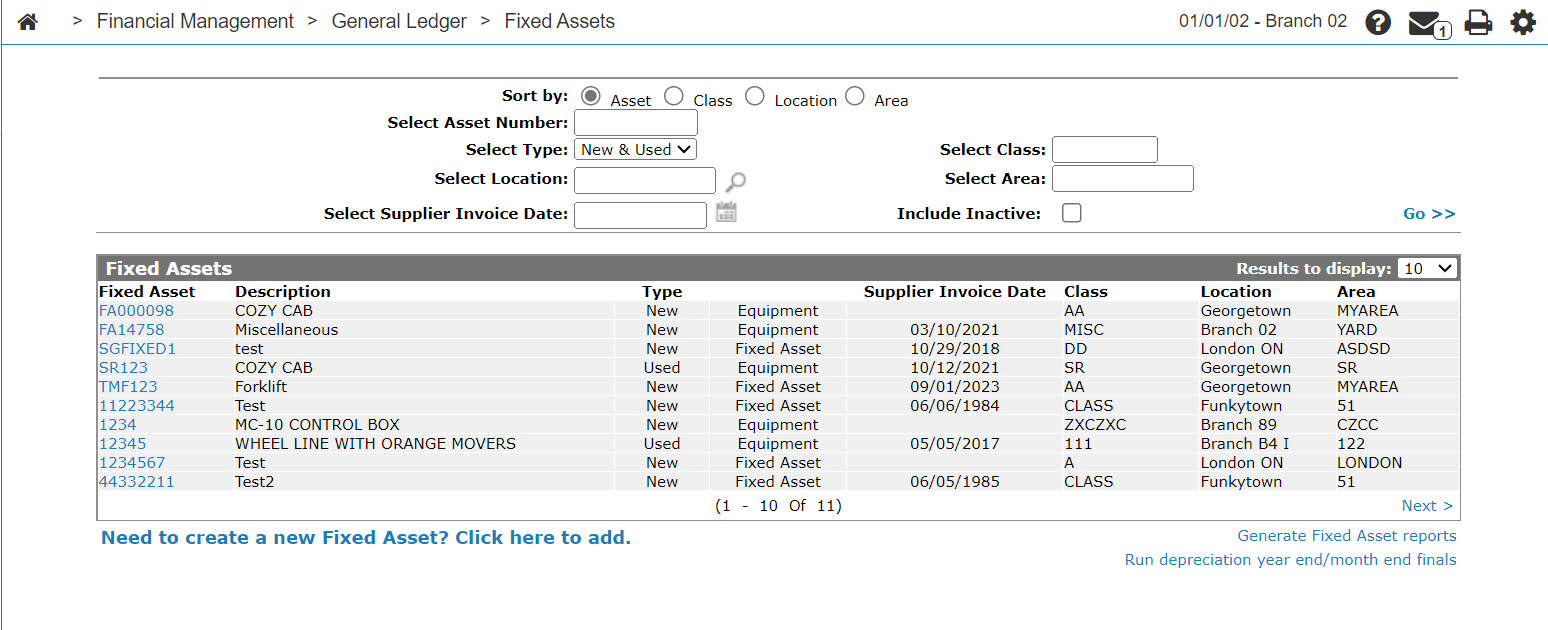

From anywhere in IntelliDealer, navigate to Financial Management > General Ledger > Fixed Assets .

-

Click the Generate fixed asset reports link.

-

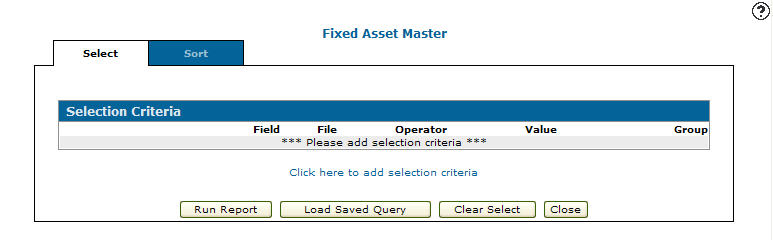

Click the Fixed Asset Master link.

-

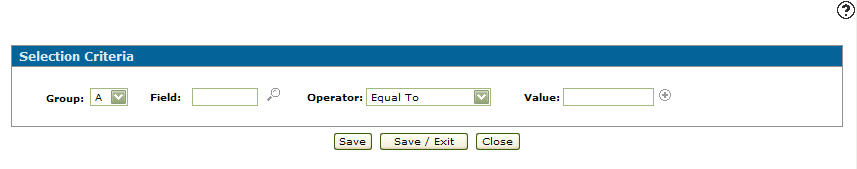

Click the Click here to add selection criteria link.

-

Fill in the fields, referring to the Selection Criteria help page.

-

Click the More

icon to add more values.

icon to add more values. -

Click Save to save your selection criteria and remain on the Selection Criteria screen.

-

When you have added all the necessary criteria, click the Save/Exit button to save your selection criteria and return to the Selection Criteria tab.

-

-

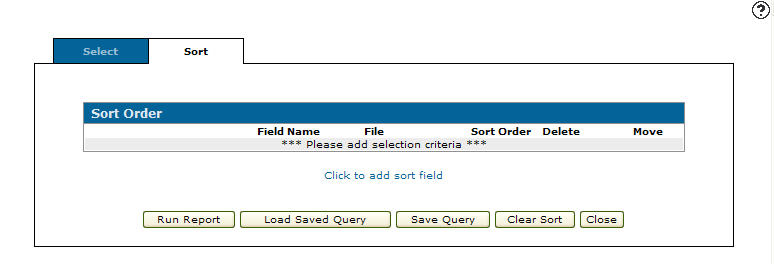

On the Selection Criteria tab, click the Sort tab.

-

Click the Click to add sort field link.

-

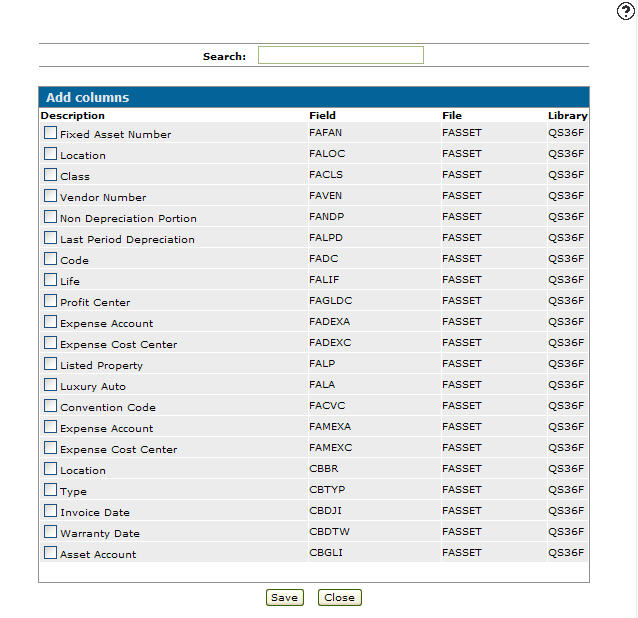

On the Add Columns screen, select the columns you wish to use for the sort order on the report, then click Save.

The Sort Order screen appears.

-

Click the Run Report button.

-

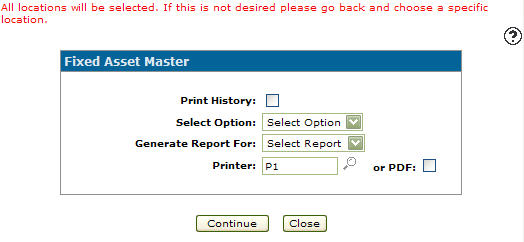

Select the options you require for the report, referring to the Fixed Asset Master help page then click Continue to create the fixed asset master report.

Running a Depreciation Year End / Month End Final

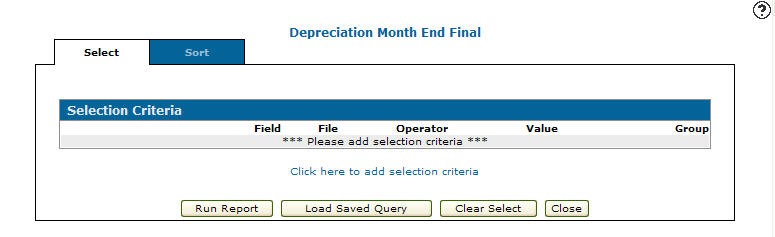

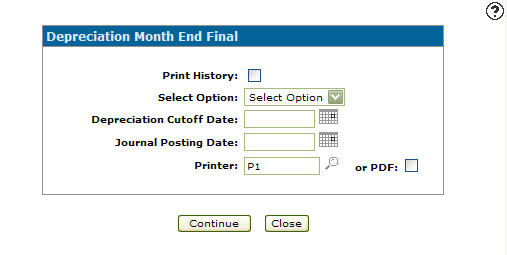

This procedure describes the process for generating any of the depreciation reports and uses the Depreciation Month End Final as an example.

-

From anywhere in IntelliDealer, navigate to Financial Management > General Ledger > Fixed Assets.

-

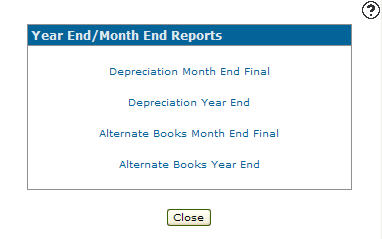

Click the Run depreciation year end/month end finals link.

-

Click on the Depreciation Month End Final link.

The Selection Criteria tab will appear.

-

Follow steps 4-8 described above in Generating a Fixed Asset Report.

-

On the Sort Order tab, click the Run Report button.

- Select the options you require for the report, referring to the Depreciation Month End Final help page, then click Continue button to create the Depreciation Month End Final report.

Generate Fixed Asset reports

The reports that can be run from the Selective Reports screen after clicking on the Generate Fixed Asset reports link are:

| Reports | Description |

|---|---|

| Fixed Asset Master (FAS001) | Creates a fixed asset current fiscal year report that calculates fixed asset depreciation for assets based on the selection criteria selected. See Generating a Fixed Asset Report. |

| Fixed Asset Master - Current Cost (FAS001) | Creates a fixed asset master - current cost report that calculates the current cost fixed asset depreciation for assets based on the selection criteria selected. |

| Fixed Asset Future Depreciation (FAS005-01010) | Creates a fixed asset future depreciation report that calculates future fixed asset depreciation for assets based on the selection criteria selected. There is no date selection option here; the system is using current calendar date to generate the details. If a unit has already been depreciated for the month it will not show on this report. |

| Fixed Asset Depreciation Preliminary (FAS005) | Creates a fixed asset depreciation preliminary report that calculates the fixed asset depreciation for a determined period of time for assets based on the selection criteria selected. |

Run depreciation year end/month end finals

The reports that can be run from the Year End/Month End screen after clicking the Run depreciation year end/month end finals link are:

| Reports | Description |

|---|---|

| Depreciation Month End Final |

Runs a depreciation month end final that calculates and posts the depreciation to the G/L for the selected fixed assets. See Running a Depreciation Year End / Month End Final. If the asset is a whole good the equipment system is also updated the same way as a billing run. |

| Depreciation Year End |

Runs a depreciation year end that resets the year to date depreciation to zero, ending all depreciation for the year being closed and checks to ensure that all assets have been fully depreciated for the year. Warning: Running a Depreciation Year End report requires all Depreciation Month End Finals to be completed for the year being closed. Once this report completes, you cannot go back and run Month End Finals for any months in the closed year. |

| Alternate Books Month End Final (FAS009) | Runs an alternate books month end final that allows the user to calculate depreciation differently for accounting purposes (G/L is not updated). This run is similar to depreciation month end final, but is for alternate books only. |

| Alternate Books Year End |

Runs an alternate books year end resetting the year to date depreciation to zero for the selected alternate book, ending all depreciation for the year being closed and checks to ensure that all assets have been fully depreciated for the year. Warning: Running a Depreciation Year End report requires all Depreciation Month End Finals to be completed for the year being closed. Once this report completes, you cannot go back and run Month End Finals for any months in the closed year. |

Click Close to close the Selective Reports or Year End/Month End screens without running a report and return to the Fixed Assets screen.

Security: 602 -Financial Management - General Ledger

Revision: 2024.11